Australian Dollar Higher Amid Upbeat Jobs Data, Credit Suisse Liquidity Pledge

16 Março 2023 - 2:37AM

RTTF2

The Australian dollar climbed against its major counterparts on

Thursday, as stronger-than-expected jobs data and a pledge by Swiss

regulators to provide liquidity to Credit Suisse bolstered risk

sentiment.

Data from the Australian Bureau of Statistics showed that the

economy added 64,600 jobs last month, topping forecasts for an

increase of 48,500 jobs after shedding 11,500 jobs in January.

The unemployment rate came in at a seasonally adjusted 3.5

percent in February.

That was beneath expectations for 3.6 percent and was down from

3.7 percent in January.

Credit Suisse announced that it would borrow up to 50 billion

Swiss francs from the Swiss National Bank to improve liquidity.

Selling pressure eased following the announcement as fresh

turmoil at Swiss lender raised concerns about the U.S. banking

crisis spreading to Europe.

The aussie rebounded against the euro and was trading at 1.5951.

The aussie may face resistance around the 1.53 level.

The aussie rose to 0.6662 against the greenback, 0.9150 against

the loonie and 88.71 against the yen, from its early lows of

0.6606, 0.9094 and 87.82, respectively. The currency is seen facing

resistance around 0.68 against the greenback, 0.93 against the

loonie and 92.00 against the yen.

The aussie was up against the kiwi, at a 3-day high of 1.0784.

On the upside, 1.09 is likely seen as its next resistance

level.

Looking ahead, Canada wholesale sales data for January, U.S.

building permits, housing starts, export and import prices, all for

February, and U.S. weekly jobless claims data are due to be

released in the New York session.

At 9:15 am ET, European Central Bank's monetary policy decision

is due. Economists widely expect the bank to raise the benchmark

refi rate by 50 basis points to 3.50 percent.

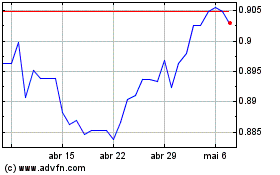

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

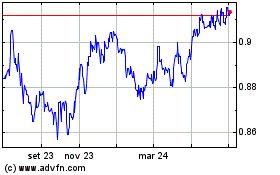

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024