Pound Rises Amid Risk Appetite

12 Maio 2023 - 4:39AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Friday, as European stocks traded higher

with financials and luxury goods makers rising on the back of

strong earnings.

Sentiment was also helped by optimism that the Federal Reserve

would halt interest-rate increases in the next policy review in

June.

In economic releases, the U.K. economy expanded for the second

straight quarter, in line with expectations, though output shrunk

unexpectedly in the month of March, preliminary data from the

Office for National Statistics showed.

Gross domestic product grew 0.1 percent from the fourth quarter,

when it expanded at the same pace.

In the European trading today, the pound rose to 0.8696 against

the euro, 1.2541 against the U.S. dollar and 169.13 against the

yen, from early lows of 0.8732, 1.2506 and 168.17, respectively. If

the Sterling extends its uptrend, it is likely to find resistance

around 0.85 against the euro, 1.27 against the greenback and 174.00

against the yen.

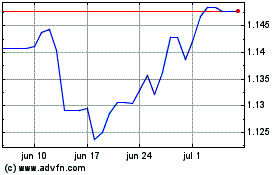

Against the Swiss franc, the pound edged up to 1.1202 from an

early 1-week low of 1.1155. The GBP/CHF pair may find its

resistance around the 1.13 area.

Looking ahead, U.S. export and import prices for April, U.S.

University of Michigan's preliminary consumer sentiment for May and

U.S. Baker Hughes rig count data are due in the New York

session.

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024