Yen Falls Slightly; Traders Focus On Fed Chair Powell's Speech

23 Agosto 2024 - 12:40AM

RTTF2

The Japanese yen retreated from recent highs against other major

currencies in the Asian session on Friday, as traders remain

reluctant to continue buying stocks ahead of the Kansas City Fed's

Jackson Hole Economic Symposium, which gets underway later in the

day. They look ahead to Fed Chair Jerome Powell's comments for

further clarity about the outlook for interest rates.

However, traders feel the likelihood of a rate cut next month

has already been priced into the markets.

Ahead of Powell's remarks, CME Group's FedWatch Tool indicate a

75.5 percent of a quarter point rate cut next month and a 24.5

percent chance of a half point rate cut.

Meanwhile, the safe-haven yen strengthened earlier against its

major counterparts, as the Bank of Japan Governor Kazuo Ueda

signaled in a speech before lawmakers about his intention to hike

interest rates if inflation remained on track to meet the 2 percent

objective.

In economic news, data from the Ministry of Internal Affairs and

Communications showed that the core inflation that excludes prices

of fresh food rose marginally to 2.7 percent in July from 2.6

percent in June. The rate came in line with expectations.

Headline inflation held steady at 2.8 percent in July. On a

monthly basis, consumer prices gained 0.2 percent after rising 0.3

percent in June.

In the Asian trading today, the yen fell to 162.35 against the

euro and 191.22 against the pound, from recent highs of 161.69 and

190.38, respectively. The EUR/JPY and GBP/JPY pairs may test

support for the yen near 165.00 and 198.00 regions,

respectively.

Against the U.S. dollar and the Swiss franc, the yen slipped to

145.90 and 171.30 from recent lows of 145.30 and 170.84,

respectively. If the yen extends its downtrend, it is likely to

find support around 150.00 against the greenback and 174.00 against

the franc.

Moving away from a recent 4-day high of 97.57 against the

Australian dollar, the yen edged down to 98.08. The yen is likely

to find support around the 99.00 region.

Against the New Zealand and the Canadian dollars, the yen

dropped to 89.78 and 107.33 from early highs of 89.41 and 106.88,

respectively. On the downside, 91.00 against the kiwi and 108.00

against the loonie are seen as the next support levels for the

yen.

Looking ahead, Canada retail sales for July, U.S. building

permits for July, home sales for July and U.S. Baker Hughes oil rig

count data are due to be released in the New York session.

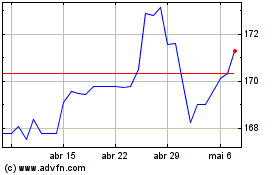

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Jul 2024 até Ago 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Ago 2023 até Ago 2024