U.S. Dollar Index Slumps To Lowest Levels In Over A Year

23 Agosto 2024 - 1:41PM

RTTF2

The value of the U.S. dollar saw a notable rebound during

Thursday's trading but has pulled back sharply during trading on

Friday.

The U.S. dollar index has slumped by 0.81 points or 0.8 percent

to 100.70, falling to its lowest levels in over a year.

The buck is trading at 144.35 yen versus the 146.29 yen it

fetched at the close of New York trading on Thursday. Against the

euro, the dollar is valued at $1.1189 compared to yesterday's

$1.1112.

The sharp pullback by the greenback comes as highly anticipated

remarks by Federal Reserve Chair Jerome Powell indicated the

central bank is prepared to begin lowering interest rates.

"The time has come for policy to adjust," Powell said at the

Jackson Hole Economic Symposium, although he noted the "timing and

pace of rate cuts will depend on incoming data, the evolving

outlook, and the balance of risks."

Powell's determination that it is time for the Fed to begin

cutting rates comes as his "confidence has grown that inflation is

on a sustainable path back to 2 percent."

Fed officials have repeatedly said they need "greater

confidence" inflation is moving sustainably toward the central

bank's 2 percent target before they would consider cutting

rates.

Powell said inflation is now much closer to the Fed's objective,

with consumer prices rising 2.5 percent year-over-year in July, and

noted progress toward 2 percent has resumed after a pause earlier

this year.

The remarks by Powell came as recent inflation data has

increased confidence the Fed will cut interest rates at its next

monetary policy meeting in September.

"Chair Powell just rang the bell to start rate cuts," said MBA

SVP and Chief Economist Mike Fratantoni. "He was careful to note

that incoming data will inform the pace of cuts, but a cut is

coming in September, and this cut will be the first in a series

that should bring the federal funds target down significantly over

the next 18 months."

According to CME Group's FedWatch Tool, there is a 65.5 percent

chance of a quarter point rate cut at the September 17-18 meeting

and a 34.5 percent chance of a half point rate cut.

The minutes of the Fed's late July meeting, released on

Wednesday, revealed that the "vast majority" of participants

believed it would "likely be appropriate" to lower rates at the

next meeting if inflation data continued to come in "about as

expected."

In U.S. economic news, a report released by the Commerce

Department showed a substantial increase by new home sales in the

U.S. in the month of July.

The Commerce Department said new home sales spiked by 10.6

percent to an annual rate of 739,000 in July after rising by 0.3

percent to an upwardly revised rate of 668,000 in June.

Economists had expected new home sales to jump by 2.1 percent to

an annual rate of 630,000 from the 617,000 originally reported for

the previous month.

With the much bigger than expected surge, new home sales reached

their highest annual rate since hitting 741,000 in May 2023.

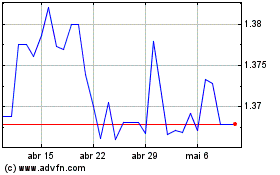

US Dollar vs CAD (FX:USDCAD)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

US Dollar vs CAD (FX:USDCAD)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024