U.S. Dollar Rises As U.S. President-elect Donald Trump Wins

12 Novembro 2024 - 12:40AM

RTTF2

The U.S. dollar strengthened against other major currencies in

the Asian session on Tuesday, as investors believed that they would

benefit from the upcoming government of Donald Trump.

Though the markets are optimistic that Trump's policies such as

tax reductions and deregulation will help boost corporate earnings,

they see an uptick in inflation amid proposed increase in tariffs

that will complicate the US Fed's interest-rate plans.

Investors await key U.S. inflation readings, reports on retail

sales and industrial production, and FOMC member commentary for

additional clues to the Fed's rate trajectory.

In the Asian trading today, the U.S. dollar rose to nearly a

3-1/2-month high of 0.8818 against the Swiss franc, a 6-day high of

1.2837 against the pound and a 5-day high of 154.06 against the

yen, from yesterday's closing quotes of 0.8805, 1.2869 and 153.71,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 0.89 against the franc, 1.26 against the

pound and 156.00 against the yen.

Against the euro and the Canadian dollar, the greenback advanced

to 1.0638 and 1.3949 from Monday's closing quotes of 1.0654 and

1.3924, respectively. The greenback may test resistance around 1.05

against the euro and 1.38 against the loonie.

Looking ahead, Germany ZEW economic sentiment for November is

set to be released in the European session.

In the New York session, U.S. NFIB business optimism index for

October, Canada building permits for September, U.S. Redbook

report, U.S. consumer inflation expectations for October are slated

for release.

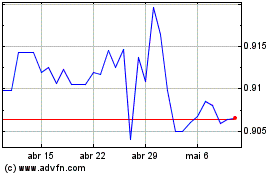

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024