U.S. Dollar Drops Ahead Of Inflation Data

09 Dezembro 2024 - 12:15PM

RTTF2

The U.S. dollar declined against its most major counterparts in

the New York session on Monday, as investors focus on inflation

data for more clues on the Federal Reserve's rate trajectory.

Reports on consumer and producer price inflation are due to be

released on Wednesday and Thursday, respectively.

Friday's jobs data reinforced expectations that the Fed will cut

interest rates again.

Markets are pricing in an 85 percent probability of a

quarter-point rate cut later this month.

The monetary policy decisions from several central banks will be

under the spotlight.

The European Central Bank is widely expected to deliver a

quarter-point cut on Thursday.

The greenback edged down to 1.0594 against the euro, 1.2798

against the pound and 0.8758 against the franc, off its early 4-day

highs of 1.0531, 1.2716 and 0.8804, respectively. The next possible

support for the currency is seen around 1.08 against the euro, 1.29

against the pound and 0.86 against the franc.

The greenback declined to 1.4093 against the loonie and 0.5888

against the kiwi, from its early nearly 2-week highs of 1.4175 and

0.5804, respectively. The currency is seen finding support around

1.38 against the loonie and 0.60 against the kiwi.

The greenback fell to 0.6471 against the aussie, setting a 5-day

low. The currency is likely to locate support around the 0.67

level.

In contrast, the greenback firmed to a 10-day high of 151.34

against the yen. If the currency rises further, it is likely to

test resistance around the 154.00 region.

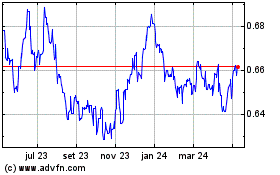

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

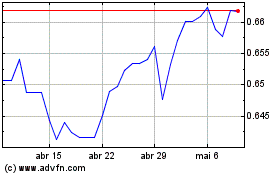

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024