Euro Rises As Eurozone Inflation Surges At 5-Month High

07 Janeiro 2025 - 3:53AM

RTTF2

The euro strengthened against other major currencies in the

European session on Tuesday, after Eurozone inflation rose to the

highest level in five months in December largely reflecting higher

services cost.

Data from Eurostat showed that the harmonized index of consumer

prices climbed 2.4 percent from a year ago, following a 2.2 percent

gain in November. The pace of growth matched economists'

expectations.

Excluding prices of energy, food, alcohol and tobacco, core

inflation held steady at 2.7 percent in December and also came in

line with forecast.

On a monthly basis, the HICP moved up 0.4 percent in December,

data showed.

Data from the same agency showed that the euro area unemployment

rate remained unchanged in November. The jobless rate stood at

seasonally adjusted 6.3 percent in November, the same as in

October. But this was down from 6.5 percent in November 2023.

Data showed that 10.819 million people in the euro area were

unemployed. Compared to October, unemployment decreased by 39,000.

On a yearly basis, the number of people out of work fell

333,000.

Meanwhile, markets are on edge over the U.S. President-elect

Donald Trump called a report from The Washington Post about him

considering scaling back his tariff plans, "fake news."

After taking office on Jan. 20, Trump is expected to impose

tariffs of 10 percent on global imports into the U.S. along with a

60 percent tariff on Chinese goods.

Many economists warned the move the move could drive up

inflation and keep U.S. interest rates higher for longer. In the

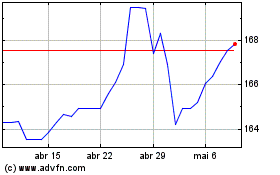

European trading today, the euro rose to 8-day highs of 0.9441

against the Swiss franc, 1.0434 against the U.S. dollar and 164.55

against the yen, from early lows of 0.9396, 1.0376 and 163.71,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 0.95 against the franc, 1.06 against the

greenback and 166.00 against the yen.

Against the pound, the euro edged up to 0.8306 from an early low

of 0.8291. The euro is likely to find resistance around the 0.84

region.

Looking ahead, U.S. and Canada trade data for November, U.S.

Redbook report and Canada Ivey's PMI data for December are slated

for release in the New York session.

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Dez 2024 até Jan 2025

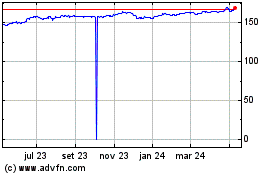

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Jan 2024 até Jan 2025