Canadian Dollar Advances Amid Risk Appetite

28 Janeiro 2025 - 10:42AM

RTTF2

The Canadian dollar climbed against its major counterparts in

the New York session on Tuesday, as U.S. stocks recovered following

a sell-off on Monday.

Traders focus on Federal Reserve meeting for additional insights

into the monetary policy outlook.

The Fed is widely expected to leave interest rates unchanged on

Wednesday, but traders are likely to pay close attention to the

accompanying statement for clues about the outlook for rates.

The European Central Bank (ECB) meets on Thursday and another

rate cut is fully priced in by markets.

The ECB is expected to continue its rate-cutting cycle in 2025,

with analysts expecting moderate cuts of 0.25 percentage points

each, probably in each of the four rate monetary policy meetings in

the first half of the year.

The loonie climbed to a 4-day high of 1.4990 against the euro

and a 6-day high of 0.8979 against the aussie, off its early lows

of 1.5084 and 0.9047, respectively. The currency is seen facing

resistance around 1.46 against the euro and 0.86 against the

aussie.

The loonie recovered to 1.4369 against the greenback, from an

early 1-week low of 1.4420. The currency is poised to challenge

resistance around the 1.35 level.

The loonie recovered against the yen and was trading at 108.12.

The next possible resistance for the currency is seen around the

110.00 level.

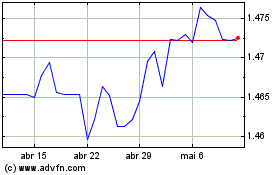

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Dez 2024 até Jan 2025

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Jan 2024 até Jan 2025