Commodity Currencies Advance After Trump's Tariff Delay

03 Fevereiro 2025 - 10:59PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Tuesday, as traders reacted positively to U.S.

President Donald Trump's latest decision to delay imposing the

planned tariffs on Mexico and Canada after successful negotiations

with the respective leaders. The tariffs could have renewed

inflation fears, leading the U.S. Fed to keep interest rates on

hold for longer.

U.S. President Donald Trump struck deals to delay 25 percent

import taxes on Canada and Mexico for 30 days, helping avert a

trade war for now.

It remains to be seen how China would respond to the new

across-the-board 10 percent tariffs that are set to take effect

today.

Boston Fed President Susan Collins and Atlanta Fed President

Raphael Bostic have warned on Monday that the Trump

administration's plans for trade tariffs come with inflation risks,

creating uncertainty over the Federal Reserve's rate path.

Crude oil prices settled higher after Trump's imposed tariffs on

imports from Canada threatened to disrupt North America's tightly

integrated oil market. West Texas Intermediate Crude oil futures

for March settled at $73.16 a barrel, up $0.63 or about 0.87

percent.

In economic news, data from Statistics New Zealand showed that

the total number of building permits issued in New Zealand in

December was down a seasonally adjusted 5.6 percent on month in

December, coming in at 2,478. That follows the downwardly revised

4.9 percent increase in November.

In the year ended December, the actual number of new dwellings

consented was 33,600, down 9.8 percent from a year earlier.

In the Asian trading today, the Australian dollar rose to a

4-day high of 96.62 against the yen, from a recent low of 96.20.

The aussie may test resistance around the 99.00 region.

The aussie advanced to 0.6222 against the U.S. dollar, from a

recent low of 0.6198. On the upside, 0.63 is seen as the next

resistance level for the aussie.

Against the euro and the NZ dollar, the aussie edged up to

1.6602 and 1.1071 from yesterday's closing quotes of 1.6611 and

1.1048, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 1.64 against the euro and 1.11

against the kiwi.

The NZ dollar rose to 0.5632 against the U.S. dollar and 87.43

against the yen, from recent lows of 0.5582 and 87.45,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 0.59 against the greenback and 90.00 against the

yen.

Against the euro, the kiwi edged up to 1.8343 from yesterday's

closing value of 1.8353. On the upside, 1.81 is seen as the next

upside target for the kiwi.

The Canadian dollar rose to nearly a 3-week high of 0.8948

against the Australian dollar and a 4-day high of 107.70 against

the yen, from yesterday's closing quotes of 0.8967 and 107.67,

respectively. If the loonie extends its uptrend, it is likely to

find resistance around 0.88 against the aussie and 109.00 against

the yen.

Against the U.S. dollar and the euro, the loonie edged up to

1.4417 and 1.4894 from recent lows of 1.4503 and 1.4929,

respectively. The loonie may test resistance around 1.39 against

the greenback and 1.47 against the euro.

Looking ahead, U.S. factory orders for December and U.S.

RCM/TIPP Economic Optimism Index for February are due to be

released in the New York session.

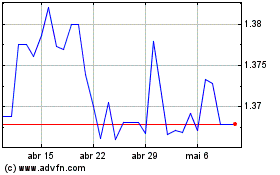

US Dollar vs CAD (FX:USDCAD)

Gráfico Histórico de Câmbio

De Jan 2025 até Fev 2025

US Dollar vs CAD (FX:USDCAD)

Gráfico Histórico de Câmbio

De Fev 2024 até Fev 2025