U.S. Dollar Rises Amid Escalating Trade War Tensions

09 Fevereiro 2025 - 10:33PM

RTTF2

The U.S. dollar strengthened against other major currencies in

the Asian session on Monday, amid concerns over China-U.S. trade

tensions, and potential new tariffs on imports from Canada, Mexico

and the European Union. U.S. President Donald Trump said he will

announce 25 percent tariffs on all imports of steel and

aluminum.

Trump also said he will announce reciprocal tariffs on many

countries, with the U.S. imposing tariffs on imports equal to the

rates imposed on American exports.

The jobs report for January in the United States revealed a

deceleration in job growth, accompanied by a decrease in the

unemployment rate. This development has heightened the probability

that the U.S. Federal Reserve (Fed) will maintain stable interest

rates throughout the year.

Data from the Labor Department showed on last Friday that

non-farm payroll employment rose by 143,000 jobs in January

compared to economist estimates for an increase of about 170,000

jobs.

Meanwhile, employment in December and November surged by

upwardly revised 307,000 jobs and 261,000 jobs, respectively,

reflecting a net upward revision of 100,000 jobs.

The unemployment rate dipped to 4.0 percent in January from 4.1

percent in December. The unemployment rate was expected to remain

unchanged.

In the Asian trading now, the U.S. dollar rose to 6-day highs of

1.0299 against the euro and 0.9123 against the Swiss franc, from

Friday's closing quotes of 1.0327 and 0.9094, respectively. If the

greenback extends its uptrend, it is likely to find resistance

around 1.01 against the euro and 0.92 against the franc.

Against the pound and the yen, the greenback edged up to 1.2380

and 152.20 from last week's closing quotes of 1.2409 and 151.40,

respectively. The greenback may test resistance around 1.21 against

the pound and 157.00 against the yen.

Against the Australia, the New Zealand and the Canadian dollars,

the greenback advanced to a 5-day high of 0.6252, a 6-day high of

0.5638 and a 4-day high of 1.4358 from last week's closing quotes

of 0.6271, 0.5660 and 1.4294, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 0.60

against the aussie, 0.55 against the kiwi and 1.48 against the

loonie.

Looking ahead, Eurozone Sentix investor confidence survey

results for February are due. The sentiment index is expected to

rise to -16.4 in February from -17.7 in January.

In the New York session, U.S. consumer inflation expectations

for January is slated for release.

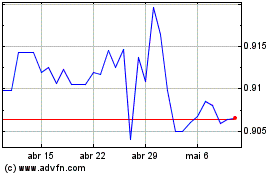

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Jan 2025 até Fev 2025

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Fev 2024 até Fev 2025