Antipodean Currencies Fall Amid Global Trade War Concerns

13 Março 2025 - 1:18AM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Thursday, as concerns about the impact of the

ongoing trade war continue to weigh on the markets.

U.S. President Donald Trump escalated global trade tensions by

threatening more tariffs on EU goods. Trump also hinted at

financial repercussions if Russia rejects the Ukraine ceasefire

proposal. Trump's steel and aluminum tariffs took effect on

Wednesday, raising fears of a widening global trade war.

In economic news, data from the Australian Bureau of Statistics

showed that the total number of building permits issued in

Australia increased as initially estimated in January. Building

consents climbed a seasonally adjusted 6.3 percent monthly to

16,579 units in January, much faster than the 1.7 percent gain in

December. That was in line with the flash data published on March

6.

Permits for private sector houses rose 1.1 percent on month to

9,042, while consents for private sector dwellings excluding houses

surged 12.7 percent to 7,213.

On a yearly basis, permits for private sector houses grew 8.9

percent, approvals for private sector dwellings excluding houses

rallied 41.6 percent, and overall permits were up 21.7 percent.

Meanwhile, Australia's Consumer Inflation Expectations, which

measure how much consumers estimate inflation to be over the next

12 months, dropped from 4.6% in February to 3.6% in March, the

lowest level since April 2024.

In the Asian trading today, the Australian dollar fell to 0.6308

against the U.S. dollar and 1.7266 against the euro, from a recent

6-day high of 0.6334 and a 4-day high of 1.7188, respectively. If

the aussie extends its downtrend, it is likely to find support

around 0.61 against the greenback and 1.75 against the euro.

The aussie slid to 93.26 against the yen, from a recent high of

93.94. The aussie may test support near the 91.00 region.

Against the Canada and the New Zealand dollars, the aussie edged

down to 0.9076 and 1.1012 from recent highs of 0.9097 and 1.1031,

respectively. On the downside, 0.89 against the loonie and 1.09

against the kiwi are seen as the next support levels for the

aussie.

The NZ dollar fell to a 2-day low of 84.30 against the yen, from

a recent high of 85.17. The next possible downside target for the

kiwi is seen around the 82.00 region.

Against the U.S. dollar and the euro, the kiwi edged down to

0.5709 and 1.9049 from recent 3-day highs of of 0.5742 and 0.8959,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.50 against the greenback and 1.92 against the

euro.

Looking ahead, Eurostat is slated to release euro area

industrial production figures for January at 6:00 am ET in the

European session. Industrial output is expected to grow 0.5 percent

month-on-month in January, in contrast to the 1.1 percent decrease

in December.

In the New York session, U.S. building permits for January, PPI

for February and U.S. weekly jobless claims data are slated for

release.

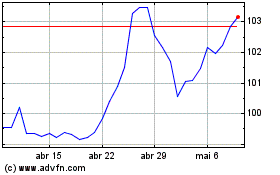

AUD vs Yen (FX:AUDJPY)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

AUD vs Yen (FX:AUDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025