NZ Dollar Slides Amid RBNZ Rate Cut Speculation

20 Março 2025 - 1:17AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Thursday, as the New Zealand's central bank

hinted about two additional 25 basis point reductions in April and

May, with a third cut perhaps coming later in the year.

The Reserve Bank of New Zealand (RBNZ) has lowered the official

cash rate by 175 basis points to 3.75% since August 2024.

In economic news, the People's Bank of China kept its one-year

loan prime rate unchanged at 3.10 percent. Likewise, the five-year

LPR, the benchmark for mortgage rates, was retained at 3.60

percent.

Both the rates were last reduced by 25 basis points each in

October 2024.

The announcement came after the U.S. Federal Reserve left its

interest rate unchanged on Wednesday. But the Fed signaled that it

is still likely to lower rates later this year.

The NZ dollar had rose slightly against its major rivals in the

Asian session today, after New Zealand's economy grew faster than

forecast in the fourth quarter and retreated thereafter.

Data from Statistics New Zealand showed that New Zealand's gross

domestic product expanded a seasonally adjusted 0.7 percent on

quarter in the fourth quarter of 2024. That beat forecast for an

increase of 0.4 percent following the downwardly revised 1.1

percent contraction in the three months prior (originally -1.0

percent).

On a yearly basis, GDP was down 1.1 percent - again beating

expectations for a fall of 1.4 percent following the downwardly

revised 1.6 percent drop in the previous three months (originally

-1.5 percent).

In the Asian trading today, the NZ dollar fell to a 3-day low of

85.75 against the yen, from yesterday's closing value of 86.39. The

kiwi may test support around the 83.00 region.

Against the U.S. dollar and the euro, the kiwi dropped to 0.5784

and 1.8855 from Wednesday's closing quotes of 0.5820 and 1.8751,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.56 against the greenback and 1.92 against the

euro.

Against the Australian dollar, the kiwi retreated to a 2-day low

of 1.0957 from a recent near 3-1/2-month high of 1.0914. The next

possible may test support near the 1.11 region.

Looking ahead, the Swiss National Bank announces its monetary

policy decision at 4:30 am ET. The SNB is widely expected to lower

the interest rate by 25 basis points to 0.25 percent. But today's

rate is likely to be the last in the current easing cycle as the

currency has weakened notably over the last few months.

At 8:00 am ET, the Bank of England announces its monetary policy

decision. The BoE is likely to sit tight on rates today as

inflation remains sticky. The nine-member policy committee is

widely seen holding the rate at 4.50 percent in a split vote.

In the New York session, Canada PPI and raw material prices for

February, U.S. Current Account data for the fourth quarter, U.S.

weekly jobless claims data, existing home sales for February and

U.S. Consumer Board's leading index for February are slated for

release.

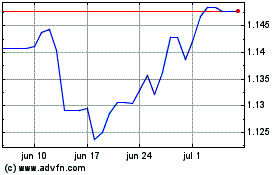

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025