TIDMASY

RNS Number : 5871Y

Andrews Sykes Group PLC

10 May 2019

Andrews Sykes Group plc

Summary of results

For the 12 months ended 31 December 2018

12 months 12 months

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Revenue from continuing operations 78,563 71,300

EBITDA* from continuing operations 26,737 22,851

Operating profit 20,681 17,589

Profit after tax for the financial period 17,046 14,101

Basic earnings per share from total operations

(pence) 40.39p 33.37p

Interim and final dividends paid per equity

share (pence) 23.80p 23.80p

Proposed final dividend per equity share

(pence) 11.90p 11.90p

Net cash inflow from operating activities 19,110 17,862

Total interim and final dividends paid 10,048 10,058

Net funds 23,381 20,293

* Earnings Before Interest, Taxation, Depreciation, profit on

sale of property, plant and equipment, Amortisation and non-

recurring items as reconciled on the consolidated income

statement.

For further information please contact:

Andrews Sykes Group plc

Paul Wood, Group Managing Director

Andrew Phillips, Chief Financial Officer 01902 328700

------------------------------------------- --------------

GCA Altium Limited (NOMAD)

Tim Richardson 0207 484 4040

------------------------------------------- --------------

Arden Partners plc (Broker)

Steve Douglas 020 7614 5900

------------------------------------------- --------------

Andrews Sykes Group plc

Chairman's Statement

Overview and financial highlights

Summary

The group's revenue for the year ended 31 December 2018 was

GBP78.6 million, an increase of GBP7.3 million, or 10.2%, compared

with the same period last year. This increase had a more than

proportionate impact on operating profit which increased by 17.6%,

or GBP3.1 million, from GBP17.6 million last year to GBP20.7

million in the year under review. This increase, which follows a

11.2% increase last year, reflects strong and improved performances

from both our hire and sales businesses in the UK and Europe and a

strong and stable performance from our business in the Middle

East.

Net finance income was GBP0.4 million this year compared with

net finance costs of GBP0.3 million in 2017. This is largely

attributable to a foreign exchange gain arising on the

retranslation of inter-company balances of GBP0.3 million this year

compared with a loss of GBP0.3 million in 2017. This reflects

further weakening of Sterling compared with both the Euro and UAE

Dirham.

The group has reported an increase in the basic earnings per

share of 7.02p, or 21%, from 33.37p in 2017 to 40.39p in the

current year. This is mainly attributable to the above improvement

in the group's operating profit which has enhanced the quality of

earnings. The growth in the basic EPS is indicative of the

underlying business performance and strength of the group.

The group continues to generate strong cash flows. Net cash

inflow from operating activities was GBP19.1 million compared with

GBP17.9 million last year. Despite shareholder related cash

outflows of GBP10.5 million on ordinary dividends and share

buybacks, net funds increased by GBP3.1 million from GBP20.3

million at 31 December 2017 to GBP23.4 million at 31 December

2018.

Our policy of returning affordable dividends to shareholders

continues and, over the last five financial years, the group has

paid GBP50.3 million in cash to shareholders. This has not been at

the

expense of our other obligations; the group pays its external

creditors in accordance with their agreed credit terms, it operates

well within its banking covenants and has met its obligations as

they fall due to fund the defined benefit pension scheme.

Therefore, in the light of the improved operating profit and

substantial net funds that are available, the Board is once again

proposing a further final dividend payment amounting to GBP5.0

million which, if approved at the forthcoming AGM, will be paid in

June 2019.

Cost control, cash and working capital management continue to be

priorities for the group. Capital expenditure is concentrated on

assets that give a good return and in total GBP7.5 million was

invested in the hire fleet this year, GBP0.6 million more than last

year and significantly more than the wasting depreciation charge of

GBP5.9 million. In addition, the group invested a further GBP1.1

million in property, plant and equipment. These actions will ensure

that the group's infrastructure and revenue generating assets are

sufficient to support future growth and profitability. Hire fleet

utilisation, condition and availability continue to be the subjects

of management focus.

Operating performance

The following table splits the results between the first and

second half years:

Turnover Operating profit

GBP'000 GBP'000

--------- ------------------

1st half 2018 37,815 9,280

--------- ------------------

1st half 2017 35,334 8,171

--------- ------------------

2nd half 2018 40,748 11,401

--------- ------------------

2nd half 2017 35,966 9,418

--------- ------------------

Total 2018 78,563 20,681

--------- ------------------

Total 2017 71,300 17,589

--------- ------------------

/

--------- ------------------

The above table demonstrates that the successful performance in

the first half of the year continued into the second half. Turnover

in the first half of the year showed a 7.0% improvement over the

same period in 2017 and, in the second half, the percentage

improvement increased to 13.3%. Operating profit for the first half

year showed a 13.6% improvement compared with the same period in

2017 and a 21.1% improvement for the second half year.

Traditionally, the group makes more profit in the second half year

due to the higher profit margins on its air conditioning products

which are hired predominantly in the second half of the year. The

effect this year was even more pronounced than normal due to the

long and hot summer throughout Northern Europe providing excellent

opportunities for this area of our business.

The operating profit of our main business segment in the UK and

Northern Europe increased from GBP15.2 million last year to GBP19.1

million in the year under review. During the first quarter a period

of very cold weather created good opportunities for our heating and

boiler hire activities and this was followed by a long hot summer

which provided excellent opportunities for our air conditioning and

chiller products. The group's management team took advantage of the

opportunities presented to them and the improved profitability

would not have been forthcoming without the considerable efforts of

all our staff. The pumping business again performed well following

continued success over recent years. Our traditional businesses

continue to be developed and supported by the expansion of

non-weather dependent niche markets which benefit the performance

of our specialist hire divisions. This year's result demonstrates

that with properly directed investment, a well maintained hire

fleet, a knowledgeable management team and dedicated employees we

are able to take full advantage of opportunities when they are

presented to us and deliver a strong performance for the benefit of

all shareholders.

Our hire and sales business in the Middle East had another

satisfactory trading year. Although the operating profit for this

business segment reduced from GBP2.9 million in 2017 to GBP2.4

million in the current year, the majority of this reduction

occurred in the first half of the year. Trading showed a

significant improvement in the second half of the year..

Our fixed installation business sector in the UK returned a

reduced operating profit of GBP0.1 million this year compared with

GBP0.4 million in 2017. The market continues to be fragmented with

high levels of price competition.

Central overheads were GBP0.9 million in both the current year

and 2017.

Profit for the financial year

Profit before tax was GBP21.1 million this year compared with

GBP17.3 million last year, an increase of GBP3.8 million. This is

attributable to the above GBP3.1 million increase in operating

profit which is supplemented by a swing in finance costs from a net

charge of GBP0.3 million last year to a net credit of GBP0.4

million this year. This was primarily due to foreign exchange rate

movements as discussed above.

Tax charges increased from GBP3.2 million in 2017 to GBP4.0

million this year. The overall effective tax

rate increased from 18.4% in 2017 to 19.0%, primarily due to a

change in mix of profits with a greater percentage of the group's

profits being earned in Europe this year compared with the Middle

East where corporation tax rates are very low. A detailed

reconciliation of the theoretical corporation tax charge based on

the accounts profit multiplied by 19% and the actual tax charge is

given in note 11 to the consolidated financial statements. Profit

for the financial year was GBP17.1 million compared with GBP14.1

million last year.

Equity dividends

The company paid two dividends during the year. On 25 June 2018,

a final dividend for the year ended 31 December 2017 of 11.9 pence

per ordinary share was paid and this was followed on 9 November

2018 by the payment of an interim dividend for 2018, also of 11.9

pence per share. Therefore, during 2018, a total of GBP10.1 million

in cash dividends has been returned to our ordinary

shareholders.

I am pleased to announce that, in view of the group's ongoing

profitability and its significant cash resources, the Board has

proposed a final dividend for 2018, also of 11.9 pence per ordinary

share. If approved at the forthcoming Annual General Meeting this

dividend, which in total amounts to GBP5.0 million, will be paid on

21 June 2019 to shareholders on the register as at 31 May 2019.

Share buybacks

The company purchased 87,723 of its own one pence ordinary

shares for cancellation during the period for a consideration of

GBP0.4 million. This purchase enhanced earnings per share and was

for the benefit of all shareholders. As at 9 May 2019, there

remained an outstanding general authority for the directors to

purchase 5,195,037 ordinary one pence shares that was granted at

last year's Annual General Meeting.

The Board believes that it is in the best interests of

shareholders if it has this authority in order that market

purchases may be made in the right circumstances if the necessary

funds are available. Accordingly, at the next Annual General

Meeting, shareholders will be asked to vote in favour of a

resolution to renew the general authority to make market purchases

of up to 12.5% of the ordinary share capital in issue.

Net funds

At 31 December 2018, the group had net funds of GBP23.4 million

compared with GBP20.3 million last year, an increase of GBP3.1

million despite shareholder related cash outflows of GBP10.5

million on ordinary dividends and share buybacks during the

year.

Bank loan facilities

The group continues to operate within its bank covenants. In

April 2017 a bank loan of GBP5 million was taken out with the

group's bankers, Royal Bank of Scotland. The first loan repayment

of GBP0.5 million was made in accordance with the bank agreement on

30 April 2018. The remaining balance of GBP4.5 million will be

repaid by three equal annual instalments of GBP0.5 million per

annum commencing on 30 April 2019 followed by a final balloon

repayment of GBP3 million due on 30 April 2022.

Outlook

The group's policy to increase investments in new

technologically advanced and environmentally friendly non-seasonal

products will be continued into 2019. Investments will also

continue in our traditional businesses to ensure we are ready to

support our customers in times of extreme weather conditions.

The group continues to face both challenges and opportunities in

all of its geographical markets but our business remains strong,

cash generative and well developed, with positive net funds. The

Board remains mindful of the favourable or adverse impact that the

weather can have on our business.

JG Murray

Chairman

9 May 2019

Andrews Sykes Group plc

Consolidated Income Statement

For the 12 months ended 31 December 2018

12 months 12 months

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Continuing operations

Revenue 78,563 71,300

Cost of Sales (31,908) (30,086)

Gross profit 46,655 41,214

Distribution costs (12,073) (11,571)

Administrative expenses (13,901) (12,054)

Operating profit 20,681 17,589

EBITDA* 26,737 22,851

Depreciation and impairment losses (6,666) (5,917)

Profit on the sale of plant and equipment 610 655

---------------------- -------------------------------

Operating profit 20,681 17,589

---------------------- -------------------------------

Finance income 461 82

Finance costs (97) (386)

---------------------- -------------------------------

Profit before taxation 21,045 17,285

Taxation (3,999) (3,184)

Profit for the financial period attributable

to equity holders of the parent 17,046 14,101

====================== ===============================

There were no discontinued operations

in either of the above periods

Earnings per share

Basic (pence) 40.39p 33.37p

Diluted (pence) 40.39p 33.37p

Interim and final dividends paid per

equity share (pence) 23.80p 23.80p

Proposed final dividend per equity share

(pence) 11.90p 11.90p

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-

recurring items.

Andrews Sykes Group plc

Consolidated Statement of Comprehensive Total Income

For the 12 months ended 31 December 2018

12 months 12 months

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Profit for the financial period 17,046 14,101

------------------------- ---------------------------

Other comprehensive (charges) / income

Items that may be reclassified to

profit and loss:

Currency translation differences

on foreign operations 405 (2)

Items that will never be reclassified

to profit and loss:

Remeasurement of defined benefit

assets and liabilities (1,649) 1,391

Related deferred tax 313 (264)

Other comprehensive (charges) / income

for the period net of tax (931) 1,125

------------------------- ---------------------------

Total comprehensive income for the

period 16,115 15,226

========================= ===========================

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 31 December 2018

31 December 2018 31 December 2017

--------------------------- ------------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 23,651 21,911

Lease prepayments 45 47

Deferred tax asset 677 102

Retirement benefit pension

surplus 1,356 3,364

-------------- ------------------

25,729 25,424

Current assets

Stocks 5,083 3,860

Trade and other receivables 19,994 17,852

Cash and cash equivalents 27,862 25,311

----------- ----------------

52,939 47,023

----------- ----------------

Current liabilities

Trade and other payables (12,889) (12,358)

Current tax liabilities (2,294) (1,696)

Bank loans (493) (493)

Obligations under finance

leases (5) (43)

(15,681) (14,590)

----------- ----------------

Net current assets 37,258 32,433

Total assets less current

liabilities 62,987 57,857

Non-current liabilities

Bank loans (3,983) (4,475)

Obligations under finance

leases - (7)

(3,983) (4,482)

-------------- ------------------

Net assets 59,004 53,375

============== ==================

Equity

Called-up share capital 423 423

Share premium 13 13

Retained earnings 54,013 48,789

Translation reserve 4,300 3,895

Other reserves 246 245

Surplus attributable to equity holders

of the parent 58,994 53,365

Non-controlling interests 10 10

Total equity 59,004 53,375

============== ==================

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 12 months ended 31 December 2018

12 months 12 months

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 22,888 21,090

Interest paid (88) (84)

Net UK corporation tax paid (2,236) (2,142)

Overseas tax paid (1,454) (1,002)

Net cash flow from operating activities 19,110 17,862

--------------------------- --------------------------------

Investing activities

Sale of property, plant and equipment 944 861

Purchase of property, plant and

equipment (7,142) (5,790)

Interest received 41 51

--------------------------------

Net cash flow from investing activities (6,157) (4,878)

--------------------------- --------------------------------

Financing activities

Loan repayments (500) (5,000)

New loans raised - 4,973

Finance lease capital repayments (45) (101)

Equity dividends paid (10,048) (10,058)

Purchase of own shares (438) -

Net cash flow from financing activities (11,031) (10,196)

--------------------------- --------------------------------

Net increase in cash and cash equivalents 1,922 2,788

Cash and cash equivalents at the

beginning of the period 25,311 22,819

Effect of foreign exchange rate

changes 629 (296)

Cash and cash equivalents at the

end of the period 27,862 25,311

=========================== ================================

Reconciliation of net cash flow

to movement in net funds in the

period

Net increase in cash and cash equivalents 1,922 2,788

Cash outflow from the repayment

of loans and finance leases 545 5,101

Cash inflow from the drawdown of

new loans net of charges - (4,963)

Non-cash movement in respect of

raising loan finance (8) (10)

Increase in net funds during the

period 2,459 2,916

Opening net funds at the beginning

of the period 20,293 17,673

Effect of foreign exchange rate

changes 629 (296)

--------------------------- --------------------------------

Closing net funds at the end of

the period 23,381 20,293

=========================== ================================

Andrews Sykes Group plc

Consolidated Statement of Changes in Equity

For the 12 months ended 31 December 2018

Attributable to equity holders of Minority Total

the parent company interest equity

---------------------------------------------------------------------------------------

Share Share Retained Translation Other

capital Premium earnings reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2016 423 13 43,619 3,897 245 48,197 10 48,207

Profit for the

financial

period - - 14,101 - - 14,101 - 14,101

Other

comprehensive

income and

(charges):

Items that may

be

reclassified

to

profit and

loss:

Currency

translation

differences

on foreign

operations - - - (2) - (2) - (2)

Items that

will

never be

reclassified

to profit and

loss:

Remeasurement

of

defined

benefit

assets and

liabilities - - 1,391 - - 1,391 1,391

Related

deferred

tax - - (264) - - (264) - (264)

Total other

comprehensive

income and

(charges) - - 1,127 (2) - 1,125 - 1,125

---------- -------------- ----------- ------------------- ------------ ----------- --------- -----------

Transactions

with

owners

recorded

directly in

equity:

Dividends paid - - (10,058) - - (10,058) - (10,058)

Total

transactions

with owners - - (10,058) - - (10,058) - (10,058)

---------- -------------- ----------- ------------------- ------------ ----------- --------- -----------

At 31 December

2017 423 13 48,789 3,895 245 53,365 10 53,375

Profit for the

financial

period - - 17,046 - - 17,046 - 17,046

Other

comprehensive

(charges) and

income:

Items that may

be

reclassified

to

profit and

loss:

Currency

translation

differences

on foreign

operations - - - 405 - 405 - 405

Items that

will

never be

reclassified

to profit and

loss:

Remeasurement

of

defined

benefit

assets and

liabilities - - (1,649) - - (1,649) (1,649)

Related

deferred

tax - - 313 - - 313 - 313

Total other

comprehensive

(charges) and

income - - (1,336) 405 - (931) - (931)

---------- -------------- ----------- ------------------- ------------ ----------- --------- -----------

Transactions

with

owners

recorded

directly in

equity:

Purchase of

own

shares (1) - (438) - 1 (438) - (438)

Dividends paid - - (10,048) - - (10,048) - (10,048)

Total

transactions

with owners (1) - (10,486) - 1 (10,486) - (10,486)

---------- -------------- ----------- ------------------- ------------ ----------- --------- -----------

At 31 December

2018 422 13 54,013 4,300 246 58,994 10 59,004

---------- -------------- ----------- ------------------- ------------ ----------- --------- -----------

Andrews Sykes Group plc

Notes

For the 12 months ended 31 December 2018

1. Basis of preparation

Whilst the information included in this preliminary announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs. Therefore the financial

information set out above does not constitute the company's

financial statements for the 12 months ended 31 December 2018 or 31

December 2017 but it is derived from those financial

statements.

2. Going Concern

The Board remains satisfied with the group's funding and

liquidity position. The group has operated throughout the 2018

financial year and until the date of signing these accounts within

its financial covenants as contained in the bank agreement.

Both loan capital and interest payments have been made in

accordance with the bank agreements. The first annual repayment due

in accordance with the loan agreement dated 30 April 2017 of GBP0.5

million was made on 30 April 2018. The group's profit and cash flow

projections indicate that the financial covenants included within

the new bank loan agreement will be met for the foreseeable

future.

The group continues to have substantial cash resources which at

31 December 2018 amounted to GBP27.9 million compared with GBP25.3

million as at 31 December 2017. Profit and cash flow projections

for 2019 and 2020, which have been prepared on a conservative basis

taking into account reasonably possible changes in trading

performance, indicate that the group will be profitable and

generate positive cash flows after loan repayments. These forecasts

and projections indicate that the group should be able to operate

within the new bank facility agreement and that all associated

covenants will be met.

The Board considers that the group has considerable financial

resources and a wide operational base. As a consequence, the Board

believes that the group is well placed to manage its business risks

successfully, as demonstrated by the current year's result, despite

some uncertain external influences.

After making enquiries, the Board has a reasonable expectation

that the group has adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Board

continues to adopt the going concern basis when preparing the

Annual Report and Financial Statements from which this preliminary

announcement is derived.

3. Distribution of Annual Report and Financial Statements

The group expects to distribute copies of the full Annual Report

and Financial Statements that comply with IFRSs by 17 May 2019

following which copies will be available either from the registered

office of the company; St David's Court, Union Street,

Wolverhampton, WV1 3JE; or from the company's website;

www.andrews-sykes.com. The Annual Report and Financial Statements

for the 12 months ended 31 December 2017 have been delivered to the

Registrar of Companies and those for the 12 months ended 31

December 2018 will be filed at Companies House following the

company's Annual General Meeting. The auditor has reported on those

financial statements; the report was unqualified, did not draw

attention to any matters by way of emphasis without qualifying

their report and did not contain details of any matters on which

they are required to report by exception.

4. Date of Annual General Meeting

The group's Annual General Meeting will be held at 10.30 a.m. on

Tuesday, 18 June 2019 at 2 Eaton Gate, London, SW1W 9BJ.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKCDNFBKDQPK

(END) Dow Jones Newswires

May 10, 2019 02:00 ET (06:00 GMT)

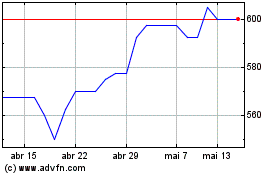

Andrews Sykes (LSE:ASY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Andrews Sykes (LSE:ASY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025