TIDMPIP

RNS Number : 9733U

PipeHawk PLC

29 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation

29 November 2023

PipeHawk plc

("PipeHawk", "Company" or the "Group")

Final Results for the year ended 30 June 2023

Highlights

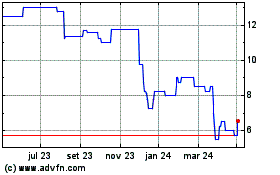

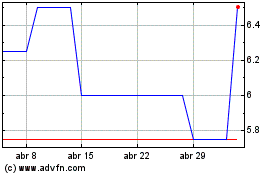

- Turnover of GBP6.5 million, an increase of 4.8% (2022: GBP6.2 million)

- Loss before taxation for the financial year of GBP 3,284,000 (2022: loss GBP 1,576,000 )

- The Group's orderbook sits in excess of GBP6 million - the highest in the Group's history

I can report that Group t urnover for the financial year ended

30 June 2023 (the "Financial Year" and the 2022/23 FY") increased

to GBP6.5 million (2022: GBP6.2 million). The Group incurred an

operating loss in the Financial Year of GBP2,899,000 (2022:

GBP1,312,000), a loss before taxation for the Financial Year of

GBP3,284,000 (2022: loss GBP1,576,000) and a loss after taxation of

GBP2,484,000 (2022: loss GBP868 ,000 ). The loss per share for the

financial year was 6.84p (2022: loss 2.42p).

Notwithstanding the resurgence of our businesses over the last

few months, due to delay in the Start of Production for the

contract manufacturing business, and given the effects of the wider

downturn and volatility in the global market uncertainty the

directors have taken a prudent view to recognise a goodwill

impairment charge totalling GBP678k.

It is evident now that the disappointing results delivered

during the last two financial years were created over a single

12-month period spanning January 2022 through until December 2022.

This was as a result of a perfect storm on the back of a faltering

recovery from Covid, the Russian invasion of the Ukraine in

February 2022 and the political chaos resulting from the

resignation of Boris Johnson as Prime Minister in June 2022, an

interregnum until the appointment, and brief term in office, of Liz

Truss from September 2022 and finally the appointment of Rishi

Sunak in late October 2022. All this set against a background of

rising fuel prices and price rises on just about every other

manufactured good, whilst the Bank of England "helps" to reduce

demand even further by increasing UK interest rates most months

whilst saying there is more pain to come! Somewhat surprisingly and

despite the aforementioned factors, quotations within the Group's

businesses over this period remained buoyant, evidencing the desire

of clients to place orders once they felt confident that a degree

of stability had materialised.

The first half of the financial year saw a slow start on sales

at GBP2.2 million, however the second half of the financial year

saw this rise to GBP4.3 million. This improvement has continued

into the first few months of the current financial year as we

anticipate being able to make full use of the much larger

facilities which we moved into at QM and TED when the market place

was looking much more positive two years ago.

We entered the current year with a Group orderbook in excess of

GBP6 million - the highest in our history, so, provided there are

no more nasty surprises to upset the resurgence of stability and

belief in our economy, I am confident the Group will be able to

report a much-improved financial return at the end of the current

financial year, with this improvement continuing thereafter.

QM Systems

For the reasons outlined above, QM had a very tough year having

only just moved to premises five times larger with consequent

increased overhead costs. Nevertheless, unlike some of its

competitors, it has weathered the storm and has come out

stronger.

Similar to the previous 2021/22 financial year, QM experienced a

year of two halves although this time in reverse. The 2022/23

financial year saw QM report a 36% increase in revenue to GBP4.2m

but with a significant loss after tax of GBP970k for the year.

However, the loss was almost entirely created within the first six

months where revenue was only GBP1.3m with a loss after tax of

GBP950k. The company steadily grew revenue throughout the second

part of the year achieving a return to profit within the final

quarter.

Towards the end of the first quarter of the 2022/23 financial

year, contract awards again began to flow into the business, and

this accelerated through the latter part of 2022 and into 2023.

Orders received during the period from September 2022 through to

June 2023 exceeded GBP7m and resulted in QM ending the 2022/23

financial year with its healthiest ever forward orderbook of

GBP5.8m. Many of these orders were quotations provided by QM 12-18

months prior, in some cases more.

The average size of order award for QM has increased to

approximately GBP500k with a number of larger orders between GBP1m

to GBP2m in value also being awarded. QM today sits in a

competitive position for contracts with values above GBP300k. QM

now has the infrastructure both in terms of resource and facilities

to deliver large multi-million-pound contracts, and today sales

generation is focused on larger contracts where QM can add real

value to our clients with a very competitive pricing structure.

The current financial year will see the Start of Production

(SOP) in three contract manufacturing business units with them

entering SOP in Q1 2024. This in turn will create a business model

that is not reliant totally on Capital expenditure project

awards.

Revenue continues to increase month on month as we head into the

2023/24 financial year and we have short/medium term visibility on

a good return to profitability and stability.

Thomson Engineering Design ("TED")

TED generated revenues in the Financial Year of GBP970k and a

loss after tax of GBP267k and has followed a similar trajectory to

QM with a depressed initial six-month period of financial year

2022/23 during which revenues were c. GBP400k, generating a loss

after tax of c. GBP220k, followed by a more buoyant second half

year where revenues were GBP570k, generating a reduced loss after

tax of c. GBP50k. Sales however did remain below our

expectations.

As Network Rail approaches the end of the CP6 funding round, a

number of new contract awards have been delayed to align to the

start of CP7 (March 2024). This clearly has a knock-on effect on

TED in delaying UK-based client sales of equipment. However, this

impact is restricted to the UK market only. As reported previously,

TED signed a distribution agreement with Unipart Rail late in 2022

and this has resulted in a substantial amount of business being

quoted to Unipart Rail. TED is now beginning to see a number of

these quotations transition into orders. However, this has had

little impact on financial year 2022/23. Unipart Rail are now

placing orders with TED on a regular basis, and we fully expect to

see a rapid growth in revenue contribution as the current financial

year 2023/24 continues. Together with increased revenue, Unipart

Rail brings a ready-made marketing system to TED's door that

provides TED with unrivalled exposure to global markets. Unipart

Rail is locally and actively present in South East Asia, Europe,

North America, Australia and the Middle East. Because of this local

presence, Unipart Rail understands the respective markets clearly

and this in turn helps TED and Unipart Rail to work together to

fine tune and develop products for each market.

Over the past year, Unipart Rail, with support from TED, has

promoted the TED product catalogue at InnoTrans 2022 - the largest

rail exhibition in Europe, Rail Live 2022 - the largest rail

exhibition in the UK. Trax 2022 - North America, MTI - Japan - Nov

2022 and Aus Rail - Australia Nov 2022. Looking forwards over the

coming year, TED's products will be exhibited at MTI - Japan - June

2024, Trax - North America - June 2024, Rail Live 2023 - UK - July

2024, RSSi / Remsa - US - July 2024 and InnoTrans - Berlin

September 2024.

TED has continued development of a number of innovative 'High

Output' machines. This suite of machines, consisting of track and

panel handlers, gantry cranes, automated rail threaders and

automated dust suppressed ballast brooms work hand in hand to

provide rail maintenance and installation operators with a very

capable set of tools that can greatly increase the speed with which

track systems can be laid for a fraction of the cost of the bigger

multi-million train-based systems utilised today. The equipment is

far smaller and lightweight, can run on a track bed without needing

rails and can be deployed quickly and easily to site at a fraction

of the cost of conventional systems.

Adien

Adien was very badly affected by the disruption to business

confidence as a result of the Conservative leadership debacle last

year. Several large projects which had been awarded to Adien were

shelved at short notice, and longer-term projects were reassessed

and pushed onto the back burner.

As the reality of deferred work became evident as significantly

more than a temporary blip, the company implemented a massive

structural change to the business, including the appointment of a

new Managing Director, consolidation of roles, leading to some

staff being made redundant, implementation of a new corporate plan

and a refocusing of the sales department as a whole. This, with the

return of a degree of business confidence, has dramatically

increased the prospects and resulting orders at Adien.

Turnover for the first quarter of the current, 23/24 financial

year is almost double that of the same period last year, and

resulting in a very satisfactory return to profitability. The

forward order book is full, and order enquiries are extremely

buoyant.

On the whole, the team at Adien are thoroughly enthused, working

well together with full commitment to see a very successful

2023/24.

UTSI

UTSI had a very cyclical year that saw the willingness of UK

& EU customers to invest in new sensor technology rise and fall

with every global event and interest rate hike. While some overseas

markets remained resiliently buoyant, overall retail sales were

still down. Demand for our more specialist systems and bespoke

design service however remained strong and rose throughout the

year, with a number of projects keeping R&D busy and bolstering

turnover.

Even though the cost of many of our raw materials started to

stabilise during the year, with some even falling, average

electronic component prices remained higher at the year end than at

the beginning, with a number of key components still in short

supply and on long lead times. With retail and trade customers

resisting further price increases, margins had to be tightened to

remain competitive and although UTSI's overall turnover increased

year on year, it could have been higher were it not for some

lingering long lead times in the supply chain, preventing orders

being completed during the financial year. As a result, a small

loss was realised.

While UTSI continues to seek new R&D project opportunities

externally, it has also been busy with a few of its own, with

internal developments concentrating on new and better sensor

systems for use in the growing environmental sciences sector. We

expect to see the first of these systems entering the market within

the next financial year.

Financial position

The Group continues to be in a net liability position and is

still reliant on my continuing financial support.

My letter of support dated 6 September 2021 was renewed on 26

November 2023 to provide the Group with financial support until 31

December 2024. Loans due to me, other than those covered by the

CULS agreement, are unsecured and accrue interest at an annual rate

of Bank of England base rate plus 2.15%.

The CULS agreement for GBP1 million, provided by me, was renewed

on 30 June 2022 and extended on identical terms, such that the CULS

are now repayable on 13 August 2026.

In addition to the loans, I have provided to the Company in

previous years, I have deferred a certain proportion of fees and

the interest due until the Company is in a suitably strong position

to make the full payments.

Historically, my fees and interest payable have been deferred.

During the year under review, the deferred element amounted to

GBP139,000. At 30 June 2023, these deferred fees and interest

amounted to approximately GBP1.8 million in total, all of which has

been recognised as a liability in the Company's accounts.

Strategy & Outlook

The Group remains committed to creating sustainable

earnings-based growth and focusing on the expansion of its business

with forward-looking products and services. PipeHawk acts

responsibly towards its shareholders, business partners, employees,

society and the environment in each of its business areas.

PipeHawk is committed to technologies and products that unite

the goals of customer value and sustainable development. Despite

wider current market conditions, all divisions of the Group are

currently performing well and I remain optimistic in my outlook for

the Group.

Gordon Watt

Chairman

Date: 28 November 2023

Enquiries:

PipeHawk plc Tel. No. 01252

Gordon Watt (Chairman) 338 959

Allenby Capital Limited (Nomad and Broker) Tel. No. 020 3328

5656

David Hart / Vivek Bhardwaj

For further information on the Company and its subsidiaries,

please visit: www.pipehawk.com

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2023

Note 30 June 30 June

2023 2022

GBP'000 GBP'000

---------- ---------

Revenue 2 6,470 6,191

Staff costs 5 (4,176) (3,861)

Impairment of goodwill Operating costs 11 (678) -

(4,515) (3,642)

---------- ---------

Operating (loss) 4 (2,899) (1,312)

(Loss) before interest and taxation (2,899) (1,312)

---------- ---------

Finance costs 3 (385) (264)

---------- ---------

(Loss) before taxation (3,284) (1,576)

Taxation 7 800 708

(Loss) for the year attributable to equity

holders of the parent (2,484) (868)

========== =========

Other comprehensive income - -

Total comprehensive (Loss) for the year

attributable to equity holder of the

parent (2,484) (868)

========== =========

(Loss) per share (pence) - basic 8 (6.84) (2.42)

(Loss) per share (pence) - diluted 8 (6.84) (2.42)

The notes form an integral part of these financial

statements.

Consolidated Statement of Financial Position

at 30 June 2023

Note 30 June 30 June

2023 2022

GBP'000 GBP'000

--------- ---------

Assets

Non-current assets

Property, plant and equipment 9 783 828

Right of use 10 2,283 2,549

Goodwill 11 679 1,357

--------- ---------

3,745 4,734

--------- ---------

Current assets

Inventories 13 253 340

Current tax assets 826 710

Trade and other receivables 14 2,767 2,389

Cash and cash equivalents 148 4

--------- ---------

3,994 3,443

Total assets 7,739 8,177

========= =========

Equity and liabilities

Equity

Share capital 18 363 363

Share premium 5,316 5,316

Retained earnings (11,131) (8,647)

--------- ---------

(5,452) (2,968)

--------- ---------

Non-current liabilities

Borrowings 4,913 5,612

Trade and other payables 16 - -

4,913 5,612

--------- ---------

Current liabilities

Borrowings Trade and other payables 16 2,886 2,674

15 5,392 2,859

8,278 5,533

Total equity and liabilities 7,739 8,177

========= =========

The notes form an integral part of these financial

statements.

Consolidated Statement of Cash Flow

For the year ended 30 June 2023

Note 30 June 30 June

2023 2022

GBP'000 GBP'000

--------- ---------

Cash flows from operating activities

Operating (Loss) (2,899) (1,312)

Adjustments for:

Impairment of goodwill 678 -

Depreciation 4 579 424

(1,642) (888)

Decrease / (increase) in inventories 87 33

Decrease / (increase) in receivables (378) (580)

Increase/(decrease) in liabilities 2,759 286

--------- ---------

Cash generated/(used) by operations 826 (1,149)

Interest paid (196) (124)

Corporation tax received 683 440

--------- ---------

Net cash generated from / (used in)

operating activities 1,313 (833)

--------- ---------

Cash flows from investing activities

Purchase of plant and equipment (111) (325)

Net cash used in investing activities (111) (325)

--------- ---------

Cash flows from financing activities

Proceeds / (repayments) from borrowings (210) 286

Proceeds / (repayments) of loan (393) 119

Repayment of leases (455) (163)

--------- ---------

Net cash (used in)/generated from financing

activities (1,058) 242

--------- ---------

Net increase / (decrease) in cash

and cash equivalents 144 (916)

Cash and cash equivalents at the beginning

of year 4 920

Cash and cash equivalents at end of

year 148 4

========= =========

The notes form an integral part of these financial

statements.

Statement of Changes in Equity

For the year ended 30 June 2023

Share premium Retained

CONSOLIDATED Share capital account earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- ---------- --------

As at 1 July 2021 349 5,215 (7,779) (2,215)

Loss for the year - - (868) (868)

Total comprehensive income - - (868) (868)

Issue of shares 14 101 - 115

---------------- -------------- ---------- --------

As at 30 June 2022 363 5,316 (8,647) (2,968)

================ ============== ========== ========

Loss for the year - - (2,484) (2,484)

Total comprehensive income (2,484) (2,484)

Issue of shares - - - -

As at 30 June 2023 363 5,316 (11,131) (5,452)

================ ============== ========== ========

The share premium account reserve arises on the issuing of

shares. Where shares are issued at a value that exceeds their

nominal value, a sum equal to the difference between the issue

value and the nominal value is transferred to the share premium

account reserve.

The notes form an integral part of these financial

statements.

1 Summary of significant accounting policies

1.1. General information

PipeHawk plc (the Company) is a limited company incorporated in

the United Kingdom under the Companies Act 2006. The addresses of

its registered office and principal place of business are disclosed

in the company information on page 3. The principal activities of

the Company and its subsidiaries (the Group) are described on page

9.

The financial statements are presented in pounds sterling, the

functional currency of all companies in the Group. In accordance

with section 408 of the Companies Act 2006 a separate statement of

comprehensive income for the parent Company has not been presented.

For the year to 30 June 2023 the Company recorded a net loss after

taxation of GBP1,822,000 (2022: GBP282,000).

1.2. Basis of preparation

The financial statements have been prepared in accordance with

UK-adopted international accounting standards (IAS) The principal

accounting policies are set out below.

Adoption of new and revised standards

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and, in

some cases, have not yet been adopted by the UK. The directors do

not expect that the adoption of these standards will have a

material impact on the financial statements of the Company in

future periods.

1.3. Basis of preparation - Going concern

The directors have reviewed the Parent Company and Group's

funding requirements for the next twelve months which show positive

anticipated cash flow generation, prior to any repayment of loans

advanced by the Executive Chairman. The preparation of cash flow

forecasts for the Group requires estimates to be made of the

quantum and timing of cash receipts from future commercial revenues

and the timing of future expenditure, all of which are subject to

uncertainty. The directors have obtained a renewed pledge from G G

Watt to provide ongoing financial support for a period of at least

twelve months from the approval date of the Group and Parent

Company statement of financial positions. The directors therefore

have a reasonable expectation that the entity has adequate

resources to continue in its operational exercises for the

foreseeable future. It is on this basis that the directors consider

it appropriate to adopt the going concern basis of preparation

within these financial statements. However, a material uncertainty

exists regarding the ability of the Group and Parent Company to

remain a going concern without the continuing financial support of

the Executive Chairman. The financial statement do not include

adjustments which would arise in the event of not being a Going

concern.

1.4. Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries). Control is achieved where the Company has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition or up to the

effective date of disposal, as appropriate. Where necessary,

adjustments are made to the financial statements of subsidiaries to

bring their accounting policies into line with those used by other

members of the Group. All intra-group transactions, balances,

income and expenses are eliminated in full on consolidation.

1.5. Business combinations

Acquisitions of subsidiaries and businesses are accounted for

using the acquisition method. The cost of the business combination

is measured as the aggregate of the fair values (at the date of

exchange) of assets given, liabilities incurred or assumed, and

equity instruments issued by the Group in exchange for control of

the acquiree. The acquiree's identifiable assets, liabilities and

contingent liabilities that meet the conditions for recognition

under IFRS 3 Business.

Goodwill arising on acquisition is recognised as an asset and

initially measured at cost, being the excess of the cost of the

business combination over the Group's interest in the net fair

value of the identifiable assets, liabilities and contingent

liabilities recognised.

1.6. Goodwill

Goodwill is initially recognised as an asset at cost and is

subsequently measured at cost less any accumulated impairment

losses.

For the purpose of impairment testing, goodwill is allocated to

each of the Group's cash-generating units expected to benefit from

the synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. If the recoverable amount of the cash-generating unit is

less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill

allocated to the unit and then to the other assets of the unit

pro-rata on the basis of the carrying amount of each asset in the

unit. An impairment loss recognised for goodwill is not reversed in

a subsequent period.

On disposal of a subsidiary, the attributable amount of goodwill

is included in the determination of the profit or loss on

disposal.

1.7. Revenue recognition

For the year ended 30 June 2023 the Group used the five-step

model as prescribed under IFRS 15 on the Group's revenue

transactions. This included the identification of the contract,

identification of the performance obligations under the same,

determination of the transaction price, allocation of the

transaction price to performance obligations and recognition of

revenue.

The point of recognition arises when the Group satisfies a

performance obligation by transferring control of a promised good

or service to the customer, which could occur over time or at a

point in time.

1.8. Sale of goods

Revenue generated from the sale of goods is recognised on

delivery of the goods to the customer. On this basis revenue is

recognised at a point in time.

1.9. Sale of services

In relation to the design and manufacture of complete software

and hardware test solutions and the provision of specialist

surveying, revenue is recognised through a review of the man-hours

completed on the project at the year-end compared to the total

man-hours required to complete the projects. Provision is made for

all foreseeable losses if a contract is assessed as

unprofitable.

Revenue represents the amount of consideration to which the

Group expects to be entitled in exchange for transferring promised

goods or services to a customer, excluding amounts collected on

behalf of third parties.

Revenue from goods and services provided to customers not

invoiced as at the reporting date is recognised as a contract asset

and disclosed as accrued income within trade and other

receivables.

Although payment terms vary from contract-to-contract invoices

are in general raised in advance of services performed. Where

billing has exceeded the revenue recognised in a period a contract

liability is recognised and this is disclosed as payments received

on account in trade and other payables.

1.10. Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses.

Depreciation is charged so as to write off the cost of assets over

their estimated useful lives, using the straight-line method. The

estimated useful lives, residual values and depreciation method are

reviewed at each year end, with the effect of any changes in

estimate accounted for on a prospective basis. Assets held under

leases are depreciated over their expected useful lives on the same

basis as owned assets or, where shorter, the term of the relevant

lease. Gains and losses on disposals are determined by comparing

the proceeds with the carrying amount and are recognised within the

Statement of Comprehensive Income.

The principal annual rates used to depreciate property, plant

and equipment are:

Equipment, fixtures and fittings 25%

Motor vehicles 25%

1.11. Inventories and work in progress

Inventories are stated at the lower of cost and net realisable

value. Costs, including an appropriate portion of fixed and

variable overhead expenses, are assigned to inventories by the

method most appropriate to the particular class of inventory, with

the majority being valued on a first-in-first-out basis. Net

realisable value represents the estimated selling price for

inventories less all estimated costs of completion and costs

necessary to make the sale.

Work in progress is valued at cost, which includes expenses

incurred on behalf of clients and an appropriate proportion of

directly attributable costs on incomplete assignments. The value of

work in progress is reduced where appropriate to provide for

irrecoverable costs

.

1.12. Financial assets

The Group's financial assets consist of cash and cash

equivalents and trade and other receivables. The Group's accounting

policy for each category of financial asset is as follows:

Financial assets held at amortised cost

Trade receivables and other receivables are classified as

financial assets held at amortised cost. They are initially

recognised at fair value plus transaction costs that are directly

attributable to their acquisition or issue and are subsequently

carried at amortised cost using the effective interest rate method,

less provision for impairment.

Impairment provisions are recognised based on its historical

credit loss experience, adjusted for forward-looking factors

specific to the debtors and the economic environment, the amount of

such a provision being the difference between the net carrying

amount and the present value of the future expected cash flows

associated with the impaired receivable. For receivables, which are

reported net, such provisions are recorded in a separate allowance

account with the loss being recognised within administrative

expenses in the statement of comprehensive income. On confirmation

that the receivable will not be collectable, the gross carrying

value of the asset is written off against the associated

provision.

The Group's financial assets held at amortised cost comprise

other receivables and cash and cash equivalents in the statement of

financial position.

Derecognition of financial assets

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire; or it

transfers the financial asset and substantially all the risks and

rewards of ownership of the asset to another entity.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments issued by the Group are recorded at

the proceeds received, net of direct issue costs.

Financial liabilities

Financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs. Financial

liabilities are subsequently measured at amortised cost using the

effective interest method, with interest expense recognised on an

effective yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability, or, where

appropriate, a shorter period.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

1.13. Leased/Right of Use assets

The leases liability is initially measured at the present value

of the remaining lease payments, discounted using the individual

entities incremental borrowing rate. The lease term comprises the

non-cancellable period of the contract, together with periods

covered by an option to extend the lease where the Group is

reasonably certain to exercise that option based on operational

needs and contractual terms. Subsequently, the lease liability is

measured at amortised cost by increasing the carrying amount to

reflect interest on the lease liability, and reducing it by the

lease payments made. The lease liability is remeasured when the

Group changes its assessment of whether it will exercise an

extension or termination option.

Right-of-use assets are initially measured at cost, comprising

the initial measurement of the lease liability adjusted for any

lease payments made at or before the commencement date, lease

incentives received and initial direct costs. Subsequently,

right-of-use assets are measured at cost, less any accumulated

depreciation and any accumulated impairment losses, and are

adjusted for certain remeasurement of the lease liability.

Depreciation is calculated on a straight-line basis over the

length of the lease. The Group has elected to apply exemptions for

short-term leases and leases for which the underlying asset is of

low value. For these leases, payments are charged to the income

statement on a straight-line basis over the term of the relevant

lease. Right-of-use assets are presented within non-current assets

on the face of the statement of financial position, and lease

liabilities are shown separately on the statement of financial

position in current liabilities and non-current liabilities

depending on the maturity of the lease payments.

Under IFRS16, right-of-use assets will be tested for impairment

in accordance with IAS36 Impairment of Assets.

Payments associated with short-term leases are recognised on a

straight-line basis as an expense in the profit or loss. Short term

leases are leases with a lease term of 12 months or less.

1.14. Pension scheme contributions

Pension contributions are charged to the statement of

comprehensive income in the period in which they fall due. All

pension costs are in relation to defined contribution schemes.

1.15. Share based payments

Equity-settled share-based payments to employees and others

providing similar services are measured at the fair value of the

equity instruments at the grant date. Details regarding the

determination of the fair value of equity-settled share-based

transactions are set out in note 18.

The fair value determined at the grant date of the

equity-settled share-based payments is expensed on a straight-line

basis over the vesting period, based on the Group's estimate of

equity instruments that will eventually vest. At each statement of

financial position date, the Group revises its estimate of the

number of equity instruments expected to vest. The impact of the

revision of the original estimates, if any, is recognised in profit

or loss over the remaining vesting period, with a corresponding

adjustment to reserves.

1.16. Foreign currencies

Monetary assets and liabilities denominated in foreign

currencies are translated into sterling at the rates of exchange

ruling at 30 June. Transactions in foreign currencies are recorded

at the rates ruling at the date of the transactions, and processed

through the profit & loss account.

1.17. Taxation

Income tax expense represents the sum of the tax currently

payable and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the

consolidated statement of comprehensive income because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible. The Group's liability for current tax is calculated

using tax rates that have been enacted or substantively enacted by

the year end date.

Deferred tax

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit, and is accounted for using the statement of financial

position liability method. Deferred tax liabilities are generally

recognised for all taxable temporary differences, and deferred tax

assets are generally recognised for all deductible temporary

differences to the extent that it is probable that taxable profits

will be available against which those deductible temporary

differences can be utilised. Such assets and liabilities are not

recognised if the temporary difference arises from goodwill or from

the initial recognition (other than in a business combination) of

other assets and liabilities in a transaction that affects neither

the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and

associates, and interests in joint ventures, except where the Group

is able to control the reversal of the temporary difference and it

is probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and

interests are only recognised to the extent that it is probable

that there will be sufficient taxable profits against which to

utilise the benefits of the temporary differences and they are

expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

statement of financial position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply in the year in which the liability is

settled or the asset realised, based on tax rates (and tax laws)

that have been enacted or substantively enacted by the year end

date. The measurement of deferred tax liabilities and assets

reflects the tax consequences that would follow from the manner in

which the Group expects, at the reporting date, to recover or

settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle its

current tax assets and liabilities on a net basis.

Current and deferred tax for the year

Current and deferred tax are recognised as an expense or income

in the statement of comprehensive income, except when they relate

to items credited or debited directly to equity, in which case the

tax is also recognised directly in equity.

1.18. Impairment of property, plant and equipment

At each year end date, the Group reviews the carrying amounts of

its property, plant and equipment to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where it is not possible to estimate the recoverable

amount of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

Where a reasonable and consistent basis of allocation can be

identified, corporate assets are also allocated to individual

cash-generating units, or otherwise they are allocated to the

smallest group of cash-generating units for which a reasonable and

consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in the statement of

comprehensive income.

1.19. Research and development

The Group undertakes research and development to expand its

activity in technology and innovation to develop new products that

will begin directly generating revenue in the future. Expenditure

on research is expensed as incurred, development expenditure is

capitalised only if the criteria for capitalisation are recognised

in IAS 38. The Company claims tax credits on its research and

development activity and recognises the income in current tax.

1.20. Government grants

During the period, the Group did not receive benefits from

Government grants.

1.21. Critical judgement in applying accounting policies and key

sources of estimation uncertainty

The following are the critical judgements and key sources of

estimation uncertainty that the directors have made in the process

of applying the entity's accounting policies and that have the most

significant effect on the amounts recognised in these financial

statements.

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash-generating units to which goodwill

has been allocated. A similar exercise is performed in respect of

investment and long-term loans in subsidiary.

The value in use calculation requires the directors to estimate

the future cash flows expected to arise from the cash-generating

unit and a suitable discount rate in order to calculate present

value, see note 11 for further details.

The carrying amount of goodwill at the year-end date was

GBP679,000 (2022: GBP1,357,000). The investment in subsidiaries at

the year-end was GBP988,000 (2022: GBP1,903,000).

The methodology adopted in assessing impairment of Goodwill is

set out in note 11 as is the sensitivity analysis applied in

relation to the outcomes of the assessment.

Impairment investment in subsidiaries and inter-company

receivables

As set out in note 12, an impairment assessment of the carrying

value of investments in subsidiaries and inter-company receivables

is in line with the methodologies adopted in the assessment of

impairment of goodwill.

Going concern

The preparation of cash flow forecasts for the Group requires

estimates to be made of the quantum and timing of cash receipts

from future commercial revenues and the timing of future

expenditure, all of which are subject to uncertainty.

2 Segmental analysis

2023 2022

GBP'000 GBP'000

--------- ---------

Turnover by geographical market

United Kingdom 6,076 5,627

Europe 162 243

Other 232 321

--------- ---------

6,470 6,191

========= =========

The Group operates out of one geographical location being the

UK. Accordingly, the primary segmental disclosure is based on

activity. Per IFRS 8 operating segments are based on internal

reports about components of the Group, which are regularly reviewed

and used by Chief Operating Decision Maker ("CODM"), the current

executive chairman, for strategic decision making and resource

allocation, in order to allocate resources to the segment and

to assess its performance. The Group's reportable operating segments

are as follows :

* Adien Limited - Utility detection and mapping

services - Sale of services

* Utsi Electronics Limited - Development, assembly and

sale of GPR equipment - Sale of goods

* QM Systems Ltd - Automation and test system solutions

- Sale of services

* Thomson Engineering Design Limited - Rail trackside

solutions (included in the test system solutions

segment) - Sale of services

* Wessex Precision Instruments Limited - Non trading

The CODM monitors the operating results of each segment for the

purpose of performance assessments and making decisions on resource

allocation. Performance is based on revenue generations and profit

before tax, which the CODM believes are the most relevant in

evaluating the results relative to other entities in the industry.

Information regarding each of the operations of each reportable

segment is included below, all non-current assets owned by the

Group are held in the UK.

Utility Development, Automation

detection assembly and test

and mapping and sale system

services of GPR equipment solutions Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ----------- --------

Year ended 30 June 2023

Total segmental revenue 1,125 169 5,176 6,470

------------- ------------------ ----------- --------

Operating (loss) / profit (214) (859) (1,826) (2,899)

Finance costs (39) (236) (110) (385)

(Loss) / Profit before

taxation (253) (1,095) (1,936) (3,284)

------------- ------------------ ----------- --------

Segment assets 558 1,181 6,000 7,739

Segment liabilities 734 5,025 7,631 13,390

Non-current asset additions 2 - 265 267

Depreciation and amortisation 14 18 482 579

============= ================== =========== ========

Utility Development, Automation

detection assembly and test

and mapping and sale system

services of GPR equipment solutions Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ----------- --------

Year ended 30 June 2022

Total segmental revenue 1,453 246 4,492 6,191

------------- ------------------ ----------- --------

Operating (loss) / profit 21 (323) (1,010) (1,312)

Finance costs (36) (171) (57) (264)

(Loss) / Profit before

taxation (15) (494) (1,067) (1,576)

------------- ------------------ ----------- --------

Segment assets 655 1,924 5,598 8,177

Segment liabilities 628 5,226 5,442 11,296

Non-current asset additions 17 55 2,941 3,013

Depreciation and amortisation 106 3 316 425

============= ================== =========== ========

3 Finance costs

2023 2022

GBP'000 GBP'000

--------- ---------

Interest payable 385 264

--------- ---------

385 264

========= =========

Interest payable comprises interest on:

Leases 107 69

Directors' loans 192 140

Other 86 55

--------- ---------

385 264

========= =========

4 Operating profit for the year

This is arrived at after charging for the Group:

2023 2022

GBP'000 GBP'000

--------- ---------

Research and development costs not capitalised 2,644 2,333

Depreciation 579 424

Impairment of goodwill 678 -

Auditor's remuneration

Fees payable to the Company's auditor for the

audit of the Group's financial statements 53 45

Fees payable to the Company's auditor and its

subsidiaries for the provision of tax services 8 7

The Company audit fee is GBP23,000 (2022: GBP9,000).

5 Staff costs

Group 2023 2022

No. No.

----- -----

Average monthly number of employees,

including directors:

Production and research 77 79

Selling and research 9 9

Administration 12 7

98 95

===== =====

Group 2023 2022

GBP'000 GBP'000

-------- --------

Staff costs, including directors:

Wages and salaries 3,602 3,387

Social security costs 376 361

Other pension costs 198 113

4,176 3,861

======== ========

Company 2023 2022

No. No.

----- -----

Average monthly number of employees,

including directors:

Selling and research - -

Administration 1 1

1 1

===== =====

Company 2023 2022

GBP'000 GBP'000

-------- --------

Staff costs, including directors:

Wages and salaries 87 131

Social security costs - 7

Other pension costs - 4

87 142

======== ========

6 Directors' remuneration

Salary Benefits 2023 2022

and fees in kind Total Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- --------- -------- --------

G G Watt 71 - 71 71

R MacDonnell 2 - 2 2

T Williams 6 - 6 -

---------- --------- -------- --------

Aggregate emoluments 79 - 79 73

========== ========= ======== ========

Directors' pensions 2023 2022

No. No.

------ -----

The number of directors who are accruing

retirement benefits under:

Defined contributions policies - 1

===== =====

The directors represent key management personnel.

Refer to note 18 for details of directors share options.

7 Taxation

2023 2022

GBP'000 GBP'000

----------- ---------------

United Kingdom Corporation Tax

Current taxation (800) (708)

Adjustments in respect of prior years - -

----------- ---------------

(800) (708)

Deferred taxation - -

----------- ---------------

Tax on loss (800) (708)

----------- ---------------

Current tax reconciliation

Taxable loss for the year (3,284) (1,576)

----------- ---------------

Theoretical tax at UK corporation

tax rate 19% (2022: 19%) (622) (289)

Effects of:

R&D tax credit adjustments (408) (350)

Fixed asset timing differences 28 (101)

Not deductible for tax purposes 3 2

Impairment of goodwill 129 -

Deferred tax not recognised 73 45

Adjustments in respect of prior

years - 1

Utilisation of losses (4) -

Short term timing differences 1 (16)

----------- ---------------

Total income tax credit (800) (708)

=========== ===============

The Group has tax losses amounting to approximately GBP3,423,000

(2022: GBP3,033,706), available for carry forward to set off

against future trading profits . No deferred tax assets have

been recognised in these financial statements due to the uncertainty

regarding future taxable profits.

Potential deferred tax assets not recognised are approximately

GBP650,000 (2022: GBP576,404).

8 Loss / profit per share

Group

Basic (pence per share) 2023 - Loss (6.84) per share; 2022 -

Loss (2.42) per share

This has been calculated on a loss of GBP2,484,000 (2022: Loss

GBP868,000) and the number of shares used was 36,312,823 (2022:

35,812,823) being the weighted average number of shares in issue

during the year.

Diluted (pence per share) 2023 - (6.84) loss per share; 2022

- (2.42) loss per share

In the current year the potential ordinary shares included in

the weighted average of shares are anti-dilutive and therefore

diluted earnings per share is equal to basic earnings per share.

9 Property, plant and equipment

Group Equipment,

fixtures Leasehold Motor

Freehold and fittings improvements vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------- ----------------- ----------- --------

Cost

At 1 July 2022 426 1,320 474 237 2,457

Additions - 56 55 - 111

Disposals - - - (65) (65)

At 30 June 2023 426 1,376 529 172 2,503

----------- -------------- ------------- --------------- --------

Depreciation

At 1 July 2022 45 1,179 168 237 1,629

Charged in year 5 63 88 - 156

Disposals - - - (65) (65)

At 30 June 2023 50 1,242 256 172 1,720

----------- -------------- ------------- --------------- --------

Net book value

At 30 June 2023 376 134 273 - 783

=========== ============== ============= =============== ========

At 30 June 2022 381 141 306 - 828

=========== ============== ============= =============== ========

10 Right of use

Group Equipment,

fixtures Leasehold Motor

Property and fittings improvements vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------- --------------- ----------- --------

Cost

At 1 July 2022 2,580 236 168 147 3,131

Additions - 156 - - 156

Disposal - - - - -

At 30 June 2023 2,580 392 168 147 3,287

----------- -------------- --------------- ----------- --------

Depreciation

At 1 July 2022 299 156 12 115 582

Charged in year 296 63 42 21 422

Disposal - - - - -

At 30 June 2023 595 219 54 136 1,004

----------- -------------- --------------- ----------- --------

Net book value

At 30 June 2023 1,985 173 114 11 2,283

=========== ============== =============== =========== ========

At 30 June 2022 2,281 80 156 32 2,549

=========== ============== =============== =========== ========

These assets have been offered as security in respect of these

lease agreements. Depreciation charged in the period on those

assets amounted to GBP422,000 (2022: GBP314,000)

11 Goodwill

. Group Goodwill Total

GBP'000 GBP'000

--------- ---------

Cost

At 1 July 2022 1,357 1,357

Additions - -

--------- ---------

At 30 June 2023 1,357 1,357

========= =========

Impairment

As at 30 June 2023 (678) -

========= =========

Net book value

At 30 June 2023 679 1,357

========= =========

At 30 June 2022 1,357 1,357

========= =========

The goodwill brought forward in the statement of financial position

at 30 June 2022 was GBP1,357,000 this has been impaired to GBP679,000

following a management review. The goodwill is made up of Adien

Limited in 2002 (GBP151,000), QM Systems Limited in 2006 (GBP516,000),

TED Limited in 2017 (GBP0), and Utsi Electronics Limited in 2021

(GBP12,000).

We consider the CGUs to be the entities as acquired under business

combinations and managed as separate legal entities, each representing

a separately identifiable and independent group of assets contributing

to the cash flows of the CGU.

This financial year due to delay in the Start of Production for

the contract manufacturing business, and given the effects of

the wider downturn and volatility in the global market uncertainty

the directors have taken a prudent view to recognise a goodwill

impairment charge totalling GBP678,000, which consists of an impairment

charge on QM Systems Limited GBP487,000, TED GBP129,000 and Adien

Limited GBP62,000.

Adien Limited represents the segment utility detection and mapping

services and QM Systems Limited represents the segment test system

solutions.

QM Systems Limited, TED, and Utsi are involved in projects surrounding:

* The creation of innovative automated assembly systems

for the manufacturing, food and pharmaceutical

sectors.

* The provision of inspection systems for the

automotive, aerospace, rail and pharmaceutical

sectors.

* Slippage testing

* Assembly and sale of GPR equipment

* Automated test systems

The Group tests goodwill annually for impairment or more frequently

if there are indicators that it might be impaired.

The recoverable amounts are determined from value in use calculations

which use cash flow projections based on financial budgets approved

by the directors covering a five-year period and calculation of

the terminal values. The key assumptions are those regarding the

discount rates, growth rates and expected changes to sales and

direct costs due to inflationary pressures during the period.

Management estimates discount rates using pre-tax rates that reflect

current market assessments of the time value of money and the

risks specific to the business. This has been estimated at 17.2%

per annum based on weighted average cost of capital.

The growth rate assumptions are based on management forecasts

as below. The results of these forecasts have then been further

impaired by the group directors in the interests of prudence.

* Adien - These have been assessed as 28% growth for

revenue in years 1 bringing it back into line with

year ending June 2022, with and 2.5% for years

thereafter.

* UTSI and PipeHawk combined these have been assessed

as 63% for growth for revenue in year 1 and 76% for

year 2, 45% for year 3, 54% for year 4, and 40% year

5.

* QM - The strong pipeline reported last year did

convert, and at 30th June 2023 QM had a closing

orderbook of GBP5.8m, the highest ever recorded. In

addition, further orders have been received in the

new financial year, and the company has a strong

pipeline of enquiries. Based on this year 1 is

showing growth of 102% This is followed by an

expected 16% growth in year 2, 21% in year 3, 7% in

year 4 and 23% for years 5, and is expected to

include start of production in all three contract

manufacturing client projects.

* TED - A prudent approach has been applied to TED

until activity generated from the recent distribution

agreement with Unipart is fully underway. The

forecasts are based on a 3% growth for year 1, 20% in

year 2, 17% in year 3 and no increase for years 4 and

5.

12 Non-current investments

Company Investment

in subsidiaries Total

GBP'000 GBP'000

----------------- --------

Cost

At 1 July 2022 1,903 1,903

Additions - -

----------------- --------

At 30 June 2023 1,903 1,903

================= ========

*

Impairment

Provided at 30 June 2023 (916) -

================= ========

Net book value

At 30 June 2023 988 1,903

================= ========

At 30 June 2022 1,903 1,903

================= ========

Parent and

Group interest

in ordinary Country of

Subsidiary shares and incorporation Principal activity

voting rights

----------------------------- ---------------- ---------------- ----------------------

Adien Ltd 100% England & Wales Specialist surveying

QM Systems Ltd 100% England & Wales Test solutions

Thomson Engineering Design 100% England & Wales Specialist in railway

Ltd equipment

Wessex Precision Instruments 100% England & Wales Slip test solutions

Ltd

Utsi Electronics Ltd 100% England & Wales GPR equipment

Wessex Test Equipment 100% England & Wales Dormant

Ltd (formerly Tech Sales

Services Ltd)

CE Marking Services Ltd 100% England & Wales Dormant

(formerly MineHawk Ltd)

An impairment assessment was performed in line with the assessment

of goodwill, see note 11 for further details. On the basis of

this assessment an impairment of the investment was made at 30

June 2023.

The registered office of all of the above named subsidiaries,

except Thomson Engineering Design Ltd and Utsi Electronics Ltd

is Manor Park Industrial Estate, Wyndham Street, Aldershot, Hampshire,

GU12 4NZ.

The registered office of Thomson Engineering Design Ltd is Units

2a & 3 Crabtree Road, Forest Vale Industrial Estate

Cinderford, Gloucestershire, United Kingdom, GL14 2YQ

The registered office of Utsi Electronics Ltd is Unit 26, Glenmore

Business Park, Ely Road, Waterbeach, Cambridge, Cambridgeshire,

CB25 9PG.

13 Inventories

Group Company

-------------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Raw materials 106 150 - -

Finished goods 147 190 - -

253 340 - -

========= ========= ========= =========

The replacement cost of the above inventories would not be significantly

different from the values stated.

The cost of inventories recognised as an expense during the year

amounted to GBP2,294,000 (2022: GBP1,886,000). For the Parent

company this was GBPnil (2022: GBP41,612).

14 Trade and other receivables

Group Company

-------------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Current

Trade receivables 1,263 1,261 - -

Amounts owed by Group undertakings

less provision - - 9 469

Other Debtors 374 522 2 -

Accrued income 190 332 - 41

Prepayments 940 274 - -

2,767 2,389 11 510

========= ========= ========= =========

15 Trade and other payables

Group Company

-------------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Current

Trade payables 1,197 972 34 38

Other taxation and social security 1,002 447 - -

Payments received on account 2,164 839 - -

Accruals and other creditors 1,029 601 103 106

5,392 2,859 137 144

========= ========= ========= =========

Group Company

---------------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- --------- ---------

Non-current

Amounts owed to Group undertakings - - 2,002 1,398

Other creditors - - - -

- - 2,002 1,398

========== =========== ========= =========

The performance obligations of the IFRS 15 contract liabilities

(payments received on account) are expected to be met within

the next financial year. The brought forward payments received

on account figure was GBP839,000, during the financial year 2023

GBP839,000 has been recognised as revenue in the statement of

comprehensive income.

16 Borrowing analysis

Group Company

-------------------- --------------------

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Due within one year

Bank and other loans 677 708 379 375

Directors' loan 1,783 1,644 1,783 1,644

Obligations under lease agreements 426 322 - -

--------- --------- --------- ---------

2,886 2,674 2,162 2,019

========= ========= ========= =========

Due after more than one year

Bank and other loans 350 491 221 331

Directors' loan 2,501 2,751 2,501 2,751

Obligations under lease agreements 2,062 2,370 - -

------ ------ ------ ------

4,913 5,612 2,722 3,082

====== ====== ====== ======

Repayable

Due within 1 year 2,886 2,729 2,162 2,072

Over 1 year but less than 2 years 3,040 3,249 2,611 2,861

Over 2 years but less than 5 years 1,873 2,361 111 221

------ ------ ------ ------

7,799 8,339 4,884 5,154

====== ====== ====== ======

Directors' loans

Included with Directors' loans and borrowings due within one

year are accrued fees and interest owing to G.G Watt of

GBP1,783,000 (2022: GBP1,644,000). The accrued fees and interest

are repayable on demand and no interest accrues on the balance.

The director's loan due in more than one year is a loan of

GBP2,501,000 from G.G Watt. Directors' loans comprise of two

elements. A loan attracting interest at 2.15% over Bank of England

base rate. At the year-end GBP1,501,000 (2022: GBP1,750,000) was

outstanding in relation to this loan. During the year to 30 June

2023 GBP393,000 (2022: GBP200,000) was repaid. The Company has the

right to defer payment for a period of 366 days.

On 13 August 2010 the Company issued GBP1 million of Convertible

Unsecured Loan Stock ("CULS") to G.G Watt, the Chairman of the

Company. The CULS were issued to replace loans made by G.G Watt to

the Company amounting to GBP1million and has been recognised in

non-current liabilities of GBP2,501,000.

Pursuant to amendments made on 13 November 2014 and 9 November

2018, and 30 June 2022 the principal terms of the CULS are as

follows:

- The CULS may be converted at the option of Gordon Watt at a

price of 3p per share at any time prior to 13 August 2026;

- Interest is payable at a rate of 10 per cent per annum on the

principal amount outstanding until converted, prepaid or repaid,

calculated and compounded on each anniversary of the issue of the

CULS. On conversion of any CULS, any unpaid interest shall be paid

within 20 days of such conversion;

- The CULS are repayable, together with accrued interest on 13

August 2026 ("the Repayment Date").

No equity element of the convertible loan stock was recognised

on issue of the instrument as it was not considered to be

material.

Bank and other loans

Included in bank and other loans is an invoice discounting facility

of GBP261,962 (2022: GBP299,635). The principal terms of which

are interest at 2.58% over Bank of England base rate and secured

on the company's debtors.

Included in bank and other loans is a secured mortgage of GBP107,438

which incurs an interest rate of 2.44% over base rate for 10

years and at a rate of 2.64% over base thereafter.

As a result of COVID 19, Coronavirus Business Interruption Loan

Scheme (CBILS) became available for the business. This enabled

the group to secure two loans. The loan for GBP GBP400,000 had

a remaining balance outstanding is GBP220,000, and the second

loan of GBP150,000 had a remaining balance outstanding is GBP110,000,

both at a rate of 2.96%. The amount of interest paid during the

year was GBP19,837.

The business was also able to secure a Bounce Back loan through

Wessex Precision Engineering of GBP24,000 the remaining balance

outstanding is GBP19,000, and Utsi obtained GBP50,000 bounce

back loan the remaining balance outstanding is GBP39,000 both

with an interest rate of 2.5%.

2023 Non-cash:

Bought Non-cash: Accrued Carried

forward Cash flows New leases fees/interests forward

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------- ------------- ---------------- ----------

Director loan 4,446 (393) - 231 4,284

Leases 2,692 (455) 156 94 2,487

Other 1,201 (210) - 37 1,028

---------- ------------- ------------- ---------------- ----------

Loans and borrowings 8,339 (1,058) 156 362 7,799

========== ============= ============= ================ ==========

2022 Non-cash:

Bought Non-cash: Accrued Carried

forward Cash flows New leases fees/interests forward

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------- ------------- ---------------- ----------

Director loan 4,140 119 - 187 4,446

Leases 324 (163) 2,584 (53) 2,692

Other 897 286 - 18 1,201

---------- ------------- ------------- ---------------- ----------

Loans and borrowings 5,361 242 2,584 152 8,339

========== ============= ============= ================ ==========

17 Financial instruments

The Group uses financial instruments, which comprise cash and

various items, such as trade receivables and trade payables that

arise from its operations. The main purpose of these financial

instruments is to finance the Group's operations.

The main risks arising from the Group's financial instruments

are credit risk, liquidity risk and interest rate risk. A number

of procedures are in place to enable these risks to be controlled.

For liquidity risk these include profit/cash forecasts by business

segment, quarterly management accounts and comparison against

forecast. The board reviews and agrees policies for managing this

risk on a regular basis.

Credit risk

The credit risk exposure is the carrying amount of the financial

assets as shown in note 14 (with the exception of prepayments

which are not financial assets) and the exposure to the cash balances.

Of the amounts owed to the Group at 30 June 2023, the top 3 customers

comprised 30% (2022: 34%) of total trade receivables in the segment

Automation and test system solutions.

The Group has adopted a policy of only dealing with creditworthy

counterparties and the Group uses its own trading records to rate

its major customers, also the Group invoices in advance where

possible. The Group's exposure and the credit ratings of its counterparties

are continuously monitored and the aggregate value of transactions

concluded is spread amongst approved counterparties. Having regard

to the credit worthiness of the Groups significant customers the

directors believe that the Group does not have any significant

credit risk exposure to any single counterparty.

Within revenue there are two customers which individually represent

13.6% and 11.36% of the overall revenue for the financial year.

An analysis of trade and other receivables:

2023 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000 GBP'000

-------------- --------------- ----------------

Performing 0.00% 2,767 -

2022 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000

------------------- ------------------- -------------------

Performing 0.00% 2,389 -

Interest rate risk

The Group finances its operations through a mixture of shareholders'

funds and borrowings. The Group borrows exclusively in Sterling

and principally at fixed and floating rates of interest and

are disclosed at note 16.

As disclosed in note 16 the Group is exposed to changes in interest

rates on its borrowings with a variable element of interest.

If interest rates were to increase by one percentage point the

interest charge would be GBP15,000 higher. An equivalent decrease

would be incurred if interest rates were reduced by one percentage

point.

Liquidity risk

As stated in note 1 the Executive Chairman, G.G Watt, has pledged

to provide ongoing financial support for a period of at least

twelve months from the approval date of the Group statement

of financial position. It is on this basis that the directors

consider that neither the Group nor the Company is exposed to

a significant liquidity risk.

Contractual maturity analysis for financial liabilities:

2023 Less than Due between Due between

1 year 1-2 years 2 - 5+ years Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------ -------------- --------

Trade and other

payables 1,734 - - 1,734

Borrowings 2,514 2,594 204 5,312

Lease liability 426 393 1,668 2,487

---------- ------------ -------------- --------

4,674 2,987 1,872 9,533

========== ============ ============== ========

2022 Less than Due between Due between

1 year 1-2 years 2 - 5+ years

Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------ -------------- --------

Trade and other

payables 1,876 - - 1,876

Borrowings 2,405 2,887 355 5,647

Lease liability 322 363 2,007 2,692

---------- ------------ -------------- --------

4,603 3,250 2,362 10,215

========== ============ ============== ========

Financial liabilities of the Company are all due within less than

three months with the exception of the intercompany balances that

are due between 1 and 5 years.

Fair value of financial instruments

Loans and receivables are measured at amortised cost. Financial

liabilities are measured at amortised cost using the effective

interest method. The directors consider that the fair value of

financial instruments are not materially different to their carrying

values.

Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to

be able to move to a position of providing returns for shareholders

and benefits for other stakeholders and to maintain an optimal

capital structure to reduce the cost of capital.

The Group manages trade debtors, trade creditors and borrowings

and cash as capital. The entity is meeting its objective for managing

capital through continued support from G G Watt as described per

note 1.

18 Share capital

2023 2023 2022 2022

No. GBP'000 No. GBP'000

----------- -------- ----------- --------

Authorised

Ordinary shares of 1p each 40,000,000 400 40,000,000 400

=========== ======== =========== ========

Allotted and fully paid

Brought forward 36,312,823 363 34,860,515 349

Issued during the year - - 1,452,308 14

Carried forward 36,312,823 363 36,312,823 363

=========== ======== =========== ========

Fully paid ordinary shares carry one vote per share and carry

a right to dividends.

12,953,703 (2022: 11,773,703) share options were outstanding

at the year end, comprising the 2,100,000 employee options and

the 10,853,703 share options and warrants held by directors disclosed

below.

Share based payments have been included in the financial statements

where they are material. No share-based payment expense has been

recognised.

No deferred tax asset has been recognised in relation to share

options due to the uncertainty of future available profits.

The director and employee share options were issued as part of

the Group's strategy on key employee remuneration, they lapse

if the employee ceases to be an employee of the Group during

the vesting period.

Employee options

Date options exercisable Number of Exercise price

shares

Between July 2016 and July

2023 60,000 3.00p

Between November 2019 and 400,000 3.875p

November 2026

Between November 2020 and 100,000 3.75p

November 2027

Between March 2024 and March 1,290,000 8.00p

2031

Between January 2026 and January 1,400,000 14.25p

2033

Directors' share options

Number of options

--------- ----------------------------- --------- ------------

Granted Lapsed Date from

Directors' At during during At end Exercise which

share options start the year the of year price exercisable

of year year

-------- --------- ------- ---------- --------- ------------

18 Mar

G G Watt 750,000 - - 750,000 8.0p 2024

18 Mar

R MacDonnell 200,000 - - 200,000 8.0p 2024

10 Jan

T Williams - 200,000 - 200,000 14.25p 2026

The Company's share price at 30 June 2023 was 13p. The high and

low during the period under review were 16.5p and 11.25p respectively.

In addition to the above, in consideration of loans made to the

Company, G.G Watt has warrants over 3,703,703 ordinary shares

at an exercise price of 13.5p and a further 6,000,000 ordinary

shares at an exercise price of 3.0p.

The weighted average contractual life of share options outstanding

at the year-end is 7.72 years (2022: 7.09 years).

19 Related party transactions

Directors' loan disclosures are given in note 16. The interest

payable to directors in respect of their loans during the year

was:

G.G Watt - GBP188,402

The directors are considered the key management personnel of

the Company. Remuneration to directors is disclosed in note 6.

Included within the amounts due from and to Group undertakings

were the following balances:

2023 2022

GBP GBP

---------- --------

Balance due from:

Thomson Engineering Design Limited 679,649 462,482

Wessex Precision Engineering Limited 8,520 6,120

Balance due to:

Adien Limited 99,278 147,738

QM Systems Limited 1,702,813 979,323

Utsi Electronics Limited 200,001 271,115

These intergroup balances vary through the flow of working capital