SigmaRoc PLC Admission to AIM (5881Y)

04 Janeiro 2024 - 5:15AM

UK Regulatory

TIDMSRC

RNS Number : 5881Y

SigmaRoc PLC

04 January 2024

4 January 2024

SIGMAROC PLC

(" SigmaRoc ", the " Company " or the " Group ")

Admission to AIM

SigmaRoc (AIM: SRC), the AIM quoted lime and limestone group, is

pleased to announce the Admission of its Enlarged Share Capital,

comprising 693,801,899 Existing Ordinary Shares, 418,464,565

Placing Shares and 2,588,066 REX Intermediaries Offer Shares, to

trading on AIM effective from 8.00 a.m. on 4 January 2024 and

completion of the acquisition of the Deal 1 Targets.

Highlights of the Acquisitions

-- Provide an opportunity to become Northern Europe's leader in

lime and a key supplier to the structural growth markets critical

for the green transition.

-- Lime and limestone are key resources in the transition to a

more sustainable economy. New applications for lime and limestone

products as part of a drive for sustainability include the

production and recycling of lithium batteries, the decarbonisation

of construction including through substitution of cementitious

material and new building materials, and environmental applications

including lake liming, air pollution and direct air capture.

-- The lime market is expected to continue to grow and to be

worth EUR1.9 billion in 2031 across the Enlarged Group's

markets.

-- Pro forma revenue of the Enlarged Group for FY22 would be

GBP1 billion with underlying EBITDA of GBP211 million (assuming, in

each case, exercise of the UK Call Option and Polish Call

Option).

-- The Enlarged Group is expected to be significantly cash

generative with a free cash flow target in excess of GBP100 million

per annum which is expected to enable the Enlarged Group to de-gear

at a rate of 0.5x per year with target leverage of 1.0x.

-- The Targets, together, have a consistent performance track

record delivering FY22 revenue of EUR579.7 million and EBITDA of

EUR133.7 million and EBITDA margin in excess of 20 per cent.

-- Expected to deliver revenue growth opportunities and cost

synergies resulting in at least EUR30 million of EBITDA

contribution by 31 December 2027.

-- The Targets are aligned with SigmaRoc's ESG and net zero ambitions.

-- Whereas the Deal 1 Targets are stand-alone entities, the Call

Option Targets (being the UK Target and the Polish Target) require

carving out of existing CRH businesses in order to be acquired.

-- Total consideration payable by the Company for the Deal 1

Targets is EUR745 million (approximately GBP645 million).

Trading

SigmaRoc has continued to trade well since the October Q3

update. The Company will provide fuller commentary later in January

with results expected to be at least in line with market

expectations*.

Defined terms used throughout this announcement have the

meanings set out in the admission document published by the Company

on 23 November 2023 unless the context requires otherwise.

*Consensus expectations for SigmaRoc, being the average of

forecasts for the year ending 31 December 2023 provided by analysts

covering the Company, are revenue of GBP596.9m and underlying

EBITDA of GBP110.2m.

Information on SigmaRoc is available on the Company's website

at: www.sigmaroc.com .

For further information, please contact:

SigmaRoc plc Tel: +44 (0) 207 002

Max Vermorken (Chief Executive Officer) 1080

Garth Palmer (Chief Financial Officer) ir@sigmaroc.com

Tom Jenkins (Head of Investor Relations)

Liberum Capital Limited (Nominated Tel: +44 (0) 203 100

and Financial Adviser, Joint Bookrunner 2000

and Co-Broker)

Dru Danford / Ben Cryer / Mark Harrison

/ John More / Anake Singh

Peel Hunt (Joint Bookrunner and Co-Broker) Tel: +44 (0) 20 7418

Investment Banking 8900

Mike Bell / Ed Allsopp / Ben Harrington

ECM Syndicate & Broking

Sohail Akbar / Jock Maxwell Macdonald

/ Tom Ballard

Walbrook PR Ltd (Public Relations) Tel: +44 20 7933 8780

/

Tom Cooper / Nick Rome sigmaroc@walbrookpr.com

Mob: +44 7748 325 236

(Nick)

About SigmaRoc plc

SigmaRoc is an AIM-quoted lime and limestone group targeting

quarried materials assets in the UK and Northern Europe. It seeks

to create value by purchasing assets in fragmented materials

markets and extracting efficiencies through active management and

by forming the assets into larger groups. It seeks to de-risk its

investments through the selection of projects with strong

asset-backing.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUUCGUPCPGW

(END) Dow Jones Newswires

January 04, 2024 03:15 ET (08:15 GMT)

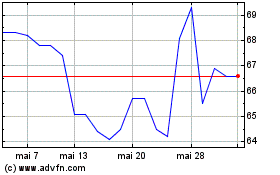

Sigmaroc (LSE:SRC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Sigmaroc (LSE:SRC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025