Atos reports third quarter 2024 revenue

Press Release

Third quarter 2024 revenue in line with

September 2nd Business

Plan

Cash position in line with September

2nd business plan

& FY2024 outlook

Q3 2024 revenue of €2,305m, down -4.4%

organically, consistent with September

2nd business plan

communicated on September

2nd, 2024

- Eviden down -6.4% organically due

to continued market softness in the Americas and Central Europe and

previously-established contract scope reductions

- Tech Foundations down -2.6%

organically, reflecting lower scope of work and

previously-established contract completions and terminations

- Q4 and FY2024 outlook in line with

September 2nd business plan1

Q3 order entry of €1.5bn, with stronger

commercial activity and improved order entry expected in

Q4

- Eviden book-to-bill at 73%,

compared with 80% in prior year. Solid commercial activity in BDS

with several High-Performance Computing contracts signed. Eviden Q4

book-to-bill expected to be close to Q4 20232

- Tech Foundations book-to-bill at

60%, consistent with previous years3. Q4 book-to-bill

expected to be close to historical average4 thanks to

anticipated return of multi-year contracts with existing

customers

- Group Q3 book-to-bill at 66% (84%

in prior year), in line with Q3 2023 book-to-bill excluding large

exceptional deals5. Group Q4 2024 book-to-bill expected

in line with prior year6

Cash position of €1.1bn as at September 30,

2024

- Net debt position of €4.6bn,

including a €1.6bn reduction of working capital optimization

compared with December 2023

- Q3 cash consumption of €-3m

excluding change in working capital optimization for €232m

- Full year free cash flow before

normalization of working capital optimization expected in line with

September 2nd business plan

Atos focused on its industrial turnaround and

growth:

- Decision from the Court on pre-arranged financial restructuring

plan expected today

- Financial restructuring plan expected to close in December 2024

or early January 2025

- New governance in place with Philippe Salle named chairman and

becoming CEO on February 1st.

Paris, France – October 24,

2024 - Atos, a global leader in digital transformation,

high-performance computing and information technology

infrastructure, today announces its revenue for the third quarter

of 2024.

Jean Pierre Mustier, Atos Chief

Executive Officer, declared:

“With our financial restructuring plan and

our new governance in place, Atos can confidently focus on its

industrial turnaround and growth under the leadership of Philippe

Salle. He is the best person to lead our transformation journey and

restore confidence in Atos.

I have seen a positive change of perception

with our clients, who have taken note of our restructuring, and are

looking to resume a normalized interaction with us. I expect

stronger commercial activity in the coming months, with the

anticipated return of multi-year strategic contracts with existing

customers.

I would like to take this opportunity to

sincerely thank our employees for their ongoing commitment, and our

customers and partners for their continued support.”

Revenue by Businesses

|

In € million |

Q3 2024

Revenue |

Q3 2023

revenue |

Q3 2023

revenue* |

Organic variation* |

|

Eviden |

1,093 |

1,202 |

1,167 |

-6.4% |

|

Tech Foundations |

1,212 |

1,373 |

1,244 |

-2.6% |

|

Total |

2,305 |

2,575 |

2,412 |

-4.4% |

|

*at constant scope and average exchange rates |

|

|

Group revenue was €2,305

million in Q3 2024, down -4.4% organically compared with Q3 2023 as

expected. Overall, Group revenue in the third quarter reflects

softer market conditions and is consistent with the business plan

communicated on Sept 2nd.

Eviden revenue was €1,093

million, down -6.4% organically.

-

Digital activities decreased high single-digit.

The business was impacted by the general market slowdown in

Americas and Central Europe and previously-established contract

scope reductions.

- Big

Data & Security (BDS) revenue was roughly stable

organically. In Advanced Computing, stronger activity in Denmark

and France was offset by a high comparison basis in the prior year.

Revenue in Digital Security slightly decreased, despite the growth

of Mission Critical Systems, notably in Central Europe.

Tech Foundations revenue was

€1,212 million, down -2.6% organically.

- Core

revenue (excluding BPO and value-added resale (“VAR”))

decreased low single-digit. Stronger contributions related to the

Paris Olympic & Paralympic games were offset by contract

terminations in Americas and previously-established contract scope

and volume reduction in Northern Europe & APAC.

-

Non-core revenue declined high single-digit during

the quarter as expected, reflecting contract completion in BPO

activities in the UK.

Revenue by Regional Business

Unit

| In €

million |

Q3 2024

Revenue |

Q3 2023

revenue |

Q3 2023

revenue* |

Organic variation* |

|

Americas |

500 |

606 |

558 |

-10.5% |

|

Northern Europe & APAC |

707 |

769 |

757 |

-6.6% |

|

Central Europe |

544 |

627 |

546 |

-0.4% |

|

Southern Europe |

477 |

501 |

480 |

-0.7% |

|

Others & Global Structures |

76 |

73 |

69 |

+10.1% |

|

Total |

2,305 |

2,575 |

2,412 |

-4.4% |

|

*at constant scope and average exchange rates |

|

|

Americas revenue decreased by

-10.5% on an organic basis, reflecting the current

general slowdown in market conditions and previously-established

contract terminations and completions.

- Eviden was down

double-digit, impacted by contract terminations and volume decline

in Healthcare, Finance, and Transport & Logistics. BDS declined

high single-digit due to volume reductions.

- Tech Foundations

revenue declined mid single-digit due to contract completions and

terminations as well as scope reductions with select

customers.

Northern Europe &

Asia-Pacific revenue decreased by -6.6%

on an organic basis.

- Eviden revenue declined

mid-single-digit. A revenue increase at BDS due to new business in

Advanced Computing with an innovation center in Denmark was offset

by the decline of Digital revenue, reflecting a lower demand from

Public Sector customers in the UK.

- Revenue in Tech Foundations was down

high single-digit, with contract completions and volume decline in

Public Sector BPO.

Central Europe revenue was

nearly stable at -0.4% on an organic basis.

- Eviden revenue declined low

single-digit, impacted by volume reductions in Digital from

Manufacturing and Public Sector customers.

- Tech Foundations revenue grew

mid-single-digit, with strong demand for hardware products.

Southern Europe revenue was

down -0.7% organically.

- Eviden revenue

was roughly flat. Growth in Digital, which benefitting from a

contract win with a major European utility company, was offset by

lower revenue in BDS compared to Q3 2023, when a supercomputer

project was delivered in Spain.

- Tech Foundations revenue declined

low single-digit due to volume reductions with select

customers.

Revenue in Others and Global

Structures, which encompass Middle East, Africa, Major

Events as well as the Group’s global delivery centers and global

structures, grew double-digit reflecting stronger contributions

from the Paris Olympic & Paralympic Games and the positive

performance of Africa.

Commercial activity

Order entry for the Group was

€1,526 million. Eviden order entry was €794

million and Tech Foundations order entry was €733 million.

Book-to-bill ratio for the

Group was 66% in Q3 2024, down from 84% in Q3

2023, reflecting softer market conditions and delays in contract

awards as clients await the final resolution of the Group’s

refinancing plan. This ratio is in line with the book-to-bill ratio

for Q3 2023, excluding exceptionally large

contract7.

Book-to-bill ratio at Eviden

was 73%. Main contracts signatures during the

third quarter included the supply of an HPC to a leading player in

the Aerospace sector, another HPC contract signed with a major

French utility provider, together with control room utility

solutions.

Book-to-bill ratio at Tech

Foundations was 60%, consistent with the

seasonality observed in previous years, in particular in Q3 2021

(54%) and in Q3 2022 (58%). Main contracts signatures in the third

quarter included several renewals to provide Hybrid Cloud &

Infrastructure services in Financial Services, Public Sector, and

Manufacturing industries.

Stronger commercial activity is expected in the

coming months in both Eviden and Tech Foundation, which would lead

to a significant improvement of the Group book-to-bill ratio in the

fourth quarter, as confidence in the Group’s financial

sustainability has been restored.

At the end of September 2024, the full

backlog was €14.7 billion representing 1.4 years of

revenue. The full qualified pipeline amounted to

€5.7 billion at the end of September 2024.

Human resources

The total headcount was

82,211 at the end of September 2024, decreasing by

-10.3% since the end of June 2024. Following contract completions

in Americas and the UK, the Group transferred circa 4,900 employees

to the new providers. Excluding these transfers, headcount has

decreased by circa -5%.

During the third quarter, the Group hired 1,839

staff (of which 91% were Direct employees), while attrition rate

increased compared with Q2. The attrition rate over the past 9

months is in line with normal historical levels.

Q3 cash position

As of September 30, 2024, cash & cash

equivalents was €1.1 billion, down €1.2 billion compared with

December 31, 2023 primarily reflecting €1.6 billion lower working

capital actions compared with the end of fiscal 2023 and €1.1

billion of new borrowings.

As of September 30, 2024, net debt was €4.6

billion compared with €2.2 billion at the end of last year,

reflecting primarily the reduction of working capital optimization

down to €265 million.

Cash consumption was €-3 million in the third quarter, excluding

change in working capital optimization of €232 million.

Full year 2024 outlook

The Group expects for the full year 2024:

- Mid-single-digit organic revenue

decrease, corresponding to revenue of circa €9.7 billion

- Operating margin of circa €238

million excluding additional provisions to be booked for some

underperforming contracts8

- Change in cash before debt repayment

of circa €-783 million excluding the full unwind of the working

capital optimization of circa €1.8 billion as of December 31,

2023.

Financial restructuring process

Atos expected to receive today the decision from

the Court on its pre-arranged financial restructuring plan.

Assuming the plan is accepted by the court, the

next steps of the financial restructuring process would be as

follows:

November 12 – 22:

|

- €233 million rights issue with

preferred subscription rights

|

Mid to end December:

|

- Execution of concomitant reserved

capital increases

|

|

End of December 2024 or early 2025 |

- Receipt of €1.5bn to €1.7bn of new

money debt

- Closing of the restructuring

process

|

Asset disposal processes

The discussions with Alten regarding the sale of

the Worldgrid business are progressing well and are on track.

Following the communication issued on October 7,

discussions related to the potential acquisition by the French

state of the Advanced Computing, Mission-Critical Systems and

Cybersecurity Products businesses of BDS are continuing based on a

new proposal compatible with the financial restructuring plan of

the Company.

Governance

As communicated on October 15, 2024, Philippe

Salle has been appointed as Chairman of the Board of Directors of

the Company with immediate effect and as Chairman and Chief

Executive Officer with effect from February 1, 2025.

Conference call

Atos’ Management invites you to a conference

call on the Group revenue for the third quarter of 2024, on

Thursday, October 24, 2024 at 08:00 am (CET –

Paris).

You can join the webcast of the

conference:

- via the

following link:

https://edge.media-server.com/mmc/p/bkriazto

- by telephone by

dial-in, 10 minutes prior the starting time. Please note that if

you want to join the webcast by telephone, you must

register in advance of the conference using the following

link:

https://register.vevent.com/register/BI8dc47a058ab84cb88b1ba638c295b440

Upon registration, you will be provided with

Participant Dial In Numbers, a Direct Event Passcode and a unique

Registrant ID. Call reminders will also be sent via email the day

prior to the event.

During the 10 minutes prior to the beginning of the call, you will

need to use the conference access information provided in the email

received upon registration.

After the conference, a replay of the webcast

will be available on atos.net, in the Investors section.

APPENDIX

9-month organic revenue evolution by

RBUs and business lines

| In €

million |

9-month 2024

Revenue |

9 month 2023

revenue* |

|

Organic variation* |

|

Americas |

1,608 |

1,748 |

|

-8.0% |

|

Northern Europe & APAC |

2,249 |

2,320 |

|

-3.0% |

|

Central Europe |

1,621 |

1,673 |

|

-3.1% |

|

Southern Europe |

1,561 |

1,564 |

|

-0.2% |

|

Others & Global Structures |

230 |

211 |

|

+9.1% |

|

Total |

7,268 |

7,516 |

|

-3.3% |

| *at

constant scope and average exchange rates |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

In € million |

9-month 2024

Revenue |

9-month2023

revenue* |

|

Organic variation* |

|

Eviden |

3,478 |

3,658 |

|

-4.9% |

|

Tech Foundations |

3,790 |

3,858 |

|

-1.8% |

|

Total |

7,268 |

7,516 |

|

-3.3% |

| *at

constant scope and average exchange rates |

|

|

|

|

Q3 2023 Revenue at constant scope and

exchange rates reconciliation

For the analysis of the Group’s performance,

revenue is compared with Q3 2023 revenue at constant scope and

foreign exchange rates. Reconciliation between the Q3 2023 reported

revenue and the Q3 2023 revenue at constant scope and foreign

exchange rates is presented below.

In 2023, the Group reviewed the accounting

treatment of certain third-party standard software resale

transactions following the decision published by ESMA in October

2023 that illustrated the IFRS IC decision and enacted a

restrictive position on the assessment of Principal vs. Agent under

IFRS 15 for such transactions. The Q3 2023 revenue is therefore

restated by €-15 million. The restatement impacted Eviden in the

Americas RBU without impacting the operating margin.

Q3 2023 revenue

In € million |

Q3 2023 published |

Restatement |

Q3 2023 restated |

Internal transfers |

Scope effects |

Exchange rates effects |

Q3 2023* |

| Eviden |

1,217 |

-15 |

1,202 |

-3 |

-31 |

-1 |

1,167 |

| Tech

Foundations |

1,373 |

0 |

1,373 |

3 |

-122 |

-9 |

1,244 |

|

Total |

2,590 |

-15 |

2,575 |

0 |

-154 |

-10 |

2,412 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Q3 2023 revenue

In € million |

Q3 2023 published |

Restatement |

Q3 2023 restated |

Internal transfers |

Scope effects |

Exchange rates effects |

Q3 2023* |

| Americas |

621 |

-15 |

606 |

0 |

-34 |

-13 |

558 |

| Norther Europe

& APAC |

769 |

0 |

769 |

0 |

-18 |

7 |

757 |

| Central

Europe |

627 |

0 |

627 |

0 |

-81 |

0 |

546 |

| Southern

Europe |

501 |

0 |

501 |

0 |

-21 |

0 |

480 |

| Others &

Global structures |

73 |

0 |

73 |

0 |

0 |

-3 |

69 |

|

Total |

2,590 |

-15 |

2,575 |

0 |

-154 |

-10 |

2,412 |

*: At constant scope and foreign exchange rates

Scope effects on revenue amounted to €-154

million. They mainly related to the divesture of UCC across all

regions, EcoAct in Americas, Southern Europe and Northern Europe

& Asia-Pacific, State Street JV in Americas and Elexo in

Southern Europe.

Currency effects negatively contributed to

revenue for €-10 million. They mostly came from the depreciation of

the American dollar, Argentinian peso, Brazilian real, and Turkish

lira, not offset by the appreciation of the British pound.

***

Disclaimer

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group’s expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Atos’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Atos’s plans, objectives, strategies, goals, future events, future

revenues or synergies, or performance, and other information that

is not historical information. Actual events or results may differ

from those described in this document due to a number of risks and

uncertainties that are described within the 2023 Universal

Registration Document filed with the Autorité des Marchés

Financiers (AMF) on May 24, 2024 under the registration number

D.24-0429 and the half-year report filed with the Autorité des

Marchés Financiers (AMF) on August 6, 2024. Atos does not

undertake, and specifically disclaims, any obligation or

responsibility to update or amend any of the information above

except as otherwise required by law.

This document does not contain or constitute an offer of Atos’s

shares for sale or an invitation or inducement to invest in Atos’s

shares in France, the United States of America or any other

jurisdiction. This document includes information on specific

transactions that shall be considered as projects only. In

particular, any decision relating to the information or projects

mentioned in this document and their terms and conditions will only

be made after the ongoing in-depth analysis considering tax, legal,

operational, finance, HR and all other relevant aspects have been

completed and will be subject to general market conditions and

other customary conditions, including governance bodies and

shareholders’ approval as well as appropriate processes with the

relevant employee representative bodies in accordance with

applicable laws .

About Atos

Atos is a global leader in digital

transformation with circa 82,000 employees and annual revenue of

circa €10 billion. European number one in cybersecurity, cloud and

high-performance computing, the Group provides tailored end-to-end

solutions for all industries in 69 countries. A pioneer in

decarbonization services and products, Atos is committed to a

secure and decarbonized digital for its clients. Atos is a SE

(Societas Europaea) and listed on Euronext Paris.

The purpose of Atos is to help design

the future of the information space. Its expertise and services

support the development of knowledge, education and research in a

multicultural approach and contribute to the development of

scientific and technological excellence. Across the world, the

Group enables its customers and employees, and members of societies

at large to live, work and develop sustainably, in a safe and

secure information space.

Contacts

Investor relations:

David Pierre-Kahn | investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33

6 29 34 85 67

Individual shareholders: 0805 65 00 75

Press contact: globalprteam@atos.net

1 Eviden Q4 organic revenue evolution expected slightly negative

and Tech Foundations Q4 revenue expected to decrease double digit

on previously established contract completions and terminations

2 Q4 2023 Eviden book-to-bill of 100%

3 2021 (54%), 2022 (58%) and 2023 (84% including one large

exceptional deal)

4 Q4 2021-2023 book-to-bill average of 98%

5 Q3 2023 book-to-bill of 65% excluding one large exceptional deal

in Eviden and another one in Tech Foundations

6 108%

7 Book-to-bill ratio of 65% in Q3 2023, excluding an exceptionally

large contract at Eviden and another at Tech Foundations.

8 Negotiations are in progress with customers, which could lead to

a low double digit % reduction of the operating margin

- PR-Atos reports third quarter 2024 revenue

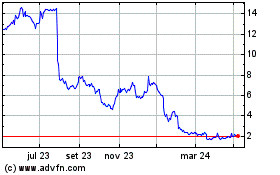

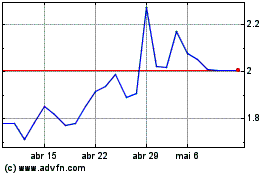

Atos (EU:ATO)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Atos (EU:ATO)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024