Closing of US$35 million Revolving Credit Facility and Update on Impact Benefit Agreement

30 Dezembro 2024 - 9:34AM

UK Regulatory

Closing of US$35 million Revolving Credit Facility and Update on

Impact Benefit Agreement

Reykjavík, Dec. 30, 2024 (GLOBE NEWSWIRE) --

(“Amaroq” or the “Company”)

Closing of US$35 million Revolving Credit

Facility and Update on Impact Benefit Agreement

TORONTO, ONTARIO – 30 December 2024 – Amaroq

Minerals Ltd. (AIM, TSXV, NASDAQ Iceland: AMRQ), an independent

mine development company with a substantial land package of gold

and strategic mineral assets in Southern Greenland, is pleased to

announce the successful closing of its previously announced US$35

million debt financing package with Landsbankinn hf.

(“Landsbankinn”) in three Revolving Credit Facilities (the

"Facilities"), securing a substantial increase and extension to its

current debt facilities (see press release dated July 02,

2024).

Ellert Arnarson, Amaroq CFO,

commented:

“We are pleased to have successfully closed

and signed definitive documentation for our enhanced debt financing

package with Landsbankinn, securing larger facilities at more

favourable terms. This simplifies our debt structure, while further

strengthening our liquidity and financial flexibility, following a

successful equity raise completed in December 2024.

“We remain well positioned to further

develop our Nalunaq project in South Greenland following First Gold

production, with ramp-up to nameplate capacity expected in 2025. We

remain committed to disciplined capital management as we approach

our strategic growth ambitions and delivering long-term value for

our stakeholders.”

The debt financing package with Landsbankinn

consists of:

- US$18.5 million Facility A and

US$10 million Facility B with a margin of 9.5% per annum, reducing

to 7.5% once Facility C has become available.

- US$6.5 million Facility C with a

margin of 7.5% per annum, available once all other facilities have

been fully drawn and the Company’s cumulative EBITDA over the

preceding three-month period exceeds CAD 6 million.

Facility A will be used to refinance the

Company’s existing revolving credit facilities entered into on 1

September 2023. Amounts borrowed under Facility B and Facility C

will be applied towards working capital and general corporate

purposes and involve covenants relating to EBITDA and equity

ratio.

The Facilities carry a 1.5% arrangement fee,

payable depending on closing and utilisation dates, a 0.4%

commitment fee on unutilised amounts, and a termination date of 1

December 2026.

The Facilities will be secured by a combination

of a property and operational equipment mortgage, share pledge over

subsidiaries, certain bank account pledges and a license transfer

agreement. Execution of the security documentation is a condition

precedent to the utilization of the Facilities.

In parallel, the unutilized US$10 million cost

overrun facility with JLE Property Ltd., dated 1 September 2024,

will be cancelled.

Update on Impact Benefit Agreement

Additionally, the Company provides an update on

the progress of the Impact Benefit Agreement (IBA).

Amaroq has been actively working in

collaboration with the Government of Greenland and Kommune Kujalleq

to advance the IBA. However, due to the Government of Greenland’s

need to address competing priorities, the IBA will not be

formalized by 31 December 2024, as was previously announced.

In recognition of these circumstances, the

potential for an extension of the deadline to 30 June 2025 has been

indicated by the Government of Greenland. Amaroq remains fully

committed to its collaborative approach to ensure the IBA reflects

the shared objectives of all parties. This delay to the

formalization of the IBA will not impact current and future mining

operations, with ramp-up to nameplate plant capacity of 260-300

tonnes per day at Nalunaq still planned to take place in Q4

2025.

Enquiries:

Amaroq Minerals Ltd.

Eldur Olafsson, Executive Director and CEO

eo@amaroqminerals.com

Ellert Arnarson, CFO

ea@amaroqminerals.com

Eddie Wyvill, Corporate Development

+44 (0)7713 126727

ew@amaroqminerals.com

Panmure Liberum Limited (Nominated Adviser and Corporate

Broker)

Scott Mathieson

Nikhil Varghese

Kieron Hodgson

Josh Moss

+44 (0) 20 7886 2500

Canaccord Genuity Limited (Corporate

Broker)

James Asensio

Harry Rees

George Grainger

+44 (0) 20 7523 8000

Camarco (Financial PR)

Billy Clegg

Elfie Kent

Fergus Young

+44 (0) 20 3757 4980

For Corporation updates:

Follow @Amaroq_Minerals on X (Formerly known as Twitter)

Follow Amaroq Minerals Ltd. on LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business objectives are the

identification, acquisition, exploration, and development of gold

and strategic metal properties in South Greenland. The Company's

principal asset is a 100% interest in the Nalunaq Gold mine. The

Company has a portfolio of gold and strategic metal assets in

Southern Greenland covering the two known gold belts in the region

as well as advanced exploration projects at Stendalen and the Sava

Copper Belt exploring for Strategic metals such as Copper, Nickel,

Rare Earths and other minerals. Amaroq Minerals is continued under

the Business Corporations Act (Ontario) and wholly owns Nalunaq

A/S, incorporated under the Greenland Public Companies Act.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Inside Information

This announcement contains inside information

for the purposes of Article 7 of the UK version of Regulation (EU)

No. 596/2014 on Market Abuse ("UK MAR"), as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018,

and Regulation (EU) No. 596/2014 on Market Abuse ("EU MAR").

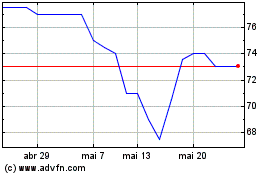

Amaroq Minerals (LSE:AMRQ)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Amaroq Minerals (LSE:AMRQ)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025