Atos launches a reverse stock split

07 Março 2025 - 3:30AM

UK Regulatory

Atos launches a reverse stock split

Press release

Atos launches a reverse stock

split

Paris, France - March 7, 2025.

– Atos SE (the “Company”) announces the

implementation of a reverse stock split of the shares comprising

its share capital, through the exchange of 10,000 old shares of

€0.0001 par value for 1 new share of €1.00 par value.

Given the number of Atos shares issued during

the capital increases carried out as part of the Company’s

accelerated safeguard plan and the low share value, the reverse

stock split aims to restore a normal number of shares, reduce share

price volatility and support a new stock market dynamic.

The reverse stock split is a purely technical

exchange transaction with no direct impact on the total value of

the Company’s shares held by each shareholder.

For example, for a shareholder holding 30,000

shares before the operation:

|

|

Before the reverse stock split

(until April 23, 2025) |

After the reverse stock split

(from April 24, 2025) |

|

Number of shares |

30,000 |

3 |

|

Indicative value of the share (1) |

€0.0049 |

€49 |

|

Portfolio value (2) |

€147 |

€147 |

(1) Value at the close

of trading on March 6, 2025.

(2) Excluding price fluctuations.

|

Frequently Asked Questions (FAQ) relating to the reverse stock

split are available on the Company’s website in the “Investors”

section. |

Main terms and conditions of the reverse

stock split

Following delegation of powers by the

shareholders’ combined General Meeting of January 31, 2025

(29th resolution), the Board of Directors, at its

meeting on March 6, 2025, decided on the terms and conditions of

the reverse stock split, which are detailed below.

- Start date of the reverse

stock split operations: March 25, 2025.

- Effective date of the

reverse stock split: April 24, 2025.

- Basis of the reverse stock

split: exchange of 10,000 ordinary shares with a par value

of 0.0001 euro each for 1 new share with a par value of 1 euro and

current dividend rights.

- Number of old shares

subject to the reverse stock split: 190,229,952,668 shares

with a par value of 0.0001 euro.1

- Number of new shares to be

issued as a result of the reverse stock split: 19,022,995

shares with a par value of 1 euro.1

- Exchange period:

30 days from the start date of the reverse stock split, i.e. from

March 25 (inclusive) to April 23, 2025 (inclusive).

- Whole shares: the

conversion of old shares into new shares will be carried out

automatically (procédure d’office).

- Fractional shares:

shareholders who do not hold a number of old shares corresponding

to a whole number of new shares must personally purchase or sell

fractional old shares, in order to obtain a multiple of 10,000

until April 23, 2025 inclusive.

After this period, shareholders who have not

been able to obtain a number of shares that is a multiple of 10,000

will be compensated by their financial intermediary in accordance

with Articles L. 228-6-1 and R. 228-12 of the French Commercial

Code and market practice.

Old shares that have not been consolidated will

be delisted at the end of the reverse stock split period.

- Rights attached to the

shares: the new shares will carry immediate voting rights.

At the end of the reverse split period, shares that have not been

consolidated will lose their voting rights and will no longer be

included in the calculation of the quorum, and their rights to

future dividends will be suspended.

- Centralization:

all transactions relating to the reverse stock split will be

carried out by Société Générale Securities Services, 32 rue du

Champ de Tir, CS 30812, 44308 Nantes Cedex 3, appointed as agent

for the centralization of reverse stock split transactions.

Pursuant to Articles L. 228-6-1 and R. 228-12 of

the French Commercial Code and in accordance with the decision of

the Board of Directors held on March 6, 2025, at the end of a

period of thirty days from March 25, 2025, the new shares that

could not be allocated individually and correspond to fractional

rights will be sold on the stock market by the account holders, and

the proceeds of the sale will be allocated in proportion to the

fractional rights of each rights holder.

The old shares subject to the reverse stock

split will be admitted to trading on the Euronext regulated market

in Paris under ISIN code FR0000051732, until the last day of

trading on April 23, 2025. The new shares resulting from the

reverse stock split will be admitted to trading on the Euronext

regulated market in Paris from April 24, 2025, the first day of

trading, under ISIN code FR001400X2S4.

- Suspension of the exercise

of securities giving access to the share capital: the

exercise of share subscription warrants issued by the Company (the

“BSA”) is suspended from March 17, 2025 to April

27, 2025 (inclusive).

- Adjustment of the exercise

parity for BSA and free share allocation rights: following

the reverse stock split, the BSA exercise parity and free share

allocation rights under the Company’s current free share allocation

plans will be adjusted to take account of the reverse stock split,

in accordance with the terms and conditions applicable to each of

the instruments concerned.

A notice of reverse stock split and suspension

of the right to exercise share subscription warrants will be

published in the Bulletin des Annonces Légales

Obligatoires (BALO) on March 10, 2025.

Reverse stock split indicative

timetable

|

March 10, 2025 |

Publication of the notice of reverse stock split in the BALO and of

the notice of suspension of share subscription warrants (BSA) |

|

March 17, 2025 |

Start of the period of suspension of exercise of the BSA |

|

March 25 to April 23, 2025 |

Exchange period: shareholders can buy and sell shares to manage

fractional shares |

|

From March 26, 2025 |

Suspension of DSS (Deferred Settlement Service) for old

shares |

|

April 23, 2025 |

Last day of the exchange period and last trading day for old

shares |

|

April 24, 2025 |

Effective date of the reverse stock split and first day of

trading of the new shares |

|

April 24 to May

25, 2025 |

Compensation period for shareholders with fractional rights through

their financial intermediaries |

|

April 28, 2025 |

Restart of the period of suspension of exercise of the BSA |

***

About Atos

Atos is a global leader in digital

transformation with c. 78,000 employees and annual revenue of

c. €10 billion. European number one in cybersecurity, cloud

and high-performance computing, the Group provides tailored

end-to-end solutions for all industries in 68 countries. A pioneer

in decarbonization services and products, Atos is committed to a

secure and decarbonized digital for its clients. Atos is a SE

(Societas Europaea), and listed on Euronext Paris.

The purpose of Atos is to help design

the future of the information space. Its expertise and services

support the development of knowledge, education and research in a

multicultural approach and contribute to the development of

scientific and technological excellence. Across the world, the

Group enables its customers and employees, and members of societies

at large to live, work and develop sustainably, in a safe and

secure information space.

Contacts

Investor relations: David Pierre-Kahn

| investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33 6 29 34 85 67

Individual shareholders: +33 8 05 65 00 75

Press contact: globalprteam@atos.net

1 The number of shares resulting from the

reverse stock split may be adjusted in the event that holders of

securities giving access to the share capital exercise their rights

outside the period of suspension of their right to do so. The

definitive number of shares resulting from the reverse split will

be recorded by the Board of Directors or by the Chairman and Chief

Executive Officer at the end of the reverse split.

- AtosSE_PR_LaunchReverseStockSplit_EN_vfinal

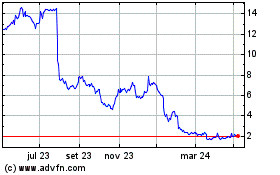

Atos (EU:ATO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

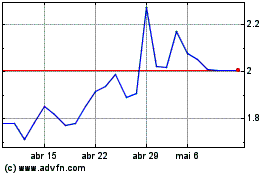

Atos (EU:ATO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025