Royalty Financing with HCRx: GENFIT Announces Approval of the

Amendment of the Terms and Conditions of its 2025 OCEANEs

- All resolutions approved by bondholders

- Closing of Royalty Financing and receipt of first €130

million instalment expected shortly

- Upon closing of the Royalty Financing, GENFIT will

implement the Repurchase of the 2025 OCEANEs and pay the Consent

Fee

Lille (France), Cambridge

(Massachusetts, United States), Zurich (Switzerland), March 10,

2025 - GENFIT (Nasdaq and Euronext:

GNFT), a biopharmaceutical company dedicated to improving

the lives of patients with rare and life-threatening liver diseases

(the “Company”), today announces the results of

the bondholders’ vote at the general meeting of the 2025 OCEANEs

holders which took place this Monday, March 10, 2025 at 2:30pm

(Paris time): all resolutions proposed by the Company were

approved.

General meeting of the 2025 OCEANEs

holders

The terms and conditions of the 2025 OCEANEs

contained a negative pledge clause which limited the ability of the

Company to grant security interests to its creditors upon its

present or future assets or revenues. The closing of the royalty

financing with HCRx (the “Royalty Financing”),

which was signed and announced by GENFIT on January 30, 2025, was

subject to approval of 2025 OCEANEs bondholders of an amendment to

this negative pledge clause, allowing for the grant of the security

interest contemplated in the Royalty Financing documentation, and

other customary closing conditions.

All resolutions proposed by the Company to the

bondholders were approved unanimously, at 100% of the votes cast,

with a quorum of 95.79%.

The Company can therefore move forward with

preparation for the closing of the Royalty Financing, which will be

announced in a subsequent press release.

The result of the vote resolution by resolution

is available on the website of the Company

(https://ir.genfit.com/financials/General-Meeting).

Implementation of the

Repurchase

As announced on February 10, 2025 and February

14, 2025, the Company proposed to all of the 2025 OCEANEs holders

to enter into a Put Option Agreement, pursuant to which the Company

unconditionally and irrevocably undertook to repurchase the 2025

OCEANEs of such holder at a price of EUR 32.75 per bond, subject to

approval by the general meeting of the 2025 OCEANEs holders of the

amendment of the terms and conditions of the 2025 OCEANEs and the

closing of the Royalty Financing (the

“Repurchase”). Holders have until March 19, 2025

to exercise this option.

The settlement of the Repurchase is expected to occur on March 26,

2025. The repurchased 2025 OCEANEs will be canceled by the

Company.

Payment of the Consent Fee

The Company also undertook, subject to the

approval of the amendment of the terms and conditions of the 2025

OCEANEs and the closing of the Royalty Financing, to pay a consent

fee (the “Consent Fee”) of EUR 0.90 to the holders of 2025 OCEANEs

still outstanding after cancellation of the repurchased 2025

OCEANEs. The Consent Fee will only be paid after the Repurchase has

taken place. The 2025 OCEANEs that have been bought back by the

Company as part of the Repurchase (or that have been converted

prior to 5:00 p.m. (Paris time) on the date falling 2 business days

prior to the date of payment of the Consent Fee) will thus not

receive the Consent Fee.

The payment of the Consent Fee is expected to

occur on April 14, 2025.

Anticipated Calendar of

Events

|

March 19, 2025 |

Deadline for relevant 2025 OCEANEs holders to exercise their put

option under the Put Option Agreements

|

|

March 26, 2025 |

Repurchase settlement date

|

|

April 14, 2025 |

Payment of the Consent Fee |

ABOUT GENFIT

GENFIT is a biopharmaceutical company committed

to improving the lives of patients with rare, life-threatening

liver diseases whose medical needs remain largely unmet. GENFIT is

a pioneer in liver disease research and development with a rich

history and a solid scientific heritage spanning more than two

decades. Today, GENFIT has built up a diversified and rapidly

expanding R&D portfolio of programs at various stages of

development. The Company focuses on Acute-on-Chronic Liver Failure

(ACLF). Its ACLF franchise includes five assets under development:

VS-01, NTZ, SRT-015, CLM-022 and VS-02-HE, based on complementary

mechanisms of action using different routes of administration.

Other assets target other serious diseases, such as

cholangiocarcinoma (CCA), urea cycle disorder (UCD) and organic

acidemia (OA). GENFIT's expertise in the development of

high-potential molecules from early to advanced stages, and in

pre-commercialization, was demonstrated in the accelerated approval

of Iqirvo® (elafibranor1) by the U.S. Food and Drug

Administration, the European Medicines Agency and the Medicines and

Healthcare Regulatory Agency in the UK for Primary Biliary

Cholangitis (PBC). Beyond therapies, GENFIT also has a diagnostic

franchise including NIS2+® in Metabolic dysfunction-associated

steatohepatitis (MASH, formerly known as NASH for non-alcoholic

steatohepatitis) and TS-01 focusing on blood ammonia levels. GENFIT

is headquartered in Lille, France and has offices in Paris

(France), Zurich (Switzerland) and Cambridge, MA (USA). The Company

is listed on the Nasdaq Global Select Market and on the Euronext

regulated market in Paris, Compartment B (Nasdaq and Euronext:

GNFT). In 2021, Ipsen became one of GENFIT's largest shareholders,

acquiring an 8% stake in the Company's capital. www.genfit.com

FORWARD LOOKING STATEMENTS

This press release contains certain

forward-looking statements, including those within the meaning of

the Private Securities Litigation Reform Act of 1995 with respect

to GENFIT, including, but not limited to statements about the

closing of the Royalty Financing and its implementation, and the

implementation calendar of the OCEANEs 2025 Repurchase. The use of

certain words, such as "believe", "potential", "expect", “target”,

“may”, “will”, "should", "could", "if" and similar expressions, is

intended to identify forward-looking statements. Although the

Company believes its expectations are based on the current

expectations and reasonable assumptions of the Company’s

management, these forward-looking statements are subject to

numerous known and unknown risks and uncertainties, which could

cause actual results to differ materially from those expressed in,

or implied or projected by, the forward-looking statements. These

risks and uncertainties include, among others, the uncertainties

inherent in research and development, including in relation to

safety of drug candidates, cost of, progression of, and results

from, our ongoing and planned clinical trials, review and approvals

by regulatory authorities in the United States, Europe and

worldwide, of our drug and diagnostic candidates, pricing, approval

and commercial success of elafibranor in the relevant

jurisdictions, exchange rate fluctuations, and our continued

ability to raise capital to fund our development, as well as those

risks and uncertainties discussed or identified in the Company’s

public filings with the AMF, including those listed in Chapter 2

"Risk Factors and Internal Control" of the Company's 2023 Universal

Registration Document filed on April 5, 2024 (no. D.24-0246) with

the Autorité des marchés financiers ("AMF"), which is

available on GENFIT's website (www.genfit.fr) and the AMF's website

(www.amf.org), and those discussed in the public documents and

reports filed with the U.S. Securities and Exchange Commission

("SEC"), including the Company’s 2023 Annual Report on Form 20-F

filed with the SEC on April 5, 2024, the Half-Year Business and

Financial Report dated September 19, 2024 and subsequent filings

and reports filed with the AMF or SEC or otherwise made public, by

the Company. In addition, even if the results, performance,

financial position and liquidity of the Company and the development

of the industry in which it operates are consistent with such

forward-looking statements, they may not be predictive of results

or developments in future periods. These forward-looking statements

speak only as of the date of publication of this press release.

Other than as required by applicable law, the Company does not

undertake any obligation to update or revise any forward-looking

information or statements, whether as a result of new information,

future events or otherwise.

CONTACTS

GENFIT | Investors

Tel: +33 3 2016 4000 | investors@genfit.com

GENFIT | Media

Stephanie Boyer – Press relations | Tel: +333 2016 4000 |

stephanie.boyer@genfit.com

GENFIT | 885 Avenue Eugène Avinée, 59120 Loos -

FRANCE | +333 2016 4000 | www.genfit.com

1 Elafibranor is marketed and commercialized in the U.S by Ipsen

under the trademark Iqirvo®.

- Royalty Financing with HCRx: GENFIT Announces Approval of the

Amendment of the Terms and Conditions of its 2025 OCEANEs

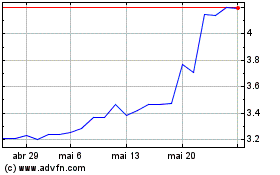

Genfit (EU:GNFT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

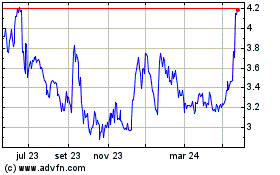

Genfit (EU:GNFT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025