SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D. C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

the month of November 2024

Commission

File Number: 001-06439

SONY

GROUP CORPORATION

(Translation

of registrant’s name into English)

1-7-1 KONAN, MINATO-KU, TOKYO, 108-0075, JAPAN

(Address

of principal executive offices)

The

registrant files annual reports under cover of Form 20-F.

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F,

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

SONY GROUP CORPORATION

(Registrant)

|

| |

|

|

| |

By: |

|

/s/ Hiroki Totoki |

| |

|

|

(Signature) |

| |

Hiroki Totoki |

| |

President, Chief Operating Officer and |

| |

Chief Financial Officer |

Date:

November 8, 2024

List

of Materials

Documents

attached hereto:

Press

release: Sony Group Corporation to Issue Stock Acquisition Rights for the Purpose of Granting Stock Options

1-7-1 Konan, Minato-ku

Tokyo, 108-0075 Japan

November 8, 2024

Sony Group Corporation to Issue Stock Acquisition Rights

for the Purpose of Granting Stock Options

Sony

Group Corporation (the “Corporation”) today announces that, the Representative Corporate Executive Officer of the Corporation

decided to issue stock acquisition rights for the purpose of granting stock options, pursuant to the delegation of authority approved

by resolutions of the Board of Directors of the Corporation.

| I. | The reason the Corporation will issue stock acquisition rights

for the purpose of granting stock options |

The Corporation will issue stock acquisition rights

to corporate executive officers and employees of the Corporation, and directors, officers and employees of subsidiaries of the Corporation,

for the purpose of giving them an incentive to contribute towards the improvement of the business performance of the Corporation and of

its group companies (collectively the “Group”) and thereby improving the business performance of the Group by making the economic

interest which such directors, officers or employees will receive correspond to the business performance of the Group.

| II. | The principal terms of the issue |

1.

The Fifty-First Series of stock acquisition rights (the “Stock Acquisition Rights” in this Section 1)

| (1) | Persons to whom Stock Acquisition Rights will be allocated and number of Stock Acquisition Rights to be allocated: |

| |

Number of persons |

| |

(Number of Stock Acquisition Rights) |

| Corporate executive officers of the Corporation |

6 | |

(16,700) |

| Employees of the Corporation |

18 | |

(2,690) |

| Directors and officers of the subsidiaries of the Corporation |

10 | |

(2,390) |

| Employees of the subsidiaries of the Corporation |

144 | |

(6,890) |

| |

total: 178 | |

(total: 28,670) |

| (2) | Class and number of shares to be issued or transferred upon exercise of Stock Acquisition Rights: |

2,867,000

shares of common stock of the Corporation

The number of shares to be issued or

transferred upon exercise of each Stock Acquisition Right (the “Number of Granted Shares”) shall be 100 shares.

| (3) | Aggregate number of Stock Acquisition Rights: |

28,670

| (4) | Method for calculating the amount to be paid in exchange for the Stock Acquisition Rights: |

The amount of money to be paid in exchange for the Stock Acquisition

Rights shall be the amount obtained by multiplying the option price per share of common stock (calculated using the Black-Scholes model

based on the basic figures in (ii) through (vii) below), by the number of shares to be received by exercising the Stock Acquisition Rights.

| i. | Option price per share of common stock (C) |

| ii. | Share price (𝑆): The closing price of the Corporation’s

common stock in regular trading on the Tokyo Stock Exchange (the “Closing Price”) on November 22, 2024 (if there is no Closing

Price on such date, the Closing Price on the immediately preceding trading day) |

| iii. | Exercise price (𝐾): The average of the Closing Prices for the

ten (10) consecutive trading days (excluding days on which there is no Closing Price) immediately prior to the allotment date of such

Stock Acquisition Rights; provided, however, that if such calculated price is lower than the Closing Price on the trading day immediately

preceding the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date, the Closing Price on the immediately

preceding trading day), Exercise price (𝐾) shall be the Closing Price on the trading day immediately preceding the allotment date

of Stock Acquisition Rights. |

| iv. | Estimated remaining years(t): 5.70 years |

| v. | Volatility (𝜎): The volatility rate of the share price based

on the Closing Prices during 5.70 years (from March 25, 2019 to November 22, 2024) |

| vi. | Risk-free rate (𝑟):

Interest rate on Japanese government bonds whose remaining years correspond to the expected remaining years. |

| vii. | Dividend Yield (𝑞):

Dividend per share (expected dividend for the year ending March 31, 2025) / share price (S) |

| viii. | Cumulative density function of the standard normal distribution:

(N(・)) |

(Note

1): The amount calculated using the above formula will be the fair value of the Stock Acquisition Rights and will not be an amount that

is particularly favorable to the allottee of the Stock Acquisition Rights (the “Allottee” in this Section 1).

The payment of

the amount to be paid by the Allottee in exchange for the Stock Acquisition Rights multiplied by the Allottee’s allotted number

of Stock Acquisition Rights (the “Total Amount to be Paid” in this item (4) of Section 1) will be made by offsetting such

amount against: (i) remuneration claims, in an amount equal to the Total Amount to be Paid, which will be granted to the Allottee by the

Corporation, if the Allottee is a corporate executive officer or an employee of the Corporation, or, (ii) remuneration claims in an amount

equal to the Total Amount to be Paid, which will be granted to the Allottee by subsidiaries of the Corporation and assumed by the Corporation,

if the Allottee is a director, officer or an employee of a subsidiary of the Corporation. Therefore, no monetary payment will be made

by the Allottee on the Allotment Date for the purpose of paying the Total Amount to be Paid. However, these remuneration claims shall

be granted on the condition that the Allottee enters into an allocation agreement with the Corporation (the “Allocation Agreement”).

(Note 2) The specific amount to be paid

in exchange for the Stock Acquisition Rights will be determined on November 22, 2024.

| (5) | Amount of assets to be contributed upon exercise of Stock Acquisition Rights: |

The amount of assets to be contributed upon exercise of each Stock

Acquisition Right shall be the amount obtained by multiplying the amount to be paid per share to be issued or transferred upon exercise

of Stock Acquisition Rights (the “Exercise Price”) by the Number of Granted Shares. The Exercise Price shall initially be

the average of the Closing Prices for the ten (10) consecutive trading days (excluding days on which there is no Closing Price) immediately

prior to the allotment date of such Stock Acquisition Rights (any fraction less than one (1) yen arising as a result of such calculation

shall be rounded up to the nearest one (1) yen); provided, however, that if such calculated price is lower than the Closing Price

on the trading day immediately preceding the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date, the

Closing Price on the immediately preceding trading day), the Exercise Price shall be the amount equal to the Closing Price on the trading

day immediately preceding the allotment date of Stock Acquisition Rights.

| (6) | Period during which Stock Acquisition Rights may be exercised: |

From and including November 25, 2025, up to and including November 24,

2034. If the last day of such period falls on a holiday of the Corporation, the immediately preceding business day shall be the last

day of such period. The exercise of Stock Acquisition Rights during such period shall be subject to the restrictions provided for in

the Allocation Agreement.

| (7) | Conditions for the exercise of Stock Acquisition Rights: |

| (a) | No Stock Acquisition Right may be exercised in part. |

| (b) | In the event of a resolution being passed at a general meeting of shareholders of the Corporation for

an agreement for any consolidation, amalgamation or merger (other than a consolidation, amalgamation or merger in which the Corporation

is the continuing corporation), or in the event of a resolution being passed at a general meeting of shareholders of the Corporation (or,

where a resolution of a general meeting of shareholders is not necessary, at a meeting of the Board of Directors of the Corporation) for

any agreement for share exchange (kabushiki-kokan) or any plan for share transfer (kabushiki-iten) pursuant to which the

Corporation is to become a wholly-owned subsidiary of another corporation, Stock Acquisition Rights may not be exercised on and after

the effective date of such consolidation, amalgamation or merger, such share exchange (kabushiki-kokan) or such share transfer

(kabushiki-iten). |

| (c) | The exercise of the Stock Acquisition Rights shall be subject to the conditions and restrictions provided

for in the Allocation Agreement. |

| (8) | Matters concerning the amount of capital and the additional paid-in capital increased by the issuance

of shares upon exercise of Stock Acquisition Rights: |

| (a) | The amount of capital increased by the issuance of shares upon exercise of Stock Acquisition Rights shall

be the amount obtained by multiplying the maximum limit of capital increase, as calculated in accordance with the provisions of Paragraph

1, Article 17 of the Company Accounting Ordinance of Japan, by 0.5, and any fraction less than one (1) yen arising as a result

of such calculation shall be rounded up to the nearest one (1) yen. |

| (b) | The amount of additional paid-in capital increased by the issuance of shares upon exercise of Stock Acquisition

Rights shall be the amount obtained by deducting the capital to be increased, as provided in (a) above, from the maximum limit of

capital increase, as also provided in (a) above. |

| (9) | Mandatory repurchase of Stock Acquisition Rights: |

Not applicable.

| (10) | Restrictions on the acquisition of Stock Acquisition Rights through transfer: |

The Stock Acquisition Rights cannot be acquired through transfer,

unless such acquisition is expressly approved by the Board of Directors of the Corporation. Transfer of the Stock Acquisition Rights

shall be subject to the restrictions provided for in the Allocation Agreement.

| (11) | Allotment date of Stock Acquisition Rights: |

November 25, 2024

2.

The Fifty-Second Series of Stock Acquisition Rights (the “Stock Acquisition Rights” in this Section 2)

| (1) | Persons to whom Stock Acquisition Rights will be allocated and number of Stock Acquisition Rights to be allocated: |

| |

Number of persons |

| |

(Number of Stock Acquisition Rights) |

| Employees of the Corporation |

2 | |

(267) |

| Directors and officers of the subsidiaries of the Corporation |

5 | |

(6,975) |

| Employees of the subsidiaries of the Corporation |

15 | |

(7,116) |

| |

total: 22 | |

(total: 14,358) |

| (2) | Class and number of shares to be issued or transferred upon exercise of Stock Acquisition Rights: |

1,435,800

shares of common stock of the Corporation

The number of shares to be issued or

transferred upon exercise of each Stock Acquisition Right (the “Number of Granted Shares”) shall be 100 shares.

| (3) | Aggregate number of Stock Acquisition Rights: |

14,358

| (4) | Method for calculating the amount to be paid in exchange for the Stock Acquisition Rights: |

The amount of money to be paid in exchange for the Stock Acquisition

Rights shall be the amount obtained by multiplying the option price per share of common stock (calculated using the Black-Scholes model

based on the basic figures in (ii) through (vii) below), by the number of shares to be received by exercising the Stock Acquisition Rights.

| i. | Option price per share of common stock (C) |

| ii. | Share price (𝑆):

The price obtained by converting the Closing Price on November 22,

2024 (if there is no Closing Price on such date, the Closing Price on the immediately preceding trading day) into U.S. dollars (by the

exchange rate quotations by a leading commercial bank in Tokyo for selling spot U.S. dollars by telegraphic transfer) against yen |

| iii. | Exercise

price (𝐾): The U.S. dollar amount obtained by dividing the

average of the Closing Prices for the ten (10) consecutive trading days (excluding days on which there is no Closing Price) immediately

prior to the allotment date of such Stock Acquisition Rights (the “Reference Yen Price”) by the average of the exchange rate

quotations by a leading commercial bank in Tokyo for selling spot U.S. dollars by telegraphic transfer against yen for such ten (10) consecutive

trading days (the “Reference Exchange Rate”) (any fraction less than one (1) cent arising as a result of such calculation

shall be rounded up to the nearest one (1) cent); provided, however, that if the Reference Yen Price is lower than the Closing

Price on the trading day immediately preceding the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date,

the Closing Price on the immediately preceding trading day), Exercise price (𝐾) shall be the U.S. dollar amount obtained by dividing

the Closing Price on the trading day immediately preceding the allotment date of Stock Acquisition Rights by the Reference Exchange Rate

(any fraction less than one (1) cent arising as a result of such calculation shall be rounded up to the nearest one (1) cent). |

| iv. | Estimated remaining years (t): 5.83 years |

| v. | Volatility (𝜎):

The volatility rate of the share price based on the closing price of

the Corporation’s American Depository Receipts (ADRs) on the New York Stock Exchange on each trading day during the 5.83 year (from

February 25, 2019 to November 22, 2024) |

| vi. | Risk-free rate (𝑟):

Interest rate on Japanese government bonds whose remaining years correspond to the expected remaining years. |

| vii. | Dividend Yield (𝑞):

Dividend per share (expected dividend for the year ending March 31,

2025) / the Closing Price on November 22, 2024 (if there is no Closing Price on such date, the Closing Price on the immediately preceding

trading day) |

| viii. | Cumulative density function of the standard normal distribution:

(N (・)) |

(Note

1) The amount calculated using the above formula will be the fair value of the Stock Acquisition Rights and will not be an amount that

is particularly favorable to the allottee of the Stock Acquisition Rights (the “Allottee” in this Section 2).

The payment of the amount to be

paid by the Allottee in exchange for the Stock Acquisition Rights multiplied by the Allottee’s allotted number of Stock

Acquisition Rights (the “Total Amount to be Paid” in this item (4) of Section 2) will be made by offsetting such amount

against: (i) remuneration claims, in an amount equal to the Total Amount to be Paid, which will be granted to the Allottee by the

Corporation, if the Allottee is an employee of the Corporation, or, (ii) remuneration claims in an amount equal to the Total Amount

to be Paid, which will be granted to the Allottee by subsidiaries of the Corporation and assumed by the Corporation, if the Allottee

is a director, officer or an employee of a subsidiary of the Corporation. Therefore, no monetary payment will be made by the

Allottee on the Allotment Date for the purpose of paying the Total Amount to be Paid. However, these remuneration claims shall be

granted on the condition that the Allottee enters into an allocation agreement with the Corporation (the “Allocation Agreement”).

(Note 2) The specific amount to be paid

in exchange for the Stock Acquisition Rights will be determined on November 22, 2024.

| (5) | Amount of assets to be contributed upon exercise of Stock Acquisition Rights: |

The amount of assets to be contributed upon exercise of each Stock

Acquisition Right shall be the amount obtained by multiplying the amount to be paid per share to be issued or transferred upon exercise

of Stock Acquisition Rights (the “Exercise Price”) by the Number of Granted Shares. The Exercise Price shall initially be

the U.S. dollar amount obtained by dividing the average of the Closing Prices for the ten (10) consecutive trading days (excluding days

on which there is no Closing Price) immediately prior to the allotment date of such Stock Acquisition Rights by the average of the exchange

rate quotations by a leading commercial bank in Tokyo for selling spot U.S. dollars by telegraphic transfer against yen for such ten (10)

consecutive trading days (any fraction less than one (1) cent arising as a result of such calculation shall be rounded up to the nearest

one (1) cent); provided, however, that if the Reference Yen Price is lower than the Closing Price on the trading day immediately

preceding the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date, the Closing Price on the immediately

preceding trading day), the Exercise Price shall be the U.S. dollar amount obtained by dividing the Closing Price on the trading day immediately

preceding the allotment date of Stock Acquisition Rights by the Reference Exchange Rate (any fraction less than one (1) cent arising as

a result of such calculation shall be rounded up to the nearest one (1) cent).

| (6) | Period during which Stock Acquisition Rights may be exercised: |

From and including November 25, 2025, up to and including November 24,

2034. If the last day of such period falls on a holiday of the Corporation, the immediately preceding business day shall be the last

day of such period. The exercise of Stock Acquisition Rights during such period shall be subject to the restrictions provided for in

the Allocation Agreement.

| (7) | Conditions for the exercise of Stock Acquisition Rights: |

| (a) | No Stock Acquisition Right may be exercised in part. |

| (b) | In the event of a resolution being passed at a general meeting of shareholders of the Corporation for

an agreement for any consolidation, amalgamation or merger (other than a consolidation, amalgamation or merger in which the Corporation

is the continuing corporation), or in the event of a resolution being passed at a general meeting of shareholders of the Corporation (or,

where a resolution of a general meeting of shareholders is not necessary, at a meeting of the Board of Directors of the Corporation) for

any agreement for share exchange (kabushiki-kokan) or any plan for share transfer (kabushiki-iten) pursuant to which the

Corporation is to become a wholly-owned subsidiary of another corporation, Stock Acquisition Rights may not be exercised on and after

the effective date of such consolidation, amalgamation or merger, such share exchange (kabushiki-kokan) or such share transfer

(kabushiki-iten). |

| (c) | The exercise of the Stock Acquisition Rights shall be subject to the conditions and restrictions provided

for in the Allocation Agreement. |

| (8) | Matters concerning the amount of capital and the additional paid-in capital increased by the issuance

of shares upon exercise of Stock Acquisition Rights: |

| (a) | The amount of capital increased by the issuance of shares upon exercise of Stock Acquisition Rights shall

be the amount obtained by multiplying the maximum limit of capital increase, as calculated in accordance with the provisions of Paragraph

1, Article 17 of the Company Accounting Ordinance of Japan, by 0.5, and any fraction less than one (1) yen arising as a result

of such calculation shall be rounded up to the nearest one (1) yen. |

| (b) | The amount of additional paid-in capital increased by the issuance of shares upon exercise of Stock Acquisition

Rights shall be the amount obtained by deducting the capital to be increased, as provided in (a) above, from the maximum limit of

capital increase, as also provided in (a) above. |

| (9) | Mandatory repurchase of Stock Acquisition Rights: |

Not applicable.

| (10) | Restrictions on the acquisition of Stock Acquisition Rights through transfer: |

The Stock Acquisition Rights cannot be acquired through transfer (other

than any transfer upon the death of a holder of the Stock Acquisition Rights to such holder’s estate or beneficiaries), unless

such acquisition is expressly approved by the Board of Directors of the Corporation. Transfer of the Stock Acquisition Rights shall be

subject to the restrictions provided for in the Allocation Agreement.

| (11) | Allotment date of Stock Acquisition Rights: |

November 25, 2024

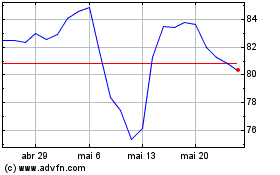

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024