Bitcoin rises after drop, influenced by tensions in the Middle East

Bitcoin (COIN:BTCUSD) rose above $61,500 after 10 PM on Tuesday,

dipped below $61,000 by 09:30 AM on Wednesday, and hit an intraday

high of $62,380 at 12 PM. Priced at $61,720, up 1.48% at the time

of writing, Bitcoin fluctuated amid escalating conflict between

Iran and Israel, with BTC plunging after Iran launched missiles in

response to Israeli attacks in Lebanon.

Gold (PM:XAUUSD), traditionally seen as a safe haven, rose while

BTC experienced its worst October start, a historically optimistic

month. Geopolitical uncertainty continues to impact the market,

highlighting BTC’s growing maturity compared to gold.

Cryptocurrency liquidations totaled $523 million in 24 hours, while

investor sentiment fell to the “fear” category.

With rising tensions in the Middle East, traders adjusted their

targets below $60,000, potentially reaching $54,000. Analysts like

Roman and Toni Ghinea warn of a possible price “trap,” while others

like Michaël van de Poppe see a potential recovery after touching

$60,000, considering reduced liquidity. A retest of its all-time

high of $73,679 may take time, with analyst Peter Brandt suggesting

that only a close above $71,000 will indicate the resumption of a

solid upward trend.

Bitcoin ETF outflows total $242.6 million, led by Fidelity and Ark

On October 1, Bitcoin ETFs recorded net outflows of $242.6

million, reversing the significant inflows from the previous week.

Fidelity’s ETF (AMEX:FBTC) led with $144.7 million in outflows,

followed by Ark’s (AMEX:ARKB) with $84.3 million. Bitwise

(AMEX:BITB) and VanEck (AMEX:HODL) also posted losses, while

BlackRock’s ETF (NASDAQ:IBIT) was the only one to register $40.8

million in inflows.

U.S. spot Ether ETFs recorded $48.6 million in withdrawals on

Tuesday. The Grayscale Ethereum Trust (AMEX:ETHE) led the outflows,

totaling $26.6 million. The Fidelity Ethereum Fund (AMEX:FETH) saw

$25 million in withdrawals, followed by Bitwise’s (AMEX:ETHW) with

a $0.9 million outflow. Other Ethereum ETFs posted modest inflows

or no movement.

Franklin Templeton expands tokenized fund to Aptos, strengthening

blockchain integration

Franklin Templeton, with $1.4 trillion in assets, has added the

Aptos blockchain to its tokenized U.S. government securities fund,

FOBXX. Aptos is the fifth blockchain to integrate with the fund,

following Avalanche, Arbitrum, Stellar, and Polygon. The expansion

is driven by Aptos’ compatibility with the manager’s Benji system.

Although significant for the financial sector, the Aptos token

(COIN:APTUSD) still dropped 2.8% for the week, despite a 4.4%

increase in the last 24 hours, trading at $7.88. FOBXX now manages

over $435 million.

Bitwise moves forward with filing for XRP-linked ETF

Bitwise, an asset manager, has taken a major step by filing for

an exchange-traded fund (ETF) linked to XRP (COIN:XRPUSD). The

company submitted an S-1 form to the U.S. Securities and Exchange

Commission, necessary for the creation of new securities. While the

S-1 filing is the first step, final approval still requires

additional documents. XRP is the sixth-largest cryptocurrency, with

a market capitalization of $33.1 billion.

POL declines despite Polygon updates

Despite initial optimism surrounding the migration from MATIC to

POL, Polygon’s POL cryptocurrency faced significant declines in

late September. While Bitcoin posted a nearly 8% monthly gain, 95%

of POL holders saw unrealized losses, with the token down 6.6% in

September.

Even with the Ahmedabad hardfork, which brought improvements to

the PoS chain by increasing contract capacity and resolving stuck

transactions, POL remains under pressure. These updates, aimed at

developers, have not yet compensated for the asset’s negative

market performance.

Fernando Pereira, a Bitget analyst, noted that despite POL’s

recent challenges due to competition from other layer-two

solutions, the asset is historically undervalued and may offer a

50% short-term appreciation.

“POL is going through a tough period in its existence, as

several layer-two solutions have emerged in the market with much

more aggressive proposals that have reduced interest in the

network. The asset is in a historically cheap price zone and could

easily return to its fair price region (around $0.50). Seeking

regions above $1.00 is very difficult for POL in the medium term,

but this does not prevent investors who enter the coin today from

seeking a 50% appreciation in the coming months,” Pereira

emphasized.

Kraken ends support for Monero in Europe due to regulations

Kraken has announced that it will stop trading and deposits of

Monero (COIN:XMRUSD) in the European Economic Area (EEA) starting

October 31, 2024, due to new regulatory requirements. The exchange

will allow withdrawals until December 31, converting remaining

tokens into Bitcoin. The decision follows European Union

regulations banning the use of privacy-focused tokens. Other

countries, such as Japan and South Korea, have also banned

anonymity-focused tokens. Monero plunged after the announcement,

accumulating a -17.2% drop over the last seven days.

Ava Protocol and Sony collaborate for Ethereum L2 blockchain

automation

Ava Protocol and Sony Block Solutions Labs are collaborating to

integrate automation into Sony’s public Ethereum L2 blockchain

(NYSE:SONY), aiming to facilitate the use of transactions and smart

contracts. This partnership, part of the Soneium Spark program,

seeks to allow developers and creators to tokenize real assets,

monetize work, and leverage automatic payments. The initiative

could be transformative for the Web3 industry, promoting greater

global adoption of decentralized technologies. Ava Protocol’s

solution lowers entry barriers into Web3 by simplifying processes

and providing accessible tools.

Taurus and Chainlink partner for institutional tokenization

Taurus, a digital asset infrastructure provider, has partnered

with Chainlink Labs (COIN:LINKUSD) to drive the adoption of

tokenized assets in institutional markets. The partnership aims to

enhance data transparency, security, and cross-chain mobility.

Using Chainlink’s data feeds, Taurus will provide information on

market prices and identity, facilitating transactions across

multiple chains. The collaboration faces regulatory challenges but

offers new opportunities for financial institutions in the

tokenized assets sector.

Hut 8 converts $38 million debt into shares, gaining financial

flexibility

Hut 8 (NASDAQ:HUT), a major Bitcoin mining company, announced

that Anchorage Digital converted the remaining $38 million of a

loan into common shares at $16.395 per share, with a 51% premium.

The conversion eliminates the remaining debt, giving Hut 8 more

flexibility to expand into AI and mining infrastructure.

Pavel Durov clarifies Telegram’s privacy policy and data sharing

Telegram CEO Pavel Durov explained that since 2018, the platform

has shared IP addresses and phone numbers of criminals with

authorities. The recent policy update unifies privacy practices

across regions. Durov emphasized that these disclosures are made

upon formal legal requests. The change comes after Durov’s arrest

in France over allegations of failure to moderate content and share

data, sparking criticism over the action.

US voters see pro-crypto policies as important factor in elections

A survey by Consensys and HarrisX reveals that 49% of U.S.

voters consider pro-crypto policies important for upcoming

elections. Among crypto owners, 85% support pro-crypto candidates,

with 92% planning to vote. Donald Trump and Kamala Harris were

mentioned, with Trump receiving 56% support due to his pro-crypto

stance. The survey highlights that voters want clear regulation and

expect the U.S. to lead crypto innovation, with the SEC and

Treasury seen as primary regulators, while 11% believe the sector

is self-regulated.

Christie’s issues blockchain-based digital certificates for

photography collection

Christie’s, in partnership with Kresus, is issuing digital

ownership certificates for 130 lots from Trevor Traina’s

photography collection, auctioned in New York. These certificates

will be minted on Coinbase’s Base blockchain, ensuring transparency

and security for collectors. Christie’s continues to explore

blockchain use in the art market, following its historic auction of

Beeple’s “Everyday” collection in 2021.

Lamborghini launches Web3 platform for digital cars in partnership

with Animoca Brands

Lamborghini announced the Web3 platform “Fast ForWorld,”

allowing its cars to be used in blockchain games. In partnership

with Animoca Brands, the initiative brings the brand’s first

blockchain integration into games like Torque Drift 2 and REVV

Racing. The launch, scheduled for November 7, will include a 3D

wallet for interaction with digital cars, offering a digital

experience for fans and customers, solidifying Lamborghini’s

presence in the Web3 gaming ecosystem.

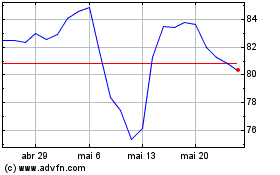

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024