Qualcomm (NASDAQ:QCOM) – The semiconductor

company exceeded expectations with an adjusted EPS of $2.69,

against the expected $2.56, and revenue of $10.24 billion, above

the expected $9.90 billion. Net income increased to $2.92 billion,

with automotive growing 86% and device chips by 12%. The company

projects revenue between $10.5 billion and $11.3 billion for the

next quarter, above LSEG estimates of $10.59 billion. Shares rose

7.9% pre-market.

Wolfspeed (NYSE:WOLF) – The semiconductor

developer posted revenue of $195 million for the first fiscal

quarter of 2025, slightly below last year’s $197 million. GAAP

gross margin was -19% due to underutilization costs, while non-GAAP

margin stood at 3%. Next quarter projections show revenue between

$160 and $200 million and a GAAP net loss of $362 to $401 million.

Shares dropped 24.8% pre-market.

Lyft (NASDAQ:LYFT) – The ride-hailing company

posted an adjusted loss of $0.03 per share in Q3, beating the

expected $0.20 loss, with revenue of $1.52 billion, up 32% YoY and

above projections of $1.44 billion. Net loss was $12.4 million.

Gross bookings reached $4.1 billion, up 16% from last year. Future

guidance estimates gross bookings between $4.28 and $4.35 billion.

Shares rose 22.4% pre-market.

AppLovin (NASDAQ:APP) – The app marketing

platform reported EPS of $1.25 in Q3, beating the $0.92 estimate.

Quarterly revenue hit $1.2 billion, surpassing the expected $1.13

billion. For Q4 2024, the company projects revenue between $1.24

and $1.26 billion, above the $1.18 billion consensus, indicating

solid performance and positive outlook. Shares rose 27.5%

pre-market.

Arm Holdings (NASDAQ:ARM) – The chip design

company surpassed expectations, recording total revenue of $844

million, above the projected $810 million. The royalty segment grew

23%, reaching $514 million, above the expected $502 million. Net

income was $107 million, or $0.10 per share, with adjusted EPS of

$0.30, above the $0.26 forecast. Next quarter projects revenue

between $920 and $970 million and adjusted EPS of $0.32 to $0.36,

against the consensus of $939 million and $0.33, respectively.

Shares fell 6.2% pre-market.

Take-Two Interactive (NASDAQ:TTWO) – The video

game developer reported adjusted EPS of $0.66, above estimates of

$0.42 but below last year’s $1.22. Revenue of $1.47 billion

slightly beat expectations. However, next quarter and fiscal year

projections are below expectations, with projected EPS of $0.55 and

$2.48, respectively. Shares rose 2.0% pre-market.

HubSpot (NYSE:HUBS) – The CRM and marketing

platform reported Q3 adjusted EPS of $2.18, up 37% YoY, with

revenue of $670 million, 20% above 2023’s $558 million, exceeding

analyst estimates of $1.91 EPS and $647 million in revenue. Shares

rose 6.5% pre-market.

SolarEdge (NASDAQ:SEDG) – The solar solutions

provider reported Q3 revenue of $260.9 million, down 2% QoQ and 64%

YoY. The solar segment grew 3% to $247.5 million. GAAP net loss was

$1.21 billion with a per-share loss of $21.11. Q4 projections

forecast revenue between $180 million and $200 million. Shares fell

19.4% pre-market, after closing down 22.2% on Wednesday.

Dutch Bros (NYSE:BROS) – The drive-thru coffee

chain reported Q3 earnings of $0.16 per share, exceeding the $0.12

forecast. Revenue was $338.21 million, above the estimated $325.14

million and last year’s $264.51 million. The company opened 38 new

stores and expects annual revenue between $1.255 and $1.26 billion,

above previous guidance. Shares rose 15.9% pre-market.

Bumble (NASDAQ:BMBL) – The online dating

platform reported Q3 revenue of $274 million, down 1%, with a net

loss of $849.3 million due to $892.2 million in impairment charges.

Adjusted EBITDA was $82.6 million (30.2%). Paying users rose 10% to

2.9 million. Q4 revenue guidance is between $256 and $262 million.

Shares fell 1.4% pre-market.

Match Group (NASDAQ:MTCH) – The parent company

of Hinge, OK Cupid, Tinder, and Plenty of Fish reported Q3 EPS of

$0.51, surpassing analysts’ $0.48 estimate. Revenue was $895

million, slightly below the $902.86 million consensus. For Q4 2024,

revenue projections are between $865 and $875 million, below the

$906 million expectations. Shares fell 12.9% pre-market.

Zillow Group (NASDAQ:Z) – The online real

estate platform posted Q3 revenue of $581 million, up 17% YoY and

above the $555 million estimate. It reported a net loss of $20

million, better than the expected $40 million loss. For Q4 2024,

revenue is projected between $525 and $540 million, in line with

analyst predictions.

AMC Entertainment (NYSE:AMC) – The U.S. movie

theater chain reported Q3 revenue of $1.33 billion in 2024, driven

by releases like “Deadpool 3” and “Despicable Me 4,” though still

5% below the previous year. Net loss was $20.7 million, with an

adjusted per-share loss of $0.06, beating the expected $0.07.

Adjusted EBITDA reached $161 million, the second-highest for the

period. Shares fell 4.2% pre-market.

e.l.f. Beauty (NYSE:ELF) – The affordable

cosmetics company beat expectations with an adjusted EPS of $0.77,

versus the $0.43 estimate, and revenue of $301 million, above the

$286 million expectation, fueled by a 40% increase in sales. The

company raised its annual revenue forecast to $1.3 billion and

anticipates adjusted EPS between $3.47 and $3.53, reflecting strong

multi-generational appeal. Shares rose 9.4% pre-market.

Coty (NYSE:COTY) – The cosmetics and fragrance

company reported adjusted profit of $128.1 million, or $0.15 per

share for the quarter, above last year’s $0.09, with net revenue of

$1.67 billion, slightly below LSEG’s $1.68 billion estimate. Coty

expects annual profit to hit the lower end of the 54 to 57 cents

forecast, citing weak beauty product demand in major markets like

the U.S. and Australia.

Clover Health (NASDAQ:CLOV) – The health

insurance company posted a Q3 loss per share of $0.02, better than

the expected $0.04 loss. Quarterly revenue was $331 million, below

the $346.27 million estimate. For the fiscal year 2024, revenue is

projected between $1.35 and $1.37 billion, slightly below the $1.39

billion consensus. Shares fell 8.5% pre-market.

MercadoLibre (NASDAQ:MELI) – The Latin American

e-commerce platform posted adjusted EPS of $7.83, below the $10

forecast, with revenue of $5.31 billion, exceeding the $5.28

billion projection. While payment volume increased 34% and gross

merchandise volume grew 14% YoY, investments in shipping operations

and credit card origination impacted profitability.

Coeur Mining (NYSE:CDE) – The precious metals

miner reported net income of $48.7 million in Q3, equivalent to

$0.12 per share, exceeding Wall Street’s $0.07 expectations,

marking a strong recovery from last year’s loss. Quarterly revenue

reached $313.5 million. Shares rose 2.5% pre-market.

Hecla Mining (NYSE:HL) – The U.S. precious

metals miner posted Q3 2024 revenue of $245.1 million, its

second-largest ever, with adjusted net income of $19.7 million or

$0.03 per share. Silver production was 3.6 million ounces. Future

guidance suggests a decrease in silver production with increased

costs, while gold estimates remain stable. Shares fell 1.8%

pre-market.

Albemarle (NYSE:ALB) – The lithium supplier

reported a Q3 net loss of $1.07 billion or a loss of $9.45 per

share, adjusted to $1.55 per share, missing analyst expectations of

a $0.31 loss and $1.39 billion revenue, reporting $1.35 billion in

revenue. Annual revenue forecast is between $5.5 billion and $6.2

billion.

Corteva (NYSE:CTVA) – The agricultural chemical

company posted a Q3 loss of $0.49 per share, higher than the

analysts’ estimate of a $0.30 loss. Net sales fell 10% to $2.33

billion due to reduced demand and lower agricultural commodity

prices. The company revised its annual forecast to $17.0 billion to

$17.2 billion, below the prior expectations of up to $17.5 billion.

Shares fell 7.6% pre-market.

Marathon Oil (NYSE:MRO) – The U.S. oil company

exceeded estimates with an adjusted Q3 EPS of $0.64, slightly above

LSEG’s forecast of $0.63. Total production reached 421,000 boepd,

with crude oil production rising to 207,000 barrels per day. The

company raised its annual production forecast to 393,000 boepd,

benefiting from growing U.S. oil demand.

Gilead Sciences (NASDAQ:GILD) – The U.S.

biopharmaceutical company reported Q3 adjusted EPS of $2.02,

exceeding the $1.55 forecast, with revenue of $7.5 billion, above

the $7 billion estimate. The company raised its annual profit

forecast to between $4.25 and $4.45 per share and revenue to up to

$28.1 billion, driven by strong sales of Biktarvy and Veklury.

Shares rose 1.6% pre-market.

Beyond Meat (NASDAQ:BYND) – The plant-based

meat producer posted quarterly revenue of $81 million, a 7.6%

increase, surpassing the forecast of $80.7 million. The adjusted

loss was $0.41 per share, less than the $0.44 estimate. The company

revised its annual revenue forecast to between $320 million and

$330 million, citing reduced demand for plant-based products.

Shares fell 4.9% pre-market.

Other corporate highlights for today

Meta Platforms (NASDAQ:META) – The U.S. Supreme

Court debated Meta’s proposal to dismiss an investor lawsuit

accusing Facebook of concealing data misuse by users. The case

questions whether Facebook should have informed investors of the

Cambridge Analytica data breach as a future risk that had already

occurred. The justices will deliberate on corporate responsibility

for revealing past incidents impacting investors, with a decision

expected by June. Shares fell 0.3% pre-market.

Alphabet (NASDAQ:GOOGL) – Donald Trump may ease

some antitrust policies from Biden’s administration, including

reducing pressure to break up Google, preferring instead to

regulate fair business practices. Trump may also review merger

guidelines and ease non-compete restrictions, while maintaining

antitrust cases against Big Tech with a softer approach. Shares

rose 0.5% pre-market.

Amazon (NASDAQ:AMZN) – The Czech Republic-based

online grocer Rohlik Group partnered with Amazon to expand its

service in Germany. Operating as Knuspr.de, Rohlik plans to offer

products to Prime members, starting in Berlin. Amazon shares fell

0.6% pre-market.

Kroger (NYSE:KR) and

Albertsons (NYSE:ACI) – Kroger shares closed up

4.2% on Wednesday, with Trump’s victory potentially paving the way

for a merger-friendly environment. Kroger had attempted to acquire

Albertsons, but the FTC blocked the proposal under Joe Biden’s

administration due to strict antitrust policies.

Trump Media & Technology Group (NASDAQ:DJT)

– Investors shorting Trump Media lost $420 million following a 196%

rise in shares leading up to Trump’s election victory over Kamala

Harris. Considered a “meme stock,” DJT draws loyal followers,

presenting volatility and potential for a “short squeeze,” forcing

short-sellers to cover significant losses. Early Wednesday trading

saw a 61% surge in Trump Media shares before closing up 5.94%.

Trump, holding 57% of shares, increased his stake by $231.8

million. Shares dropped 9.4% pre-market.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) and GlobalFoundries (NASDAQ:GFS) – TSMC

and GlobalFoundries are nearing final awards under the Chips and

Science Act, which aims to boost U.S. chip production. The

Department of Commerce informed Congress of progress, signaling

advancements amid concerns over potential future rollbacks. TSMC

shares rose 1.1% pre-market, while GlobalFoundries shares fell

0.4%.

Roblox (NYSE:RBLX) – Roblox announced new rules

preventing children under 13 from accessing social games and

creating certain content. Changes aim to enhance child safety

following criticism. Starting November 18, children will need

parental consent to access specific features. Shares fell 0.2%

pre-market.

Mastercard (NYSE:MA), Visa

(NYSE:V) – The European Commission is investigating whether Visa

and Mastercard’s fees harm retailers in the European Union. In

September, questionnaires were sent to retailers and payment

providers, seeking information on the impact of fees from 2016 to

2023. The probe could lead to fines of up to 10% of the companies’

global revenues, depending on the findings.

Costco Wholesale (NASDAQ:COST) – Costco

reported that hurricanes and a port strike raised sales last month,

but demand dropped in October. Sales rose 7.2% YoY, totaling $20.03

billion, with notable growth in e-commerce. However, the company

faced challenges due to impulsive buying in September.

Tesla (NASDAQ:TSLA) – A U.S. appeals court

upheld the verdict clearing Tesla and CEO Elon Musk of misleading

investors with tweets about “funding secured” to take the company

private in 2018. The 9th Circuit Court rejected shareholders’

request for a retrial, stating jury instructions were neither

confusing nor did they increase the burden of proof for investors.

Separately, Musk’s support for Donald Trump strengthens his

influence over policies favorable to his companies, such as Tesla

and SpaceX, with Musk donating $119 million to a pro-Trump group.

The presidency may reduce barriers previously hindering

advancements in autonomous technology, rockets, and brain chips.

Tesla shares closed up 14.8% on Wednesday, though Trump’s

presidency may mean less support for electric vehicles and more

distractions for Musk. Shares fell 0.6% pre-market.

Stellantis (NYSE:STLA) – Stellantis announced

cuts to approximately 1,100 employees at its Jeep Gladiator plant

in Toledo, Ohio, aiming to improve efficiency and reduce inventory.

The decision has sparked tension with the United Auto Workers

(UAW), whose president, Shawn Fain, threatened a national strike.

Stellantis argues it is complying with the union agreement, and

employees will receive a year of unemployment benefits. Shares rose

1.7% pre-market.

Boeing (NYSE:BA) – Israel’s Ministry of Defense

announced a $5.2 billion purchase of 25 Boeing F-15 fighter jets,

part of a U.S. aid package, with delivery expected by 2031.

Taiwan’s largest carrier, China Airlines, plans to split its

multi-billion-dollar long-haul jet order between Airbus and Boeing,

with a cargo jet decision still pending. The airline is evaluating

Boeing’s 777X and Airbus’ A350-1000 to replace its aging fleet and

support growth, amid Trump’s victory in the U.S., potentially

impacting Taiwan-Washington diplomatic and trade relations. Boeing

shares rose 1.1% pre-market.

Rio Tinto (NYSE:RIO) – The Trump administration

is expected to prioritize permitting to secure enough copper for

the energy transition, according to Rio Tinto, which faces

challenges in developing the Resolution mine in Arizona with

partner BHP. The project, potentially meeting a quarter of U.S.

copper demand, is stalled due to legal disputes and Native American

opposition. Shares rose 2.6% pre-market.

ArcelorMittal (NYSE:MT) – ArcelorMittal has

called for tougher trade measures against Chinese steel exports,

which are distorting the European market with low prices. CEO

Aditya Mittal expressed concern over rising imports but remains

optimistic about demand in H2 2024, anticipating inventory

restocking. Shares rose 3.3% pre-market.

Corning (NYSE:GLW) – The European Union is

investigating Corning for potential anti-competitive practices

related to its Gorilla Glass, used in mobile devices. The European

Commission is examining whether Corning distorted competition

through exclusive agreements with phone manufacturers, potentially

blocking competitors, with substantial fines possible.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland appointed former AT&T attorney David R.

McAtee II to its board following the discovery of additional

accounting errors. McAtee will oversee corporate governance amidst

ongoing Justice Department and SEC investigations. ADM will

reaffirm prior results and canceled an earnings conference call.

Shares fell 0.2% pre-market.

JPMorgan Chase (NYSE:JPM) – CEO Jamie Dimon

confirmed he will remain at the bank and does not intend to join

the Trump administration, despite recent speculation he might

become Treasury Secretary. Dimon is praised for his nearly 19-year

leadership, especially during economic crises, and JPMorgan’s board

has potential successors lined up. Shares fell 0.8% pre-market.

Blackstone (NYSE:BX), Retail

Opportunity Investments Corp (NASDAQ:ROIC) – Blackstone

Real Estate agreed to acquire Retail Opportunity Investments Corp

(ROIC) for around $4 billion, including debt. The offer of $17.50

per share represents a 5.5% premium. ROIC, which owns over 90

supermarket-anchored shopping centers, benefited from rising rents

and inflation. The deal is set to close in Q1 2025. Additionally,

Blackstone plans to refinance $3.6 billion in junior debt for its

acquisition of AirTrunk Pte. Ltd., its largest investment in the

Asia-Pacific region. The new funds will support the data center

operator’s expansion in the area.

StoneX Group (NASDAQ:SNEX) – StoneX Group,

which owns brands like FOREX.com, announced it will not pursue an

offer for CAB Payments after its nearly $500 million acquisition

proposal. CAB Payments remains confident in its strategy and

assessed the offer of 145 pence per share.

CVS Health (NYSE:CVS) – CVS Health appointed

Steve Nelson to lead Aetna after rising medical costs and declining

profits. Facing investor pressure, the company replaced CEO Karen

Lynch with David Joyner and announced a $1.2 billion restructuring

plan, including closing stores and business lines. Shares rose 0.1%

pre-market.

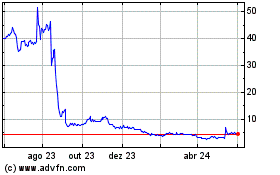

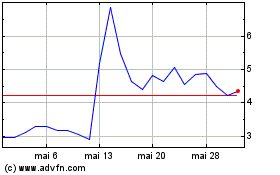

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024