TFS Financial Corporation (NASDAQ: TFSL) (the "Company"), the

holding company for Third Federal Savings and Loan Association of

Cleveland (the "Association"), today announced results for the

quarter and fiscal year ended September 30, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231026462702/en/

Chairman and CEO Marc A. Stefanski

(Photo: Business Wire)

“While increases in interest rates have been a challenge during

the last two quarters, we are well-positioned for rate

uncertainties in our industry,” said Chairman and CEO Marc A

Stefanski. “We have seen modest growth in our loan portfolio, as

well as increases in deposits each quarter during our fiscal year.

Our Tier 1 capital ratio remains strong at 11 percent – more than

double the regulatory requirement. Like we have been for the past

85 years, we remain strong, stable and safe.”

Highlights - Fourth Quarter Fiscal 2023

- Reported net income of $19.5 million

- Added $540 million of new residential mortgage loans with an

average yield of 6.32%

- Increased total deposits by $381 million

- Paid a $0.2825 dividend per share

The Company reported net income of $19.5 million for the quarter

ended September 30, 2023, an increase of $1.9 million from $17.6

million for the quarter ended June 30, 2023. Results improved

quarter over quarter primarily due to an increase in net interest

income and a decrease in non-interest expenses.

Net interest income increased $1.6 million to $70.4 million for

the quarter ended September 30, 2023 from $68.8 million for the

quarter ended June 30, 2023. The increase was primarily the result

of an increase in the average balance and yield on loans, partially

offset by an increase in the cost of funding. The interest rate

spread was 1.46% for the quarter ended September 30, 2023 compared

to 1.50% for the quarter ended June 30, 2023. The net interest

margin was 1.74% for the quarter ended September 30, 2023 compared

to 1.75% for the prior quarter.

During the quarter ended September 30, 2023, there was a $0.5

million provision for credit losses compared to no provision for

the quarter ended June 30, 2023. The total allowance for credit

losses increased $2.2 million, to $104.8 million, or 0.69% of total

loans receivable, primarily due to growth in the home equity loans

and lines of credit portfolios. There was $1.8 million in net loan

recoveries during the quarter ended September 30, 2023.

Total non-interest expense decreased $1.4 million to $51.5

million for the quarter ended September 30, 2023, from $52.9

million for the quarter ended June 30, 2023. The decrease consisted

mainly of a $3.1 million decrease in marketing costs and a $1.3

million decrease in other operating expenses, partially offset by a

$3.4 million increase in salaries and employee benefits. The

decrease in other operating expenses was mainly due to a combined

decrease in third party loan origination costs and expenses for

public relations and events related to the Association's 85th

anniversary celebrations. Salaries and employee benefits returned

to a normalized level after a one-time adjustment to incentive

accruals during the previous quarter.

Total assets increased by $322.7 million, or 2%, to $16.92

billion at September 30, 2023 from $16.59 billion at June 30, 2023.

The increase was mainly the result of new loan originations

exceeding the total of loan sales and principal repayments.

Loans held for investment, net of allowance and deferred loan

expenses, increased $282.1 million, or 2%, to $15.17 billion at

September 30, 2023 from $14.88 billion at June 30, 2023.

Compared to June 30, 2023, deposits increased by $380.7 million

to $9.45 billion at September 30, 2023, consisting of a $562.7

million increase in certificates of deposit and a $187.7 million

decrease in savings and checking accounts combined.

Borrowed funds decreased $178.6 million to $5.27 billion at

September 30, 2023 from $5.45 billion at June 30, 2023.

Highlights - Fiscal Year 2023

- Reported net income of $75.3 million

- Added $1.86 billion of new residential mortgage loans with

weighted average yield of 5.55%

- Grew net interest income by 6% compared to fiscal year

2022

- Remained well capitalized, with a Tier 1 leverage ratio of

10.96%

- Paid a $1.13 dividend per share

The Company reported net income of $75.3 million for the fiscal

year ended September 30, 2023 compared to net income of $74.6

million for the fiscal year ended September 30, 2022. The $0.7

million increase was mainly due to an increase in net interest

income offset by an increase in non-interest expenses.

Net interest income increased by $16.2 million, or 6.0%, to

$283.6 million for the fiscal year ended September 30, 2023,

compared to $267.4 million for the fiscal year ended September 30,

2022, driven by loan growth and a higher interest rate environment

for all categories of interest-earning assets. The weighted average

cost of funding also increased, resulting in an 18 basis point

decrease in the interest rate spread, to 1.57% for the fiscal year

ended September 30, 2023 from 1.75% for the fiscal year ended

September 30, 2022. The net interest margin was 1.80% for the

fiscal year ended September 30, 2023 compared to 1.88% for the

prior year period.

During the fiscal year ended September 30, 2023, there was a

$1.5 million release of provision for credit losses compared to

$1.0 million of provision expense for the fiscal year ended

September 30, 2022. Net loan recoveries totaled $6.4 million during

the fiscal year ended September 30, 2023 and $9.7 million during

the prior year. The total allowance for credit losses at September

30, 2023 was $104.8 million, or 0.69% of total loans receivable,

compared to $99.9 million, or 0.70% of total loans receivable, at

September 30, 2022. The allowance for credit losses included $27.5

million and $27.0 million in liabilities for unfunded commitments

at September 30, 2023 and September 30, 2022, respectively.

Total loan delinquencies increased $2.2 million to $23.4

million, or 0.15% of total loans receivable, at September 30, 2023

from $21.2 million, or 0.15% of total loans receivable, at

September 30, 2022. Non-accrual loans decreased $3.7 million to

$31.9 million, or 0.21% of total loans receivable, at September 30,

2023 from $35.6 million, or 0.25% of total loans receivable, at

September 30, 2022.

Total non-interest income decreased $2.4 million, or 10.1%, to

$21.4 million for the fiscal year ended September 30, 2023 from

$23.8 million for the fiscal year ended September 30, 2022. The

decrease consisted mainly of a $2.1 million decrease in loan fees

and service charges and a $0.6 million decrease in each of net gain

on the sale of loans and income and death benefits from life

insurance contracts. The decrease in fees and service charges was

primarily due to a decrease in income from title company

partnerships related to a slowing in refinance activity.

Total non-interest expenses increased $15.0 million, or 7.6%, to

$213.1 million for the fiscal year ended September 30, 2023, from

$198.1 million for the fiscal year ended September 30, 2022 and

included increases of $3.5 million in salaries and employee

benefits, $4.0 million in marketing costs, $0.9 million in office

property, equipment and software expenses, $4.1 million in federal

("FDIC") insurance premiums and assessments and $2.5 million in

other operating expenses. The increase in other operating expenses

was mainly due to public relations and event costs for the

Association's 85th anniversary celebration during fiscal 2023 and

an increase in pension expense related to net actuarial gains and

losses that are reassessed annually. FDIC premiums increased due to

growth in deposits and a two basis point increase in FDIC

assessment rates that went into effect on January 1, 2023.

Total assets increased by $1.13 billion, or 7%, to $16.92

billion at September 30, 2023 from $15.79 billion at September 30,

2022. The increase was mainly the result of new loan originations

exceeding the total of loan sales and principal repayments, along

with increases in cash and cash equivalents and investment

securities available for sale.

Cash and cash equivalents increased $97.1 million, or 26%, to

$466.7 million at September 30, 2023 from $369.6 million at

September 30, 2022 due to normal fluctuations and liquidity

management.

Investment securities available for sale increased $50.4

million, or 11%, to $508.3 million at September 30, 2023 from

$457.9 million at September 30, 2022. During the year, $59.5

million of U.S. Treasury notes were purchased and pledged as

collateral for initial margin requirements on swap contracts. The

increase was partially offset by $9.7 million of additional

unrealized losses on the investment securities portfolio.

Loans held for investment, net of allowance and deferred loan

expenses, increased $908.7 million, or 6%, to $15.17 billion at

September 30, 2023 from $14.26 billion at September 30, 2022. The

residential mortgage loan portfolio increased $538.3 million, to

$12.08 billion, and home equity loans and lines of credit increased

$396.6 million, to $3.03 billion. Loan originations and purchases

during the fiscal year ended September 30, 2023 included $1.86

billion of residential mortgage loans and $1.70 billion of equity

loans and lines of credit compared to $3.65 billion of residential

mortgage loans and $2.16 billion of equity loans and lines of

credit originated or purchased during the fiscal year ended

September 30, 2022. The decrease in loan originations was primarily

due to a generally increasing interest rate environment, resulting

in minimal refinance activity. New mortgage loans included 89%

purchases and 34% adjustable rate loans during the fiscal year

ended September 30, 2023.

Deposits increased $528.8 million, or 6%, to $9.45 billion at

September 30, 2023 from $8.92 billion at September 30, 2022. The

increase was the result of a $786.7 million increase in

certificates of deposit ("CDs") and a $95.4 million increase in

savings accounts, partially offset by a $134.8 million decrease in

money market deposit accounts and a $226.6 million decrease in

checking accounts. There were $1.16 billion in brokered deposits at

September 30, 2023 compared to $575.2 million at September 30,

2022. At September 30, 2023, brokered deposits included $665.0

million of three-month certificates of deposit accounts aligned

with pay-fixed interest rate swap contracts, with a remaining

weighted average effective maturity of approximately 4.1 years.

Borrowed funds increased $480.4 million, or 10%, to $5.27

billion at September 30, 2023 from $4.79 billion at September 30,

2022. The increase was primarily used to fund loan growth. The

total balance of borrowed funds at September 30, 2023, all from the

FHLB, included $592.0 million of overnight advances, $1.51 billion

of term advances with a weighted average maturity of approximately

2.1 years, and $3.15 billion of term advances, aligned with

interest rate swap contracts, with a remaining weighted average

effective maturity of approximately 3.7 years. Additional borrowing

capacity at the FHLB was $1.38 billion at September 30, 2023.

Total shareholders' equity increased $83.0 million, or 4.5%, to

$1.93 billion at September 30, 2023 from $1.84 billion at September

30, 2022. Activity reflects $75.3 million of net income and a $62.1

million net increase in accumulated other comprehensive income,

reduced by $58.3 million for dividends paid and $5.0 million in

repurchases of common stock. Additionally, there was $9.0 million

of net positive adjustments related to our stock compensation and

employee stock ownership plans. The change in accumulated other

comprehensive income is primarily due to a net positive change in

unrealized gains and losses on swap contracts. During the fiscal

year ended September 30, 2023, a total of 361,869 shares of our

common stock were repurchased at an average cost of $13.82 per

share. The Company's eighth stock repurchase program allows for a

total of 10,000,000 shares to be repurchased, with 5,191,951 shares

remaining to be repurchased at September 30, 2023.

The Company declared and paid a quarterly dividend of $0.2825

per share during each of the quarters of fiscal year 2023. As a

result of a mutual member vote, Third Federal Savings and Loan

Association of Cleveland, MHC (the "MHC"), the mutual holding

company that owns approximately 81% of the outstanding stock of the

Company, was able to waive its receipt of its share of the dividend

paid. Under Federal Reserve regulations, the MHC is required to

obtain the approval of its members every 12 months for the MHC to

waive its right to receive dividends. As a result of a July 11,

2023 member vote and the subsequent non-objection of the Federal

Reserve, the MHC has the approval to waive receipt of up to $1.13

per share of possible dividends to be declared on the Company’s

common stock during the twelve months subsequent to the members’

approval (i.e., through July 11, 2024), including a total of up to

$0.8475 remaining. The MHC has conducted the member vote to approve

the dividend waiver each of the past ten years under Federal

Reserve regulations and for each of those ten years, approximately

97% of the votes cast were in favor of the waiver.

The Company operates under the capital requirements for the

standardized approach of the Basel III capital framework for U.S.

banking organizations (“Basel III Rules”). At September 30, 2023

all of the Company's capital ratios substantially exceed the

amounts required for the Company to be considered "well

capitalized" for regulatory capital purposes. The Company's Tier 1

leverage ratio was 10.96%, its Common Equity Tier 1 and Tier 1

ratios were each 19.13% and its total capital ratio was 19.85%.

On October 26, 2023, the Board of Directors of TFS Financial

Corporation approved certain leadership changes to be effective as

of January 1, 2024. The Board appointed Timothy W. Mulhern, who

currently serves as the Company’s Chief Financial Officer, to the

roles of Chief Innovation Officer of Third Federal Savings and Loan

and Vice President of the Company. Additionally, the Board

appointed Meredith S. Weil as the Company’s Chief Financial

Officer. Ms. Weil currently serves as the Chief Operating Officer

and Secretary of the Company and as Chief Operating Officer of the

Association. She will continue to serve as the Company’s Secretary.

Effective with these changes, Ms. Weil and other key officers of

the respective entities will absorb responsibilities formerly

performed by the Chief Operating Officer.

“I am very pleased to announce these changes that strengthen the

capacity of our executive team to confront current economic

challenges,” said Mr. Stefanski. “The diverse backgrounds and

business acumen of Ms. Weil and Mr. Mulhern have prepared them well

to serve in these new roles.”

Ms. Weil, age 57, has served as the Company’s Chief Operating

Officer since 2018. Ms. Weil joined Third Federal Savings and Loan

in 1999 and has served as Chief Operating Officer of the

Association since 2012. Ms. Weil has served on the Company’s Board

of Directors since 2014 and has been the Company’s Secretary since

2021. She has worked in the banking industry since 1992.

Mr. Mulhern, age 57, was named the Chief Financial Officer of

the Company in January 2022. Mr. Mulhern joined Third Federal

Savings and Loan in 2003 and has held several key roles in

management including IT and Servicing. He was named the Chief

Credit Officer in August 2018 and Director of Internal Audit in

June 2019.

Presentation slides as of September 30, 2023 will be available

on the Company's website, www.thirdfederal.com, under the Investor

Relations link within the "Recent Presentations" menu, beginning

October 27, 2023. The Company will not be hosting a conference call

to discuss its operating results.

Third Federal Savings and Loan Association is a leading provider

of savings and mortgage products, and operates under the values of

love, trust, respect, a commitment to excellence and fun. Founded

in Cleveland in 1938 as a mutual association by Ben and Gerome

Stefanski, Third Federal’s mission is to help people achieve the

dream of home ownership and financial security. It became part of a

public company in 2007 and celebrated its 85th anniversary in May

2023. Third Federal, which lends in 25 states and the District of

Columbia, is dedicated to serving consumers with competitive rates

and outstanding service. Third Federal, an equal housing lender,

has 21 full service branches in Northeast Ohio, four lending

offices in Central and Southern Ohio, and 16 full service branches

throughout Florida. As of September 30, 2023, the Company’s assets

totaled $16.92 billion.

Forward Looking Statements

This report contains

forward-looking statements, which can be identified by the use of

such words as estimate, project, believe, intend, anticipate, plan,

seek, expect and similar expressions. These forward-looking

statements include, among other things:

- statements of our goals,

intentions and expectations;

- statements regarding our

business plans and prospects and growth and operating

strategies;

- statements concerning trends in

our provision for credit losses and charge-offs on loans and

off-balance sheet exposures;

- statements regarding the trends

in factors affecting our financial condition and results of

operations, including credit quality of our loan and investment

portfolios; and

- estimates of our risks and

future costs and benefits.

These forward-looking statements

are subject to significant risks, assumptions and uncertainties,

including, among other things, the following important factors that

could affect the actual outcome of future events:

- significantly increased

competition among depository and other financial institutions,

including with respect to our ability to charge overdraft

fees;

- inflation and changes in the

interest rate environment that reduce our interest margins or

reduce the fair value of financial instruments, or our ability to

originate loans;

- general economic conditions,

either globally, nationally or in our market areas, including

employment prospects, real estate values and conditions that are

worse than expected;

- the strength or weakness of the

real estate markets and of the consumer and commercial credit

sectors and its impact on the credit quality of our loans and other

assets, and changes in estimates of the allowance for credit

losses;

- decreased demand for our

products and services and lower revenue and earnings because of a

recession or other events;

- changes in consumer spending,

borrowing and savings habits;

- adverse changes and volatility

in the securities markets, credit markets or real estate

markets;

- our ability to manage market

risk, credit risk, liquidity risk, reputational risk, regulatory

risk and compliance risk;

- our ability to access

cost-effective funding;

- changes in liquidity, including

the size and composition of our deposit portfolio and the

percentage of uninsured deposits in the portfolio;

- legislative or regulatory

changes that adversely affect our business, including changes in

regulatory costs and capital requirements and changes related to

our ability to pay dividends and the ability of Third Federal

Savings, MHC to waive dividends;

- changes in accounting policies

and practices, as may be adopted by the bank regulatory agencies,

the Financial Accounting Standards Board or the Public Company

Accounting Oversight Board;

- the adoption of implementing

regulations by a number of different regulatory bodies, and

uncertainty in the exact nature, extent and timing of such

regulations and the impact they will have on us;

- our ability to enter new markets

successfully and take advantage of growth opportunities;

- our ability to retain key

employees;

- future adverse developments

concerning Fannie Mae or Freddie Mac;

- changes in monetary and fiscal

policy of the U.S. Government, including policies of the U.S.

Treasury, the Federal Reserve System, Fannie Mae, the OCC, FDIC,

and others;

- the continuing governmental

efforts to restructure the U.S. financial and regulatory

system;

- the ability of the U.S.

Government to remain open, function properly and manage federal

debt limits;

- changes in policy and/or

assessment rates of taxing authorities that adversely affect us or

our customers;

- changes in accounting and tax

estimates;

- changes in our organization and

changes in expense trends, including but not limited to trends

affecting non-performing assets, charge-offs and provisions for

credit losses;

- the inability of third-party

providers to perform their obligations to us;

- our ability to retain key

employees;

- cyber-attacks, computer viruses

and other technological risks that may breach the security of our

websites or other systems to obtain unauthorized access to

confidential information, destroy data or disable our systems;

and

- the impact of wide-spread

pandemic, including COVID-19, and related government action, on our

business and the economy.

Because of these and other

uncertainties, our actual future results may be materially

different from the results indicated by any forward-looking

statements. Any forward-looking statement made by us in this report

speaks only as of the date on which it is made. We undertake no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise, except as may be required by law.

TFS FINANCIAL CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CONDITION

(unaudited)

(In thousands, except share

data)

September 30,

2023

June 30, 2023

September 30,

2022

ASSETS

Cash and due from banks

$

29,134

$

23,278

$

18,961

Other interest-earning cash

equivalents

437,612

412,937

350,603

Cash and cash equivalents

466,746

436,215

369,564

Investment securities available for

sale

508,324

513,303

457,908

Mortgage loans held for sale

3,260

595

9,661

Loans held for investment, net:

Mortgage loans

15,177,844

14,897,681

14,276,478

Other loans

4,411

4,022

3,263

Deferred loan expenses, net

60,807

56,780

50,221

Allowance for credit losses on loans

(77,315

)

(74,803

)

(72,895

)

Loans, net

15,165,747

14,883,680

14,257,067

Mortgage loan servicing rights, net

7,400

7,545

7,943

Federal Home Loan Bank stock, at cost

247,098

247,098

212,290

Real estate owned, net

1,444

1,400

1,191

Premises, equipment, and software, net

34,708

34,901

34,531

Accrued interest receivable

53,910

49,837

40,256

Bank owned life insurance contracts

312,072

310,498

304,040

Other assets

117,017

109,916

95,428

TOTAL ASSETS

$

16,917,726

$

16,594,988

$

15,789,879

LIABILITIES AND SHAREHOLDERS’

EQUITY

Deposits

$

9,449,820

$

9,069,069

$

8,921,017

Borrowed funds

5,273,637

5,452,228

4,793,221

Borrowers’ advances for insurance and

taxes

124,417

74,359

117,250

Principal, interest, and related escrow

owed on loans serviced

29,811

16,510

29,913

Accrued expenses and other liabilities

112,680

96,698

84,139

Total liabilities

14,990,365

14,708,864

13,945,540

Commitments and contingent liabilities

Preferred stock, $0.01 par value,

100,000,000 shares authorized, none issued and outstanding

—

—

—

Common stock, $0.01 par value, 700,000,000

shares authorized; 332,318,750 shares issued

3,323

3,323

3,323

Paid-in capital

1,755,027

1,753,801

1,751,223

Treasury stock, at cost

(776,101

)

(775,852

)

(771,986

)

Unallocated ESOP shares

(27,084

)

(28,167

)

(31,417

)

Retained earnings—substantially

restricted

886,984

882,034

870,047

Accumulated other comprehensive income

85,212

50,985

23,149

Total shareholders’ equity

1,927,361

1,886,124

1,844,339

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

16,917,726

$

16,594,988

$

15,789,879

TFS FINANCIAL CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(In thousands, except share and per

share data)

For the three months

ended

September 30,

2023

June 30, 2023

March 31, 2023

December 31,

2022

September 30,

2022

INTEREST AND DIVIDEND INCOME:

Loans, including fees

$

154,763

$

144,347

$

136,835

$

129,665

$

114,871

Investment securities available for

sale

4,141

3,712

3,455

3,062

1,904

Other interest and dividend earning

assets

9,836

8,598

7,262

6,243

4,236

Total interest and dividend income

168,740

156,657

147,552

138,970

121,011

INTEREST EXPENSE:

Deposits

55,565

48,905

39,876

29,855

23,582

Borrowed funds

42,812

38,973

38,408

33,958

21,920

Total interest expense

98,377

87,878

78,284

63,813

45,502

NET INTEREST INCOME

70,363

68,779

69,268

75,157

75,509

PROVISION (RELEASE) FOR CREDIT LOSSES

500

—

(1,000

)

(1,000

)

—

NET INTEREST INCOME AFTER PROVISION FOR

CREDIT LOSSES

69,863

68,779

70,268

76,157

75,509

NON-INTEREST INCOME:

Fees and service charges, net of

amortization

2,061

1,919

1,924

1,936

2,220

Net gain (loss) on the sale of loans

(119

)

21

579

17

(1,113

)

Increase in and death benefits from bank

owned life insurance contracts

2,204

2,790

2,123

2,238

2,761

Other

954

1,113

703

966

514

Total non-interest income

5,100

5,843

5,329

5,157

4,382

NON-INTEREST EXPENSE:

Salaries and employee benefits

28,660

25,332

30,390

28,403

27,206

Marketing services

3,881

7,023

6,671

7,713

4,256

Office property, equipment and

software

6,886

7,246

6,802

6,800

6,558

Federal insurance premium and

assessments

3,629

3,574

3,488

2,761

2,722

State franchise tax

1,185

1,230

1,268

1,208

1,201

Other expenses

7,243

8,472

6,955

6,309

6,799

Total non-interest expense

51,484

52,877

55,574

53,194

48,742

INCOME BEFORE INCOME TAXES

23,479

21,745

20,023

28,120

31,149

INCOME TAX EXPENSE

3,933

4,142

4,115

5,927

5,716

NET INCOME

$

19,546

$

17,603

$

15,908

$

22,193

$

25,433

Earnings per share - basic and diluted

$

0.07

$

0.06

$

0.06

$

0.08

$

0.06

Weighted average shares outstanding

Basic

277,589,775

277,472,312

277,361,293

277,320,904

277,383,038

Diluted

278,826,441

278,590,810

278,499,145

278,462,937

278,505,233

TFS FINANCIAL CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(In thousands, except share and per

share data)

For the Year Ended

September 30,

2023

2022

INTEREST AND DIVIDEND INCOME:

Loans, including fees

$

565,610

$

395,691

Investment securities available for

sale

14,370

5,501

Other interest and dividend earning

assets

31,939

8,141

Total interest and dividend income

611,919

409,333

INTEREST EXPENSE:

Deposits

174,201

76,943

Borrowed funds

154,151

64,994

Total interest expense

328,352

141,937

NET INTEREST INCOME

283,567

267,396

PROVISION (RELEASE) FOR CREDIT LOSSES

(1,500

)

1,000

NET INTEREST INCOME AFTER PROVISION FOR

CREDIT LOSSES

285,067

266,396

NON-INTEREST INCOME:

Fees and service charges, net of

amortization

7,840

9,934

Net gain on the sale of loans

498

1,136

Increase in and death benefits from bank

owned life insurance contracts

9,355

9,984

Other

3,736

2,750

Total non-interest income

21,429

23,804

NON-INTEREST EXPENSE:

Salaries and employee benefits

112,785

109,339

Marketing services

25,288

21,263

Office property, equipment and

software

27,734

26,783

Federal insurance premium and

assessments

13,452

9,361

State franchise tax

4,891

4,859

Other expenses

28,979

26,541

Total non-interest expense

213,129

198,146

INCOME BEFORE INCOME TAXES

93,367

92,054

INCOME TAX EXPENSE

18,117

17,489

NET INCOME

$

75,250

$

74,565

Earnings per share

Basic

$

0.27

$

0.26

Diluted

$

0.26

$

0.26

Weighted average shares outstanding

Basic

277,436,382

277,370,762

Diluted

278,583,454

278,686,365

TFS FINANCIAL CORPORATION AND

SUBSIDIARIES

AVERAGE BALANCES AND YIELDS

(unaudited)

Three Months Ended

Three Months Ended

Three Months Ended

September 30, 2023

June 30, 2023

September 30, 2022

Average Balance

Interest Income/

Expense

Yield/ Cost (1)

Average Balance

Interest Income/

Expense

Yield/ Cost (1)

Average Balance

Interest Income/

Expense

Yield/ Cost (1)

(Dollars in thousands)

Interest-earning assets:

Interest-earning cash equivalents

$

370,577

$

5,149

5.56

%

$

350,574

$

4,481

5.11

%

$

370,138

$

2,118

2.29

%

Investment securities

63,231

781

4.94

%

24,046

320

5.32

%

3,758

11

1.17

%

Mortgage-backed securities

449,351

3,360

2.99

%

470,457

3,392

2.88

%

458,734

1,893

1.65

%

Loans (2)

15,037,776

154,763

4.12

%

14,676,829

144,347

3.93

%

14,108,190

114,871

3.26

%

Federal Home Loan Bank stock

247,098

4,687

7.59

%

235,177

4,117

7.00

%

198,306

2,118

4.27

%

Total interest-earning assets

16,168,033

168,740

4.17

%

15,757,083

156,657

3.98

%

15,139,126

121,011

3.20

%

Noninterest-earning assets

503,865

543,310

474,634

Total assets

$

16,671,898

$

16,300,393

$

15,613,760

Interest-bearing liabilities:

Checking accounts

$

993,952

125

0.05

%

$

1,064,738

1,317

0.49

%

$

1,387,365

2,670

0.77

%

Savings accounts

1,869,756

7,864

1.68

%

1,890,427

8,087

1.71

%

1,852,614

2,580

0.56

%

Certificates of deposit

6,369,734

47,576

2.99

%

6,042,798

39,501

2.61

%

5,861,011

18,332

1.25

%

Borrowed funds

5,294,285

42,812

3.23

%

5,175,982

38,973

3.01

%

4,453,039

21,920

1.97

%

Total interest-bearing liabilities

14,527,727

98,377

2.71

%

14,173,945

87,878

2.48

%

13,554,029

45,502

1.34

%

Noninterest-bearing liabilities

226,083

264,952

220,129

Total liabilities

14,753,810

14,438,897

13,774,158

Shareholders’ equity

1,918,088

1,861,496

1,839,602

Total liabilities and shareholders’

equity

$

16,671,898

$

16,300,393

$

15,613,760

Net interest income

$

70,363

$

68,779

$

75,509

Interest rate spread (1)(3)

1.46

%

1.50

%

1.86

%

Net interest-earning assets (4)

$

1,640,306

$

1,583,138

$

1,585,097

Net interest margin (1)(5)

1.74

%

1.75

%

2.00

%

Average interest-earning assets to average

interest-bearing liabilities

111.29

%

111.17

%

111.69

%

Selected performance ratios:

Return on average assets (1)

0.47

%

0.43

%

0.65

%

Return on average equity (1)

4.08

%

3.78

%

5.53

%

Average equity to average assets

11.50

%

11.42

%

11.78

%

(1)

Annualized.

(2)

Loans include both mortgage loans held for

sale and loans held for investment.

(3)

Interest rate spread represents the

difference between the yield on average interest-earning assets and

the cost of average interest-bearing liabilities.

(4)

Net interest-earning assets represent

total interest-earning assets less total interest-bearing

liabilities.

(5)

Net interest margin represents net

interest income divided by total interest-earning assets.

TFS FINANCIAL CORPORATION AND

SUBSIDIARIES

AVERAGE BALANCES AND YIELDS

(unaudited)

Year Ended

Year Ended

September 30, 2023

September 30, 2022

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Average

Balance

Interest

Income/

Expense

Yield/

Cost

(Dollars in thousands)

Interest-earning assets:

Interest-earning cash equivalents

$

356,450

$

16,826

4.72

%

$

384,947

$

3,178

0.83

%

Investment securities

23,636

1,123

4.75

%

3,643

43

1.18

%

Mortgage-backed securities

464,919

13,247

2.85

%

439,269

5,458

1.24

%

Loans (1)

14,657,265

565,610

3.86

%

13,258,517

395,691

2.98

%

Federal Home Loan Bank stock

233,013

15,113

6.49

%

173,506

4,963

2.86

%

Total interest-earning assets

15,735,283

611,919

3.89

%

14,259,882

409,333

2.87

%

Noninterest-earning assets

515,123

482,501

Total assets

$

16,250,406

$

14,742,383

Interest-bearing liabilities:

Checking accounts

$

1,093,036

6,081

0.56

%

$

1,326,882

4,186

0.32

%

Savings accounts

1,798,663

24,686

1.37

%

1,859,990

4,553

0.24

%

Certificates of deposit

6,123,979

143,434

2.34

%

5,826,286

68,204

1.17

%

Borrowed funds

5,114,045

154,151

3.01

%

3,671,323

64,994

1.77

%

Total interest-bearing liabilities

14,129,723

328,352

2.32

%

12,684,481

141,937

1.12

%

Noninterest-bearing liabilities

239,387

255,388

Total liabilities

14,369,110

12,939,869

Shareholders’ equity

1,881,296

1,802,514

Total liabilities and shareholders’

equity

$

16,250,406

$

14,742,383

Net interest income

$

283,567

$

267,396

Interest rate spread (2)

1.57

%

1.75

%

Net interest-earning assets (3)

$

1,605,560

$

1,575,401

Net interest margin (4)

1.80

%

1.88

%

Average interest-earning assets to average

interest-bearing liabilities

111.36

%

112.42

%

Selected performance ratios:

Return on average assets

0.46

%

0.51

%

Return on average equity

4.00

%

4.14

%

Average equity to average assets

11.58

%

12.23

%

(1)

Loans include both mortgage loans held for

sale and loans held for investment.

(2)

Interest rate spread represents the

difference between the yield on average interest-earning assets and

the cost of average interest-bearing liabilities.

(3)

Net interest-earning assets represent

total interest-earning assets less total interest-bearing

liabilities.

(4)

Net interest margin represents net

interest income divided by total interest-earning assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026462702/en/

TFS Financial Corporation Jennifer Rosa (216) 429-5037

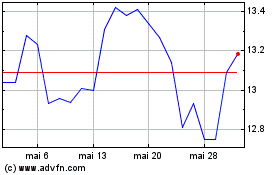

TFS Financial (NASDAQ:TFSL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

TFS Financial (NASDAQ:TFSL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025