Third Federal Savings and Loan Association of Cleveland, MHC Receives Non-Objection for Dividend Waiver

09 Agosto 2024 - 5:36PM

Business Wire

Third Federal Savings and Loan Association of Cleveland, MHC

(the “MHC”) is pleased to announce that it received the

non-objection of the Federal Reserve Bank of Cleveland to waive

receipt of dividends on the shares of stock it owns of TFS

Financial Corporation (NASDAQ: TFSL) (the “Company”), up to $1.13

per share during the 12 months ending July 9, 2025. Actual

dividends during that period are declared at the discretion of the

Company’s board of directors.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240809722180/en/

Chairman and CEO Marc A. Stefanski

(Photo: Business Wire)

“We appreciate the ongoing support of our members for the MHC

dividend waiver and are pleased to announce the non-objection from

the Federal Reserve,” said Chairman and CEO Marc A. Stefanski. “The

result will allow us the opportunity to maximize the capability to

offer dividends to our institutional and individual shareholders.

This, along with a focus on capital preservation, and a proactive

approach to our business, keeps us strong, stable, and safe.”

The MHC is the mutual holding company and owner of 227,119,132

shares, or 80.9% of the Company’s common stock outstanding, and on

July 9, 2024 received the approval of its members (mainly

depositors of Third Federal) with respect to the waiver. The

members approved the waiver by casting 58% of the eligible votes,

with 97% of the votes cast in favor of the waiver. The MHC

previously waived the receipt of dividends paid by the Company in

an aggregate amount of $1.13 per share during the four quarters

ended June 30, 2024.

Third Federal Savings and Loan Association is a leading provider

of savings and mortgage products, and operates under the values of

love, trust, respect, a commitment to excellence and fun. Founded

in Cleveland in 1938 as a mutual association by Ben and Gerome

Stefanski, Third Federal’s mission is to help people achieve the

dream of home ownership and financial security. It became part of a

public company in 2007 and celebrated its 85th anniversary in May,

2023. Third Federal, which lends in 26 states and the District of

Columbia, is dedicated to serving consumers with competitive rates

and outstanding service. Third Federal, an equal housing lender,

has 21 full service branches in Northeast Ohio, two lending offices

in Central and Southern Ohio, and 16 full service branches

throughout Florida. As of June 30, 2024, the Company’s assets

totaled $17.03 billion.

This news release contains forward-looking statements as defined

in the Securities Exchange Act of 1934 and is subject to the safe

harbors created therein. The forward-looking statements contained

herein include, but are not limited to, the Company’s plans

regarding its dividends. These forward-looking statements involve

risks and uncertainties that could cause the Company’s results to

differ materially from management’s current expectations.

The Company’s risks and uncertainties are detailed in its

filings with the Securities and Exchange Commission, including our

Annual Report on Form 10-K for the fiscal year ended September 30,

2023. Forward-looking statements are based on the beliefs and

assumptions of our management and on currently available

information. The Company undertakes no responsibility to publicly

update or revise any forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240809722180/en/

Jennifer Rosa (216) 429-5037

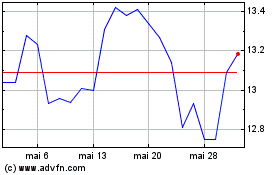

TFS Financial (NASDAQ:TFSL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

TFS Financial (NASDAQ:TFSL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025