Transaction Expands Ares Real Estate

Capabilities and Reach in Key Industrial Market

Ares Real Estate to Further Capitalize on

Long-Term Structural Tailwinds as One of the Largest Vertically

Integrated Industrial Platforms Across North America

Ares Management Corporation (NYSE: ARES) (“Ares”) announced

today that one of its subsidiaries has entered into a definitive

agreement to acquire 100% of Walton Street Capital Mexico S. de

R.L. de C.V. and certain of its affiliates (“Walton Street

Mexico”), a leading real estate asset management platform focused

primarily on the industrial sector with US$2.1 billion in assets

under management as of June 30, 2024, from Walton Street Capital,

L.L.C. (“Walton Street”).

Led by Federico Martin del Campo, Managing Partner and CEO, the

Walton Street Mexico team consists of over 15 investment

professionals that have transacted in industrial and other major

real estate sectors in Mexico for over 20 years. During this time,

the team has established itself as a leader in industrial real

estate in Mexico. Since 2010, affiliates of Walton Street Mexico

have invested across key markets through the acquisition and

development of more than 51 million square feet of industrial real

estate in over 250 separate properties and have attracted tenants

in the country’s largest industrial sectors.

Ares Real Estate has thoughtfully grown its platform over time

with a focus on expanding in key geographies and sectors that are

positioned to benefit from attractive long-term structural

tailwinds. Throughout this time, the team has maintained high

conviction in the industrial real estate sector, establishing a

total industrial portfolio of $28.1 billion and over 230 million

square feet across the U.S. and Europe, as of June 30, 2024.

Following the transaction, Ares Real Estate will leverage the

Walton Street Mexico team’s two decades of experience and local

networks as it seeks to continue to grow its industrial footprint

globally. The Walton Street Mexico team will gain the advantage of

being part of Ares’ global Real Estate team, which oversees $52

billion in assets under management and has more than 270 investment

professionals with leading capabilities across debt and equity

strategies, major real estate sectors and geographies.

“We are excited to announce this transaction and believe that

the Walton Street Mexico team will bring great insights to Ares as

we continue to grow our leading global industrial real estate

platform,” said Michael Arougheti, Chief Executive Officer and

President of Ares. “We believe that Federico and the team are

aligned with our values and will provide a distinctive edge to the

Ares Real Estate team. We are seeing a meaningful shift in supply

chain dynamics globally with Mexico emerging as an attractive

location for skilled manufacturing and we believe that these trends

will continue to increase demand for warehouse space in the

country.”

“On behalf of the broader Ares Real Estate team, we want to

welcome Federico and the Walton Street Mexico team to Ares,” said

David Roth, Co-Head of Ares U.S. Real Estate. “We have

strategically grown our industrial real estate platform over the

last few years with partnership from Dave Fazekas, Head of Ares

Industrial Management, and the team, and believe that adding

additional capability in Mexico is an important step to enhance our

global offering. We believe that we are entering Mexico at an

opportune time to capitalize on continued growth and outperformance

of the industrial real estate sector in North America.”

“Walton Street is proud to have led the development of Walton

Street Mexico into one of the preeminent private equity real estate

managers in Mexico,” said Jeff Quicksilver, Co-Founder and Managing

Partner of Walton Street Capital. “The strategic timing of the sale

allows our team to continue its focus on the growth of our U.S.

real estate equity and debt investment platforms.”

“We are excited to be joining Ares, which is well recognized as

a leading global alternative investment manager, and owner and

operator of real estate,” said Mr. Martin del Campo. “We believe

there are cultural and skill set synergies between our two teams,

which will support our ability to execute on our strategic growth

objectives in Mexico. We look forward to working alongside Ares’

global real estate team in addressing an attractive industrial

investment opportunity.”

The transaction is expected to be immediately accretive to Ares’

after-tax realized income per share of Class A and non-voting

common stock. The transaction is expected to close in the fourth

quarter of 2024 and is subject to customary closing conditions,

including regulatory approvals.

Latham & Watkins LLP served as legal counsel to Ares and

Kirkland & Ellis LLP and Mayer Brown LLP served as legal

counsel to Walton Street in connection with the transaction.

Berkshire Global Advisors L.P. served as financial advisor to

Walton Street.

About Ares Management Corporation Ares Management

Corporation (NYSE:ARES) is a leading global alternative investment

manager offering clients complementary primary and secondary

investment solutions across the credit, real estate, private equity

and infrastructure asset classes. We seek to provide flexible

capital to support businesses and create value for our stakeholders

and within our communities. By collaborating across our investment

groups, we aim to generate consistent and attractive investment

returns throughout market cycles. As of June 30, 2024, Ares

Management Corporation's global platform had over $447 billion of

assets under management, with more than 2,950 employees operating

across North America, Europe, Asia Pacific and the Middle East. For

more information, please visit www.aresmgmt.com.

About Walton Street Capital, L.L.C. Walton Street is a

private real estate investment firm that manages a diversified

equity and debt platform on behalf of its global institutional

clients. Since its inception in 1994 through its affiliates, Walton

Street has raised more than $15 billion of capital commitments from

global institutional investors and has acquired, financed, managed

and sold more than $55 billion of real estate. Through the cross

platform synergies of its investment groups, Walton Street seeks to

make real estate equity and debt investments with attractive risk

adjusted returns. Affiliates of Walton Street have actively

participated in the real estate industry in México since 1998 and

raised over $2.7 billion USD of capital commitments from

institutional investors. For more information, please visit

www.waltonst.com.

Forward-Looking Statements Statements included herein

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, which reflect our

current views with respect to, among other things, future events,

operations and financial performance. You can identify these

forward-looking statements by the use of forward-looking words such

as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “should,” “seeks,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates,” “foresees” or negative versions of

those words, other comparable words or other statements that do not

relate to historical or factual matters. The forward-looking

statements are based on our beliefs, assumptions and expectations

of our future performance, taking into account all information

currently available to us. Such forward-looking statements are

subject to various risks and uncertainties and assumptions relating

to our operations, financial results, financial condition, business

prospects, growth strategy and liquidity. These statements are not

guarantees of future performance, condition or results and involve

a number of risks and uncertainties, including the ability of Ares

to consummate the Walton Street Mexico acquisition and to

effectively integrate the acquired business into our operations, to

achieve the expected benefits therefrom and growth of the business.

Actual results may vary materially from those indicated in these

forward-looking statements as a result of a number of factors,

including those described from time to time in our filings with the

SEC. Ares does not undertake any obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926675172/en/

Ares Management Contacts Media: Brittany Cash, +1

212-301-0347 media@aresmgmt.com

Investors: Greg Mason, +1 314-282-2533

gmason@aresmgmt.com

Walton Street Capital, L.L.C. Contacts Kate Kappas, +1

312-915-2814 kappask@waltonst.com

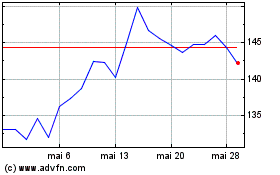

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025