Ares Management Raises €30 Billion for European Direct Lending Strategy

14 Janeiro 2025 - 10:15AM

Business Wire

Ares Capital Europe VI Final Close Exceeds

Target and Hits Hard Cap, Creating the Largest Institutional Fund

in the Global Direct Lending Market

Ares Management Corporation (“Ares”) (NYSE: ARES), a leading

global alternative investment manager, announced today the final

closing of its sixth commingled European direct lending fund, Ares

Capital Europe VI (“ACE VI” or the “Fund”). With total commitments

of €17.1 billion, the Fund closed above its €15 billion target and

reached its hard cap. Ares believes that ACE VI is the largest

institutional fund in the global direct lending market to date

based on LP equity commitments. The final Fund size represents an

approximate 53% increase in LP commitments relative to its

predecessor fund, Ares Capital Europe V, which closed in 2021 at

its €11.1 billion hard cap. Including related vehicles and

anticipated leverage, the total available capital for the Ares

European Direct Lending strategy is expected to be approximately

€30 billion.

Combined with the previously announced $33.6 billion of total

capital raised for its Senior Direct Lending Fund III (“SDL III”),

inclusive of related vehicles and anticipated leverage, Ares has

closed on approximately $64.5 billion across its SDL III and ACE VI

strategies – cementing its global market leadership.

“The final closing of ACE VI underscores the strength of Ares’

European direct lending platform as well as the strong demand from

borrowers for flexible capital solutions,” said Blair Jacobson,

Partner and Co-Head of European Credit. “We thank our existing and

new investors for their confidence in our longstanding and

differentiated strategy.”

“Over the past 18 years, we have continued to demonstrate our

market leadership through our local pan-European approach,” said

Michael Dennis, Partner and Co-Head of European Credit. “Our team’s

deep regional and sector experience, alongside our longstanding

sponsor and partner relationships, enable us to originate

significant opportunities with high-quality borrowers.”

“Our platform provides the scale, experience and innovation to

identify new opportunities and navigate unexpected challenges, and

our team is eager to continue building on our track record of

success,” said Matt Theodorakis, Partner and Co-Head of European

Direct Lending at Ares. “We remain committed to the structuring

discipline and selective capital deployment that have enabled our

business to thrive throughout cycles.”

Ares’ European Direct Lending strategy comprises approximately

90 investment professionals across London, Paris, Frankfurt,

Stockholm, Amsterdam and Madrid, as of September 30, 2024, and

manages over $74 billion in assets, inclusive of the ACE VI

commitments. Since its inception, the European Direct Lending

business has completed nearly 380 investments totaling over €70

billion. ACE VI seeks to self-originate flexible financing

solutions for high quality, market-leading European companies in

defensive industries with EBITDA in excess of €10 million. The Fund

targets a senior-secured weighting and focuses on capital

preservation, a sole or lead lender position, and low volatility.

ACE VI has already deployed significant capital, committing roughly

€6.4 billion across over 50 investments to date.

About Ares Management Corporation

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit, real

estate, private equity and infrastructure asset classes. We seek to

provide flexible capital to support businesses and create value for

our stakeholders and within our communities. By collaborating

across our investment groups, we aim to generate consistent and

attractive investment returns throughout market cycles. As of

September 30, 2024, Ares Management Corporation's global platform

had approximately $464 billion of assets under management, with

more than 3,100 employees operating across North America, Europe,

Asia Pacific and the Middle East. For more information, please

visit www.aresmgmt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114511414/en/

Media: Giles Bethule, +44 7879615114 Jacob Silber, +1 212

301 0376 media.europe@aresmgmt.com

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

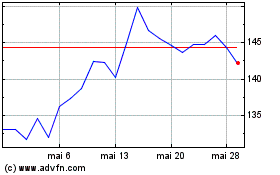

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025