AM Best Affirms Credit Ratings of EyeMed Insurance Company

04 Fevereiro 2025 - 1:24PM

Business Wire

AM Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Rating of “a”

(Excellent) of EyeMed Insurance Company (EIC) (Phoenix, AZ), a

subsidiary of EssilorLuxottica [EL: PA]. The outlook of these

Credit Ratings (ratings) is stable.

The ratings reflect EIC’s balance sheet strength, which AM Best

assesses as very strong, as well as its adequate operating

performance, neutral business profile and appropriate enterprise

risk management (ERM), as well as enhancement received from its

ultimate parent organization, EssilorLuxottica.

The balance sheet metrics are supported by EIC’s very strong

risk-adjusted capitalization, as measured by Best’s Capital

Adequacy Ratio (BCAR), which the company has maintained in each of

the past five years. The company’s balance sheet is enhanced

further by solid liquidity measures, driven by an investment

portfolio that is composed solely of cash and short-term

investments. The ratings also take into consideration EIC’s

dependence on reinsurance, which is a core part of the

organization’s strategy, and history of dividend payments, which

have limited absolute capital expansion. Combined, these factors

partially offset some of the favorable balance sheet components;

however, AM Best notes the long-standing reinsurance relationships,

and capital has grown at an 11.8% compound annual growth rate

(CAGR), despite the dividends.

EIC has reported continued earnings over the past five years and

through the first nine months of 2024. The company continues to

experience strong premium revenue growth and increased enrollment,

as evidenced by its 14.1% CAGR. EIC has maintained strong

profitability ratios, with its return on revenue consistently in

the strong upper single-digit range and return-on-equity measures

well into the high double-digit range.

EIC continues to benefit from its strong brand recognition, as

well as the expertise of its ultimate parent. Additionally, the

ratings reflect the company’s favorable market presence and overall

market share as one of the leading writers within the vision care

space. Furthermore, the ratings acknowledge EIC’s well-established

ERM program with a fully developed risk management framework and

committee structure, which is integrated with EssilorLuxottica.

The rating lift provided to EIC factors in its strategic

importance to its ultimate parent as its primary insurance

operating entity. EssilorLuxottica is a key player in the

U.S.-managed vision care business through EIC and EyeMed Vision

Care, LLC, with business primarily assumed from other health

insurance plans and written directly with employer groups. The

ratings also consider that EIC benefits from EssilorLuxottica’s

financial strength and operating synergies between the

organization’s various operating entities.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best's

Credit Ratings. For information on the proper use of Best’s Credit

Ratings, Best’s Performance Assessments, Best’s Preliminary Credit

Assessments and AM Best press releases, please view Guide to Proper

Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more

information, visit www.ambest.com.

Copyright © 2025 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204376955/en/

Jon Housel Financial Analyst +1 908 882

1898 jon.housel@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Joseph Zazzera Director +1 908 882 2442

joseph.zazzera@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

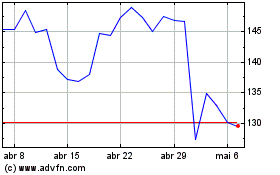

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025