- Third quarter GAAP Diluted EPS of $0.45 increased 7% over the

prior-year period

- Adjusted EPS of $1.40 increased 49% over the prior-year

period

- Revenue increased 3% on a GAAP basis and 4% on an adjusted

basis to $2.6 billion

- Repurchased $500 million of shares in the third quarter

- Raises low-end of revenue and adjusted EBITDA full-year outlook

and raises adjusted EPS full-year outlook

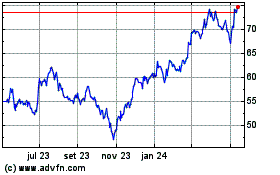

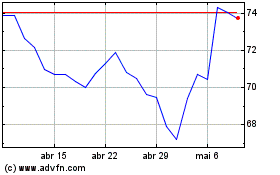

FIS® (NYSE:FIS), a global leader in financial technology, today

reported its third quarter 2024 results.

“We delivered another strong quarter of financial

outperformance, and are once again raising our full-year outlook,”

said FIS CEO and President Stephanie Ferris. “The strength of the

partnerships and new business signings this quarter underpin our

continued execution against our strategy to unlock financial

technology to the world across the money lifecycle.”

Financial Reporting Considerations for

Completed Worldpay Sale

On July 6, 2023, the Company announced an acceleration of its

previously announced separation plan to create two highly focused

global companies with greater strategic flexibility. FIS signed a

definitive agreement to sell a 55% stake in its Worldpay Merchant

Solutions business to private equity funds managed by GTCR (the

"Worldpay Sale"). The Worldpay Sale was completed on January 31,

2024.

Unless otherwise noted, all results are presented on a

continuing operations basis and exclude the results of the Worldpay

Merchant Solutions business that was classified as discontinued

operations as of the third quarter of 2023.

Following the close of the Worldpay Sale on January 31, 2024,

FIS retains a non-controlling 45% ownership interest in a new

standalone joint venture, Worldpay Holdco, LLC ("Worldpay"), and

records its proportionate share of Worldpay's earnings (loss) in

the "Equity method investment earnings (loss), net of tax" ("EMI")

line of the income statement.

Capital Allocation

Update

The Company remains committed to shareholder returns and is

reiterating its goal to repurchase approximately $4.0 billion of

shares in 2024. The Company repurchased $500 million of shares in

the third quarter, and has repurchased $3.0 billion of shares

year-to-date in 2024. Additionally, the Company continues to target

a dividend payout ratio of 35% of adjusted net earnings, excluding

EMI.

Third Quarter 2024 Financial

Results

On a GAAP basis, revenue increased 3% as compared to the

prior-year period to approximately $2.6 billion. GAAP net earnings

attributable to common stockholders from continuing operations were

$246 million or $0.45 per diluted share.

On an adjusted basis, revenue increased 4% as compared to the

prior-year period primarily driven by 6% adjusted recurring revenue

growth. Adjusted EBITDA was approximately $1.1 billion, and

Adjusted EBITDA margin contracted by 140 basis points (bps) over

the prior-year period to 41.3%, reflecting a negative impact from a

difficult grow over in corporate expenses. Adjusted net earnings

from continuing operations were $765 million, and adjusted EPS

increased by 49% as compared to the prior-year period to $1.40 per

diluted share.

($ millions, except per share data,

unaudited)

Three Months Ended September

30,

%

Adjusted

Continuing

Operations

2024

20231

Change

Growth

Banking Solutions Revenue

1,779

1,732

3%

3%

Capital Market Solutions Revenue

730

677

8%

7%

Operating Segment Total Revenue

$

2,509

$

2,409

4%

4%

Corporate and Other Revenue

61

83

(27)%

-

Consolidated FIS Revenue

$

2,570

$

2,492

3%

-

Adjusted EBITDA

$

1,060

$

1,065

—%

Adjusted EBITDA Margin

41.3

%

42.7

%

(140) bps

Net Earnings (Loss) (GAAP)

$

246

$

248

(1)%

Diluted Earnings (Loss) Per Common Share

(GAAP)

$

0.45

$

0.42

7%

Adjusted Net Earnings

$

765

$

557

37%

Adjusted EPS

$

1.40

$

0.94

49%

1Reflects revised prior period financials.

See "Exhibit J" below for additional information regarding the

immaterial corrections to results of prior periods.

Segment Information

- Banking Solutions: Third quarter revenue increased 3% on

a GAAP basis and 3% on an adjusted basis as compared to the

prior-year period to $1.8 billion, including adjusted recurring

revenue growth of 6%. Adjusted EBITDA margin expanded by 10 basis

points as compared to the prior-year period to 45.2%, primarily

driven by the Company's cost savings initiatives and operating

leverage.

- Capital Market Solutions: Third quarter revenue

increased by 8% on a GAAP basis and 7% on an adjusted basis as

compared to the prior-year period to $730 million reflecting

adjusted recurring revenue growth of 6%. Adjusted EBITDA margin

expanded by 90 basis points over the prior-year period to 49.9%,

primarily due to operating leverage and an increase in high-margin

license revenue.

- Corporate and Other: Third quarter revenue

decreased by 27% as compared to the prior-year period to $61

million. Adjusted EBITDA loss was $108 million, including $119

million of corporate expenses.

Balance Sheet and Cash

Flows

As of September 30, 2024, debt outstanding totaled $10.9

billion. Third quarter net cash provided by operating activities

was $641 million, and adjusted free cash flow was $530 million. In

the third quarter, the Company returned approximately $700 million

of capital to shareholders through $500 million of share

repurchases and $199 million of dividends paid.

Full-Year 2024 Outlook

For the full-year, the Company is raising the low-end of its

outlook for both revenue and adjusted EBITDA and is raising its

outlook for adjusted EPS by approximately 2% as compared to the

prior outlook to $5.15 - $5.20. The adjusted EPS outlook reflects

11 months of EMI contribution for the full year.

($ millions, except share data)

FY 2024

Revenue

$10,140 - $10,170

Adjusted EBITDA (Non-GAAP)1

$4,125 - $4,140

Adjusted EPS (Non-GAAP)1

$5.15 - $5.20

1The Company does not provide a

reconciliation for non-GAAP estimates on a forward-looking basis

where it is unable to provide a meaningful or accurate calculation

or estimation of reconciling items and the information is not

available without unreasonable effort.

Webcast

FIS will host a live webcast of its earnings conference call

with the investment community beginning at 8:30 a.m. (EST) on

Monday, November 4, 2024. To access the webcast, go to the Investor

Relations section of FIS’ homepage, www.fisglobal.com. A replay

will be available after the conclusion of the live webcast.

About FIS

FIS is a financial technology company providing solutions to

financial institutions, businesses and developers. We unlock

financial technology to the world across the money lifecycle

underpinning the world's financial system. Our people are dedicated

to advancing the way the world pays, banks and invests, by helping

our clients to confidently run, grow and protect their businesses.

Our expertise comes from decades of experience helping financial

institutions and businesses of all sizes adapt to meet the needs of

their customers by harnessing where reliability meets innovation in

financial technology. Headquartered in Jacksonville, Florida, FIS

is a member of the Fortune 500® and the Standard & Poor’s 500®

Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn,

Facebook and X.

FIS Use of Non-GAAP Financial

Information

Generally Accepted Accounting Principles (GAAP) is the term used

to refer to the standard framework of guidelines for financial

accounting in the United States. GAAP includes the standards,

conventions, and rules accountants follow in recording and

summarizing transactions and in the preparation of financial

statements. In addition to reporting financial results in

accordance with GAAP, we have provided certain non-GAAP financial

measures.

These non-GAAP measures include constant currency revenue,

adjusted revenue growth, adjusted EBITDA, adjusted EBITDA margin,

adjusted net earnings, adjusted EPS, and adjusted free cash flow.

These non-GAAP measures may be used in this release and/or in the

attached supplemental financial information.

We believe these non-GAAP measures help investors better

understand the underlying fundamentals of our business. As further

described below, the non-GAAP revenue and earnings measures

presented eliminate items management believes are not indicative of

FIS’ operating performance. The constant currency revenue and

adjusted revenue growth measures adjust for the effects of exchange

rate fluctuations and exclude discontinued operations, while

adjusted revenue growth also excludes revenue from Corporate and

Other, giving investors further insight into our performance.

Finally, adjusted free cash flow provides further information about

the ability of our business to generate cash. For these reasons,

management also uses these non-GAAP measures in its assessment and

management of FIS’ performance.

Constant currency revenue represents reported segment

revenue excluding the impact of fluctuations in foreign currency

exchange rates in the current period.

Adjusted revenue growth reflects the percentage change in

constant currency revenue for the current period as compared to the

prior period. Constant currency revenue is calculated by applying

prior-year period foreign currency exchange rates to current-period

revenue. When referring to adjusted revenue growth, revenue from

our Corporate and Other segment is excluded.

Adjusted EBITDA reflects net earnings (loss) before

interest, other income (expense), taxes, equity method investment

earnings (loss), and depreciation and amortization, and excludes

certain costs that do not constitute normal, recurring, cash

operating expenses necessary to operate our business. This measure

is reported to the chief operating decision maker for purposes of

making decisions about allocating resources to the segments and

assessing their performance. For this reason, adjusted EBITDA, as

it relates to our segments, is presented in conformity with

Accounting Standards Codification 280, Segment Reporting, and is

excluded from the definition of non-GAAP financial measures under

the Securities and Exchange Commission's Regulation G and Item

10(e) of Regulation S-K.

Adjusted EBITDA margin reflects adjusted EBITDA, as

defined above, divided by revenue.

Adjusted net earnings excludes the effect of purchase

price amortization, as well as certain costs that do not constitute

normal, recurring, cash operating expenses necessary to operate our

business. For purposes of calculating Adjusted net earnings, our

equity method investment earnings (loss) ("EMI") from Worldpay is

also adjusted to exclude certain costs and other transactions in a

similar manner.

Adjusted EPS reflects adjusted net earnings, as defined

above, divided by weighted average diluted shares outstanding.

Adjusted free cash flow reflects net cash provided by

operating activities, adjusted for the net change in settlement

assets and obligations and excluding certain transactions that are

closely associated with non-operating activities or are otherwise

non-operational in nature and not indicative of future operating

cash flows, less capital expenditures. Adjusted free cash flow does

not represent our residual cash flow available for discretionary

expenditures since we have mandatory debt service requirements and

other non-discretionary expenditures that are not deducted from the

measure. Adjusted free cash flow as presented in this earnings

release excludes cash flow from discontinued operations, which our

management cannot freely access following the Worldpay

separation.

Any non-GAAP measures should be considered in context with the

GAAP financial presentation and should not be considered in

isolation or as a substitute for GAAP measures. Further, FIS’

non-GAAP measures may be calculated differently from similarly

titled measures of other companies. Reconciliations of these

non-GAAP measures to related GAAP measures, including footnotes

describing the adjustments, are provided in the attached schedules

and in the Investor Relations section of the FIS website,

www.fisglobal.com.

Forward-Looking

Statements

This earnings release and today’s webcast contain

“forward-looking statements” within the meaning of the U.S. federal

securities laws. Statements that are not historical facts, as well

as other statements about our expectations, beliefs, intentions, or

strategies regarding the future, or other characterizations of

future events or circumstances, are forward-looking statements.

Forward-looking statements include statements about anticipated

financial outcomes, including any earnings outlook or projections,

projected revenue or expense synergies or dis-synergies, business

and market conditions, outlook, foreign currency exchange rates,

deleveraging plans, expected dividends and share repurchases of the

Company, the Company’s sales pipeline and anticipated profitability

and growth, plans, strategies and objectives for future operations,

strategic value creation, risk profile and investment strategies,

any statements regarding future economic conditions or performance

and any statements with respect to the future impacts of the

Worldpay Sale or any agreements or arrangements entered into in

connection with such transaction, the expected financial and

operational results of the Company, and expectations regarding the

Company’s business or organization after the separation of the

Worldpay Merchant Solutions business. These statements may be

identified by words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “will,” “should,” “could,” “would,” “project,”

“continue,” “likely,” and similar expressions, and include

statements reflecting future results, statements of outlook and

various accruals and estimates. These statements relate to future

events and our future results and involve a number of risks and

uncertainties. Forward-looking statements are based on management’s

beliefs as well as assumptions made by, and information currently

available to, management.

Actual results, performance or achievement could differ

materially from these forward-looking statements. The risks and

uncertainties to which forward-looking statements are subject

include the following, without limitation:

- changes in general economic, business and political conditions,

including those resulting from COVID-19 or other pandemics, a

recession, intensified or expanded international hostilities, acts

of terrorism, increased rates of inflation or interest, changes in

either or both the United States and international lending, capital

and financial markets or currency fluctuations;

- the risk that acquired businesses will not be integrated

successfully or that the integration will be more costly or more

time-consuming and complex than anticipated;

- the risk that cost savings and synergies anticipated to be

realized from acquisitions may not be fully realized or may take

longer to realize than expected or that costs may be greater than

anticipated;

- the risks of doing business internationally;

- the effect of legislative initiatives or proposals, statutory

changes, governmental or applicable regulations and/or changes in

industry requirements, including privacy and cybersecurity laws and

regulations;

- the risks of reduction in revenue from the elimination of

existing and potential customers due to consolidation in, or new

laws or regulations affecting, the banking, retail and financial

services industries or due to financial failures or other setbacks

suffered by firms in those industries;

- changes in the growth rates of the markets for our

solutions;

- the amount, declaration and payment of future dividends is at

the discretion of our Board of Directors and depends on, among

other things, our investment opportunities, results of operations,

financial condition, cash requirements, future prospects, and other

factors that may be considered relevant by our Board of Directors,

including legal and contractual restrictions;

- the amount and timing of any future share repurchases is

subject to, among other things, our share price, our other

investment opportunities and cash requirements, our results of

operations and financial condition, our future prospects and other

factors that may be considered relevant by our Board of Directors

and management;

- failures to adapt our solutions to changes in technology or in

the marketplace;

- internal or external security or privacy breaches of our

systems, including those relating to unauthorized access, theft,

corruption or loss of personal information and computer viruses and

other malware affecting our software or platforms, and the

reactions of customers, card associations, government regulators

and others to any such events;

- the risk that implementation of software, including software

updates, for customers or at customer locations or employee error

in monitoring our software and platforms may result in the

corruption or loss of data or customer information, interruption of

business operations, outages, exposure to liability claims or loss

of customers;

- the risk that partners and third parties may fail to satisfy

their legal obligations to us;

- risks associated with managing pension cost, cybersecurity

issues, IT outages and data privacy;

- the reaction of current and potential customers to

communications from us or regulators regarding information

security, risk management, internal audit or other matters;

- risks associated with the expected benefits and costs of the

separation of the Worldpay Merchant Solutions business, including

the risk that the expected benefits of the transaction or any

contingent purchase price will not be realized within the expected

timeframe, in full or at all, or that dis-synergies may be greater

than anticipated;

- the risk that the costs of restructuring transactions and other

costs incurred in connection with the separation of the Worldpay

business will exceed our estimates or otherwise adversely affect

our business or operations;

- the impact of the separation of Worldpay on our businesses,

including the impact on relationships with customers, governmental

authorities, suppliers, employees and other business

counterparties;

- the risk that the earnings from our minority stake in the

Worldpay business will be less than we anticipate;

- competitive pressures on pricing related to the decreasing

number of community banks in the U.S., the development of new

disruptive technologies competing with one or more of our

solutions, increasing presence of international competitors in the

U.S. market and the entry into the market by global banks and

global companies with respect to certain competitive solutions,

each of which may have the impact of unbundling individual

solutions from a comprehensive suite of solutions we provide to

many of our customers;

- the failure to innovate in order to keep up with new emerging

technologies, which could impact our solutions and our ability to

attract new, or retain existing, customers;

- an operational or natural disaster at one of our major

operations centers;

- failure to comply with applicable requirements of payment

networks or changes in those requirements;

- fraud by bad actors; and

- other risks detailed elsewhere in the “Risk Factors” and other

sections of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, and in our other filings with the

Securities and Exchange Commission.

Other unknown or unpredictable factors also could have a

material adverse effect on our business, financial condition,

results of operations and prospects. Accordingly, readers should

not place undue reliance on these forward-looking statements. These

forward-looking statements are inherently subject to uncertainties,

risks and changes in circumstances that are difficult to predict.

Except as required by applicable law or regulation, we do not

undertake (and expressly disclaim) any obligation and do not intend

to publicly update or review any of these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Fidelity National Information

Services, Inc.

Earnings Release Supplemental

Financial Information

November 4, 2024

Exhibit A

Condensed Consolidated Statements of

Earnings (Loss) - Unaudited for the three and nine months ended

September 30, 2024 and 2023

Exhibit B

Condensed Consolidated Balance Sheets -

Unaudited as of September 30, 2024, and December 31, 2023

Exhibit C

Condensed Consolidated Statements of Cash

Flows - Unaudited for the nine months ended September 30, 2024 and

2023

Exhibit D

Supplemental Non-GAAP Adjusted Revenue

Growth - Unaudited for the three and nine months ended September

30, 2024 and 2023

Exhibit E

Supplemental Disaggregation of Revenue -

Recast and Unaudited for the three and nine months ended September

30, 2024 and 2023

Exhibit F

Supplemental Non-GAAP Adjusted Free Cash

Flow Measures - Unaudited for the three and nine months ended

September 30, 2024 and 2023

Exhibit G

Supplemental GAAP to Non-GAAP

Reconciliations - Unaudited for the three and nine months ended

September 30, 2024 and 2023

Exhibit H

Supplemental Financial Information -

Unaudited for the three and nine months ended September 30, 2024

and 2023

Exhibit I

Supplemental Financial Information of

Worldpay Holdco, LLC - Unaudited for the three and eight months

ended September 30, 2024

Exhibit J

Revision of Previously Issued Consolidated

Financial Statements and Supplemental Non-GAAP Financial

Information - Unaudited

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS (LOSS)— UNAUDITED

(In millions, except per share

amounts)

Exhibit A

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

2,570

$

2,492

$

7,528

$

7,318

Cost of revenue

1,593

1,531

4,700

4,632

Gross profit

977

961

2,828

2,686

Selling, general, and administrative

expenses

521

484

1,703

1,557

Asset impairments

2

7

20

8

Other operating (income) expense, net -

related party

(36

)

—

(110

)

—

Operating income (loss)

490

470

1,215

1,121

Other income (expense):

Interest expense, net

(64

)

(162

)

(184

)

(464

)

Other income (expense), net

(38

)

11

(222

)

(74

)

Total other income (expense), net

(102

)

(151

)

(406

)

(538

)

Earnings (loss) before income taxes and

equity method investment earnings (loss)

388

319

809

583

Provision (benefit) for income taxes

108

70

215

140

Equity method investment earnings (loss),

net of tax

(33

)

—

(110

)

—

Net earnings (loss) from continuing

operations

247

249

484

443

Earnings (loss) from discontinued

operations, net of tax

(22

)

(708

)

687

(7,342

)

Net earnings (loss)

225

(459

)

1,171

(6,899

)

Net (earnings) loss attributable to

noncontrolling interest from continuing operations

(1

)

(1

)

(2

)

(2

)

Net (earnings) loss attributable to

noncontrolling interest from discontinued operations

—

(1

)

—

(3

)

Net earnings (loss) attributable to FIS

common stockholders

$

224

$

(461

)

$

1,169

$

(6,904

)

Net earnings (loss) attributable to

FIS:

Continuing operations

$

246

$

248

$

482

$

441

Discontinued operations

(22

)

(709

)

687

(7,345

)

Total

$

224

$

(461

)

$

1,169

$

(6,904

)

Basic earnings (loss) per common

share

attributable to FIS:

Continuing operations

$

0.45

$

0.42

$

0.86

$

0.74

Discontinued operations

(0.04

)

(1.20

)

1.23

(12.41

)

Total

$

0.41

$

(0.78

)

$

2.09

$

(11.66

)

Diluted earnings (loss) per common

share attributable to FIS:

Continuing operations

$

0.45

$

0.42

$

0.86

$

0.74

Discontinued operations

(0.04

)

(1.20

)

1.22

(12.41

)

Total

$

0.41

$

(0.78

)

$

2.08

$

(11.66

)

Weighted average common shares

outstanding:

Basic

545

592

558

592

Diluted

548

592

561

592

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS — UNAUDITED

(In millions, except per share

amounts)

Exhibit B

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,323

$

440

Settlement assets

736

617

Trade receivables, net

1,841

1,738

Other receivables

147

109

Receivable from related party

88

—

Prepaid expenses and other current

assets

621

641

Current assets held for sale

1,314

10,111

Total current assets

6,070

13,656

Property and equipment, net

620

695

Goodwill

17,050

16,971

Intangible assets, net

1,400

1,823

Software, net

2,229

2,115

Equity method investment

4,133

—

Other noncurrent assets

1,644

1,528

Deferred contract costs, net

1,184

1,076

Noncurrent assets held for sale

17

17,109

Total assets

$

34,347

$

54,973

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable, accrued and other

liabilities

$

1,861

$

1,773

Settlement payables

750

635

Deferred revenue

839

829

Short-term borrowings

112

4,760

Current portion of long-term debt

317

1,348

Current liabilities held for sale

1,263

8,884

Total current liabilities

5,142

18,229

Long-term debt, excluding current

portion

10,491

12,970

Deferred income taxes

717

2,179

Other noncurrent liabilities

1,426

1,446

Noncurrent liabilities held for sale

—

1,093

Total liabilities

17,776

35,917

Equity:

FIS stockholders' equity:

Preferred stock $0.01 par value

—

—

Common stock $0.01 par value

6

6

Additional paid in capital

47,080

46,934

(Accumulated deficit) retained

earnings

(22,343

)

(22,906

)

Accumulated other comprehensive earnings

(loss)

(387

)

(260

)

Treasury stock, at cost

(7,787

)

(4,724

)

Total FIS stockholders' equity

16,569

19,050

Noncontrolling interest

2

6

Total equity

16,571

19,056

Total liabilities and equity

$

34,347

$

54,973

Prior-year amounts have been revised to

correct certain immaterial misstatements. See Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS — UNAUDITED (In millions)

Exhibit C

Nine months ended September

30,

2024

2023

Cash flows from operating activities

from continuing operations:

Net earnings (loss)

$

1,171

$

(6,899

)

Less earnings (loss) from discontinued

operations, net of tax

687

(7,342

)

Net earnings (loss) from continuing

operations

484

443

Adjustment to reconcile net earnings

(loss) from continuing operations to net cash provided by operating

activities:

Depreciation and amortization

1,291

1,323

Amortization of debt issuance costs

16

22

Asset impairments

20

7

Loss on extinguishment of debt

174

—

Loss (gain) on sale of businesses,

investments and other

77

31

Stock-based compensation

142

90

Loss from equity method investment

110

—

Deferred income taxes

(200

)

(343

)

Net changes in assets and liabilities, net

of effects from acquisitions and foreign currency:

Trade and other receivables

(23

)

157

Receivable from related party

(88

)

—

Settlement activity

(3

)

5

Prepaid expenses and other assets

(129

)

(87

)

Deferred contract costs

(348

)

(272

)

Deferred revenue

(41

)

(47

)

Accounts payable, accrued liabilities and

other liabilities

(89

)

(28

)

Net cash provided by operating activities

from continuing operations

1,393

1,301

Cash flows from investing activities

from continuing operations:

Additions to property and equipment

(79

)

(88

)

Additions to software

(550

)

(496

)

Settlement of net investment hedge

cross-currency interest rate swaps

(8

)

(20

)

Net proceeds from sale of businesses and

investments

12,801

45

Cash divested from sale of business

(3,137

)

—

Acquisitions, net of cash acquired

(56

)

—

Coupon payments on interest rate swaps

(98

)

—

Other investing activities, net

(30

)

(38

)

Net cash provided by (used in) investing

activities

8,843

(597

)

Cash flows from financing activities

from continuing operations:

Borrowings

15,776

64,437

Repayment of borrowings and other

financing obligations

(24,183

)

(65,822

)

Debt issuance costs

(6

)

(2

)

Net proceeds from stock issued under

stock-based compensation plans

2

41

Treasury stock activity

(3,032

)

(16

)

Dividends paid

(608

)

(926

)

Purchase of noncontrolling interest

—

(173

)

Other financing activities, net

45

(8

)

Net cash provided by (used in) financing

activities from continuing operations

(12,006

)

(2,469

)

Cash flows from discontinued

operations:

Net cash provided by (used in) operating

activities

(5

)

1,510

Net cash provided by (used in) investing

activities

(39

)

(260

)

Net cash provided by (used in) financing

activities

(65

)

(188

)

Net cash provided by (used in)

discontinued operations

(109

)

1,062

Effect of foreign currency exchange rate

changes on cash from continuing operations

20

(17

)

Effect of foreign currency exchange rate

changes on cash from discontinued operations

(30

)

(12

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(1,889

)

(732

)

Cash, cash equivalents and restricted

cash, beginning of period

4,414

4,813

Cash, cash equivalents and restricted

cash, end of period

$

2,525

$

4,081

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL NON-GAAP ORGANIC

REVENUE GROWTH — UNAUDITED

(In millions)

Exhibit D

Three months ended September

30,

2024

2023

Constant

Currency

Adjusted

Revenue

FX

Revenue

Revenue

Growth (1)

Banking Solutions

$

1,779

$

1

$

1,780

$

1,732

3

%

Capital Market Solutions

730

(4

)

726

677

7

%

Operating segment total

2,509

(4

)

2,505

2,409

4

%

Corporate and Other

61

2

62

83

Consolidated FIS

$

2,570

$

(2

)

$

2,567

$

2,492

Nine months ended September

30,

2024

2023

Constant

Currency

Adjusted

Revenue

FX

Revenue

Revenue

Growth (1)

Banking Solutions

$

5,174

$

1

$

5,175

$

5,049

2

%

Capital Market Solutions

2,158

(8

)

2,151

2,011

7

%

Operating segment total

7,332

(7

)

7,326

7,060

4

%

Corporate and Other

196

1

197

258

Consolidated FIS

$

7,528

$

(6

)

$

7,523

$

7,318

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

(1)

Adjusted growth excludes Corporate and

Other. The Corporate and Other segment includes certain

non-strategic businesses that we plan to wind down or sell.

FIDELITY NATIONAL INFORMATION

SERVICES, INC. SUPPLEMENTAL DISAGGREGATION OF REVENUE — RECAST AND

UNAUDITED (In millions)

Exhibit E

In the following tables, revenue is

disaggregated by primary geographical market and type of revenue.

The tables also include a reconciliation of the disaggregated

revenue with the Company's reportable segments.

For the three months ended September 30,

2024 (in millions):

Banking

Solutions

Capital

Market

Solutions

Corporate and Other

Total

Primary Geographical Markets:

North America

$

1,521

$

452

$

26

$

1,999

All others

258

278

35

571

Total

$

1,779

$

730

$

61

$

2,570

Type of Revenue:

Recurring revenue:

Transaction processing and services

$

1,325

$

368

$

40

$

1,733

Software maintenance

88

145

1

234

Other recurring

66

23

10

99

Total recurring

1,479

536

51

2,066

Software license

54

92

1

147

Professional services

137

100

1

238

Other non-recurring

109

2

8

119

Total

$

1,779

$

730

$

61

$

2,570

For the three months ended September 30,

2023 (in millions):

Banking

Solutions

Capital

Market

Solutions

Corporate and Other

Total

Primary Geographical Markets:

North America

$

1,501

$

413

$

45

$

1,959

All others

231

264

38

533

Total

$

1,732

$

677

$

83

$

2,492

Type of Revenue:

Recurring revenue:

Transaction processing and services

(1)

$

1,232

$

349

$

58

$

1,639

Software maintenance

92

135

—

227

Other recurring

67

21

11

99

Total recurring

1,391

505

69

1,965

Software license

47

76

7

130

Professional services

126

96

2

224

Other non-recurring (1)

168

—

5

173

Total

$

1,732

$

677

$

83

$

2,492

(1)

December 31, 2023, was the final deadline

for states to complete all benefit issuance under federally funded

pandemic relief programs. Accordingly, revenue associated with

services the Company provided related to these programs has been

classified as Other non-recurring commencing in the fourth quarter

of 2023, and related prior-period amounts have been reclassified

from Transaction processing and services to Other non-recurring for

comparability.

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL NON-GAAP

FINANCIAL INFORMATION — RECAST AND UNAUDITED

(In millions)

Exhibit E (continued)

For the nine months ended September 30,

2024 (in millions):

Banking

Solutions

Capital

Market

Solutions

Corporate and Other

Total

Primary Geographical Markets:

North America

$

4,424

$

1,349

$

90

$

5,863

All others

750

809

106

1,665

Total

$

5,174

$

2,158

$

196

$

7,528

Type of Revenue:

Recurring revenue:

Transaction processing and services

$

3,855

$

1,104

$

130

$

5,089

Software maintenance

268

432

1

701

Other recurring

198

68

30

296

Total recurring

4,321

1,604

161

6,086

Software license

141

256

2

399

Professional services

405

295

3

703

Other non-recurring

307

3

30

340

Total

$

5,174

$

2,158

$

196

$

7,528

For the nine months ended September 30,

2023 (in millions):

Banking

Solutions

Capital

Market

Solutions

Corporate and Other

Total

Primary Geographical Markets:

North America

$

4,364

$

1,262

$

140

$

5,766

All others

685

749

118

1,552

Total

$

5,049

$

2,011

$

258

$

7,318

Type of Revenue:

Recurring revenue:

Transaction processing and services

(1)

$

3,693

$

1,035

$

189

$

4,917

Software maintenance

272

394

1

667

Other recurring

183

60

31

274

Total recurring

4,148

1,489

221

5,858

Software license

78

228

8

314

Professional services

436

293

7

736

Other non-recurring (1)

387

1

22

410

Total

$

5,049

$

2,011

$

258

$

7,318

(1)

December 31, 2023, was the final deadline

for states to complete all benefit issuance under federally funded

pandemic relief programs. Accordingly, revenue associated with

services the Company provided related to these programs has been

classified as Other non-recurring commencing in the fourth quarter

of 2023, and related prior-period amounts have been reclassified

from Transaction processing and services to Other non-recurring for

comparability.

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL NON-GAAP CASH

FLOW MEASURES — UNAUDITED

(In millions)

Exhibit F

Three months ended

Nine months ended

September 30, 2024

September 30, 2024

Net cash provided by operating

activities

$

641

$

1,393

Non-GAAP adjustments:

Acquisition, integration and other

payments (1)

132

362

Settlement activity

—

3

Adjusted cash flows from operations

773

1,758

Capital expenditures

(243

)

(629

)

Adjusted free cash flow

$

530

$

1,129

Three months ended

Nine months ended

September 30, 2023

September 30, 2023

Net cash provided by operating

activities

$

534

$

1,301

Non-GAAP adjustments:

Acquisition, integration and other

payments (1)

75

208

Settlement activity

(4

)

(5

)

Adjusted cash flows from operations

605

1,504

Capital expenditures

(215

)

(584

)

Adjusted free cash flow

$

390

$

920

Adjusted free cash flow reflects adjusted

cash flows from operations less capital expenditures (additions to

property and equipment and additions to software). Adjusted free

cash flow does not represent our residual cash flows available for

discretionary expenditures, since we have mandatory debt service

requirements and other non-discretionary expenditures that are not

deducted from the measure. Adjusted free cash flow as presented in

this earnings release excludes cash flows from discontinued

operations.

(1)

Adjusted free cash flows from operations

and free cash flow for the three and nine months ended September

30, 2024 and 2023, exclude cash payments for certain acquisition,

integration and other costs (see Note 2 to Exhibit G), net of

related tax impact. The related tax impact totaled $22 million and

$10 million for the three months and $61 million and $32 million

for the nine months ended September 30, 2024 and 2023,

respectively.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP

RECONCILIATIONS — UNAUDITED

(In millions, except per share

amounts)

Exhibit G

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net earnings (loss) attributable to FIS

from continuing operations

$

246

$

248

$

482

$

441

Provision (benefit) for income taxes

108

70

215

140

Interest expense, net

64

162

184

464

Equity method investment (earnings) loss,

net of tax

33

—

110

—

Other, net

39

(10

)

224

76

Operating income (loss), as reported

490

470

1,215

1,121

Depreciation and amortization, excluding

purchase accounting amortization

263

262

789

798

Non-GAAP adjustments:

Purchase accounting amortization (1)

168

173

502

524

Acquisition, integration and other costs

(2)

137

113

481

326

Asset impairments (3)

2

7

20

8

Indirect Worldpay business support costs

(5)

—

40

14

123

Adjusted EBITDA from continuing

operations

$

1,060

$

1,065

$

3,021

$

2,900

Net earnings (loss) attributable to FIS

from discontinued operations

$

(22

)

$

(709

)

$

687

$

(7,345

)

Provision (benefit) for income taxes

(3

)

(382

)

(994

)

(327

)

Interest expense, net

(1

)

(4

)

(2

)

(15

)

Other, net

—

30

6

(17

)

Operating income (loss)

(26

)

(1,065

)

(303

)

(7,704

)

Depreciation and amortization, excluding

purchase accounting amortization

—

11

1

160

Non-GAAP adjustments:

Purchase accounting amortization (1)

—

17

—

762

Acquisition, integration and other costs

(2)

—

86

13

140

Asset impairments (3)

—

4

—

6,843

Loss on assets held for sale (4)

—

1,549

—

1,549

Loss on sale of disposal group (11)

25

—

491

—

Indirect Worldpay business support costs

(5)

—

(40

)

(14

)

(123

)

Adjusted EBITDA from discontinued

operations

$

(1

)

$

562

$

188

$

1,627

Adjusted EBITDA

$

1,059

$

1,627

$

3,209

$

4,527

See Notes to Exhibit G.

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP

RECONCILIATIONS — UNAUDITED

(In millions, except per share

amounts)

Exhibit G (continued)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Earnings (loss) attributable to FIS from

continuing operations

$

246

$

248

$

482

$

441

Equity method investment (earnings) loss,

net of tax

33

—

110

—

Earnings (loss) attributable to FIS from

continuing operations, excluding equity method investment earnings

(loss)

279

248

592

441

Non-GAAP adjustments from continuing

operations:

Purchase accounting amortization (1)

168

173

502

524

Acquisition, integration and other costs

(2)

137

118

481

349

Asset impairments (3)

2

7

20

8

Indirect Worldpay business support costs

(5)

—

40

14

123

Non-operating (income) expense (6)

38

(11

)

222

74

Non-GAAP tax (provision) benefit (7)

2

(18

)

(82

)

(91

)

Total non-GAAP adjustments from continuing

operations

347

309

1,157

987

Adjusted net earnings attributable to FIS

from continuing operations, excluding equity method investment

earnings (loss)

626

557

1,749

1,428

Equity method investment earnings (loss),

net of tax (8)

(33

)

—

(110

)

—

Non-GAAP adjustments on equity method

investment earnings (loss), net of related (provision) benefit for

income taxes (8) (9)

172

—

504

—

Adjusted equity method investment earnings

(loss) (8)

139

—

394

—

Adjusted net earnings attributable to FIS

from continuing operations

$

765

$

557

$

2,143

$

1,428

Earnings (loss) attributable to FIS from

discontinued operations, net of tax

$

(22

)

$

(709

)

$

687

$

(7,345

)

Non-GAAP adjustments from discontinued

operations:

Purchase accounting amortization (1)

—

17

—

762

Acquisition, integration and other costs

(2)

—

86

13

155

Asset impairments (3)

—

4

—

6,843

Indirect Worldpay business support costs

(5)

—

(40

)

(14

)

(123

)

Amortization on long-lived assets held for

sale (10)

—

(63

)

(30

)

(63

)

Non-operating (income) expense (6)

—

29

6

(21

)

Loss on assets held for sale (4)

—

1,549

—

1,549

Loss on sale of disposal group (11)

25

—

491

—

Non-GAAP tax (provision) benefit (7)

(3

)

(451

)

(1,017

)

(528

)

Total non-GAAP adjustments from

discontinued operations

22

1,131

(551

)

8,574

Adjusted net earnings attributable to FIS

from discontinued operations

$

—

$

422

$

136

$

1,229

Adjusted net earnings attributable to FIS

common stockholders

$

765

$

979

$

2,279

$

2,657

See Notes to Exhibit G.

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP

RECONCILIATIONS — UNAUDITED

(In millions, except per share

amounts)

Exhibit G (continued)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Earnings (loss) attributable to FIS from

continuing operations

$

0.45

$

0.42

$

0.86

$

0.74

Equity method investment (earnings) loss,

net of tax

0.06

—

0.20

—

Earnings (loss) attributable to FIS from

continuing operations, excluding equity method investment earnings

(loss)

0.51

0.42

1.06

0.74

Non-GAAP adjustments from continuing

operations:

Purchase accounting amortization (1)

0.31

0.29

0.89

0.88

Acquisition, integration and other costs

(2)

0.25

0.20

0.86

0.59

Asset impairments (3)

—

0.01

0.04

0.01

Indirect Worldpay business support costs

(5)

—

0.07

0.02

0.21

Non-operating (income) expense (6)

0.07

(0.02

)

0.40

0.12

Non-GAAP tax (provision) benefit (7)

—

(0.03

)

(0.15

)

(0.15

)

Total non-GAAP adjustments from continuing

operations

0.63

0.52

2.06

1.66

Adjusted net earnings attributable to FIS

from continuing operations, excluding equity method investment

earnings (loss)

1.14

0.94

3.12

2.41

Equity method investment earnings (loss)

(8)

(0.06

)

—

(0.20

)

—

Non-GAAP adjustments on equity method

investment earnings (loss), net of related (provision) benefit for

income taxes (8) (9)

0.31

$

—

0.90

—

Adjusted equity method investment earnings

(loss) (8)

0.25

—

0.70

—

Adjusted net earnings attributable to FIS

from continuing operations

$

1.40

$

0.94

$

3.82

$

2.41

Earnings (loss) attributable to FIS from

discontinued operations, net of tax

$

(0.04

)

$

(1.19

)

$

1.22

$

(12.37

)

Non-GAAP adjustments from discontinued

operations:

Purchase accounting amortization (1)

—

0.03

—

1.28

Acquisition, integration and other costs

(2)

—

0.14

0.02

0.26

Asset impairments (3)

—

0.01

—

11.52

Loss on assets held for sale (4)

—

2.61

—

2.61

Indirect Worldpay business support costs

(5)

—

(0.07

)

(0.02

)

(0.21

)

Amortization on long-lived assets held for

sale (10)

—

(0.11

)

(0.05

)

(0.11

)

Non-operating (income) expense (6)

—

0.05

0.01

(0.04

)

Loss on sale of disposal group (11)

0.05

—

0.88

—

Non-GAAP tax (provision) benefit (7)

(0.01

)

(0.76

)

(1.81

)

(0.89

)

Total non-GAAP adjustments from

discontinued operations

0.04

1.90

(0.98

)

14.43

Adjusted net earnings attributable to FIS

from discontinued operations

$

—

$

0.71

$

0.24

$

2.07

Adjusted net earnings attributable to FIS

common stockholders

$

1.40

$

1.65

$

4.06

$

4.47

Weighted average shares

outstanding-diluted (12)

548

594

$

561

594

See Notes to Exhibit G.

Prior-year and year-to-date 2024 amounts

have been revised to correct certain immaterial misstatements. See

Exhibit J.

Amounts in table may not sum or calculate

due to rounding.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL GAAP TO NON-GAAP

RECONCILIATIONS — UNAUDITED

(In millions, except per share

amounts)

Exhibit G (continued)

Notes to Unaudited - Supplemental GAAP

to Non-GAAP Reconciliations for the three and nine months ended

September 30, 2024 and 2023.

(1)

This item represents purchase price

amortization expense on all intangible assets acquired through

various Company acquisitions, including customer relationships,

contract value, technology assets, trademarks and trade names. The

Company has excluded the impact of purchase price amortization

expense as such amounts can be significantly impacted by the timing

and/or size of acquisitions. Although the Company excludes these

amounts from its non-GAAP expenses, the Company believes that it is

important for investors to understand that such intangible assets

contribute to revenue generation. Amortization of assets that

relate to past acquisitions will recur in future periods until such

assets have been fully amortized. Any future acquisitions may

result in the amortization of future assets.

(2)

This item represents costs comprised of

the following:

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Continuing operations:

Acquisition and integration

$

22

$

12

$

70

$

21

Enterprise transformation, including

Future Forward and platform modernization

76

79

205

223

Severance and other termination

expenses

7

6

34

48

Separation of the Worldpay Merchant

Solutions business

9

5

119

7

Incremental stock compensation directly

attributable to specific programs

20

9

46

13

Other, including divestiture-related

expenses and enterprise cost control and other initiatives

3

2

7

14

Subtotal

137

113

481

326

Accelerated amortization (a)

—

5

—

23

Total from continuing operations

$

137

$

118

$

481

$

349

Discontinued operations:

Acquisition and integration

$

—

$

4

$

—

$

11

Enterprise transformation, including

Future Forward and platform modernization

—

7

1

16

Severance and other termination

expenses

—

1

1

10

Separation of the Worldpay Merchant

Solutions business

—

68

8

97

Incremental stock compensation directly

attributable to specific programs

—

4

—

6

Other, including divestiture-related

expenses and enterprise cost control and other initiatives

—

2

3

—

Subtotal

—

86

13

140

Accelerated amortization (a)

—

—

—

14

Total from discontinued operations

$

—

$

86

$

13

$

154

Total consolidated

$

137

$

204

$

494

$

503

Amounts in table may not sum due to

rounding.

(a) For purposes of calculating Adjusted net earnings, this

item includes incremental amortization expense associated with

shortened estimated useful lives and accelerated amortization

methods for certain software and deferred contract cost assets

driven by the Company's platform modernization. The incremental

amortization expenses are included in the Depreciation and

amortization, excluding purchase accounting amortization line item

within the Adjusted EBITDA reconciliation.

(3)

For the three and nine months ended

September 30, 2024 and 2023, this item includes impairments

primarily related to the termination of certain internally

developed software projects. For the nine months ended September

30, 2023, this item also includes a $6.8 billion impairment of

goodwill related to the Merchant Solutions reporting unit in its

earnings from discontinued operations.

(4)

For the three and nine months ended

September 30, 2023, this item includes a $1.5 billion reduction of

the Worldpay Merchant Solutions disposal group's carrying value,

recorded in discontinued operations, primarily as a result of the

exclusion from the carrying value of the disposal group of certain

deferred tax liabilities that will continue to be held by FIS after

the disposal, which caused the carrying value to exceed the

estimated fair value of the disposal group.

(5) This item represents costs that were incurred in support

of the Worldpay Merchant Solutions business prior to the separation

but are not directly attributable to it and thus were not recorded

in discontinued operations. The Company expects that it will be

reimbursed for these expenses as part of Transition Services

Agreements with the purchaser or eliminate them post separation;

therefore, the expenses have been adjusted out of continuing

operations and added to discontinued operations. (6)

Non-operating (income) expense primarily consists of other income

and expense items outside of the Company's operating activities,

including fair value adjustments on certain non-operating assets

and liabilities and foreign currency transaction remeasurement

gains and losses. For the nine months ended September 30, 2024,

earnings from continuing operations also includes loss on

extinguishment of debt of approximately $174 million relating to

tender discounts and fees; the write-off of unamortized bond

discounts, debt issuance costs and fair value basis adjustments;

and gains on related derivative instruments. For the nine months

ended September 30, 2023, this item also includes $32 million of

impairment on an equity security investment which the Company

agreed to sell for less than its carrying value. (7) This

adjustment is based on an adjusted effective tax rate of 14.5% and

14.0% for the periods ended September 30, 2024 and 2023,

respectively, which reflects adjustments to our GAAP effective tax

rate to take into account primarily certain cash tax benefits from

our equity method investment in Worldpay. For the nine months ended

September 30, 2024, the Company recorded a tax benefit of $991

million in its earnings from discontinued operations primarily from

the write-off of U.S. deferred tax liabilities that were not

transferred in the Worldpay Sale, net of the estimated U.S. tax

cost that the Company expects to incur as a result of the Worldpay

Sale. This adjustment includes the removal of the impact of this

tax benefit from our earnings from discontinued operations for this

period. (8) FIS completed the separation of Worldpay on

January 31, 2024, retaining a non-controlling 45% ownership

interest that is recorded under the equity method of accounting.

FIS' share of Worldpay's results under the equity method of

accounting reflects activity beginning on February 1, 2024.

(9) This item represents FIS' proportionate share of Worldpay's

non-GAAP adjustments on its earnings (loss) consistent with FIS'

non-GAAP measures and is comprised of the following:

Three months ended

September 30, 2024

Eight months ended

September 30, 2024

FIS' share of Worldpay:

Purchase accounting amortization

$

133

$

442

Acquisition, integration and other costs

(a)

28

139

Non-operating (income) expense

47

27

Non-GAAP tax (provision) benefit

(36

)

(104

)

Non-GAAP adjustments on equity method

investment earnings (loss), net of related (provision) benefit for

income taxes

$

172

$

504

Amounts in table may not sum due to

rounding.

(a) Worldpay acquisition, integration, and

other costs for the three months and eight months ended September

30, 2024, consist primarily of transaction and transition costs

related to the separation from FIS.

(10) The Company stopped recording depreciation and

amortization on the long-lived assets classified as held for sale

beginning July 5, 2023. The amount of depreciation and amortization

that would have been recorded in discontinued operations had these

assets not been classified as held for sale has been deducted from

adjusted net earnings for comparability purposes. (11) An

initial loss on sale of disposal group of $466 million was recorded

upon closing of the Worldpay Sale to reflect the impact of the

excess of the carrying value of the disposal group over the

estimated fair value less cost to sell. During the three months

ended September 30, 2024, an additional $25 million estimated loss

on sale was recorded to reflect the impact of estimated

post-closing adjustments, reflecting a cumulative estimated loss on

sale of $491 million. (12) For the three and nine months

ended September 30, 2023, Adjusted net earnings is a gain, while

the corresponding GAAP amount for this period is a loss. As a

result, in calculating Adjusted net earnings per share-diluted for

this period, the weighted average shares outstanding-diluted amount

of approximately 594 million and 594 million used in the

calculation includes approximately 2 million and 2 million shares

for the three and nine months ended September 30, 2023,

respectively, that in accordance with GAAP are excluded from the

calculation of the GAAP Net loss per share-diluted for the periods,

due to their anti-dilutive impact.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION — UNAUDITED

(In millions)

Exhibit H

The Company completed the Worldpay Sale on

January 31, 2024. The results of the Worldpay Merchant Solutions

business prior to the completion of the Worldpay Sale have been

presented as discontinued operations. The following table

represents a reconciliation of the major components of Earnings

(loss) from discontinued operations, net of tax, presented in the

consolidated statements of earnings (loss), reflecting activity

through January 31, 2024 (the date the Worldpay Sale closed) (in

millions). The Company's presentation of earnings (loss) from

discontinued operations excludes general corporate overhead costs

that were historically allocated to the Worldpay Merchant Solutions

business. Additionally, beginning on July 5, 2023, the Company

stopped amortization of long-lived assets held for sale in

accordance with ASC 360.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Major components of earnings (loss) from

discontinued operations before income taxes:

Revenue

$

3

$

1,201

$

409

$

3,636

Cost of revenue

(4

)

(193

)

(68

)

(1,462

)

Selling, general, and administrative

expenses

—

(520

)

(155

)

(1,486

)

Asset impairments

—

(4

)

—

(6,843

)

Interest income (expense), net

1

4

2

15

Other, net

—

(30

)

(4

)

17

Earnings (loss) from discontinued

operations related to major components of pretax earnings

(loss)

—

458

184

(6,123

)

Loss on assets held for sale (1)

—

(1,549

)

—

(1,549

)

Loss on sale of disposal group (2)

(25

)

—

(491

)

—

Earnings (loss) from discontinued

operations

(25

)

(1,091

)

(307

)

(7,672

)

Provision (benefit) for income taxes

(2)

(3

)

(382

)

(994

)

(327

)

Earnings (loss) from discontinued

operations, net of tax attributable to FIS

$

(22

)

$

(709

)

$

687

$

(7,345

)

(1)

Loss on assets held for sale includes a

$1.5 billion reduction of the Worldpay Merchant Solutions disposal

group's carrying value, recorded in discontinued operations,

primarily as a result of the exclusion from the carrying value of

the disposal group of certain deferred tax liabilities that will

continue to be held by FIS after the disposal, which caused the

carrying value to exceed the estimated fair value of the disposal

group.

(2)

An initial loss on sale of disposal group

of $466 million was recorded upon closing of the Worldpay Sale to

reflect the impact of the excess of the carrying value of the

disposal group over the estimated fair value less cost to sell.

During the three months ended September 30, 2024, an additional $25

million estimated loss on sale was recorded to reflect the impact

of estimated post-closing adjustments, reflecting a cumulative

estimated loss on sale of $491 million. Upon closing of the

Worldpay Sale, the Company also recorded a tax benefit of $991

million primarily from the write-off of U.S. deferred tax

liabilities that were not transferred in the Worldpay Sale, net of

the estimated U.S. tax cost that the Company expects to incur as a

result of the Worldpay Sale. The estimated U.S. tax cost remains

unchanged based on available data and management determinations as

of September 30, 2024. Post-closing selling price adjustments and

completion of other purchase agreement provisions in connection

with the Worldpay Sale could result in further adjustments to the

loss on sale amount and the estimated U.S. tax cost.

FIDELITY NATIONAL INFORMATION

SERVICES, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION OF WORLDPAY HOLDCO, LLC — UNAUDITED

(In millions)

Exhibit I

Summary Worldpay Holdco, LLC financial

information is as follows:

Three months ended

September 30, 2024

Eight months ended

September 30, 2024 (1)

Revenue

$

1,248

$

3,429

Gross profit

$

718

$

1,771

Earnings (loss) before income taxes

$

(99

)

$

(326

)

Net earnings (loss) attributable to

Worldpay Holdco, LLC

$

(160

)

$

(431

)

FIS share of net earnings (loss)

attributable to Worldpay Holdco, LLC, net of tax (2)

$

(33

)

$

(110

)

The following is a GAAP to Non-GAAP

reconciliation of Adjusted EBITDA for Worldpay Holdco LLC.

Three months ended

September 30, 2024

Eight months ended

September 30, 2024 (1)

Net earnings (loss) attributable to

Worldpay Holdco, LLC

$

(160

)

$

(431

)

Provision (benefit) for income taxes

60

102

Interest expense, net

146

410

Other, net

106

65

Operating income (loss)

152

146

Depreciation and amortization, excluding

purchase accounting amortization

23

52

Non-GAAP adjustments:

Purchase accounting amortization

295

982

Transition, acquisition, integration and

other costs (3)

62

308

Adjusted EBITDA

$

532

$

1,488

(1)

FIS completed the separation of Worldpay

on January 31, 2024. Accordingly, Worldpay's results reflects

activity beginning on February 1, 2024.

(2)

Amount includes our share of the net

income attributable to Worldpay and our investor-level tax benefit

of $39 million and $84 million for the three and eight months ended

September 30, 2024, respectively, and is reported as equity method

investment earnings (loss), net of tax on our consolidated

statement of earnings.

(3)

This item represents primarily transaction

and transition costs associated with the separation of Worldpay

from FIS.

FIDELITY NATIONAL INFORMATION SERVICES,

INC.

REVISION OF PREVIOUSLY ISSUED CONSOLIDATED

FINANCIAL STATEMENTS AND SUPPLEMENTAL NON-GAAP FINANCIAL

INFORMATION — UNAUDITED

(In millions)

Exhibit J

Revision of Previously Issued Consolidated Financial

Statements

During the third quarter of 2024, we identified immaterial

non-cash misstatements affecting the Company's previously issued

consolidated financial statements as of and for the annual periods

ended December 31, 2023 and 2022, and the quarterly periods ended

March 31 and June 30, 2024. The misstatements related primarily to

the timing of the recognition of expenses associated with

inventory-related accruals, along with their related balance sheet

impacts, and the presentation of certain value-added tax balances

in the consolidated financial statements. We have revised our

prior-period financial statements to correct these misstatements as

well as other unrelated immaterial misstatements, including

adjustments to Revenue and Other income (expense), net. The

revisions ensure comparability across all periods reflected in the

consolidated financial statements. The GAAP diluted EPS net impact

of these prior-period revisions is a $0.04 decrease to the six

months ended June 30, 2024, no change for fiscal year 2023 and a

$0.05 decrease for fiscal year 2022. The non-GAAP diluted EPS net

impact of these prior-period revisions is a $0.02 decrease for the

six months ended June 30, 2024, a $0.03 decrease for fiscal year

2023 and a $0.06 decrease for fiscal year 2022. The revisions had

no impact to adjusted free cash flow. A summary of the revisions to

the previously reported results is provided below.

The following tables sets forth our revisions to the

Consolidated Statement of Earnings/(Loss) for each of the periods

indicated.

Six months ended June 30,

2023

Six months ended June 30,

2024

For the year ended December

31, 2022

For the year ended December

31, 2023

As reported

Adjustment

As revised

As reported

Adjustment

As revised

As reported

Adjustment

As revised

As reported

Adjustment

As revised

Revenue

$

4,821

$

6

$

4,826

$

4,957

$

1

$

4,958

$

9,719

$

1

$

9,720

$

9,821

$

10

$

9,831

Cost of revenue

3,086

16

3,102

3,091

15

3,106

6,216

43

6,259

6,145

30

6,175

Operating income

661

(10

)

651

739

(14

)

725

1,218

(42

)

1,176

1,467

(20

)

1,447

Other income (expense), net

(113

)

28

(86

)

(167

)

(17

)

(184

)

4

(2

)

2

(183

)

18

(164

)

Earnings (loss) before income taxes and

equity method investment earnings (loss)

246

18

263

452

(31

)

421

941

(44

)

898

663

(2

)

662

Provision (benefit) for income tax

65

5

69

116