Corning Incorporated (NYSE:GLW) today announced results for the

first quarter of 2009, as well as its expectations for the second

quarter.

First-Quarter Highlights

- Sales were $989 million, a 9%

decrease sequentially.

- Earnings per share (EPS) were

$0.01. Excluding special items, EPS were $0.10,* down 23%

sequentially.

- Display Technologies combined

LCD glass volume, including Corning�s wholly owned business and

Samsung Corning Precision Glass Co., Ltd. (SCP), increased 4%

sequentially. Volume in the company�s wholly owned business was

down 1% sequentially, while SCP�s volume was up about 7%.

- Gross margin was 27%, slightly

lower than fourth-quarter gross margin of 28%.

- Corporate restructuring charges

were $165 million pretax and in line with expectations.

Quarter One Financial

Comparisons

� �

Q1 2009 � �

Q4 2008 � �

% Change � �

Q1

2008 � �

% Change Net Sales in millions �

$989 �

�

$1,084 � �

(9%) � �

$1,617 � �

(39%)

Net Income in millions �

$14 � �

$249 � �

(94%) � �

$1,029 � �

(99%) Non-GAAP Net Income

in millions*

�

$150 � �

$208 � �

(28%) � �

$702 � �

(79%) GAAP EPS �

$0.01 � �

$0.16 � �

(94%) � �

$0.64 � �

(98%) Non-GAAP EPS* �

$0.10 � �

$0.13 � �

(23%) � �

$0.44 � �

(77%)

*These are non-GAAP financial measures. The reconciliation

between GAAP and non-GAAP measures is provided in the tables

following this news release, as well as on the company�s investor

relations website.

�We were very pleased with our first-quarter performance given

the high level of economic uncertainty we were facing,� Wendell P.

Weeks, chairman and chief executive officer, said. �The biggest

questions we had coming into the first quarter were first, would

the strong LCD TV sales rate continue in this tough environment,

and second, when would the display supply chain contraction end? It

was satisfying to see the continued strength of LCD TV sales at

retail worldwide throughout the first quarter. We were also pleased

to see demand for our glass pick up sooner than we anticipated, an

indication that the display supply chain contraction was ending.

These contributed to stronger-than-expected sales and earnings

performance this quarter.�

First-Quarter Segment Results

Sales in the Display Technologies segment were $357 million,

down 8% sequentially. Sequential price declines were significant,

but in line with the company�s expectations. Positive foreign

exchange rate movements basically offset the slight volume decline

in the wholly owned business.

Telecommunications segment sales were $385 million, down 5%

sequentially. Stronger optical fiber, cable and private network

demand in China was offset by lower private network, cable, and

hardware and equipment sales in North America.

Environmental Technologies segment sales were $110 million, down

14% sequentially, mirroring the difficulties experienced in the

global automotive industry and continued weakness in heavy-duty

diesel sales in the U.S.

Corning�s equity earnings were $195 million, down significantly

from last year�s fourth-quarter equity earnings of $288 million.

Equity earnings from Dow Corning Corporation were $5 million, an

appreciable decline from the fourth quarter. First-quarter equity

earnings from Dow Corning include $29 million in restructuring

charges. Samsung Corning Precision�s equity earnings contribution

was $187 million, down 2% versus the fourth quarter of last year.

Volume gains were more than offset by price declines, which were

higher than Corning�s wholly owned business.

Looking Forward

James B. Flaws, vice chairman and chief financial officer, said,

�While economic uncertainty remains, we are expecting strong growth

in display as our customers continue to ramp their capacity to

match end market demand. We anticipate sequential volumes at our

wholly owned business to be up more than 50% and up more than 25%

at SCP. Therefore, we foresee relighting several of our glass

melting tanks sooner than planned.

�With increased volume and manufacturing capacity,� he

continued, �we should see considerable improvement in both the

display segment�s and the company�s gross margins in the second

quarter.� He noted that up through the end of the first quarter,

Corning used existing inventory to meet the increase in glass

demand. The company expects second-quarter glass price declines at

both its wholly owned business and SCP to be much more moderate

compared to the first quarter.

The company has increased its estimate for the 2009 LCD glass

market from 2 billion square feet to a range of 2.1 billion to 2.2

billion square feet. The change was driven by

stronger-than-anticipated demand for LCD TVs, offset slightly by

weaker-than-expected demand for notebook computers. The company now

expects LCD TV units to grow 18% this year versus its original

expectation of 9%.

Corning expects modest sequential growth in its other business

segments in the second quarter. Also, Dow Corning has seen

improving monthly sales which could lead to notably better results

for its earnings.

Flaws reminded investors that the company is not providing

specific sales or earnings guidance for the second quarter.

�However,� he said, �We expect to see significant sequential

improvement in the company�s sales, gross margin, and earnings

before special items.* Second-quarter results will also benefit

from our recently completed fixed cost reduction programs.�

He pointed out that Corning acted decisively to resize the

company�s cost structure in line with $5 billion in sales this

year. �As we said previously, if we do not see continued growth

into the second half of this year, we will consider taking further

corporate-wide restructuring actions to improve profitability.�

In concluding his comments, Flaws said, �We are encouraged by

the early market interest and growth opportunities for some of our

recent product innovations. A good example is Gorilla� glass, our

durable glass for touch screen and electronic applications. Gorilla

glass has already been designed into 20 different electronic

devices including both cell phones and notebook computers from more

than seven separate manufacturers. We believe Corning has the right

product mix and is well positioned in core markets to seize the

upside when economic growth returns.�

First-Quarter Conference Call Information

The company will host a first-quarter conference call on Monday,

April 27 at 8:30 a.m. ET. To access the call, dial (800) 398-9379,

or international access call (612) 288-0329 approximately 10 - 15

minutes prior to the start of the call. The password is �QUARTER

ONE�. The host is �SOFIO�. To listen to a live audio webcast of the

call, go to http://www.corning.com/investor_relations and follow

the instructions. A replay will be available beginning at 10:30

a.m. ET and will run through 5:00 p.m. ET, Monday, May 11 2009. To

listen, dial (800) 475-6701 or for international access dial (320)

365-3844. The access code is 994513. The webcast will be archived

for one year following the call.

Presentation of Information in this News Release

Non-GAAP financial measures are not in accordance with, or an

alternative to, GAAP. Corning�s non-GAAP net income and EPS

measures exclude restructuring, impairment and other charges and

adjustments to prior estimates for such charges. Additionally, the

company�s non-GAAP measures exclude adjustments to asbestos

settlement reserves, gains and losses arising from debt

retirements, charges or credits arising from adjustments to the

valuation allowance against deferred tax assets, equity method

charges resulting from impairments of equity method investments or

restructuring, impairment or other charges taken by equity method

companies and gains from discontinued operations. The company

believes presenting non-GAAP net income and EPS measures is helpful

to analyze financial performance without the impact of unusual

items that may obscure trends in the company�s underlying

performance. These non-GAAP measures are reconciled on the

company�s Web site at www.corning.com/investor_relations and

accompany this news release.

About Corning Incorporated

Corning Incorporated (www.corning.com) is the world leader in

specialty glass and ceramics. Drawing on more than 150 years of

materials science and process engineering knowledge, Corning

creates and makes keystone components that enable high-technology

systems for consumer electronics, mobile emissions control,

telecommunications and life sciences. Our products include glass

substrates for LCD televisions, computer monitors and laptops;

ceramic substrates and filters for mobile emission control systems;

optical fiber, cable, hardware & equipment for

telecommunications networks; optical biosensors for drug discovery;

and other advanced optics and specialty glass solutions for a

number of industries including semiconductor, aerospace, defense,

astronomy and metrology.

Forward-Looking and Cautionary Statements

This press release contains �forward-looking statements� (within

the meaning of the Private Securities Litigation Reform Act of

1995), which are based on current expectations and assumptions

about Corning�s financial results and business operations, that

involve substantial risks and uncertainties that could cause actual

results to differ materially. These risks and uncertainties

include: the effect of global political, economic and business

conditions;�conditions in the�financial and credit

markets;�currency fluctuations;�tax rates; product demand and

industry capacity; competition; reliance on a concentrated customer

base; manufacturing efficiencies; cost reductions; availability of

critical components and materials; new product commercialization;

pricing fluctuations�and�changes in the mix of sales between

premium and non-premium products; new plant start-up�or

restructuring�costs; possible disruption in commercial activities

due to terrorist activity, armed conflict, political instability or

major health concerns; adequacy of insurance; equity company

activities; acquisition and divestiture activities; the level of

excess or obsolete inventory; the rate of technology change; the

ability to enforce patents; product and components performance

issues; stock price fluctuations; and adverse litigation or

regulatory developments.�These and other�risk factors

are�detailed�in Corning�s filings with the Securities and Exchange

Commission. Forward-looking statements speak only as of the day

that they are made, and Corning undertakes no obligation to update

them in light of new information or future events.

� �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited; in millions, except

per share amounts)

� � Three months ended March 31, 2009 2008 � Net sales $ 989 $

1,617 Cost of sales � 719 � � 773 � � Gross margin 270 844 �

Operating expenses: Selling, general and administrative expenses

207 242 Research, development and engineering expenses 151 151

Amortization of purchased intangibles 3 2 Restructuring, impairment

and other charges and (credits) (Note 1) 165 (1 ) Asbestos

litigation charge (credit) (Note 2) � 4 � � (327 ) � Operating

(loss) income (260 ) 777 � Equity in earnings of affiliated

companies (Note 3) 195 312 Interest income 7 30 Interest expense

(14 ) (18 ) Other income, net � 20 � � 2 � � (Loss) income before

income taxes (52 ) 1,103 Benefit (provision) for income taxes � 66

� � (74 ) � Net income attributable to Corning Incorporated $ 14 �

$ 1,029 � � Basic earnings per common share (Note 4) $ 0.01 � $

0.66 � Diluted earnings per common share (Note 4) $ 0.01 � $ 0.64 �

Dividends declared per common share $ 0.05 � $ 0.05 � � See

accompanying notes to these financial statements. � Certain amounts

for 2008 were reclassified to conform to the 2009 presentation. � �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in millions, except

per share amounts)

� March 31, December 31, 2009 2008

Assets � Current assets:

Cash and cash equivalents $ 1,780 $ 1,873 Short-term investments,

at fair value � 805 � � 943 � Total cash, cash equivalents and

short-term investments 2,585 2,816 Trade accounts receivable, net

of doubtful accounts and allowances 593 512 Inventories 731 798

Deferred income taxes 151 158 Other current assets � 379 � � 335 �

Total current assets 4,439 4,619 � Investments 2,435 3,056

Property, net of accumulated depreciation 7,806 8,199 Goodwill and

other intangible assets, net 302 305 Deferred income taxes 3,059

2,932 Other assets � 137 � � 145 � �

Total Assets $ 18,178 �

$ 19,256 � �

Liabilities and Equity � Current liabilities:

Current portion of long-term debt $ 68 $ 78 Accounts payable 542

846 Other accrued liabilities � 982 � � 1,128 � Total current

liabilities 1,592 2,052 � Long-term debt 1,596 1,527 Postretirement

benefits other than pensions 774 784 Other liabilities � 1,521 � �

1,402 � Total liabilities � 5,483 � � 5,765 � � Commitments and

contingencies Shareholders� equity: Common stock - Par value $0.50

per share; Shares authorized: 3.8 billion; Shares issued: 1,612

million and 1,609 million 806 804 Additional paid-in capital 12,576

12,502 Retained earnings 1,876 1,940 Treasury stock, at cost;

Shares held: 63 million and 61 million (1,202 ) (1,160 )

Accumulated other comprehensive loss � (1,409 ) � (643 ) Total

Corning Incorporated shareholders' equity � 12,647 � � 13,443 �

Noncontrolling interest � 48 � � 48 � Total equity � 12,695 � �

13,491 � �

Total Liabilities and Equity $ 18,178 � $ 19,256

� � See accompanying notes to these financial statements. � Certain

amounts for 2008 were reclassified to conform to the 2009

presentation. � �

CORNING INCORPORATED AND SUBSIDIARY

COMPANIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(Unaudited; in millions)

� Three months ended March 31, 2009 2008

Cash Flows from

Operating Activities: Net income attributable to Corning

Incorporated $ 14 $ 1,029 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation 175 157

Amortization of purchased intangibles 3 2 Asbestos litigation 4

(327 ) Restructuring charges (credits) 165 (1 ) Stock compensation

charges 35 41 Undistributed earnings of affiliated companies 208

(161 ) Deferred tax benefit (119 ) (2 ) Restructuring payments (12

) (7 ) Customer deposits, net of (credits) issued (103 ) (66 )

Employee benefit payments less than (in excess of) expense 17 (48 )

Changes in certain working capital items: Trade accounts receivable

(111 ) (50 ) Inventories 39 (32 ) Other current assets (23 ) (21 )

Accounts payable and other current liabilities, net of

restructuring payments (89 ) (224 ) Other, net � 61 � � 5 �

Net

cash provided by operating activities � 264 � � 295 � �

Cash

Flows from Investing Activities: Capital expenditures (276 )

(467 ) Net proceeds from sale or disposal of assets 12 Short-term

investments - acquisitions (104 ) (724 ) Short-term investments -

liquidations � 242 � � 816 �

Net cash used in investing

activities � (126 ) � (375 ) �

Cash Flows from Financing

Activities: Net repayments of short-term borrowings and current

portion of long-term debt (63 ) (9 ) Principal payments under

capital lease obligations (9 ) Proceeds from issuance of common

stock, net 5 4 Proceeds from the exercise of stock options 1 18

Repurchase of common stock (62 ) Dividends paid (78 ) (78 ) Other,

net � 1 � � (2 )

Net cash used in financing activities �

(143 ) � (129 ) Effect of exchange rates on cash � (88 ) � 117 �

Net decrease in cash and cash equivalents (93 ) (92 ) Cash and cash

equivalents at beginning of period � 1,873 � � 2,216 � �

Cash

and cash equivalents at end of period $ 1,780 � $ 2,124 � �

Certain amounts for 2008 were reclassified to conform with the 2009

presentation. � �

CORNING INCORPORATED AND SUBSIDIARY

COMPANIES

SEGMENT RESULTS

(Unaudited; in millions)

� � � � � � � Our reportable operating segments include Display

Technologies, Telecommunications, Environmental Technologies,

Specialty Materials and Life Sciences. � � Display Telecom-

Environmental Specialty Life All Technologies munications

Technologies Materials Sciences Other Total �

Three months

ended March 31, 2009 Net sales $ 357 $ 385 $ 110 $ 60 $

76 $ 1 $ 989 Depreciation (1) $ 104 $ 31 $ 24 $ 10 $ 4 $ 3 $ 176

Amortization of purchased intangibles $ 3 $ 3 Research, development

and engineering expenses (2) $ 22 $ 23 $ 30 $ 11 $ 3 $ 36 $ 125

Restructuring, impairment and other charges $ 34 $ 15 $ 19 $ 18 $ 7

$ 4 $ 97 Equity in earnings (loss) of affiliated companies $ 180 $

(4 ) $ 2 $ 12 $ 190 Income tax (provision) benefit (3) $ (7 ) $ 1 �

$ 14 � $ 10 � � � $ 7 � $ 25 � Net income (loss) (4) $ 218 � $ (1 )

$ (44 ) $ (27 ) $ 8 � $ (29 ) $ 125 � �

Three months ended

March 31, 2008 Net sales $ 829 $ 421 $ 197 $ 83 $ 81 $ 6 $

1,617 Depreciation (1) $ 90 $ 27 $ 24 $ 8 $ 4 $ 3 $ 156

Amortization of purchased intangibles $ 2 $ 2 Research, development

and engineering expenses (2) $ 24 $ 24 $ 33 $ 9 $ 2 $ 36 $ 128

Restructuring, impairment and other credits $ (1 ) $ (1 ) Equity in

earnings of affiliated companies $ 207 $ 1 $ 22 $ 230 Income tax

provision $ (61 ) $ (5 ) $ (5 ) � � $ (5 ) $ (2 ) $ (78 ) Net

income (loss) (4) $ 679 � $ 11 � $ 13 � $ (4 ) $ 10 � $ (27 ) $ 682

� (1) � Depreciation expense for Corning�s reportable segments

includes an allocation of depreciation of corporate property not

specifically identifiable to a segment. � (2) Research,

development, and engineering expenses includes direct project

spending which is identifiable to a segment. � (3) Effective

January 1, 2009, we began providing U.S. income tax expense (or

benefit) on U.S. earnings (losses) due to the change in our

conclusion about the realizability of our U.S. deferred tax assets

in 2008. As a result of the change in our tax position, we adjusted

the allocation of taxes to our operating segments in 2009 to

reflect this difference. � (4) Many of Corning�s administrative and

staff functions are performed on a centralized basis. Where

practicable, Corning charges these expenses to segments based upon

the extent to which each business uses a centralized function.

Other staff functions, such as corporate finance, human resources

and legal are allocated to segments, primarily as a percentage of

sales. � �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

SEGMENT RESULTS

(Unaudited; in millions)

� � A reconciliation of reportable segment net income to

consolidated net income follows (in millions): � � � � � � � Three

months ended March 31, � � 2009 � 2008 Net income of reportable

segments $ 154 $ 709 Non-reportable segments (29 ) (27 )

Unallocated amounts: Net financing costs (1) (20 ) 9 Stock-based

compensation expense (35 ) (41 ) Exploratory research (20 ) (18 )

Corporate contributions (9 ) (11 ) Equity in earnings of affiliated

companies (2) 5 82 Asbestos litigation (3) (4 ) 327 Other corporate

items (4) � � (28 ) � � (1 ) Net income � $ 14 � � $ 1,029 � (1) �

Net financing costs include interest income, interest expense, and

interest costs and investment gains associated with benefit plans.

� (2) Represents the equity of Dow Corning Corporation. In the

first quarter of 2009, equity earnings of affiliated companies, net

of impairments includes a charge of $29 million representing

restructuring charges at Dow Corning Corporation. � (3) In the

first quarter of 2008, Corning reduced its liability for asbestos

litigation as a result of the increase in the likelihood of a

settlement under recently proposed terms and a corresponding

decrease in the likelihood of a settlement under terms established

in 2003. � (4) In the first quarter of 2009, other corporate items

included $68 million ($44 million after-tax) of restructuring

charges. � �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

� �

1. Restructuring � In the first quarter of 2009,

Corning recorded a charge of $165 million ($107 million after-tax),

which was comprised primarily of severance costs, special

termination benefits and outplacement services for a corporate-wide

restructuring plan. �

2. Asbestos Litigation � On

March 28, 2003, Corning announced that it had reached agreement

with the representatives of asbestos claimants for the settlement

of all current and future asbestos claims against Corning and

Pittsburgh Corning Corporation (PCC) which might arise from PCC

products or operations (the 2003 Plan). On December 21, 2006, the

Bankruptcy Court issued an order denying confirmation of the 2003

Plan. On January 10, 2008, some of the parties in the proceeding

advised the Bankruptcy Court that they had made substantial

progress on an amended plan of reorganization (the Amended PCC

Plan) that resolved issues raised by the Court in denying the

confirmation of the 2003 Plan. � As a result of progress in the

parties� continuing negotiations, Corning believes the Amended PCC

Plan now represents the most probable outcome of this matter and

the probability that the 2003 plan will become effective has

diminished. The proposed settlement under the Amended PCC Plan

requires Corning to contribute its equity interest in PCC and

Pittsburgh Corning Europe, N.V. (PCE) and to contribute a fixed

series of cash payments, recorded at present value on December 31,

2008. Corning will have the option to contribute shares rather than

cash, but the liability is fixed by dollar value and not number of

shares. As a result, the estimated asbestos litigation liability is

no longer impacted by movements in the value of Corning common

stock. The Amended PCC Plan does not include non-PCC asbestos

claims that may be or have been raised against Corning. Corning has

recorded an additional amount for such claims in its estimated

asbestos litigation liability. � In the first quarter of 2009, we

recorded charges of $4 million ($2 million after-tax) to adjust the

asbestos litigation liability for the change in value of the

components of the Amended PCC Plan. �

3. Equity in

Earnings of Affiliated Companies �

In the first quarter of 2009,

equity in earnings of affiliated companies included charges of $29

million ($27 million after-tax) for Corning�s share of the

restructuring charges at Dow Corning Corporation.

�

4. Weighted Average Shares Outstanding � Weighted

average shares outstanding are as follows (in millions): � �

Three months ended Three months ended

�������������March

31,�������������

December 31,

����2009����

����2008����

����2008����

� Basic 1,548 1,566 1,546 Diluted 1,559 1,598 1,559

Diluted used for non-GAAP

measures

1,559 1,598 1,559 � �

CORNING INCORPORATED AND SUBSIDIARY

COMPANIES

QUARTERLY SALES

INFORMATION

(Unaudited; in millions)

� � � � � �

2009 2008 Q1 Q1 Q2

Q3 Q4 Total �

Display Technologies $

357 $ 829 $ 809 $ 696 $ 390 $ 2,724 �

Telecommunications

Fiber and cable 192 214 248 258 200 920 Hardware and equipment �

193 � 207 � 229 � 238 � 205 � 879 385 421 477 496 405 1,799 �

Environmental Technologies Automotive 64 137 132 112 77 458

Diesel � 46 � 60 � 77 � 65 � 51 � 253 110 197 209 177 128 711 �

Specialty Materials 60 83 104 101 84 372 �

Life

Sciences 76 81 87 83 75 326 �

Other � 1 � 6 � 6 � 2 � 2

� 16 �

Total $ 989 $ 1,617 $ 1,692 $ 1,555 $ 1,084 $ 5,948 �

The above supplemental information is intended to facilitate

analysis of Corning�s businesses. � �

CORNING INCORPORATED AND

SUBSIDIARY COMPANIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE TO GAAP FINANCIAL MEASURE

Three Months Ended March 31,

2009

(Unaudited; amounts in millions,

except per share amounts)

� � � � � � � � � � � � � � Corning�s net income and earnings per

share (EPS) excluding special items for the first quarter of 2009

are non-GAAP financial measures within the meaning of Regulation G

of the Securities and Exchange Commission. Non-GAAP financial

measures are not in accordance with, or an alternative to,

generally accepted accounting principles (GAAP). The company

believes presenting non-GAAP net income and EPS is helpful to

analyze financial performance without the impact of unusual items

that may obscure trends in the company�s underlying performance. A

detailed reconciliation is provided below outlining the differences

between these non-GAAP measures and the directly related GAAP

measures. �

Per

Share

Income (Loss)

Before

Income Taxes

Net

Income

� Earnings per share (EPS) and net income, excluding special items

$ 0.10 $ 146 $ 150 � Special items: Restructuring charges (a) (0.07

) (165 ) (107 ) � Asbestos litigation (b) (4 ) (2 ) � Equity in

earnings of affiliated companies (c) � (0.02 ) � (29 ) � (27 ) �

Total EPS and net income $ 0.01 � $ (52 ) $ 14 � � �

(a)�

In the first quarter of 2009, Corning recorded a charge of $165

million ($107 million after-tax), which was comprised primarily of

severance costs, special termination benefits and outplacement

services for a corporate-wide restructuring plan. �

(b)�

In the first quarter of 2009, Corning recorded a charge of $4

million ($2 million after-tax) to adjust the asbestos liability for

change in value of the components of the Amended PCC Plan. �

(c)�

In the first quarter of 2009, equity in earnings of affiliated

companies included a charge of $29 million ($27 million after-tax)

for our share of the restructuring charges at Dow Corning

Corporation. � �

CORNING INCORPORATED AND SUBSIDIARY

COMPANIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE TO GAAP FINANCIAL MEASURE

Three Months Ended March 31,

2008

(Unaudited; amounts in millions,

except per share amounts)

� � � � � � � � � � � � � Corning�s net income and earnings per

share (EPS) excluding special items for the first quarter of 2008

are non-GAAP financial measures within the meaning of Regulation G

of the Securities and Exchange Commission. Non-GAAP financial

measures are not in accordance with, or an alternative to,

generally accepted accounting principles (GAAP). The company

believes presenting non-GAAP net income and EPS is helpful to

analyze financial performance without the impact of unusual items

that may obscure trends in the company�s underlying performance. A

detailed reconciliation is provided below outlining the differences

between these non-GAAP measures and the directly related GAAP

measures. �

Per

Share

Income Before

Income Taxes

Net

Income

� Earnings per share (EPS) and net income, excluding special items

$ 0.44 $ 463 $ 702 � Special items: Asbestos litigation (a) � 0.20

� 327 � 327 � Total EPS and net income $ 0.64 $ 790 $ 1,029 � �

(a) In the first quarter of 2008,

Corning recorded a credit of $327 million (before- and after-tax)

to adjust the asbestos liability from $1 billion

to $675 million, including the

components of the Amended PCC Plan and the estimated liability for

non-PCC asbestos claims.

�

� �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE TO GAAP FINANCIAL MEASURE

Three Months Ended December 31,

2008

(Unaudited; amounts in millions,

except per share amounts)

� � � � � � � � � � � � � � Corning�s net income and earnings per

share (EPS) excluding special items for the fourth quarter of 2008

are non-GAAP financial measures within the meaning of Regulation G

of the Securities and Exchange Commission. Non-GAAP financial

measures are not in accordance with, or an alternative to,

generally accepted accounting principles (GAAP). The company

believes presenting non-GAAP net income and EPS is helpful to

analyze financial performance without the impact of unusual items

that may obscure trends in the company�s underlying performance. A

detailed reconciliation is provided below outlining the differences

between these non-GAAP measures and the directly related GAAP

measures. � �

Per

Share

Loss BeforeIncome Taxes

Net

Income

� Earnings per share (EPS) and net income, excluding special items

$ 0.13 $ (51) $ 208 � Special items: Asbestos litigation (a) 0.02

28 28 � Restructuring, impairment, and other charges (b) (0.01)

(22) (21) � Available-for-sale securities (c) (0.01) (11) (11) �

Valuation allowance release (d) � 0.03 � � � 45 � Total EPS and net

income $ 0.16 $ (56) $ 249 � �

(a)�

In the fourth quarter of 2008, Corning recorded a credit of $28

million (before- and after-tax) to adjust the asbestos liability

for the change in value of certain components of the Amended PCC

Plan and the estimated liability for non-PCC asbestos claims. �

(b)�

In the fourth quarter of 2008, Corning recorded a charge of $22

million ($21 million after-tax) comprised primarily of severance

costs for a restructuring plan in the Telecommunications segment. �

(c)�

In the fourth quarter of 2008, Corning recorded a loss of $11

million (before- and after-tax) on certain available-for-sale

securities included in cash and short-term investments. �

(d)�

In the fourth quarter of 2008, Corning recorded a deferred tax

asset valuation allowance release of $45 million resulting from a

change in our estimate of current-year U.S. taxable income. � �

CORNING INCORPORATED AND SUBSIDIARY COMPANIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE TO GAAP FINANCIAL MEASURE

Three Months Ended March 31,

2009 and December 31, 2008

(Unaudited; amounts in

millions)

� � � � � � � � � Corning�s free cash flow financial measure for

the three months ended March 31, 2009 and December 31, 2008 are

non-GAAP financial measures within the meaning of Regulation G of

the Securities and Exchange Commission. Non-GAAP financial measures

are not in accordance with, or an alternative to, generally

accepted accounting principles (GAAP). The company believes

presenting non-GAAP financial measures are helpful to analyze

financial performance without the impact of unusual items that may

obscure trends in the company�s underlying performance. A detailed

reconciliation is provided below outlining the differences between

this non-GAAP measure and the directly related GAAP measures. � �

Three Three months ended months ended

March 31, 2009

December 31, 2008 � Cash flows from operating activities $

264 $ 380 � Less: Cash flows from investing activities (126 )

(1,138 ) � Plus: Short-term investments - acquisitions 104 567 �

Less: Short-term investments - liquidations � (242 ) � (193 ) �

Free cash flow $ -- � $ (384 )

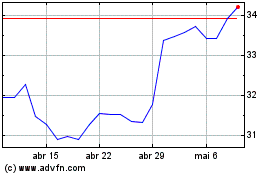

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

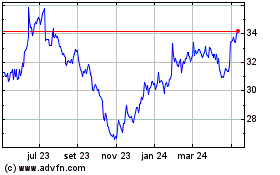

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024