Corning Sees Continued Strength in LCD Market

09 Dezembro 2009 - 11:00AM

Business Wire

Corning Incorporated (NYSE:GLW) today will announce that

continued strength in worldwide LCD television sales has led to an

increase in the company’s fourth-quarter glass substrate volume

expectations, and an improved outlook on 2010 glass market growth.

These improved estimates will be provided by Corning Vice Chairman

and Chief Financial Officer James B. Flaws in remarks to be

delivered at the Barclays Capital Global Technology Conference in

San Francisco.

Flaws will tell investors that “lights are green in display,”

noting that worldwide LCD TV year-over-year October sales increased

45%, the second-highest monthly growth rate of the year. He will

point out that the October sales strength occurred in all major TV

markets, with LCD TV unit sales up 28% in the U.S., 20% in Europe,

115% in China, and 73% in Japan. “In the U.S., LCD TV sales

remained strong throughout all of November, including the week of

Black Friday,” Flaws will say. The retail data is the result of

reports from a variety of independent consumer market research

organizations (NPD, GFK, BCN, and CMM) and the company’s internal

analysis.

“As a result,” Flaws will say, “panel makers continue to run at

high utilization rates in the fourth quarter and glass supply is

very tight. We expect glass demand to remain this way through the

remainder of the quarter. Therefore, we are raising our

fourth-quarter volume estimates to flat to up slightly.” Previously

the company said fourth-quarter volume could be flat to down

slightly. Estimates include both Corning’s wholly owned business

and Samsung Corning Precision Glass Co., Ltd., Corning’s equity

affiliate in Korea. “Fourth-quarter demand is strong enough that if

we could produce more glass, we would be able to sell it,” he will

remark.

Flaws will add that Corning now anticipates the worldwide glass

market will be closer to 2.4 billion square feet this year, an

improvement from earlier estimates of 2.3 billion square feet. He

will point out that Corning now believes global LCD TV sales will

exceed 132 million, up from the previous expectation of 129 million

sets.

Regarding other Corning businesses, he will say that the

Telecommunications segment remains on track with the company’s

previous guidance of a 10% to 15% sequential decline as the

industry continues experiencing global weakness, except in China.

The Environmental Technologies segment is seeing

better-than-expected sales strength in both automotive and diesel

products. Automotive demand appears to be fueled by an

industry-wide need to replenish inventory in the supply chain, and

diesel demand is the result of sales in advance of more stringent

2010 heavy-duty engine emissions regulations. This has led Corning

to improve its expectation of fourth-quarter segment sales to be

flat sequentially versus the previous down 10% to 15%.

2010 Market Strength

“The strength of the fourth quarter suggests that the 2010 LCD

glass market could be larger than what we previously thought. If

the supply chain exits this year at healthy levels and retail sales

continue strong, the normal seasonal decline the glass industry

usually experiences in the first quarter may be less than

anticipated,” he will add. “Our early modeling suggests that 2010

worldwide LCD glass demand could be between 2.7 billion and 2.8

billion square feet.” Flaws also will say the company believes its

Display Technologies segment’s gross margin has the potential to

expand in 2010 from its current levels.

Looking forward, Flaws will tell investors, “There is an

opportunity for further LCD glass volume growth over the next

several years. LCD television growth will be driven by penetration

into the embedded TV base, an increase in the number of sets per

home and a shorter replacement cycle.” He will point out that LCD

TVs represent only 19% of the 2.1 billion installed base.

Flaws will comment that the company expects spending across the

Telecommunications industry to be lower next year, as the industry

is typically one of the last to recover from economic downturns. In

its Environmental Technologies segment, automotive emissions

control product sales are expected to grow from their current

depressed levels. He will add that Corning remains confident that

the diesel business could reach $500 million in sales within the

next few years as emissions regulations take hold in several

countries.

In other businesses, he will explain that the Specialty

Materials segment has a significant growth opportunity with its

Gorilla™ glass, a scratch-resistant cover glass for portable

display devices. “The response to Gorilla has been tremendous. The

glass is already used in more than 50 devices today and is included

in the design of 50 additional products planned to be launched in

the future. We believe Gorilla glass has the potential to be a $300

million business in the next several years …with the potential to

be much larger,” he will say.

The company is also making investments in developing glass for

thin-film solar panels; a second generation of its Epic® System for

high-throughput, label-free drug discovery; silicon-on-glass

substrate technology for OLED mobile displays; commercial

production of green lasers for microprojectors; and Advanced-Flow™

glass reactors for chemical production.

“Corning is a growth company and a market leader in each of our

major product areas, with an innovation pipeline that is producing

promising technologies with the potential to deliver significant

revenues over the next decade,” Flaws will conclude.

Corning’s comments to investors at the Barclays Capital Global

Technology Conference will be available by accessing the IR events

calendar on Corning’s Web site. To access the calendar, go to

www.corning.com/investor_relations and click Investor Events on the

left.

Forward-Looking and Cautionary Statements

This press release contains “forward-looking statements” (within

the meaning of the Private Securities Litigation Reform Act of

1995), which are based on current expectations and assumptions

about Corning’s financial results and business operations, that

involve substantial risks and uncertainties that could cause actual

results to differ materially. These risks and uncertainties

include: the effect of global political, economic and business

conditions; conditions in the financial and credit

markets; currency fluctuations; tax rates; product demand

and industry capacity; competition; reliance on a concentrated

customer base; manufacturing efficiencies; cost reductions;

availability of critical components and materials; new product

commercialization; pricing fluctuations and changes

in the mix of sales between premium and non-premium

products; new plant start-up or restructuring costs;

possible disruption in commercial activities due to terrorist

activity, armed conflict, political instability or major health

concerns; adequacy of insurance; equity company activities;

acquisition and divestiture activities; the level of excess or

obsolete inventory; the rate of technology change; the ability to

enforce patents; product and components performance issues; stock

price fluctuations; and adverse litigation or regulatory

developments. These and other risk factors

are detailed in Corning’s filings with the Securities and

Exchange Commission. Forward-looking statements speak only as

of the day that they are made, and Corning undertakes no obligation

to update them in light of new information or future events.

About Corning Incorporated

Corning Incorporated (www.corning.com) is the world leader in

specialty glass and ceramics. Drawing on more than 150 years of

materials science and process engineering knowledge, Corning

creates and makes keystone components that enable high-technology

systems for consumer electronics, mobile emissions control,

telecommunications and life sciences. Our products include glass

substrates for LCD televisions, computer monitors and laptops;

ceramic substrates and filters for mobile emission control systems;

optical fiber, cable, hardware & equipment for

telecommunications networks; optical biosensors for drug discovery;

and other advanced optics and specialty glass solutions for a

number of industries including semiconductor, aerospace, defense,

astronomy and metrology.

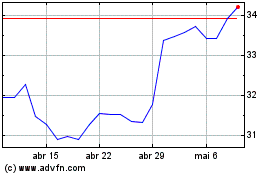

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

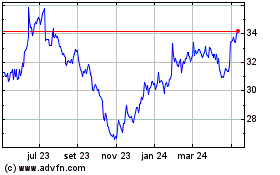

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024