Dow Corning Reports Sales and Profits for First Quarter of 2014

29 Abril 2014 - 9:30AM

Business Wire

Dow Corning Corp. today announced first quarter 2014 sales

of $1.52 billion, an increase of 21 percent over 2013, and net

income of $191 million. Adjusted net income in the first quarter of

2014 was $109 million, an increase of 65 percent compared with the

first quarter of 2013.

J. Donald Sheets, Dow Corning's executive

vice president and chief financial officer (Photo: Business

Wire)

Adjusted net income for 2014 excluded gains from a derivative

contract and long term sales agreements. Adjusted net income for

2013 excluded restructuring expenses. Additional information about

Dow Corning’s financial results:

First Quarter Results

- Sales were $1.52 billion, 21

percent higher than last year’s first quarter.

- Adjusted net income was $109 million,

65 percent higher than last year’s first quarter.

- Dow Corning’s Silicones segment

experienced volume growth across most geographic regions.

- Dow Corning’s Polysilicon segment

continued to see strong shipments as customers accepted delivery of

material purchased through long-term contracts.

Q1

2014 Q1 2013 % Change Sales (in billions) $

1.52 $ 1.26 21 % Net income (in millions) $

191 $ 62 207 % Adjusted net income* (in millions)

$ 109 $ 66 65 %

*Adjusted net income is a non-GAAP financial measure which

excludes certain unusual items. The reconciliation between GAAP and

non-GAAP measures is shown in the table following the news

release.

Comments from Dow Corning’s Executive Vice President and Chief

Financial Officer J. Donald Sheets:

- “Dow Corning’s strategy and leading

technology are enabling us to compete well and deliver stronger

financial performance despite continued industry oversupply and

volatility in the global marketplace.”

- “Our Silicones segment saw increases in

volume in the first quarter as customers look to Dow Corning for

its stability and strength in delivering quality products, reliable

supply and innovation for our customers.”

- “In our Polysilicon segment, Hemlock

Semiconductor Group continued to see strong shipments of both

semiconductor and solar grade polysilicon as customers with

long-term contracts accepted delivery of contracted material.”

- “In 2014, Dow Corning is focusing on

growth by providing our customers with industry leading products

and services. We are confident that our product portfolio and

talented team are well positioned to help return Dow Corning to the

trajectory of growth we expect.”

About Dow Corning

Dow Corning (www.dowcorning.com) provides performance-enhancing

solutions to serve the diverse needs of more than 25,000 customers

worldwide. A global leader in silicones, silicon-based technology

and innovation, Dow Corning offers more than 7,000 products and

services via the company’s Dow Corning® and XIAMETER® brands. Dow

Corning is equally owned by The Dow Chemical Company and Corning,

Incorporated. More than half of Dow Corning’s annual sales are

outside the United States.

About Hemlock Semiconductor Group

Hemlock Semiconductor Group (hscpoly.com) is comprised of

several joint venture companies owned in majority by Dow Corning

Corporation. Hemlock Semiconductor is a leading provider of

polycrystalline silicon and other silicon-based products used in

the manufacturing of semiconductor devices and solar cells and

modules. Hemlock Semiconductor began its operations in 1961.

Dow Corning Corporation Selected Financial

Information (in millions of U. S. dollars)

(Unaudited) Consolidated

Income Statement Data Three Months Ended March

31, 2014 2013 Net Sales

$ 1,524.2 $ 1,264.4 Net

Income Attributable to Dow Corning $ 190.9

$ 62.1 Adjustment for Long-Term Sales

Agreement1 $ (17.2 ) $

- Adjustment for Contract Asset2

$ (64.4 ) $ -

Adjustment for Restructuring, net3 $ -

$ 4.3 Adjusted Net

Income4 $ 109.3 $

66.4

1

The three month period ended March 31, 2014 included an

adjustment for a gain on a long-term sales agreement.

2

The three month period ended March 31, 2014 included an

adjustment for the change in market value of a derivative contract

asset.

3

The three month period ending March 31, 2013 included an

adjustment for restructuring charges.

4

Adjusted Net Income is a non-GAAP financial measure which

excludes certain unusual items and which reconciles to Net Income

as shown. Consolidated Balance Sheet Data

March 31, 2014 December

31, 2013 Assets Current Assets

$ 4,158.4 $ 3,995.7 Property, Plant

and Equipment, Net 7,111.6 7,231.1 Other

Assets 1,207.8 1,075.3 $

12,477.8 $ 12,302.1 Liabilities and

Equity Current Liabilities $

1,380.7 $ 1,346.0 Other Liabilities

7,165.8 7,177.5 Equity 3,931.3

3,778.6 $ 12,477.8 $

12,302.1

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20140429006050/en/

Dow Corning Corp.Jarrod Erpelding,

989.496.1582Jarrod.Erpelding@dowcorning.com

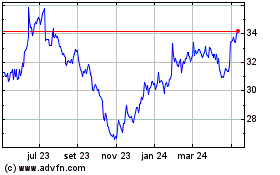

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

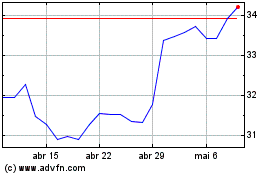

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024