Williams Beats on Q3 Earnings, Lags Y/Y - Analyst Blog

31 Outubro 2013 - 5:37PM

Zacks

North American energy firm, Williams Companies

Inc. (WMB) reported better-than-expected third-quarter

2013 earnings, owing to lower selling, general and administrative

expenses.

Earnings per share (EPS) – excluding special items – came in at 19

cents, above the Zacks Consensus Estimate of 14 cents.

However, the EPS decreased by 24.0% from the year-ago adjusted

profit of 25 cents due to drop in the natural gas liquid (NGL) and

olefin margins.

Revenues of $1,623.0 million were down 7.4% from third-quarter 2012

and also fell short of the Zacks Consensus Estimate of $1,714

million. Lower product sales in the Williams Partners business unit

affected the results.

Segmental Analysis

Williams Partners: This segment reported

adjusted operating profit of $388.0 million in the quarter, down

12.6% from $444.0 million in the year-ago quarter.

Decreased olefin and NGL margins impacted the results. These

factors were partially offset by reduced operating costs.

Williams NGL & Petchem Services: The

unit registered quarterly adjusted operating loss of $2.0 million

against $16.0 million profit in the third quarter of 2012.

The results were hurt by a scheduled plant shutdown owing to

maintenance activities.

Access Midstream Partners: The segment

reported an adjusted operating profit of $6.0 million.

Other: The segment posted adjusted profit

of $3.0 million, as against the year-ago quarter of $1.0

million.

Expenses

Selling, general and administrative costs were recorded at

$130.0 million, down 5.1% from $137.0 million in the third quarter

of 2012.

Capital Expenditure & Balance Sheet

During the quarter, Williams’ capital expenditure was $1,012.0

million. As of Sep 30, 2013, the company had long-term debt of

$10,359.0 million, representing a debt-to-capitalization ratio of

68.4%. Williams has a cash balance of about $732.0 million.

Guidance

For 2013, Williams guided EPS in the range of 80–85 cents

(indicating a mid-point of 83 cents). The same for 2014 is

projected between $1.00 and $1.20 (mid-point $1.10). For 2015,

Williams projects EPS of $1.35 to $1.65 with a mid-point of

$1.50.

Williams expects to generate total adjusted operating profit of

$1,790.0–$1,900.0 million in 2013, $2,200.0–$2,600.0 million in

2014 and $2,820.0− $3,320.0 million in 2015.

Capital and investment expenses are projected at

$4,100.0–$4,600.0 million for 2013, $4,350.0–$5,350.0 million for

2014 and $3,370.0–$4,350.0 million for 2015.

Williams maintained its previously-announced annual dividend payout

growth of 20% from 2013 to 2015. The company believes that

significant increase in cash flows from its Williams Partners and

Access Midstream Partners units will aid dividend growth.

Stocks to Consider

Williams currently carries a Zacks Rank #3 (Hold), implying that it

is expected to perform in line with the broader U.S. equity market

over the next one to three months.

Meanwhile, one can look at energy stocks like Baytex Energy

Corp. (BTE), VOC Energy Trust (VOC) and

Matador Resources Co. (MTDR) that offer better

prospects. All the stocks sport a Zacks Rank #1 (Strong Buy).

BAYTEX ENERGY (BTE): Free Stock Analysis Report

MATADOR RESOURC (MTDR): Free Stock Analysis Report

VOC ENERGY TRST (VOC): Free Stock Analysis Report

WILLIAMS COS (WMB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

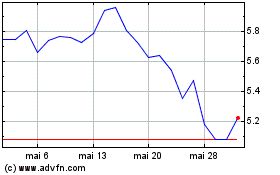

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025