UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the quarterly period ended June 30,

2024

or

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from to

Commission File Number: 001-35160

VOC ENERGY TRUST

(Exact name of registrant as specified in its charter)

| Delaware |

|

80-6183103 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| The Bank of New York Mellon Trust Company, N.A., Trustee |

|

|

| Global Corporate Trust |

|

|

| 601 Travis Street, Floor 16 |

|

|

| Houston, Texas |

|

77002 |

| (Address of principal executive offices) |

|

(Zip Code) |

1-713-483-6020

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units of Beneficial Interest |

|

VOC |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x

No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). Yes ¨ No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer ¨ |

|

Accelerated

filer ¨ |

| Non-accelerated filer x |

|

Smaller reporting company x |

| |

|

Emerging growth company

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No

x

As of August 9, 2024, 17,000,000 Units of

Beneficial Interest in VOC Energy Trust were outstanding.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

VOC ENERGY TRUST

STATEMENTS OF DISTRIBUTABLE INCOME

(Unaudited)

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Income from net profits interest | |

$ | 3,377,463 | | |

$ | 4,222,042 | | |

$ | 6,981,577 | | |

$ | 8,550,794 | |

| Cash on hand withheld for Trust expenses | |

| (196,626 | ) | |

| (76,177 | ) | |

| (214,281 | ) | |

| (119,366 | ) |

| General and administrative expenses (1) | |

| (120,837 | ) | |

| (235,865 | ) | |

| (477,296 | ) | |

| (611,428 | ) |

| Distributable income | |

$ | 3,060,000 | | |

$ | 3,910,000 | | |

$ | 6,290,000 | | |

$ | 7,820,000 | |

| Distributions per Trust unit (17,000,000 Trust units issued and outstanding at June 30, 2024 and 2023) | |

$ | 0.18 | | |

$ | 0.23 | | |

$ | 0.37 | | |

$ | 0.46 | |

| |

(1) |

Includes $31,215 and $30,014 paid to VOC Brazos Energy Partners, LP (“VOC Brazos”) during the three months ended June 30, 2024 and 2023, respectively, and $61,229 and $58,874 during the six months ended June 30, 2024 and 2023, respectively. Also includes $37,500 paid to The Bank of New York Mellon Trust Company, N.A. during each of the three-month periods ended June 30, 2024 and 2023 and $75,000 during each of the six-month periods ended June 30, 2024 and 2023. |

STATEMENTS OF ASSETS AND TRUST CORPUS

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,643,582 | | |

$ | 1,429,301 | |

| Investment in net profits interest | |

| 140,591,606 | | |

| 140,591,606 | |

| Accumulated amortization and impairment | |

| (129,548,020 | ) | |

| (128,648,342 | ) |

| Total assets | |

$ | 12,687,168 | | |

$ | 13,372,565 | |

| | |

| | | |

| | |

| TRUST CORPUS | |

| | | |

| | |

| Trust corpus, 17,000,000 Trust units issued and outstanding at June 30, 2024 and December 31, 2023 | |

$ | 12,687,168 | | |

$ | 13,372,565 | |

STATEMENTS OF CHANGES IN TRUST CORPUS

(Unaudited)

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Trust corpus, beginning of period | |

$ | 12,928,840 | | |

$ | 14,619,274 | | |

$ | 13,372,565 | | |

$ | 15,048,316 | |

| Income from net profits interest | |

| 3,377,463 | | |

| 4,222,042 | | |

| 6,981,577 | | |

| 8,550,794 | |

| Cash distributions | |

| (3,060,000 | ) | |

| (3,910,000 | ) | |

| (6,290,000 | ) | |

| (7,820,000 | ) |

| Trust expenses | |

| (120,837 | ) | |

| (235,865 | ) | |

| (477,296 | ) | |

| (611,428 | ) |

| Amortization of net profits interest | |

| (438,298 | ) | |

| (444,516 | ) | |

| (899,678 | ) | |

| (916,747 | ) |

| Trust corpus, end of period | |

$ | 12,687,168 | | |

$ | 14,250,935 | | |

$ | 12,687,168 | | |

$ | 14,250,935 | |

The accompanying notes are an integral part of

these financial statements.

VOC ENERGY TRUST

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

Note 1. Organization of the Trust

VOC Energy Trust (the “Trust”) is a

statutory trust formed on November 3, 2010 (capitalized on December 17, 2010), under the Delaware Statutory Trust Act pursuant

to a Trust Agreement dated November 3, 2010 (as amended and restated on May 10, 2011, the “Trust Agreement”) among

VOC Brazos Energy Partners, L.P., a Texas limited partnership (“VOC Brazos”), as trustor, The Bank of New York Mellon Trust

Company, N.A., as Trustee (the “Trustee”), and Wilmington Trust Company, as Delaware Trustee (the “Delaware Trustee”).

The Trust was created to acquire and hold a term net profits interest for the benefit of the Trust unitholders.

VOC Brazos is a privately held limited partnership

engaged in the production and development of oil and natural gas from properties located in Texas. VOC Kansas Energy Partners, L.L.C.,

a Kansas limited liability company (“VOC Kansas”), is a privately held limited liability company engaged in the production

and development of oil and natural gas from properties primarily located in Kansas along with a limited number of Texas properties. In

connection with the closing of the initial public offering of units of beneficial interest in the Trust (“Trust Units”) in

May 2011, VOC Brazos acquired all of the membership interests in VOC Kansas in exchange for newly issued limited partner interests

in VOC Brazos pursuant to a Contribution and Exchange Agreement, dated August 30, 2010, as amended, by and between VOC Brazos and

VOC Kansas. This resulted in VOC Kansas becoming a wholly-owned subsidiary of VOC Brazos.

The Trust was created to acquire and hold a term

net profits interest representing the right to receive 80% of the net proceeds (calculated as described below in Note 5) from production

from the underlying properties (as defined below). The net profits interest consists of working interests in substantially all of the

oil and natural gas properties held by VOC Brazos and VOC Kansas in the States of Kansas and Texas as of the date of the conveyance of

the net profits interest to the Trust. We refer to the properties in which the Trust holds the net profits interest as the “underlying

properties.”

The net profits interest is passive in nature,

and the Trustee has no management control over and no responsibility relating to the operation of the underlying properties. The net profits

interest entitles the Trust to receive 80% of the net proceeds attributable to VOC Brazos’ interest from the sale of production

from the underlying properties during the term of the Trust. The net profits interest will terminate on the later to occur of (1) December 31,

2030 or (2) the time when 10.6 million barrels of oil equivalent (“MMBoe”) (which is the equivalent of 8.5 MMBoe

in respect of the net profits interest) have been produced from the underlying properties and sold, and the Trust will soon thereafter

wind up its affairs and terminate.

As of June 30, 2024, cumulatively, since inception,

the Trust has received payment for 80% of the net proceeds attributable to VOC Brazos’ interest from the sale of 8.9 MMBoe of production

from the underlying properties (which is the equivalent of 7.1 MMBoe (unaudited) in respect of the net profits interest).

The Trustee can authorize the Trust to borrow money

to pay administrative or incidental expenses of the Trust that exceed cash held by the Trust. The Trustee may authorize the Trust to borrow

from the Trustee or the Delaware Trustee as a lender provided the terms of the loan are similar to the terms it would grant to a similarly

situated commercial customer with whom it did not have a fiduciary relationship. The Trustee may also deposit funds awaiting distribution

in an account with itself and make other short-term investments with the funds distributed to the Trust.

Note 2. Basis of Presentation

The accompanying Statement of Assets and Trust

Corpus as of December 31, 2023, which has been derived from audited financial statements, and the unaudited interim financial statements

as of June 30, 2024 and for the three- and six-month periods ended June 30, 2024 and 2023, have been prepared pursuant to the

rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, certain information and note

disclosures normally included in annual financial statements have been omitted pursuant to those rules and regulations.

The preparation of financial statements requires

the Trust to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates. The Trustee believes such information includes all the disclosures necessary to make

the information presented not misleading. The information furnished reflects all adjustments that are, in the opinion of the Trustee,

necessary for a fair presentation of the results of the interim period presented. The financial information should be read in conjunction

with the financial statements and notes thereto included in the Trust’s Annual Report on Form 10-K for the year ended December 31,

2023.

Note 3. Trust Accounting Policies

The Trust uses the modified cash basis of accounting

to report receipts of the net profits interest and payments of expenses incurred. The net profits interest represents the right to receive

revenues (oil and natural gas sales), less direct operating expenses (lease operating expenses, lease maintenance, lease overhead, and

production and property taxes) and an adjustment for lease equipment costs and lease development expenses (which are capitalized in financial

statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”))

of the underlying properties, times 80%. Actual cash receipts may vary due to timing delays of actual cash receipts from the property

operators or purchasers and due to wellhead and pipeline volume balancing agreements or practices. The actual cash distributions of the

Trust will be made based on the terms of the conveyance creating the Trust’s net profits interest. Expenses of the Trust, which

include accounting, engineering, legal and other professional fees, Trustee fees, an administrative fee paid to VOC Brazos and out-of-pocket

expenses, are recognized when paid. Under U.S. GAAP, revenues and expenses would be recognized on an accrual basis. Amortization of the

investment in net profits interest is recorded on a unit-of-production method in the period in which the cash is received with respect

to such production. Such amortization does not reduce distributable income, rather it is charged directly to Trust corpus.

This comprehensive basis of accounting other than

U.S. GAAP corresponds to the accounting permitted for royalty trusts by the SEC as specified by Staff Accounting Bulletin Topic 12:E,

Financial Statements of Royalty Trusts.

Investment in the net profits interest was recorded

initially at the historical cost of VOC Brazos and is periodically assessed to determine whether its aggregate value has been impaired

below its total capitalized cost based on the underlying properties. The Trust will provide a write-down to its investment in the net

profits interest if and when total capitalized costs, less accumulated amortization, exceeds undiscounted future net revenues attributable

to the proved oil and gas reserves of the underlying properties. There was no impairment of the investment in the net profits interest

during the quarters ended June 30, 2024 or 2023.

No new accounting pronouncements were adopted or

issued during the quarter ended June 30, 2024 that would impact the financial statements of the Trust.

Note 4. Investment in Net Profits Interest

The net profits interest was recorded at the historical

cost of VOC Brazos on May 10, 2011, the date of the conveyance of the net profits interest to the Trust, and was calculated as follows:

| Oil and gas properties | |

$ | 197,270,173 | |

| Accumulated depreciation and depletion | |

| (17,681,155 | ) |

| Hedge liability | |

| (1,717,713 | ) |

| 20-year asset retirement liability | |

| (2,131,797 | ) |

| Net property to be conveyed | |

| 175,739,508 | |

| Times 80% net profits interest to Trust | |

$ | 140,591,606 | |

Note 5. Income from Net Profits Interest

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

Excess of revenues over direct operating expenses and

lease equipment and development costs(1) | |

$ | 4,221,829 | | |

$ | 5,277,552 | | |

$ | 8,726,971 | | |

$ | 10,688,492 | |

| Times 80% net profits interest to Trust | |

| 80 | % | |

| 80 | % | |

| 80 | % | |

| 80 | % |

Income from net profits interest before reserve

adjustments | |

| 3,377,463 | | |

| 4,222,042 | | |

| 6,981,577 | | |

| 8,550,794 | |

VOC Brazos reserve for future development,

maintenance or operating expenditures(2) | |

| — | | |

| — | | |

| — | | |

| — | |

| Income from net profits interest(3) | |

$ | 3,377,463 | | |

$ | 4,222,042 | | |

$ | 6,981,577 | | |

$ | 8,550,794 | |

| (1) | Excess of revenues over direct operating expenses and lease equipment and development costs reflect expenses and costs incurred by

VOC Brazos during each of the December through February production periods for the three months ended June 30 and during

each of the September through February production periods for the six months ended June 30. Pursuant to the terms of the

conveyance of the net profits interest, lease equipment and development costs are to be deducted when calculating the distributable income

to the Trust. |

| (2) | Pursuant to the terms of the conveyance of the net profits interest, VOC Brazos can reserve up to $1.0 million for future development,

maintenance or operating expenditures at any time. During the three months ended June 30, 2024 and 2023, and the six months ended

June 30, 2024 and 2023, VOC Brazos did not withhold or release any dollar amounts due to the Trust from the reserve. The reserve

balance was $1.0 million at June 30, 2024 and 2023. |

| (3) | The income from net profits interest is based upon the cash receipts from VOC Brazos for the oil and gas production. The revenues

from oil production are typically received by VOC Brazos one month after production; thus, the cash received by the Trust during the three

months ended June 30, 2024 substantially represents production by VOC Brazos from December 2023 through February 2024,

and the cash received by the Trust during the three months ended June 30, 2023 substantially represents production by VOC Brazos

from December 2022 through February 2023. The cash received by the Trust during the six months ended June 30, 2024

substantially represents production by VOC Brazos from September 2023 through February 2024, and the cash received by the Trust

during the six months ended June 30, 2023 substantially represents production by VOC Brazos from September 2022 through February 2023. |

For the three and six months ended June 30,

2024 and 2023, MV Purchasing, LLC, an affiliate of VOC Brazos, purchased a significant portion of the production of the underlying properties.

Sales to MV Purchasing, LLC are under short-term arrangements, ranging from one to six months, using market sensitive pricing.

Note 6. Income Taxes

The Trust is a Delaware statutory trust and is

not required to pay federal or state income taxes. Accordingly, no provision for federal or state income taxes has been made.

Note 7. Distributions to Unitholders

VOC Brazos makes quarterly payments of the net

profits interest to the Trust. The Trustee determines for each quarter the amount available for distribution to the Trust unitholders.

This distribution is expected to be made on or before the 45th day following the end of each quarter to the Trust unitholders of record

on the 30th day of the month following the end of each quarter (or the next succeeding business day). Such amounts will be equal to the

excess, if any, of the cash received by the Trust relating to the preceding quarter, over the expenses of the Trust paid for such quarter,

subject to adjustments for changes made by the Trustee during such quarter in any cash reserves established for future expenses of the

Trust. From the first quarter of 2022 to the second quarter of 2023, the Trustee withheld a portion of the proceeds otherwise available

for distribution each quarter to gradually build a reserve of approximately $1.175 million for the payment of future known, anticipated

or contingent expenses or liabilities of the Trust. The Trustee may increase or decrease the targeted amount at any time and may increase

or decrease the rate at which it is withholding funds to build the cash reserve at any time, without advance notice to the unitholders.

Cash held in reserve will be invested as required by the Trust Agreement. Any cash reserved in excess of the amount necessary to pay or

provide for the payment of future known, anticipated or contingent expenses or liabilities eventually will be distributed to unitholders,

together with interest earned on the funds. This cash reserve is included in cash and cash equivalents on the accompanying Statements

of Assets and Trust Corpus.

The first quarterly distribution during 2024 was

$3,230,000, or $0.19 per Trust Unit, and was made on February 14, 2024 to Trust unitholders owning Trust Units as of January 30,

2024. Such distribution included the net proceeds of production collected by VOC Brazos from October 1, 2023 through December 31,

2023.

The second quarterly distribution during 2024 was

$3,060,000, or $0.18 per Trust Unit, and was made on May 15, 2024 to Trust unitholders owning Trust Units as of April 30, 2024.

Such distribution included the net proceeds of production collected by VOC Brazos from January 1, 2024 through March 31, 2024.

The first quarterly distribution during 2023 was

$3,910,000, or $0.23 per Trust Unit, and was made on February 14, 2023 to Trust unitholders owning Trust Units as of January 30,

2023. Such distribution included the net proceeds of production collected by VOC Brazos from October 1, 2022 through December 31,

2022 and was net of $231,030 withheld by the Trustee towards the building of the cash reserve described above and with that amount, the

targeted reserve was fully funded.

The second quarterly distribution during 2023 was

$3,910,000, or $0.23 per Trust Unit, and was made on May 12, 2023 to Trust unitholders owning Trust Units as of May 1, 2023.

Such distribution included the net proceeds of production collected by VOC Brazos from January 1, 2023 through March 31, 2023.

Note 8. Advance for Trust Expenses

Under the terms of the Trust Agreement, the Trustee

is allowed to borrow money to pay Trust expenses. During the three and six months ended June 30, 2024 and 2023, there were no borrowings

or amounts owed for money borrowed in previous quarters. Under the terms of the Trust Agreement, VOC Brazos has provided a letter of credit

in the amount of $1.7 million to the Trustee to protect the Trust against the risk that it does not have sufficient cash to pay future

expenses.

Note 9. Subsequent Events

On July 18, 2024, the Trust announced a Trust

distribution of net profits for the quarterly payment period ended June 30, 2024. Unitholders of record on July 30, 2024 will

receive a distribution amounting to $3,060,000, or $0.18 per Trust Unit, which will be paid on August 14, 2024.

Item 2. Trustee’s Discussion and Analysis of Financial Condition

and Results of Operations.

The following discussion of the Trust’s financial

condition and results of operations should be read in conjunction with the financial statements and notes thereto. The Trust’s purpose

is, in general, to hold the net profits interest, to distribute to the Trust unitholders cash that the Trust receives in respect of the

net profits interest and to perform certain administrative functions in respect of the net profits interest and the Trust Units. The Trust

derives substantially all of its income and cash flows from the net profits interest. All information regarding operations has been provided

to the Trustee by VOC Brazos.

Results of Operations

Results of Operations for the Quarters Ended June 30,

2024 and 2023

The following is a summary of income from net profits

interest received by the Trust for the three months ended June 30, 2024 and 2023 consisting of the April distribution for each

respective year:

| | |

Three months ended

June 30, | |

| | |

2024 | | |

2023 | |

| Sales volumes: | |

| | | |

| | |

| Oil (Bbl) | |

| 110,534 | | |

| 120,771 | |

| Natural gas (Mcf) | |

| 64,808 | | |

| 74,644 | |

| Total (BOE) | |

| 121,335 | | |

| 133,212 | |

| Average sales prices: | |

| | | |

| | |

| Oil (per Bbl) | |

$ | 71.25 | | |

$ | 74.16 | |

| Natural gas (per Mcf) | |

$ | 3.10 | | |

$ | 5.37 | |

| Gross proceeds: | |

| | | |

| | |

| Oil sales | |

$ | 7,875,193 | | |

$ | 8,955,923 | |

| | |

Three months ended

June 30, | |

| | |

2024 | | |

2023 | |

| Natural gas sales | |

| 201,034 | | |

| 401,092 | |

| Total gross proceeds | |

| 8,076,227 | | |

| 9,357,015 | |

| Costs: | |

| | | |

| | |

| Production and development costs: | |

| | | |

| | |

| Lease operating expenses | |

| 3,312,352 | | |

| 3,637,884 | |

| Production and property taxes | |

| 183,728 | | |

| 279,484 | |

| Development expenses | |

| 358,318 | | |

| 162,095 | |

| Total costs | |

| 3,854,398 | | |

| 4,079,463 | |

| | |

| | | |

| | |

| Excess of revenues over direct operating expenses and lease equipment and development costs | |

| 4,221,829 | | |

| 5,277,552 | |

| Times net profits interest over the term of the Trust | |

| 80 | % | |

| 80 | % |

| Income from net profits interest before reserve adjustments | |

| 3,377,463 | | |

| 4,222,042 | |

| VOC Brazos reserve for future development, maintenance or operating expenditures | |

| — | | |

| — | |

| Income from net profits interest | |

$ | 3,377,463 | | |

$ | 4,222,042 | |

The cash received by the Trust from VOC Brazos

during the quarter ended June 30, 2024 substantially represents the production by VOC Brazos from December 2023 through February 2024.

The cash received by the Trust from VOC Brazos during the quarter ended June 30, 2023 substantially represents the production

by VOC Brazos from December 2022 through February 2023. The revenues from oil production are typically received by VOC Brazos

one month after production.

Gross

proceeds. Oil and natural gas sales were $8,076,227 for the three months ended June 30, 2024, a decrease of

$1,280,788 or 13.7% from $9,357,015 for the three months ended June 30, 2023. Revenues are a function of oil and natural gas

sales prices and volumes sold. The decrease in gross proceeds was due to decreases in market prices for oil and natural gas and a

decrease in oil and natural gas sales volumes, as further discussed below, during the second quarter of 2024. During the three

months ended June 30, 2024, the average price for oil decreased 3.9% to $71.25 per Bbl and the average price for natural gas

decreased 42.3% to $3.10 per Mcf. Oil sales volumes were 110,534 Bbls for the three months ended June 30, 2024, a decrease of

10,237 Bbls or 8.5% from 120,771 Bbls for the three months ended June 30, 2023, while natural gas sales volumes were

64,808 Mcf, a decrease of 9,836 Mcf or 13.2% from 74,644 Mcf for the same period in 2023. These oil and natural gas sales volume decreases are partially the result of severe winter storms in January 2024 that affected Kansas

and Texas and resulted in a curtailment of production on certain of the underlying properties, as discussed in the Trust’s Current

Report on Form 8-K filed on January 19, 2024. The snow and ice associated with those storms disabled electrical power to the affected

underlying properties for an extended period, rendering some properties inaccessible, and generally created difficult working conditions.

Costs.

Lease operating expenses were $3,312,352 for the three months ended June 30, 2024, a decrease of $325,532 or 8.9% from $3,637,884

for the three months ended June 30, 2023. Production and property taxes were $183,728 for the three months ended June 30, 2024,

a decrease of $95,756 or 34.3% from $279,484 for the same period in 2023. Such decrease is the result of a $63,281 decrease in production

taxes, primarily due to lower sales prices, and a $32,475 decrease in property taxes. Development expenses were $358,318 for the three

months ended June 30, 2024, an increase of $196,223 or 121.1% from $162,095 for the same period in 2023. Such increase was primarily

due to increased development activity during the three months ended June 30, 2024, compared to the three months ended June 30,

2023.

Excess

of revenues over direct operating expenses and lease equipment and development costs. The excess of revenues over direct operating

expenses and lease equipment and development costs from the underlying properties was $4,221,829 for the three months ended June 30,

2024, a decrease of $1,055,723 or 20.0% from $5,277,552 for the three months ended June 30, 2023. The Trust’s 80% net profits

interest of these totals was $3,377,463 and $4,222,042, respectively. During the three months ended June 30, 2024 and 2023, VOC Brazos

did not withhold or release any dollar amounts due to the Trust from the previously established cash reserve for future development, maintenance

or operating expenditures, which resulted in income from the net profits interest of $3,377,463 and $4,222,042 for such periods, respectively.

These amounts were reduced by a Trustee holdback for current estimated Trust expenses of $317,463 and $312,042 for the three months ended

June 30, 2024 and 2023, respectively. The Trustee paid general and administrative expenses of $120,837 for the three months ended

June 30, 2024, a decrease of $115,028 from $235,865 for the three months ended June 30, 2023. These factors resulted in distributable

income for the three months ended June 30, 2024 of $3,060,000, a decrease of $850,000 from $3,910,000 for the three months ended

June 30, 2023.

Results of Operations for the Six Months Ended June 30, 2024

and 2023

The following is a summary of income from net profits

interest received by the Trust for the six months ended June 30, 2024 and 2023 consisting of the January and April distributions

for each respective year:

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| Sales volumes: | |

| | | |

| | |

| Oil (Bbl) | |

| 226,939 | | |

| 248,371 | |

| Natural gas (Mcf) | |

| 132,729 | | |

| 158,145 | |

| Total (BOE) | |

| 249,061 | | |

| 274,729 | |

| Average sales prices: | |

| | | |

| | |

| Oil (per Bbl) | |

$ | 76.45 | | |

$ | 78.56 | |

| Natural gas (per Mcf) | |

$ | 3.17 | | |

$ | 6.58 | |

| Gross proceeds: | |

| | | |

| | |

| Oil sales | |

$ | 17,349,682 | | |

$ | 19,512,430 | |

| Natural gas sales | |

| 421,080 | | |

| 1,040,163 | |

| Total gross proceeds | |

| 17,770,762 | | |

| 20,552,593 | |

| Costs: | |

| | | |

| | |

| Production and development costs: | |

| | | |

| | |

| Lease operating expenses | |

| 7,220,002 | | |

| 7,660,187 | |

| Production and property taxes | |

| 1,018,212 | | |

| 1,173,442 | |

| Development expenses | |

| 805,577 | | |

| 1,030,472 | |

| Total costs | |

| 9,043,791 | | |

| 9,864,101 | |

| | |

| | | |

| | |

| Excess of revenues over direct operating expenses and lease equipment and development costs | |

| 8,726,971 | | |

| 10,688,492 | |

| Times net profits interest over the term of the Trust | |

| 80 | % | |

| 80 | % |

| Income from net profits interest before reserve adjustments | |

| 6,981,577 | | |

| 8,550,794 | |

| VOC

Brazos reserve for future development, maintenance or operating expenditures | |

| — | | |

| — | |

| Income from net profits interest | |

$ | 6,981,577 | | |

$ | 8,550,794 | |

The cash received by the Trust from VOC

Brazos during the six months ended June 30, 2024 substantially represents the production by VOC Brazos from September 2023 through

February 2024. The cash received by the Trust from VOC Brazos during the six months ended June 30, 2023 substantially

represents the production by VOC Brazos from September 2022 through February 2023. The revenues from oil production are typically

received by VOC Brazos one month after production.

Gross

proceeds. Oil and natural gas sales were $17,770,762 for the six months ended June 30, 2024, a decrease of $2,781,831

or 13.5% from $20,552,593 for the six months ended June 30, 2023. Revenues are a function of oil and natural gas sales prices

and volumes sold. The decrease in gross proceeds was due to decreases in market prices for oil and natural gas and a decrease in oil and

natural gas sales volumes, as further discussed below, during the six months ended June 30, 2024. During the six months ended June 30, 2024, the average

price for oil decreased 2.7 % to $76.45 per Bbl and the average price for natural gas decreased 51.8% to $3.17 per Mcf. Oil sales volumes

were 226,939 Bbls for the six months ended June 30, 2024, a decrease of 21,432 Bbls or 8.6% from 248,371 Bbls for the six months

ended June 30, 2023, while natural gas sales volumes were 132,729 Mcf, a decrease of 25,416 Mcf or 16.1% from 158,145 Mcf for the

same period in 2023. These oil and natural gas sales volume decreases are partially the result of severe winter storms in January 2024 that affected Kansas

and Texas and resulted in a curtailment of production on certain of the underlying properties, as discussed in the Trust’s Current

Report on Form 8-K filed on January 19, 2024. The snow and ice associated with those storms disabled electrical power to the affected

underlying properties for an extended period, rendering some properties inaccessible, and generally created difficult working conditions.

Costs.

Lease operating expenses were $7,220,002 for the six months ended June 30, 2024, a decrease of $440,185 or 5.7% from $7,660,187 for

the six months ended June 30, 2023. Production and property taxes were $1,018,212 for the six months ended June 30, 2024, a

decrease of $155,230 or 13.2% from $1,173,442 for the six months ended June 30, 2023. Such decrease is the result of a $129,024 decrease

in production taxes, primarily due to lower sales volumes and sales prices for oil and natural gas, and a $26,206 decrease in property

taxes. Development expenses were $805,577 for the six months ended June 30, 2024, a decrease of $224,895 or 21.8% from $1,030,472

for the same period in 2023. Such decrease was primarily due to a decrease in development activity and drilling expenses during the six

months ended June 30, 2024, compared to the six months ended June 30, 2023, a period that included approximately $200,000 in

costs associated with the completion costs of two horizontal wells in Texas.

Excess

of revenues over direct operating expenses and lease equipment and development costs. The excess of revenues over direct

operating expenses and lease equipment and development costs from the underlying properties was $8,726,971 for the six months ended June 30,

2024, a decrease of $1,961,521 or 18.4% from $10,688,492 for the six months ended June 30, 2023. The Trust’s 80% net profits

interest of these totals was $6,981,577 and $8,550,794, respectively. During the six months ended June 30, 2024 and 2023, VOC Brazos

did not withhold or release any dollar amounts due to the Trust from the previously established cash reserve for future development, maintenance

or operating expenditures, which resulted in income from the net profits interest of $6,981,577 and $$8,550,794 for such periods, respectively.

These amounts were reduced by a Trustee holdback for current estimated Trust expenses of $691,577 and $499,764 for the six months ended

June 30, 2024 and 2023, respectively, and a Trustee holdback for future estimated Trust expenses of $231,030 for the six months ended

June 30, 2023. The Trustee paid general and administrative expenses of $477,296 for the six months ended June 30, 2024, a decrease

of $134,132 from $611,428 for the six months ended June 30, 2023. These factors resulted in distributable income of $6,290,000

for the six months ended June 30, 2024 and $7,820,000 for the six months ended June 30, 2023.

Liquidity and Capital Resources

Other than Trust administrative expenses, including

any reserves established by the Trustee for future liabilities, the Trust’s only use of cash is for distributions to Trust unitholders.

Administrative expenses include payments to the Trustee as well as a quarterly administrative fee to VOC Brazos pursuant to an administrative

services agreement. Each quarter, the Trustee determines the amount of funds available for distribution. Available funds are the

excess cash, if any, received by the Trust from the net profits interest and other sources (such as interest earned on any amounts reserved

by the Trustee) in that quarter, over the Trust’s expenses paid for that quarter. Available funds are reduced by any cash

that the Trustee decides to reserve for future development, maintenance or operating expenses. As of June 30, 2024, the Trustee held

$1,643,582 as cash and cash equivalents on the accompanying Statements of Assets and Trust Corpus, which includes the $1.175 million cash

reserve described below, as such a reserve.

The Trustee may cause the Trust to borrow funds

required to pay expenses if the Trustee determines that the cash on hand and the cash to be received are insufficient to cover the Trust’s

expenses. If the Trust borrows funds, the Trust unitholders will not receive distributions until the borrowed funds are repaid.

During the three and six months ended June 30, 2024 and 2023, there were no such borrowings. VOC Brazos has provided a letter of

credit in the amount of $1.7 million to the Trustee to protect the Trust against the risk that it does not have sufficient cash to pay

future expenses.

From the first quarter of 2022 to the second quarter

of 2023, the Trustee withheld a portion of the proceeds otherwise available for distribution each quarter to gradually build a $1.175

million cash reserve for the payment of future known, anticipated, or contingent expenses or liabilities of the Trust. This amount is

in addition to the $1.7 million letter of credit described above. The Trustee may increase or decrease the targeted amount at any time

and may increase or decrease the rate at which it withholds funds to build the cash reserve at any time, without advance notice to the

unitholders. Cash held in reserve will be invested as required by the Trust Agreement. Any cash reserved in excess of the amount necessary

to pay or provide for the payment of future known, anticipated or contingent expenses or liabilities eventually will be distributed to

unitholders, together with interest earned on the funds.

Income to the Trust from the net profits interest

is based on the calculation and definitions of “gross proceeds” and “net proceeds” contained in the conveyance.

As substantially all of the underlying properties

are located in mature fields, VOC Brazos does not expect future costs for the underlying properties to change significantly compared to

recent historical costs other than changes due to fluctuations in the general cost of oilfield services. VOC Brazos may establish

a cash reserve of up to $1,000,000 in the aggregate at any given time from the dollar amount otherwise distributable to the Trust to reduce

the impact on distributions of uneven capital expenditure timing. The cash reserve balance was $1,000,000 at June 30, 2024 and 2023.

Note Regarding Forward-Looking Statements

This Form 10-Q includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact included in

this Form 10-Q, including without limitation the statements under “Trustee’s Discussion and Analysis of Financial Condition

and Results of Operations”, are forward-looking statements. Although VOC Brazos advised the Trust that it believes that the expectations

reflected in the forward-looking statements contained herein are reasonable, no assurance can be given that such expectations will prove

to have been correct. Important factors that could cause actual results to differ materially from expectations (“Cautionary Statements”)

are disclosed in this Form 10-Q and in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023

(the “Form 10-K”), including under the section “Item 1A. Risk Factors”. All subsequent written and oral

forward-looking statements attributable to the Trust or persons acting on its behalf are expressly qualified in their entirety by the

Cautionary Statements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

The Trust is a smaller reporting company as defined

by Rule 12b-2 of the Exchange Act and is not required to provide the information under this Item.

Item 4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures. The Trustee maintains disclosure controls and procedures designed to ensure that

information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is recorded, processed,

summarized and reported within the time periods specified in the rules and regulations promulgated by the SEC. Disclosure controls

and procedures include controls and procedures designed to ensure that information required to be disclosed by the Trust is accumulated

and communicated by VOC Brazos to the Trustee, as trustee of the Trust, and its employees who participate in the preparation of the Trust’s

periodic reports as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report,

the Trustee carried out an evaluation of the Trust’s disclosure controls and procedures. A Trust Officer of the Trustee has concluded

that the disclosure controls and procedures of the Trust are effective.

Due to the contractual arrangements of (i) the

Trust Agreement and (ii) the conveyance of the net profits interest, the Trustee relies on (A) information provided by VOC Brazos,

including historical operating data, plans for future operating and capital expenditures, reserve information and information relating

to projected production and (B) conclusions and reports regarding reserves by the Trust’s independent reserve engineers. See

“Risk Factors—Neither the Trust nor the Trust’s unitholders have the ability to influence VOC Brazos or control the

operations or development of the underlying properties” in the Form 10-K.

Changes

in Internal Control over Financial Reporting. During the quarter ended June 30, 2024, there was no change in the

Trust’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the

Trust’s internal control over financial reporting. The Trustee notes for purposes of clarification that it has no authority over,

and makes no statement concerning, the internal control over financial reporting of VOC Brazos.

PART II—OTHER INFORMATION

Item 1A. Risk Factors.

There have not been any material changes from the

risk factors previously disclosed in the Trust’s response to Item 1A to Part I of the Form 10-K.

Item 5. Other Information.

Rule 10b5-1

Trading Plans. During the three months ended June 30, 2024, no officer or employee of the Trustee who performs policy-making

functions for the Trust adopted, modified, or terminated any Rule 10b5-1 trading arrangement or non-Rule 10b5-1 trading arrangement,

as such terms are defined in Item 408(a) of Regulation S-K, with respect to the Trust units.

Item 6. Exhibits.

The exhibits listed below are filed or furnished

as part of this Quarterly Report on Form 10-Q.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

VOC ENERGY TRUST |

| |

|

| |

By: |

The Bank of New York Mellon Trust Company, N.A., as Trustee |

| |

|

|

| |

By: |

/s/ ELAINA C. RODGERS |

| |

|

Elaina C. Rodgers |

| |

|

Vice President |

| Date: August 9, 2024 |

|

|

The Registrant, VOC Energy Trust, has no principal

executive officer, principal financial officer, board of directors or persons performing similar functions. Accordingly, no additional

signatures are available and none have been provided. In signing the report above, the Trustee does not imply that it has performed any

such function or that such function exists pursuant to the terms of the Trust Agreement under which it serves.

EXHIBIT 31

CERTIFICATION

I, Elaina C. Rodgers, certify that:

| |

1. |

I have reviewed this quarterly report on Form 10-Q of VOC Energy Trust (the “Trust”), for which The Bank of New York Mellon Trust Company, N.A., acts as Trustee; |

| |

2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, distributable income and changes in Trust corpus of the registrant as of, and for, the periods presented in this report; |

| |

4. |

I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and I have: |

| |

a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which this report is being prepared; |

| |

b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| |

5. |

I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors: |

| |

a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

b) |

Any fraud, whether or not material, that involves any persons who have a significant role in the registrant’s internal control over financial reporting. |

In giving the foregoing certifications in paragraphs 4 and 5, I

have relied to the extent I consider reasonable on information provided to me by VOC Brazos Energy Partners, L.P.

| Date: August 9, 2024 |

/s/ ELAINA C. RODGERS |

| |

Elaina C. Rodgers |

| |

Vice President |

| |

The Bank of New York Mellon Trust Company, N.A., |

| |

Trustee for VOC Energy Trust |

EXHIBIT 32

August 9, 2024

Via EDGAR

Securities and Exchange Commission

Judiciary Plaza

450 Fifth Street, N.W.

Washington, D.C. 20549

Re: Certification pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

Ladies and Gentlemen:

In connection with the Quarterly Report of VOC Energy Trust (the “Trust”)

on Form 10-Q for the quarterly period ended June 30, 2024 as filed with the Securities and Exchange Commission on the date hereof

(the “Report”), the undersigned, not in its individual capacity but solely as the trustee of the Trust, certifies pursuant

to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to its knowledge:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as

amended; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Trust. |

The above certification is furnished solely pursuant to Section 906

of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) and is not being filed as part of the Report or as a separate disclosure document.

| |

The Bank of New York Mellon Trust Company, N.A. |

| |

Trustee for VOC Energy Trust |

| |

|

|

| |

By: |

/s/ ELAINA C. RODGERS |

| |

|

Elaina C. Rodgers |

| |

|

Vice President and Trust Officer |

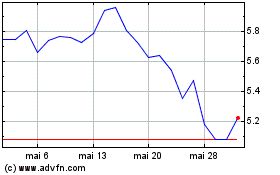

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024