Form 8-K - Current report

18 Julho 2024 - 5:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 18, 2024

VOC Energy Trust

(Exact name of registrant as specified in its

charter)

| Delaware |

001-35160 |

80-6183103 |

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

The Bank of New York Mellon Trust Company,

N.A., Trustee

Global Corporate Trust

601 Travis Street, Floor 16

Houston, Texas |

77002 |

| (Address

of principal executive offices) |

(Zip

Code) |

Registrant’s telephone number, including

area code: 1-713-483-6020

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Units

of Beneficial Interest |

VOC |

The

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On July 18, 2024, VOC Energy Trust issued

a press release announcing the Trust quarterly distribution for the payment period ended June 30, 2024. A copy of the press release

is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Pursuant to General Instruction B.2 of Form 8-K,

the press release attached as Exhibit 99.1 is not “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated

by reference in any filing by VOC Energy Trust under the Exchange Act or the Securities Act of 1933, as amended, but is instead “furnished”

for purposes of that instruction.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VOC

Energy Trust |

| |

|

| |

By:

The Bank of New York Mellon Trust Company, N.A., |

| |

|

as Trustee |

| |

|

|

| Date: July 18, 2024 |

|

By: |

/s/ Elaina C. Rodgers |

| |

|

Elaina

C. Rodgers |

| |

|

Vice

President |

Exhibit

99.1

VOC

Energy Trust

VOC

Energy Trust Announces Trust Quarterly Distribution

VOC

ENERGY TRUST

The

Bank of New York Mellon Trust Company, N.A., Trustee

NEWS

RELEASE

FOR IMMEDIATE RELEASE

Houston, Texas, July 18, 2024 — VOC Energy Trust (NYSE Symbol

— VOC) announced the Trust distribution of net profits for the quarterly payment period ended June 30, 2024.

Unitholders of record on July 30, 2024 will receive a distribution

amounting to $3,060,000 or $0.18 per unit, payable August 14, 2024.

Volumes, average sales prices and net profits for the payment period

were:

| Sales volumes: | |

| | |

| Oil (Bbl) | |

| 116,006 | |

| Natural gas (Mcf) | |

| 65,815 | |

| Total (BOE) | |

| 126,975 | |

| Average sales prices: | |

| | |

| Oil (per Bbl) | |

$ | 78.36 | |

| Natural gas (per Mcf) | |

$ | 2.74 | |

| Gross proceeds: | |

| | |

| Oil sales | |

$ | 9,090,488 | |

| Natural gas sales | |

| 180,419 | |

| Total gross proceeds | |

$ | 9,270,907 | |

| Costs: | |

| | |

| Lease operating expenses | |

$ | 3,784,091 | |

| Production and property taxes | |

| 539,469 | |

| Development expenses | |

| 699,074 | |

| Total costs | |

$ | 5,022,634 | |

| Net proceeds | |

$ | 4,248,273 | |

| Percentage applicable to Trust’s Net Profits Interest | |

| 80 | % |

| Net profits interest | |

$ | 3,398,618 | |

| Increase in cash reserve held by VOC Brazos Energy Partners, L.P. | |

| 0 | |

| Total cash proceeds available for the Trust | |

$ | 3,398,618 | |

| Provision for current estimated Trust expenses | |

| (338,618 | ) |

| Net cash proceeds available for distribution | |

$ | 3,060,000 | |

This press release contains forward-looking statements. Although VOC

Brazos has advised the Trust that VOC Brazos believes that the expectations contained in this press release are reasonable, no assurances

can be given that such expectations will prove to be correct. The announced distributable amount is based on the amount of cash received

or expected to be received by the Trustee from the underlying properties on or prior to the record date with respect to the quarter ended

June 30, 2024. Any differences in actual cash receipts by the Trust could affect this distributable amount. Other important factors

that could cause these statements to differ materially include the actual results of drilling operations, risks inherent in drilling and

production of oil and gas properties, the ability of commodity purchasers to make payment, actions by the members of the Organization

of Petroleum Exporting Countries, and other risk factors described in the Trust’s Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission. Statements made in this press release are qualified by the cautionary

statements made in these risk factors. The Trust does not intend, and assumes no obligations, to update any of the statements included

in this press release.

| Contact: |

|

VOC

Energy Trust |

|

| |

|

The

Bank of New York Mellon Trust Company, N.A., as Trustee |

|

| |

|

Elaina

Rodgers |

|

| |

|

(713)

483-6020 |

|

| |

|

601

Travis Street, Floor 16, Houston, TX 77002 |

|

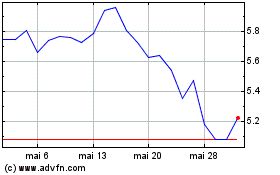

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Voc Energy (NYSE:VOC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024