Filed Pursuant to Rule 424(b)(3)

Registration No. 333-215288

PROSPECTUS SUPPLEMENT NO. 15

(to Prospectus dated March 21, 2018)

Vistra Energy Corp.

168,779,076 Shares of Common Stock

____________________

This prospectus supplement supplements the prospectus dated March 21, 2018 (as supplemented to date, the Prospectus), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-215288). This prospectus supplement is being filed to update and supplement the information in the Prospectus with information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on May 4, 2018 (the Current Report). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate solely to 168,779,076 shares of Vistra Energy Corp. common stock, par value $.01 per share, which we refer to as our common stock or the Vistra Energy common stock, which may be offered for resale from time to time by the stockholders named under the heading “Principal and Selling Stockholders” in the Prospectus, whom we refer to as the selling stockholders. The shares of our common stock offered under the Prospectus, as supplemented by this prospectus supplement, may be resold by the selling stockholders at fixed prices, prevailing market prices at the times of sale, prices related to such prevailing market prices, varying prices determined at the times of sale or negotiated prices and, accordingly, we cannot determine the price or prices at which shares of our common stock may be resold. The shares of our common stock offered by the Prospectus and this prospectus supplement may be resold by the selling stockholders directly to investors or to or through underwriters, dealers or other agents, as described in more detail in the Prospectus. For more information, see the section entitled “Plan of Distribution” in the Prospectus. We do not know if, when or in what amounts a selling stockholder may offer shares of our common stock for resale. The selling stockholders may resell all, some or none of the shares of our common stock offered by the Prospectus, as supplemented by this prospectus supplement, in one or multiple transactions.

This prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates and supplements the information in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “VST.” On May 14, 2018, the closing sales price of our common stock as reported on the NYSE was $23.10 per share.

____________________

Investing in our common stock involves risks. Before making a decision to invest in our common stock, you should carefully consider the information referred to under the heading “

Risk Factors

” beginning on page 21 of the Prospectus.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

____________________

The date of this prospectus supplement is May 15, 2018.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2018

VISTRA ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38086

|

|

36-4833255

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

6555 Sierra Drive

Irving, TX

|

|

75039

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(214) 812-4600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.l4a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240. 14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

Item 5.02.

|

Departure for Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On May 1, 2018, the board of directors (the “Board”) of Vistra Energy Corp. (the “Company”) approved and entered into an Amended and Restated Employment Agreement (the “Amendment”), dated May 1, 2018 (the “Effective Date”), by and between the Company and Curtis A. Morgan. Pursuant to the Amendment, Mr. Morgan’s employment agreement with the Company will be extended for an additional term that ends on May 1, 2022, and thereafter, the Amendment provides for automatic one-year extensions, unless either the Company or Mr. Morgan gives 60 days’ prior written notice electing not to extend the Amendment.

The foregoing summary highlights certain information contained in the Amendment. It does not contain all the information that may be important to you and is qualified in its entirety by reference to the Amendment attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

|

|

|

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders

|

On May 1, 2018, at the Company’s 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”), the Company's stockholders approved the proposals listed below. The final voting results regarding each proposal are set forth in the following tables.

The Election of Directors

Proposal One - The Election of Directors if Merger Closed Prior to Annual Meeting.

Given that the merger between the Company and Dynegy Inc. (the “Merger”) closed on April 9, 2018 (the “Closing Date”), and such Closing Date was prior to the 2018 Annual Meeting, Proposal One was the relevant proposal for the election of directors. Accordingly, Proposal Two, which would have only applied if the Closing Date was subsequent to the 2018 Annual Meeting, has no effect. Voting results for Proposal One were as follows:

Hilary E. Ackermann:

|

|

|

|

|

|

|

|

|

For

|

|

Abstain

|

|

Broker Nonvotes

|

|

372,910,965

|

|

204,850

|

|

11,428,661

|

Brian K. Ferraioli:

|

|

|

|

|

|

|

|

|

For

|

|

Abstain

|

|

Broker Nonvotes

|

|

345,702,675

|

|

27,413,140

|

|

11,428,661

|

Jeff D. Hunter:

|

|

|

|

|

|

|

|

|

For

|

|

Abstain

|

|

Broker Nonvotes

|

|

343,069,024

|

|

30,046,791

|

|

11,428,661

|

As a result, Hilary E. Ackermann, Brian K. Ferraioli, and Jeff D. Hunter were elected to the Board.

Proposal Three - Approval, on an Advisory Basis, of Named Executive Officer Compensation

.

Voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker

Nonvotes

|

|

370,638,138

|

|

2,424,970

|

|

52,707

|

|

11,428,661

|

As a result, the compensation of the named executive officers was approved on an advisory basis.

Proposal Four - Approval, on an Advisory Basis, of the Frequency of Future Advisory Votes on Named Executive Officer Compensation

.

Voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

2 Years

|

|

3 Years

|

|

Abstain

|

|

Broker

Nonvotes

|

|

372,356,814

|

|

128,487

|

|

611,174

|

|

19,340

|

|

11,428,661

|

As a result, the frequency of one year for future advisory votes on named executive officer compensation was approved on an advisory basis.

Proposal Five - Ratification of the Selection of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for the Year Ended December 31, 2018

.

Voting results were as follows:

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

382,948,536

|

|

1,586,978

|

|

8,962

|

As a result, the Company's selection of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2018 was ratified.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibit is filed in accordance with the provisions of Item 601 of Regulation S-K:

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Amended and Restated Employment Agreement, dated May 1, 2018, between the Company and Curtis A. Morgan.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Vistra Energy Corp.

|

|

|

|

|

|

Dated: May 4, 2018

|

|

/s/ Stephanie Zapata Moore

|

|

|

|

Name:

|

|

Stephanie Zapata Moore

|

|

|

|

Title:

|

|

Executive Vice President and General Counsel

|

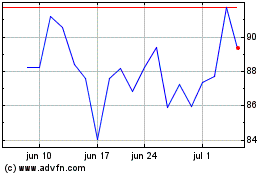

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024