Candente Gold Announces El Oro Tailings Inferred Resource Contains 119,900 oz Gold and 3M oz Silver

10 Julho 2014 - 5:00AM

Marketwired Canada

Candente Gold Corp. (TSX:CDG)(LMA:CDG) ("Candente Gold" or "the Company") is

pleased to report that an Inferred Mineral Resource Estimate has been completed

on the Mexico Mines tailings deposit under option from the Municipality of El

Oro de Hidalgo in Mexico.

Inferred Resource Estimate(i)

----------------------------------------------------------------------------

Classification Tonnes Au g/t Ag g/t Ounces Au Ounces Ag

----------------------------------------------------------------------------

Inferred 1,267,400 2.94 75.12 119,900 3,061,200

----------------------------------------------------------------------------

Note: (i) Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability. All figures have been rounded to reflect the

accuracy of the estimate.

An increase of approximately 40% on gold content and 30% on silver content from

historic assessments is attributed to two main factors. Recent topographic

surveying generated a more accurate surface expression of the tailings resulting

in an increase from 5.6 to 6.8 hectares and an increase in the bulk density to

1.5 kilograms per cubic metre ("kg/m3") from 1.3 kg/m3, which had been used in

historic assessments. A bulk density of 1.5 kg/m3 is considered more typical for

old settled tailings produced by grinding that have had time to drain, as these

old tailings are not contained in a tailings impoundment.

"This Mineral Resource Estimate will now be the basis for a Preliminary Economic

Assessment ("PEA") of the El Oro Mexico Mine Tailings which we anticipate will

demonstrate both very positive potential and a clear path forward for a Tailings

Recovery Operation ("TRO") as recommended by JDS Energy and Mining Inc. ("JDS")

in their high level conceptual study (News Release 034 April 15, 2014),"

commented Joanne Freeze, P. Geo., President and CEO of Candente Gold.

The estimate reflects the results of the recently completed (May 2014) auger and

channel sampling program (see News Release 036 June 26, 2014) as compared with

extensive historic assessments including drill testing and metallurgical test

work. The 2014 verification sampling program of the 1990 historic results was

completed through systematic sampling of the upper 3.0 metres of the tailings

with a hand auger and vertically channel sampling the lower 5 to 10 metres of

the tailings dump. In 1990, Luismin drilled 297.7 metres in 22 holes and in

1951, the Cooperativa de Las Dos Estrellas drilled 2162.7 metres in 184 holes. A

National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") technical report documenting the updated Mineral Resource estimate will

be filed on SEDAR within 45 days. The mineral resources reported herein have

been estimated using criteria consistent with the Canadian Institute of Mining

and Metallurgy ("CIM") Definition Standards (2014) and in conformity with the

CIM "Estimation of Mineral Resources and Mineral Reserves Best Practice" (2003)

guidelines. The contained metal figures shown are in-situ. No assurance can be

given that the estimated quantities will be produced. All figures have been

rounded to reflect accuracy and to comply with securities regulatory

requirements. Some summations may not agree due to rounding. This reported

Mineral Resource has an effective date of July 8th, 2014.

It is reasonably expected that the majority of the Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with infill drilling,

additional sampling, metallurgical testing, specific gravity and bulk density

estimations, confirmation of grade/quality continuity and with current quality

assurance and quality control standards. In addition, mining methods, mineral

processing, infrastructure, economic, marketing, legal, environmental, social

and governmental factors would need to be considered.

Qualified Persons: Allan Reeves, P.Geo., Principal of Tuun Consulting and Nadia

M. Caira, P.Geo., Principal of World Metals Inc., are the Qualified Persons as

defined by National Instrument 43-101. Mr. Reeves is responsible for the mineral

resources reported above and he has reviewed and approved disclosure of these

mineral resources. Ms. Caira is responsible for the geological and sampling

including Quality Assurance and Control for the project and has reviewed and

approved this disclosure.

Estimation Parameters: The Mexico Mine Tailings mineral resource was constrained

on the west and north by an offset of 30m from an existing highway and is

reported at a cut-off grade of 2.5 g/t gold equivalent ("AuEq"). Gold and silver

recoveries used were 50% and 50% respectively. Metal prices used were 12-month

rolling averages for: gold US$1,304.92/oz and silver US$20.67/oz. Mining and

processing costs and G&A used were $7.00, $27.00 and $11.00 US per tonne

respectively.

Quality Assurance and Control: A total of 123 samples in security sealed buckets

were driven by a Candente employee for sample preparation to ALS-Guadalajara,

Mexico. The sample pulps were then sent to ALS-Vancouver, B.C. for gold by Fire

Assay of a 50 gram charge (Au-AA23) with ICP-ES or AAS finish and was completed

with a gravimetric finish. Silver (Ag) was determined by ME-MS41, a 41 element

analysis with overlimits (greater than 100 ppm Ag) completed by fire assay with

gravimetric finish (Ag-OG46). QA/QC included the insertion and continual

monitoring of numerous standards and blanks into the sample stream, and the

collection of duplicate samples at random intervals within each batch.

Background on the Tailings

In 2013, Candente Gold acquired the right to process historic tailings left from

pre-1930s milling of ores from the Mexico Mine in the El Oro District in Mexico

State, Mexico. The tailings deposit lies within the town of El Oro and are

adjacent to existing road access, power and water services.

In April 2014, JDS Energy and Mining Inc. ("JDS") conducted a high level

conceptual study for a Tailings Recovery Operation ("TRO") near to the El Oro

site. The Company's strategy is to look for opportunities to develop cash flow

in the near term with relatively low capital costs. Study results indicate that

the Mexican mine tailings from El Oro have the potential to meet this criteria

and justify further study on the economic potential of a TRO.

As part of the conceptual study JDS evaluated a variety of metallurgical

processes, which have been historically tested by various parties for gold and

silver extraction from the tailings. Considering only industry standard

metallurgical processes typically utilized by other operations, the historical

metallurgical test work on El Oro tailings indicates that minimum overall

recoveries of 50% may be expected, however test work also indicates potential

for higher recoveries of 60% to 70%.

In keeping with both environmental and social responsibility policies of

Candente Gold, the proposed TRO would see the Company provide the El Oro

municipality with a remediation program, which would include relocation of the

tailings from the current site, within the town, to a nearby green fields

process facility in an unpopulated and under-utilized area. Once treated the

tailings would be contained by an engineered structure designed to international

standards. This would both remediate current potential environmental risks and

rehabilitate the current land making it available for the town's future

development.

Three other tailings deposits also exist within the Municipality of El Oro and

are included in the Agreement but require further testing and evaluations prior

to making a decision to reprocess and reclaim.

For more details, you may view our El Oro Tailings Update Presentation at:

http://www.candentegold.com/s/presentations.asp

About Candente Gold

Candente Gold's flagship asset is El Oro, a district scale gold project

encompassing the largest and most prolific high grade gold dominant epithermal

vein system in Mexico. The project covers 20 veins with past production and more

than 57 veins in total, from which approximately 6.4 million ounces of gold and

74 million ounces of silver were reported to have been produced from just two of

these veins.

Modern understanding of epithermal vein systems strongly indicates that several

of the El Oro district's veins hold potential for discovery of significant gold

and silver mineralization, particularly below the historic workings of the San

Rafael Vein, which was mined to an average depth of only 200 metres and produced

4 million ounces gold and 44 million ounces of silver.

Candente Gold also holds an extensive portfolio of 100% owned, early to

mid-stage; high and low sulphidation epithermal gold projects in Peru. Many of

these projects have significant exploration completed and targets ready to be

drill tested.

This news release may contain forward-looking statements including but not

limited to comments regarding the timing and content of upcoming work programs,

geological interpretations, receipt of property titles, potential mineral

recovery processes, etc. Forward-looking statements address future events and

conditions and therefore involve inherent risks and uncertainties. Actual

results may differ materially from those currently anticipated in such

statements. Candente relies upon litigation protection for forward-looking

statements.

CAUTIONARY NOTE TO U.S. INVESTORS

We advise U.S. investors that this news release uses terms that are not

recognized by the United States Securities and Exchange Commission ("SEC"),

including "mineral resources", "measured resources", "indicated resources" and

"inferred resources". The estimation of measured and indicated resources

involves greater uncertainty as to their existence and economic feasibility than

the estimation of proven and probable reserves. U.S. investors are cautioned not

to assume that mineral resources in these categories will be converted to

reserves. The estimation of inferred resources involves far greater uncertainty

as to their existence and economic viability than the estimation of other

categories of resources. U.S. investors are cautioned not to assume that

estimates of inferred mineral resources exist, are economically mineable, or

will be upgraded into measured or indicated mineral resources. U.S. investors

are cautioned not to assume that mineral resources in any of these categories

will be converted into reserves.

On behalf of the Board of Candente Gold Corp.

Joanne Freeze, P.Geo., President & CEO

NR 037

FOR FURTHER INFORMATION PLEASE CONTACT:

Candente Gold Corp.

Walter Spagnuolo

Manager, Investor Relations

Mobile: +1 (604) 306-8477 or Local: + 1 (604) 689-1957 ext 3

toll free: 1 (877) 689-1964 ext 3

info@candentegold.com

Candente Gold Corp.

Nataly Reategui

Investor Relations, Peru

(511) 715-2001 ext 107

(511) 717-1233 (FAX)

nreategui@candente.com

www.candentegold.com

Senvest Capital (TSX:SEC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

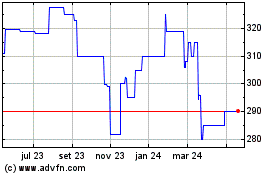

Senvest Capital (TSX:SEC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024