Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the first quarter

ended June 30, 2019. All amounts are expressed in Canadian dollars

unless otherwise noted.

Quarterly Highlights

- IFRS Gross Profit of $4.1 million compared to $2.1 million for

Q4 2019 and $4.0 million for Q1 2019, an increase of 98% and 9%

respectively.

- Non-IFRS Cash Gain of $1.5 million, compared to a loss of $0.03

million in the previous quarter.

- Total Comprehensive Income of $0.46 million, a 168% increase

year-over-year (“YoY”).

- Currency Loans totaling $20.1 million of balance sheet capital

extended to users against their pledged precious metals, earning

interest rates ranging from 3.75% to 4.69%.

- Corporate Precious Metal Exposure of $25.9 million at quarter

end, a 3% quarter-over-quarter increase.

- Tangible Common Equity grew to $129.9 million from $113.1

million in Q1 2019, a 14.9% increase YoY.

- Client Assets Under Custody stable at $1.8 billion as at June

30, 2019.

- Gold Linked Dividend Policy Approved by the Board of

Directors.

IFRS Consolidated Income Statement

Data

(expressed in $000s except loss per

share)

FY 2020

FY 2019

FY 2018

Q1

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Revenue1

59,116

64,171

84,029

69,550

63,794

98,447

85,158

77,185

Fee Revenue

606

591

580

610

575

580

584

645

Gross margin

1,517

1,393

1,566

1,611

1,686

2,250

1,903

957

Gross profit (excludes precious metal

inventory P&L)

2,682

2,782

2,749

3,092

3,321

3,663

9,692

1,971

Gross profit

(includes precious metal inventory

P&L)

4,104

2,069

4,152

2,182

3,978

2,108

10,008

1,999

(1)

In accordance with IFRS, the Company has

prospectively changed its revenue accounting policy in Q3 2019 and

has provided retrospective application. The Company restated

revenue prior to Q3 2019 as net basis instead of gross for fees

from exchange services. Transfer of fiat currency to the customer

and receipt by the Company of precious metals, crypto assets or

other fiat currency, were treated as an exchange service (net

basis), instead of revenue from the sale of the fiat currency

(gross basis). There is no impact to gross margin and net income.

The current revenue accounting policy is consistent with the March

31, 2019 year end policy.

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Please visit our SEDAR profile to view the Company’s

consolidated financial statements and MD&A.

Statement from the Chief Executive Officer

It has been four years since Goldmoney Inc. was listed on the

TSX Venture exchange, embarking on a mission to democratize access

to physical precious metals. That mission was borne out of a thesis

that precious metals would play a pivotal role in shielding one’s

savings from the punitive policies implemented in the post-2008

financial crisis era by global central banks, politicians, and

academic economists. As a business enterprise, our belief was that

building long-term businesses oriented around our central thesis

would not only help clients around the world who would be

experiencing the negative ramifications of this new normal but also

be rewarding to our long-term shareholders.

Over this past year and more specifically the past few weeks, it

is becoming apparent that our central thesis is proving to be

correct. We are witnessing a monumental failure on the part of the

mainstream narrative that has been proselytized since the financial

crisis, and as a result, confidence in fiat currencies and

financial abstractions of all sorts are fading. In response, gold

has reached an all-time high when measured in most of the world’s

fiat currencies and recently has been moving rapidly toward its

high watermark in US dollars. Our four core businesses, (a)

Goldmoney.com, (b) Mene.com, (c) SchiffGold.com, and (d)

LendBorrowTrust.com., offer our shareholders asymmetric leverage to

a rising gold price by earning demonstrable returns on capital from

revenue earned in storage, trading, jewelry, coins, lending, and

transactions involving physical precious metals.

Though this quarter ended before some of the major jumps in gold

and silver prices occurred, we can already see how well our group’s

earnings power and intrinsic value is leveraged to such moves. This

quarter saw our gross profit from normal operations reach an

all-time high in terms of % margin. The decline in nominal revenue

this quarter and in general over the past few quarters are banal in

my view and relates to seasonal factors. Moreover, what can now be

seen more clearly is the normalization of our cash costs being

better reflected in our results because the effects from Menē Inc.

have been isolated from its deconsolidation. Even in this quarter,

there is over $1.1 million in non-cash costs being accounted for

and by my estimation, an additional $1 million of non-core cash

costs which are either being invested in new ventures and growth or

reflect regulatory and professional fees we expect will diminish.

In short, our core business is becoming observably profitable on a

cash basis and even on an IFRS accounting basis.

The good news is continuing beyond the quarter date. At the time

of writing, the total of Goldmoney Inc.’s client assets and our

balance sheet is approaching $2.2 billion, an all-time record.

Precious metals on our balance sheet is nearing $30 million. The

combination of core business delivering earning streams and a

golden balance sheet capable of earning demonstrable returns has

given myself and your board confidence to implement policies that

will reward long-term shareholders.

In this regard, your board has agreed to a dividend policy. The

dividend for this first quarter of 2020 is $0.003215 per share. The

dividend will be paid on August 27, 2019 to shareholders of record

on August 20, 2019.

Going forward, the Company will implement quarterly dividends

(the “Gold Linked” dividends) which will be “Linked” to a benchmark

price of gold set at US$1,500 per gold ounce. The aggregate

dividend payment during each quarter will rise or fall by the same

percent as the percentage change of the average daily closing gold

price for the quarter against the Linked price. For example, if the

average of the quarter’s daily closing price were US$1,650, which

is 10% above the Linked price, the total aggregate cash value of

the dividend for the quarter would increase by 10%. Assuming a US

dollar gold price of US$1,500 per ounce, the annual dividend

payment will be approximately $1 million, representing about a

0.65% yield to our current market cap.

The Gold-Linked dividend policy and all quarterly Gold-Linked

dividend payments are subject to board review and may be adjusted

at the discretion of the board from time to time.

Should our financial situation continue to improve, I will

recommend to your board to consider increasing the Gold-Linked

dividend amount above $1 million.

In closing, we would like to thank all our clients,

shareholders, and colleagues for their continued hard-work and

dedication to our group companies.

Roy Sebag, Chairman and Chief Executive Officer

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's consolidated financial statements for the quarter ended

June 30, 2019 and prepared in accordance with International

Financial Reporting Standards ("IFRS") and the corresponding

management's discussion and analysis, which are available under the

Company's profile on SEDAR at www.sedar.com.

Investor Relations Questions

Shareholders of Goldmoney are encouraged to submit questions to

management by emailing ir@goldmoney.com. The Company will

periodically publish responses to selected questions received in

order to allow all investors ongoing access to information about

Goldmoney’s strategy, operations, and business plans.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure. This

figure excludes from IFRS Net Income the impact of non-cash items,

including the amortization of intangible assets and stock-based

compensation. Refer to the MD&A for a detailed breakdown of

these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Adjusted Gross Profit3 is a non IFRS financial measure, also

referred to as Gross profit excluding gain/(loss) on revaluation of

precious metals inventories. This figure excludes from Gross profit

the gain (loss) on revaluation of precious metals inventories.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the quarter ended June 30, 2019.

About Goldmoney Inc.

Goldmoney Inc. (TSX:XAU) is a precious metal focused investment

company. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal investment, custody and

storage, jewelry, coin retailing, and lending. Goldmoney manages

and oversees in excess of $1.8 billion in assets for clients around

the world. The company’s operating subsidiaries include:

Goldmoney.com, Menē Inc. (TSXV:MENĒ), SchiffGold.com, and Lend

& Borrow Trust. Through these businesses and other investment

activities, Goldmoney gains long-term exposure to precious metals.

For more information about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

SEDAR. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190813005216/en/

Media and Investor Relations inquiries:

Renee Wei Director of Global Communications Goldmoney

Inc. renee.wei@goldmoney.com

Steve Fray Chief Financial Officer Goldmoney Inc. +1 647

499 6748

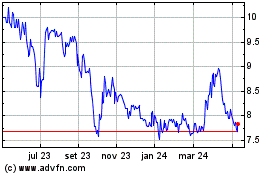

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

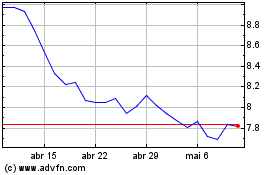

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024