Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the third quarter

ended December 31, 2019. All amounts are expressed in Canadian

dollars unless otherwise noted.

Quarterly Highlights

- IFRS Revenue of $108.1 million, an increase of $24.1 million

(29%) Year-over-Year (“YoY”).

- Gross Margin of $2.5 million, an improvement of $0.9 million

(58%) YoY.

- Gross Margin Percentage expanded by 31 basis points

Quarter-over-Quarter (“QoQ”) from 1.97% in Q2 2020 to 2.28% in Q3

2020.

- IFRS Gross Profit of $4.4 million, compared to $4.2 million in

Q3 2019, an improvement of 5% YoY.

- Tangible Common Equity(2) of $122.3 million, compared to $126

million at March 31, 2019

- Currency and Precious Metal Loans totaling $23.1 million of

balance sheet capital extended to users against their pledged

precious metals, earning interest rates up to 4.72%.

- Total Comprehensive Loss of $5.8 million, a $35.3 million

decrease compared to Q3 2019.

- SchiffGold Revenue increased by 26% YoY to $41.3 million. Net

Income rose by 195% due to favourable precious metals prices.

- Client Asset Under Custody increased by 14% from $1.75 billion

as at March 31, 2019 to $2 billion as at December 31, 2019.

IFRS Consolidated Income Statement

Data

($000s, except earnings per share)

FY 2020

FY 2019

Q3

Q2

Q1

Q4

Q3

Q2

Revenue (1)

108,161

127,154

59,116

64,171

84,029

69,550

Fee Revenue

719

599

606

591

580

610

Gross margin

2,469

2,501

1,517

1,393

1,566

1,611

Interest income

461

536

555

416

448

502

Gross profit Excl. revaluation of precious

metals inventories

3,649

3,633

2,682

2,782

2,749

3,092

Gross profit Incl. revaluation of precious

metals inventories(3)

4,369

5,636

4,104

2,069

4,152

2,182

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Statement from the Chief Executive Officer

Fiscal Q3 2020 was a transition quarter because we crossed an

important threshold in resolving several regulatory matters that

have been lingering for nearly three years. Throughout this

process, the Company viewed these events as non-material and within

the ordinary course of business. They were headwinds to be expected

given our grand ambition to make physical gold accessible to

anyone, everywhere.

Because of this guiding ethos and because we are the sector’s

leader, we have been on the front lines and addressed these matters

by engaging the best law firms, auditors, and regulatory experts to

assist us. The costs we have incurred are approaching $10 million

and have been reflected in an abnormally high ‘Professional Fees’

line-item. We have been guiding shareholders that eventually this

line-item will begin to decline towards a normalized rate of a

regulated public company. We believe that moment has arrived in

this transition quarter. Going forward we expect a significantly

reduced level of spending on regulatory matters.

To adapt to the present regulatory environment, we have adjusted

our business model in several ways. For example, we exited

cryptocurrency, began charging a minimum fee, and augmented our

bank-like KYC (know your customer) and AML (anti-money laundering)

processes to achieve an industry-leading standard. We estimate that

70% of our payroll costs have been attributed to compliance

matters, which reflects the state of financial services today.

The good news is that we have navigated our company safely

through this period, and over the past three years, our brand

equity, balance sheet, revenues, and client assets have all grown

to new records. We have positioned our long-term business model to

deal with the regulatory realities of the day. The future of

Goldmoney Inc. is not only bright for clients, but shareholders

too. With this transition quarter behind us, they can begin to

appreciate the long-term earnings potential of our business when

adjusting for non-cash and extraordinary items.

For example, over the past 9 months, Goldmoney Inc. has

generated $14.1 million of Gross Profit on $294.4 million of

Revenue vs. $10.3 million of Gross Profit on $217.4 million of

Revenue one year ago. Against that Gross Profit ($24.4 million in

cash generated over 18 months of operations), Goldmoney Inc. spent

$8.8 million on professional fees, of which approximately 80% is

attributed to the exceptional regulatory issues referred to above.

Adjusting our operating performance for these and other non-cash

and extraordinary line items (Stock Based Compensation, Foreign

Exchange movements, Depreciation and Amortization) shows a growing

business that can produce significant free cash flow (50% or more

of Gross Profit).

Further, these figures include significant R&D and capex

spending on innovative ventures within the group that are expensed

through the Payroll, Technology and Development Cost line items. We

believe that one of these new ventures has the potential to deliver

Menē Inc. like returns to the group over the next few years.

Appreciating this picture of long-term profitability, applying

appropriate multiples on such profitability in this current

environment, and netting our significant tangible capital, results

in a measurable intrinsic value for Goldmoney Inc.

In conclusion, Goldmoney Inc. is well positioned to deliver

long-term returns to shareholders. With this transition quarter

behind us, we intend to deliver those results in the near

future.

I would like to thank our team members across five offices

around the world for their hard work. It was their work and

steadfast morale that has brought our company to our present

position.

I would also like to thank our clients for continuing to trust

us with their hard-earned savings. While clients may no longer be

able to purchase and sell cryptocurrency, buy gold with every kind

of payment processor, or find Goldmoney the most convenient place

to make and receive gold payments, Goldmoney remains the

gold-standard in physical custody of precious metal savings outside

the fractional reserve banking system. Safeguarding the assets

owned by our customers is our core business, and it is ultimately

the most important service we can provide.

- Roy Sebag, Chairman and Chief Executive Officer

Financial Information and IFRS Standards

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's consolidated financial statements for the quarter ended

December 31, 2019 and prepared in accordance with International

Financial Reporting Standards ("IFRS") and the corresponding

management's discussion and analysis, which are available under the

Company's profile on SEDAR at www.sedar.com.

Investor Relations Questions

Shareholders of Goldmoney are encouraged to submit questions to

management by emailing ir@goldmoney.com. The Company will

periodically publish responses to selected questions received in

order to allow all investors ongoing access to information about

Goldmoney’s strategy, operations, and business plans.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure. This

figure excludes from IFRS Net Income the impact of non-cash items,

including the amortization of intangible assets and stock-based

compensation. Refer to the MD&A for a detailed breakdown of

these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Adjusted Gross Profit3 is a non IFRS financial measure, also

referred to as Gross profit excluding gain/(loss) on revaluation of

precious metals inventories. This figure excludes from Gross profit

the gain (loss) on revaluation of precious metals inventories.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the quarter ended December 31, 2019.

About Goldmoney Inc.

Goldmoney Inc. (TSX: XAU) is a precious metal focused investment

company. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal investment, custody and

storage, jewelry, coin retailing, and lending. Goldmoney manages

and oversees in excess of $2.0 billion in assets for clients around

the world. The company’s operating subsidiaries include:

Goldmoney.com, Menē Inc. (TSXV: MENĒ), SchiffGold.com, and Lend

& Borrow Trust. Through these businesses and other investment

activities, Goldmoney gains long-term exposure to precious metals.

For more information about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

SEDAR. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200214005528/en/

Media and Investor Relations inquiries:

Renee Wei Director of Global Communications Goldmoney

Inc. renee.wei@goldmoney.com

Steve Fray Chief Financial Officer Goldmoney Inc. +1 647

499 6748

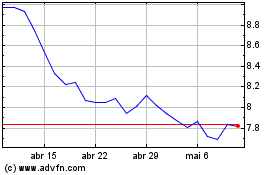

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

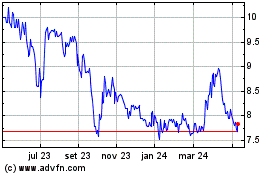

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024