Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the fourth quarter

and fiscal year ended March 31, 2020. All amounts are expressed in

Canadian dollars unless otherwise noted.

Financial Highlights

- Record Annual IFRS Revenue of $458.9 million, an increase of

$177.3 million or 63% Year-over-Year (“YoY”).

- Record Annual Gross Profit of $22.3 million, a $9.9 million or

80% increase YoY. Growth Profit Percentage expanded 45 basis points

to 4.85%.

- Record Quarterly IFRS Revenue of $164.4 million in Q4 2020, an

increase of 156% compared to Q4 2019. Q4 IFRS Gross Profit of $8.2

million, an increase of $6 million or 294%, also a new record.

- Record Annual Fee Revenue of $4.4 million, an increase of $2.1

million or 87% over the prior year.

- Reduced Operating Expenses by $3.5 million, or 15% to $20.6

million during fiscal year 2020.

- Generated Operating Cash Flow of $2.5 million in the fiscal

year an improvement of $7 million over the prior year.

- Tangible Common Equity of $114 million, with $36.6 million in

cash and cash equivalents. Total Shareholders’ Equity of $172.4

million as of the end of Q4 2020.

- Corporate Metal Position of $16.5 million at end of the fiscal

year excluding precious metal loans.

- Currency and Precious Metal Loans totaling $23.5 million of

balance sheet capital extended to users against their precious

metals and Menē Inc., earning interest rates ranging from 2.58% to

4.20% as at March 31, 2020.

- IFRS Net Loss of $9.7 million in FY 2020.

- Goldmoney.com Asset Under Custody increased by 18% YoY to $2.07

billion as at March 31, 2020.

- SchiffGold continued to generate strong growth with an 78%

increase in revenue, 169% increase in gross margin, and 355%

increase in operating income.

Business Highlights

- Increased equity stake in investment subsidiary Menē Inc.

(TSXV:MENE). Menē recently reported record revenue and gross profit

for its fiscal year ended December 31, 2019.

- Increased investment to reach 100% ownership in LBT Holdings

Limited.

- Expanded the Goldmoney Global Vault Network with two new vault

locations in Singapore and Frankfurt, Germany. The Company now

offers vaulting options at 15 locations in eight countries in North

America, Europe and Asia.

- Unveiled a new Vault-to-Vault Exchange feature that allows

clients securely and effortlessly exchange metals from one vault to

another on the Goldmoney Global Vault Network.

- Introduced a minimum monthly storage fee and optimized fee

schedule to capture the full value of service and drive incremental

margin growth.

IFRS Consolidated Income

Statement Data

(expressed in $000s)

FY 2020

FY 2019

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1

Revenue

164,441

108,161

127,154

59,116

64,171

84,029

69,550

63,794

Fee revenue

2,489

719

599

606

591

580

610

575

Gross margin

4,390

2,469

2,501

1,517

1,393

1,566

1,611

1,686

Interest income

374

461

536

555

416

448

502

446

Gross profit excl. revaluation of precious

metals inventories

7,253

3,649

3,633

2,682

2,782

2,749

3,092

3,321

Gross profit Incl. revaluation of precious

metals inventories

8,157

4,369

5,636

4,104

2,069

4,152

2,182

3,978

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

COVID-19 Update

While the COVID-19 pandemic subdued global economic growth and

increased volatility in the financial markets, it has accelerated

demand for safe-haven assets such as precious metals. The Company

is uniquely positioned to continue to serve its clients online and

help them protect their financial wealth during this challenge

time. As impact of the pandemic became clear in March 2020, the

Company swiftly introduced a series of initiatives with a focus on

supporting the physical and financial wellbeing of its clients, its

staff and community, while safeguarding the long-term financial

strength of the business:

- Transitioned global staff to remote work while maintaining the

highest levels of security and client confidentiality.

- Temporarily closed all Goldmoney branch locations to walk-in

traffic.

- Maintained the same 0.5% buy and sell fees and low storage

costs that include full insurance.

- Optimized workforce and technology network to support heavy

trading volumes and new client sign ups.

- Further drove cost reductions by minimizing non-essential

operating and marketing expenses.

Annual Shareholder Letter

Read the full Goldmoney Inc. Fiscal Year 2020 Shareholder Letter

here.

Financial Information and IFRS Standards

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's consolidated financial statements for the quarter and

fiscal year ended March 31, 2020 and prepared in accordance with

International Financial Reporting Standards ("IFRS") and the

corresponding management's discussion and analysis, which are

available under the Company's profile on SEDAR at

www.sedar.com.

Investor Questions

In lieu of a conference call, shareholders of Goldmoney are

encouraged to read the FY 2020 Shareholder Letter and submit any

questions to management by emailing ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure. This

figure excludes from IFRS Net Income the impact of non-cash items,

including the amortization of intangible assets and stock-based

compensation. Refer to the MD&A for a detailed breakdown of

these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Adjusted Gross Profit3 is a non IFRS financial measure, also

referred to as Gross profit excluding gain/(loss) on revaluation of

precious metals inventories. This figure excludes from Gross profit

the gain (loss) on revaluation of precious metals inventories.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2020.

About Goldmoney Inc.

Goldmoney Inc. (TSX: XAU) is a precious metal focused investment

company. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal investment, custody and

storage, jewelry, coin retailing, and lending. Goldmoney manages

and oversees in excess of $2.0 billion in assets for clients around

the world. The company’s operating subsidiaries include:

Goldmoney.com, Menē Inc. (TSXV: MENĒ), SchiffGold.com, and Lend

& Borrow Trust. Through these businesses and other investment

activities, Goldmoney gains long-term exposure to precious metals.

For more information about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

SEDAR. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200629005200/en/

Media and Investor Relations inquiries:

Renee Wei Director of Global Communications Goldmoney

Inc. renee.wei@goldmoney.com

Steve Fray Chief Financial Officer Goldmoney Inc. +1 647

250 7170

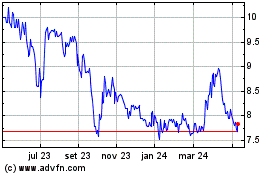

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

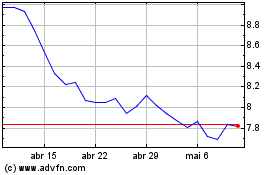

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024