Revenue Up 12%; Backlog Up 77% On Multiple

Contract Awards

Sypris Solutions, Inc. (Nasdaq/GM: SYPR) today reported

financial results for its second quarter ended July 3, 2022.

HIGHLIGHTS

─────────────────────

- Revenue for the quarter increased 11.8%

year-over-year, driven by a 25.6% increase for Sypris Electronics

and a 4.7% increase for Sypris Technologies.

- Orders increased 360% on a year-over-year

basis and 169% sequentially driven by a 524% and 240% increase at

Sypris Electronics, respectively.

- Backlog increased 77% driven by Sypris

Electronics, which increased 84.1% year-over-year and 72.7%

year-to-date on the strength of multiple contract awards.

- Gross margin for the quarter decreased 360

basis points from the prior year primarily reflecting a change in

revenue mix for both segments and costs incurred to support

capacity improvements.

- Sypris Electronics announced several important

new contract awards and releases during the quarter, including the

following:

- A follow-on contract to manufacture advanced

integrated electronic warfare and communications avionics system

modules for an American family of single-seat, single-engine,

all-weather stealth multirole combat aircraft. One of the largest

government DOD programs, production is expected to begin in

2022;

- A multi-year, follow-on, full-rate production

contract to produce and test multiple power supply modules for the

upgrade of the electronic warfare suite of an important U.S.

fighter aircraft program. The upgrade is intended to replace the

functionally obsolete self-protection system of the aircraft. The

transition to full-rate production is expected to begin in 2022;

and

- Releases under a new, multi-year follow-on

contract to produce and test power supply modules for a large,

mission-critical U.S. Navy electronic warfare improvement program.

The upgrade will provide the capability to jam incoming missiles

that threaten a warship, cue decoys and adapt quickly to evolving

threats. Full-rate production is expected to begin in 2022.

- Sypris Technologies announced that it has

entered into a multi-year contract extension to provide drivetrain

components for use in the production of medium and heavy-duty

commercial vehicles with a leading global commercial vehicle

original equipment manufacturer.

- The Company updated its full-year outlook for

2022, maintaining the expected increase in revenue at 25 to 30%

year-over-year while adjusting the gross margin guidance to a 25 to

50 basis point increase with revenue mix and supply chain

inefficiencies slowing the margin improvement in the near term.

Cash flow from operations is expected to show double digit

percentage growth reflecting increased year-over-year profitability

and favorable working capital changes during the year.

────────────────────

“We were pleased with our year-over-year revenue growth in both

segments and the significant growth in backlog for Sypris

Electronics. While the timing of program launches has been impacted

by continued supply chain disruptions, we continue to work with our

customers and vendors to navigate the market conditions and

identify solutions to satisfy our customers and the end users of

our products,” commented Jeffrey T. Gill, President and Chief

Executive Officer.

“Backlog for Sypris Electronics continued to increase on both a

year-over-year and sequential basis, resulting in our largest book

of business in over a decade. The record backlog is expected to

support revenue growth over the balance of this year and in 2023,

with a portion of the orders with delivery dates extending into

2024. Customer funding has already been secured for a portion of

these key programs, which enables us to procure inventory under

multi-year purchase orders to mitigate future supply chain

issues.

“Overall demand from customers serving the automotive,

commercial vehicle, sport utility and off-highway markets has

remained stable, with new product line shipments offsetting

headwinds for automotive and commercial vehicle components as our

customers adjust inventory levels to align with OEM build

schedules. We continue to invest in new equipment, maintain or

upgrade existing assets, and drive continuous improvement

initiatives to add capacity and support more cost-efficient

operations in the future. The recent successful extension of

long-term contracts with two of our key customers supports our

revenue base and provides opportunities to expand these

relationships in the coming years.

“Orders for our energy products during the second quarter

increased 13% year-over-year, with open quotes outstanding on

several large projects. Additional opportunities for growth may

exist with new projects in support of increasing rig counts over

pre-pandemic levels. We are also actively pursuing applications for

our products in adjacent markets to further diversify our industry

and customer portfolios.”

Second Quarter Results

The Company reported revenue of $29.0 million for the second

quarter of 2022, compared to $26.0 million for the prior-year

comparable period. Additionally, the Company reported a net loss of

$0.6 million, or $0.03 per share, compared to net income of $3.8

million, or $0.17 per diluted share, for the prior-year period. Net

income in the second quarter of 2021 included the recognition of a

$3.6 million gain on the forgiveness of the Company’s PPP loan.

For the six months ended July 3, 2022, the Company reported

revenue of $55.2 million compared with $46.0 million for the first

half of 2021. The Company reported a net loss of $0.4 million, or

$0.02 per share, compared with net income of $2.2 million, or $0.10

per diluted share, for the prior-year period. Results for the six

months ended July 4, 2021, included the gain from the forgiveness

of the Company’s PPP loan noted above.

Sypris Technologies

Revenue for Sypris Technologies increased to $18.0 million in

the second quarter of 2022, compared to $17.1 million for the

prior-year period. Increased shipments of components for sport

utility vehicles and price adjustments for the pass-through of

increased steel prices were partially offset by a decline in

energy-related product sales. Gross profit for the second quarter

of 2022 was $2.1 million, or 11.9% of revenue, compared to $2.5

million, or 14.6% of revenue, for the same period in 2021. In

addition to the change in revenue mix, gross profit for the second

quarter of 2022 was impacted by additional costs incurred to

support the increase in demand driven by the commercial vehicle

market anticipated over the next two years.

Sypris Electronics

Revenue for Sypris Electronics increased to $11.1 million in the

second quarter of 2022 compared to $8.8 million for the prior-year

period. Shipments under a full-rate production contract began

ramping up during the fourth quarter of 2021 and continued through

the first half of 2022, driving the increase in revenue. Supply

chain constraints partially offset these gains, limiting shipments

on certain other programs during the second quarter of 2022. Gross

profit for the second quarter of 2022 was $1.6 million, or 14.9% of

revenue, compared to $1.8 million, or 20.4% of revenue, for the

same period in 2021. Margins were impacted by production

on-boarding and engineering costs, which are typically higher on

programs that have not yet reached full rate production, and the

completion of certain mature programs.

Outlook

Commenting on the future, Mr. Gill added, “Demand from customers

serving the automotive, commercial vehicle and sport utility

markets has remained at high levels, with Class 8 forecasts showing

year-over-year production increases of 17.2% for 2022. Similarly,

demand from customers in the defense and communications sector

remains robust, while the outlook for the energy market continues

to move in the right direction.

“With a strong backlog, new program wins and long-term contract

extensions in place, we are confident that the remainder of 2022

has the potential to be very positive for Sypris. We continue to

expect a revenue increase of 25 to 30% year-over-year and a

significant increase in cash flow from operations supported by

strong earnings growth. We are adjusting our gross margin expansion

to 25 to 50 basis points over the prior year, as our expected

revenue mix has shifted from our prior outlook, and we continue to

expect supply chain inefficiencies will impact our production costs

as new programs ramp up for Sypris Electronics.”

Webcast and Conference Call Information

Sypris Solutions will host a listen only conference call to

discuss the Company's financial results today, August 16, 2022, at

9:00 a.m. (Eastern Time). To listen to the call, participants

should dial (833) 316-0560 approximately 10 minutes prior to the

start of the call (ask to be joined into the Sypris Solutions, Inc.

call).

The live broadcast of Sypris’ quarterly conference call will

also be available online at www.sypris.com on August 16, 2022,

beginning at 9:00 a.m. (Eastern Time). The online replay will be

available at approximately 11:00 a.m. (Eastern Time) and continue

for 30 days. Related presentation materials will be posted to the

“Investor Information” section of the Company’s website at

www.sypris.com, located under the sub-heading “Upcoming Events,”

prior to the call.

About Sypris Solutions

Sypris Solutions is a diversified manufacturing and engineering

services company serving the defense, transportation,

communications and energy industries. For more information about

Sypris Solutions, visit its Web site at www.sypris.com.

Forward Looking Statements

This press release contains “forward-looking” statements

within the meaning of the federal securities laws.

Forward-looking statements include our plans and expectations of

future financial and operational performance. Each

forward-looking statement herein is subject to risks and

uncertainties, as detailed in our most recent Form 10-K and Form

10-Q and other SEC filings. Briefly, we currently believe that

such risks also include the following: our failure to achieve and

maintain profitability on a timely basis by steadily increasing our

revenues from profitable contracts with a diversified group of

customers, which would cause us to continue to use existing cash

resources or require us to sell assets to fund operating losses;

our failure to successfully complete final contract negotiations

with regard to our announced contract “orders”, “wins” or “awards”;

dependence on, retention or recruitment of key employees and highly

skilled personnel and distribution of our human capital; cost,

quality and availability or lead times of raw materials such as

steel, component parts (especially electronic components), natural

gas or utilities including increased cost relating to inflation;

our failure to successfully win new business or develop new or

improved products or new markets for our products; breakdowns,

relocations or major repairs of machinery and equipment, especially

in our Toluca Plant; volatility of our customers’ forecasts

especially in the commercial truck markets and our contractual

obligations to meet current scheduling demands and production

levels (especially in our Toluca Plant), which may negatively

impact our operational capacity and our effectiveness to integrate

new customers or suppliers, and in turn cause increases in our

inventory and working capital levels; the fees, costs and supply

of, or access to, debt, equity capital, or other sources of

liquidity; the impact of COVID-19 and economic conditions on our

future operations; possible public policy response to the pandemic,

including U. S or foreign government legislation or restrictions

that may impact our operations or supply chain; the cost, quality,

timeliness, efficiency and yield of our operations and capital

investments, including the impact of inflation, tariffs, product

recalls or related liabilities, employee training, working capital,

production schedules, cycle times, scrap rates, injuries, wages,

overtime costs, freight or expediting costs; the termination or

non-renewal of existing contracts by customers; inaccurate data

about markets, customers or business conditions; disputes or

litigation involving governmental, supplier, customer, employee,

creditor, stockholder, product liability, warranty or environmental

claims; our reliance on a few key customers, third party vendors

and sub-suppliers; inventory valuation risks including excessive or

obsolescent valuations or price erosions of raw materials or

component parts on hand or other potential impairments,

non-recoverability or write-offs of assets or deferred costs;

failure to adequately insure or to identify product liability,

environmental or other insurable risks; unanticipated or uninsured

product liability claims, disasters, public health crises, losses

or business risks; the costs of compliance with our auditing,

regulatory or contractual obligations; labor relations; strikes;

union negotiations; costs associated with environmental claims

relating to properties previously owned; pension valuation, health

care or other benefit costs; our inability to patent or otherwise

protect our inventions or other intellectual property from

potential competitors; adverse impacts of new technologies or other

competitive pressures which increase our costs or erode our

margins; our reliance on revenues from customers in the oil and gas

and automotive markets, with increasing consumer pressure for

reductions in environmental impacts attributed to greenhouse gas

emissions and increased vehicle fuel economy; U.S. government

spending on products and services that Sypris Electronics provides,

including the timing of budgetary decisions; changes in licenses,

security clearances, or other legal rights to operate, manage our

work force or import and export as needed; risks of foreign

operations; currency exchange rates; inflation; war, geopolitical

conflict, terrorism, or political uncertainty, including

disruptions resulting from the conflict between Russia and Ukraine

arising out of international sanctions, foreign currency

fluctuations and other economic impacts; cyber security threats and

disruptions, including ransomware attacks on our systems and the

systems of third-party vendors and other parties with which we

conduct business, all of which may become more pronounced in the

event of geopolitical conflicts and other uncertainties, such as

the conflict in Ukraine; our ability to maintain compliance with

the Nasdaq listing standards minimum closing bid price; risks

related to owning our common stock, including increased volatility;

or unknown risks and uncertainties. We undertake no obligation to

update our forward-looking statements, except as may be required by

law.

SYPRIS SOLUTIONS, INC. Financial Highlights (In

thousands, except per share amounts)

Three Months

Ended

July 3,

July 4,

2022

2021

(Unaudited) Revenue

$

29,044

$

25,969

Net (loss) income

$

(629

)

$

3,823

(Loss) income per common share: Basic

$

(0.03

)

$

0.18

Diluted

$

(0.03

)

$

0.17

Weighted average shares outstanding: Basic

21,723

21,356

Diluted

21,723

22,846

Six Months Ended

July 3,

July 4,

2022

2021

(Unaudited) Revenue

$

55,210

$

45,951

Net (loss) income

$

(392

)

$

2,193

(Loss) income per common share: Basic

$

(0.02

)

$

0.10

Diluted

$

(0.02

)

$

0.10

Weighted average shares outstanding: Basic

21,700

21,475

Diluted

21,700

22,979

Sypris Solutions, Inc. Consolidated Statements of

Operations (in thousands, except for per share data)

Three Months Ended

Six Months Ended

July 3,

July 4,

July 3,

July 4,

2022

2021

2022

2021

(Unaudited) (Unaudited) Net revenue:

Sypris Technologies

$

17,951

$

17,139

$

35,106

$

30,329

Sypris Electronics

11,093

8,830

20,104

15,622

Total net revenue

29,044

25,969

55,210

45,951

Cost of sales: Sypris Technologies

15,820

14,630

29,843

26,649

Sypris Electronics

9,444

7,030

17,078

13,177

Total cost of sales

25,264

21,660

46,921

39,826

Gross profit: Sypris Technologies

2,131

2,509

5,263

3,680

Sypris Electronics

1,649

1,800

3,026

2,445

Total gross profit

3,780

4,309

8,289

6,125

Selling, general and administrative

3,737

3,416

7,126

6,298

Operating income (loss)

43

893

1,163

(173

)

Interest expense, net

263

211

511

433

Other expense, net

104

145

273

366

Forgiveness of PPP Loan and related interest

-

(3,599

)

-

(3,599

)

Loss (income) before taxes

(324

)

4,136

379

2,627

Income tax expense, net

305

313

771

434

Net (loss) income

$

(629

)

$

3,823

$

(392

)

$

2,193

(Loss) income per common share: Basic

$

(0.03

)

$

0.18

$

(0.02

)

$

0.10

Diluted

$

(0.03

)

$

0.17

$

(0.02

)

$

0.10

Dividends declared per common share

$

-

$

-

$

-

$

-

Weighted average shares outstanding: Basic

21,723

21,356

21,700

21,475

Diluted

21,723

22,846

21,700

22,979

Sypris Solutions, Inc. Consolidated Balance Sheets

(in thousands, except for share data)

July 3,

December 31,

2022

2021

(Unaudited)

(Note)

ASSETS Current assets: Cash and cash equivalents

$

7,486

$

11,620

Accounts receivable, net

9,478

8,467

Inventory, net

29,379

30,100

Other current assets

6,792

5,868

Total current assets

53,135

56,055

Property, plant and equipment, net

14,625

14,140

Operating lease right-of-use assets

4,699

5,140

Other assets

3,902

4,170

Total assets

$

76,361

$

79,505

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

12,838

$

11,962

Accrued liabilities

21,086

19,646

Operating lease liabilities, current portion

1,114

1,063

Finance lease obligations, current portion

1,016

983

Equipment financing obligations, current portion

347

336

Note payable - related party, current portion

2,500

-

Total current liabilities

38,901

33,990

Operating lease liabilities, net of current portion

4,306

4,878

Finance lease obligations, net of current portion

2,957

3,469

Equipment financing obligations, net of current portion

692

868

Note payable - related party, net of current portion

3,987

6,484

Other liabilities

5,880

10,530

Total liabilities

56,723

60,219

Stockholders’ equity: Preferred stock, par value $0.01 per

share, 975,150 shares authorized; no shares issued

-

-

Series A preferred stock, par value $0.01 per share, 24,850 shares

authorized; no shares issued

-

-

Common stock, non-voting, par value $0.01 per share, 10,000,000

shares authorized; no shares issued

-

-

Common stock, par value $0.01 per share, 30,000,000 shares

authorized; 22,132,002 shares issued and 22,131,983

outstanding in 2022 and 21,864,743 shares issued and

21,864,724 outstanding in 2021

221

218

Additional paid-in capital

155,214

154,904

Accumulated deficit

(113,234

)

(112,842

)

Accumulated other comprehensive loss

(22,563

)

(22,994

)

Treasury stock, 19 in 2022 and 2021

-

-

Total stockholders’ equity

19,638

19,286

Total liabilities and stockholders’ equity

$

76,361

$

79,505

Note: The balance sheet at December 31, 2021, has been derived

from the audited consolidated financial statements at that date but

does not include all information and footnotes required by

accounting principles generally accepted in the United States for a

complete set of financial statements.

Sypris Solutions, Inc. Consolidated Cash Flow

Statements (in thousands)

Six Months Ended

July 3,

July 4,

2022

2021

(Unaudited)

Cash flows from operating activities: Net (loss) income

$

(392

)

$

2,193

Adjustments to reconcile net (loss) income to net cash (used

in) provided by operating activities: Depreciation and

amortization

1,531

1,274

Forgiveness of PPP Loan and related interest

-

(3,599

)

Deferred income taxes

225

266

Stock-based compensation expense

349

163

Deferred loan costs recognized

3

3

Net loss on the sale of assets

10

11

Provision for excess and obsolete inventory

129

65

Non-cash lease expense

442

438

Other noncash items

91

90

Contributions to pension plans

(47

)

(254

)

Changes in operating assets and liabilities: Accounts

receivable

(1,155

)

(3,270

)

Inventory

711

(7,063

)

Prepaid expenses and other assets

(819

)

(335

)

Accounts payable

805

7,218

Accrued and other liabilities

(3,892

)

11,406

Net cash (used in) provided by operating activities

(2,009

)

8,606

Cash flows from investing activities: Capital expenditures

(1,840

)

(1,213

)

Proceeds from sale of assets

-

10

Net cash used in investing activities

(1,840

)

(1,203

)

Cash flows from financing activities: Principal payments on

finance lease obligations

(479

)

(211

)

Principal payments on equipment financing obligations

(165

)

(65

)

Indirect repurchase of shares for minimum statutory tax

withholdings

(36

)

(382

)

Net cash used in financing activities

(680

)

(658

)

Effect of exchange rate changes on cash balances

395

(157

)

Net (decrease) increase in cash and cash equivalents

(4,134

)

6,588

Cash and cash equivalents at beginning of period

11,620

11,606

Cash and cash equivalents at end of period

$

7,486

$

18,194

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220816005181/en/

Anthony C. Allen Chief Financial Officer (502)

329-2000

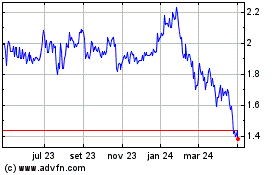

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

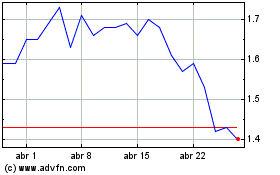

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024