Coeur Announces Agreement to Sell Southern Nevada Holdings for Upfront Cash Consideration of $150 million

19 Setembro 2022 - 7:50AM

Business Wire

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

announced that it has entered into a definitive agreement (the

“Agreement”) with a subsidiary of AngloGold Ashanti Limited

(“AngloGold”) (NYSE: AU) to sell its Crown and Sterling (“Crown

Sterling”) holdings for closing cash consideration of $150 million

and deferred cash consideration of $50 million to be paid upon

Crown Sterling attaining a total resource of at least 3.5 million

gold ounces.

The Crown Sterling holdings comprise approximately 35,500 net

acres and are located adjacent to AngloGold’s existing gold

projects in Beatty County, Nevada. Subject to customary closing

conditions, the transaction is expected to be completed in the

fourth quarter of 2022.

“The divestiture of Crown Sterling unlocks significant value for

Coeur stockholders and demonstrates our ongoing commitment to

allocating capital into our existing portfolio of near-term core

growth projects, highlighted by the Rochester expansion in northern

Nevada,” said Mitchell J. Krebs, President and Chief Executive

Officer. “The consideration represents a significant gain on our

original investment.

“Following its recent acquisition of Corvus Gold, AngloGold has

consolidated a significant portion of the Beatty district and is

the logical operator of a future standalone mining operation in the

Beatty district. We look forward to sharing in AngloGold’s future

exploration success in this prospective district.”

Gibson, Dunn & Crutcher LLP is acting as legal counsel to

Coeur.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, The Company wholly-owns the

Silvertip silver-zinc-lead development project in British Columbia

and has interests in several precious metals exploration projects

throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding the anticipated sale of Crown

Sterling (including anticipated deferred consideration) and future

prospects for the Beatty, Nevada mining district. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Such factors include, among others,

the risk that the transaction does not close on a timely basis or

at all, the risk that anticipated deferred consideration does not

become payable, the risks and hazards inherent in the mining

business (including risks inherent in developing large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically-related conditions), changes in the market price of

gold and a sustained lower price or higher treatment and refining

charge environment, risks relating to permitting and regulatory

delays (including the impact of government shutdowns), ground

conditions, grade and recovery variability, any future labor

disputes or work stoppages (involving the Company and its

subsidiaries or third parties), the uncertainties inherent in the

estimation of mineral reserves or mineral resources, the potential

effects of the COVID-19 pandemic, including impacts to workforce,

materials and equipment availability, inflationary pressures,

continued access to financing sources, government orders that may

require temporary suspension of operations and effects on suppliers

or the refiners and smelters, the effects of environmental and

other governmental regulations and government shut-downs, the risks

inherent in the ownership or operation of or investment in mining

properties or businesses in foreign countries, as well as other

uncertainties and risk factors set out in filings made from time to

time with the United States Securities and Exchange Commission, and

the Canadian securities regulators, including, without limitation,

Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual

results, developments and timetables could vary significantly from

the estimates presented. Readers are cautioned not to put undue

reliance on forward-looking statements. Coeur disclaims any intent

or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities. This does not constitute an offer of any securities for

sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220919005330/en/

Coeur Mining, Inc. Attention: Jeff Wilhoit, Director, Investor

Relations Phone: (312) 489-5800 www.coeur.com

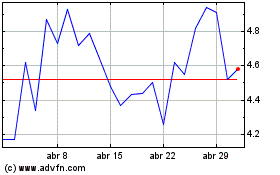

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

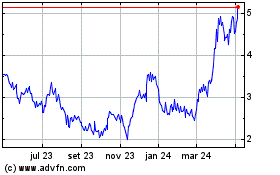

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024