FCPT Announces Sale Leaseback of Nine Car Wash properties from Top Five Operator for $40 Million

29 Junho 2023 - 7:01PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real estate

investment trust primarily engaged in the ownership and acquisition

of high-quality, net-leased restaurant and retail properties

(“FCPT” or the “Company”), is pleased to announce the acquisition

of nine car wash properties for $40 million from a top five

operator via a sale-leaseback. The properties are located in strong

retail corridors in Florida, Indiana, Louisiana, Ohio, Oklahoma,

and South Carolina. The sites are corporate-operated under a

long-term, triple net master lease. The transaction was priced at a

cap rate in range with previous FCPT transactions. Our tenant has

requested confidentiality around disclosure of the brand name.

Bill Lenehan, CEO of FCPT, stated: “We are excited to undertake

this transaction with a proven industry leader. This is FCPT’s

first major acquisition in the car wash space, and it granted FCPT

the opportunity to acquire very high-quality triple net leased real

estate at an affordable basis and rent level for the car wash

industry overall. As with all of our acquisitions, this portfolio

reflects FCPT’s commitment to sourcing opportunities that match our

high quality underwriting thresholds.”

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the ownership, acquisition

and leasing of restaurant and retail properties. The Company seeks

to grow its portfolio by acquiring additional real estate to lease,

on a net basis, for use in the restaurant and retail industries.

Additional information about FCPT can be found on the website at

www.fcpt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230629561131/en/

Four Corners Property Trust: Bill Lenehan, 415-965-8031 CEO

Gerry Morgan, 415-965-8032 CFO

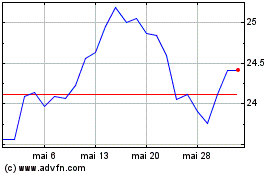

Four Corners Property (NYSE:FCPT)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

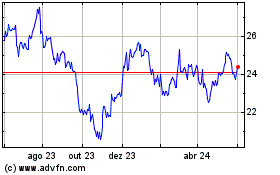

Four Corners Property (NYSE:FCPT)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024