Tiny Ltd. (“Tiny” or the “Company”) (TSXV: TINY)

is pleased to announce that WeCommerce Holdings Limited Partnership

(“WeCommerce”), an entity that is 100% owned by Tiny, has

entered into a binding arm’s length definitive share purchase

agreement (the “Agreement”) with the shareholders of Clean

Canvas Limited (“Clean Canvas”), whereby WeCommerce has

acquired all of the issued and outstanding share capital of Clean

Canvas (the “Acquisition”). The Acquisition is expected to

be accretive to WeCommerce’s consolidated revenues and operating

margins, and advances Tiny’s strategy to build, acquire and invest

in the world’s top Shopify technology businesses.

Clean Canvas is a leading designer and developer of premium

themes which have been leveraged by over 80k Shopify merchants, and

will continue to operate as an independent brand following closing.

Clean Canvas’ financial results will be consolidated for the

purposes of financial reporting in Tiny’s Q3 Financial

Statements.

Management Commentary

Clean Canvas aligns with Tiny’s investment strategy and we

expect the acquisition to be accretive. The Themes segment is

performing well both on top line growth and profitability, and with

new areas of collaboration across the portfolio, we see Themes as

an ideal long-term investment focus. The additional expertise and

thought leadership brought by the Clean Canvas team will facilitate

additional development and innovation of the storefront

experience.

We also see readily available levers that will enable our team

to drive additional growth and profitability given our substantial

existing knowledge of the Shopify theme business. WeCommerce

continues to execute a plan that we expect will result in a growing

free cash flow contribution to Tiny.

Acquisition Terms

The consideration payable by WeCommerce in connection with the

Acquisition includes an upfront cash payment of US$11.5 million and

contingent consideration of up to US$1.2 million (the

“Earn-Out”) based on Clean Canvas’ operating performance

during the next 18 months, at the option of WeCommerce, by way of

(i) cash, (ii) the issuance of up to 1,200,000 Class A common

shares in the capital of Tiny (the “Common Shares”) to Clean

Canvas at a deemed price per share equal to the 10-day volume

weighted average trading price of the Common Shares on the TSX

Venture Exchange (the “TSXV”) calculated on the day

immediately prior to the day of the issuance of such shares, or

(iii) a combination thereof.

WeCommerce has retained a purchase price holdback of US$750,000

to secure against customary post-closing adjustments as well as

potential post-closing indemnification claims.

The Acquisition constitutes an Expedited Acquisition in

accordance with the policies of the TSXV and is subject to final

approval of the TSXV.

About Tiny Ltd.

Tiny is a leading technology holding company with a strategy of

acquiring majority stakes in wonderful businesses. Tiny has three

core business segments, Beam, WeCommerce and Dribbble, with other

standalone businesses including a private equity investment

fund.

Beam, and its subsidiary companies including MetaLab, helps

start-ups to Fortune 500 companies to design, build and ship

premium digital products for both mobile and web. The Company’s

capabilities as an end-to-end product partner provide clients with

intimate insight into end-user behavior, allowing for a thorough,

strategy-led approach to product design, engineering, brand

positioning and marketing.

WeCommerce provides merchants with a suite of ecommerce software

tools to start and grow their online store. Our family of companies

and brands include Pixel Union, Out of the Sandbox, Archetype,

Foursixty, Stamped, KnoCommerce and Orbit Apps. As one of Shopify’s

first partners since 2010, WeCommerce is focused on building,

acquiring and investing in leading technology businesses operating

in the Shopify partner ecosystem.

Dribbble is a creative network and community that design

professionals use to meet, collaborate, and showcase their work.

Dribbble also hosts an online marketplace for graphics, fonts,

templates, and other digital assets.

Other standalone businesses include several software and

internet companies and the operation of a private equity fund where

the Company serves as the general partner (the “Tiny Fund”).

The Tiny Fund commenced operations in August 2020 and has total

committed capital of US$150 million.

For more about WeCommerce, please visit

https://www.wecommerce.co/ or refer to the public disclosure

documents available under Tiny’s SEDAR+ profile at

www.sedarplus.ca.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements which constitute

“forward-looking statements” and “forward-looking information”

within the meaning of applicable securities laws (collectively,

“forward-looking statements”), including statements

regarding the plans, intentions, beliefs and current expectations

of the Company with respect to future business activities and

operating performance. Forward-looking statements are often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or

similar expressions and forward-looking statements in this press

release includes, but is not limited to, information and statements

regarding: the anticipated benefits of the Acquisition; the

Company’s revenue and cash flow upon completion of the Acquisition;

the Company's belief that the Acquisition will provide significant

value to shareholders; and expectations for other economic,

business, and/or competitive factors.

Investors are cautioned that forward-looking statements are not

based on historical facts but instead reflect the Company’s

expectations, estimates or projections concerning future results or

events based on the opinions, assumptions and estimates of

management considered reasonable at the date the statements are

made. Although the Company believes that the expectations reflected

in such forward-looking statements are reasonable, such statements

involve risks and uncertainties, and undue reliance should not be

placed thereon, as unknown or unpredictable factors could have

material adverse effects on future results, performance or

achievements of the Company. Financial outlooks, as with

forward-looking information generally, are, without limitation,

based on the assumptions and subject to various risks as set out

herein.

Among the key factors that could cause actual results to differ

materially from those projected in the forward-looking statements

are the following: the potential impact of the consummation of the

Acquisition on relationships, including with regulatory bodies,

stock exchanges, lenders, employees and competitors; the diversion

of management time on the Acquisition; assumptions concerning the

Acquisition and the operations and capital expenditure plans of the

Company following completion of the Acquisition; credit, liquidity

and additional financing risks for the Company and its investees;

stock market volatility; changes in e-commerce industry growth and

trends; changes in the business activities, focus and plans of the

Company and its investees and the timing associated therewith; the

Company's actual financial results and ability to manage its cash

resources; changes in general economic, business and political

conditions, including challenging global financial conditions and

the impact of the novel coronavirus pandemic; competition risks;

potential conflicts of interest; changes in applicable laws and

regulations both locally and in foreign jurisdictions; compliance

with extensive government regulation; the risks and uncertainties

associated with foreign markets; and the other risk factors more

fully described in the Company's most recent MD&A as well as

the list of risk factors in the Company's management information

circular dated March 6, 2023 available on SEDAR+ at

https://www.sedarplus.ca under the Company's profile.

Should one or more of these risks or uncertainties materialize,

or should assumptions underlying the forward-looking statements

prove incorrect, actual results may vary materially from those

described herein as intended, planned, anticipated, believed,

estimated or expected. Although the Company has attempted to

identify important risks, uncertainties and factors which could

cause actual results to differ materially, there may be others that

cause results not to be as anticipated, estimated or intended and

such changes could be material. The Company does not intend, and

does not assume any obligation, to update the forward-looking

statements except as otherwise required by applicable law.

Neither the TSXV nor its Regulation Services Provider (as that

term is defined in the policies of the TSXV) accepts responsibility

for the adequacy or accuracy of this release.

Source: Tiny Ltd.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230907152888/en/

For more information about the Company: David Charron Chief

Financial Officer Phone: 416-418-3881 Email: david@tiny.com

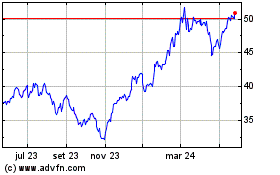

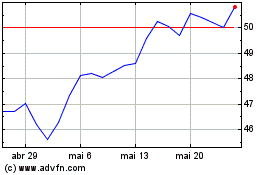

Proshares Nanotechnology... (AMEX:TINY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Proshares Nanotechnology... (AMEX:TINY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024