-Intersected 36.8 ounces per ton silver, 22.0%

lead and 22.4% zinc over 16 feet- -Provides recap of 2023

exploration program and preview of 2024 exploration plans-

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

provided an update on exploration at its high-grade Silvertip

polymetallic exploration project in northern British Columbia.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240122895073/en/

Figure 1: Location of Silvertip

high-grade polymetallic project (Graphic: Business Wire)

Coeur completed approximately 90,000 feet (28,000 meters) of

drilling in 2023 over 92 holes, 62 of which were in the Southern

Silver Zone. Since acquisition of the project in late 2017, the

Company has drilled roughly 1.1 million feet (333,000 meters) over

1,244 holes.

Highlights from surface and underground expansion drilling

completed last year are reported below and continue to support

Silvertip’s status as one of the world’s highest-grade, undeveloped

carbonate replacement deposits.

Key Highlights1,2,3

- Extremely high-grade intercept highlights continued growth

of the Southern Silver Zone – Results have been received for

almost half of total 2023 drilling at the Southern Silver Zone,

including the highest-grade intercept ever received in the zone.

Drillhole 65Z23-485-012-022, which assayed 16.1 feet at 36.8 ounces

per ton (“oz/t”) (4.9 meters at 1,261.4 grams per tonne (“g/t”))

silver, 22.0 % lead and 22.4% zinc or 3,053 g/t on a silver

equivalence basis

- Strike of Southern Silver Zone increased by 150 meters and

down dip extent by 160 meters – Southern Silver Zone is the

largest chimney structure discovered on the property to date and

accounts for approximately 10% of Silvertip’s total measured and

indicated resource and 55% of Silvertip’s total inferred resource

as of year-end 2022. Additional notable drilled intercepts from

Southern Silver Zone include:

- Hole 65Z22-485-010-030: 10.6 feet at 14.4 oz/t (3.2 meters at

492.0 g/t) silver, 5.9% lead and 8.1% zinc

- Hole 65Z22-485-010-036: 29.8 feet at 3.5 oz/t (9.1 meters at

121.0 g/t) silver, 1.5% lead and 4.6% zinc

- Hole 65Z23-485-012-004: 20.7 feet at 2.5 oz/t (6.3 meters at

87.0 g/t) silver, 1.1% lead and 10.8% zinc

- Hole 65Z23-485-012-008: 9.5 feet at 16.6 oz/t (2.9 meters at

568.0 g/t) silver, 12.0% lead and 4.5% zinc

- Hole 65Z23-485-012-021: 25.4 feet at 2.6 oz/t (7.7 meters at

88.0 g/t) silver, 0.8% lead and 7.2% zinc and 10.9 feet at 8.2 oz/t

(3.3 meters at 282.0 g/t) silver, 3.5% lead and 16.7% zinc

For a complete table of all drill results, please refer to the

following link:

https://www.coeur.com/news/news-details/2024/Silvertip-Exploration-Drilling-Update.

Please see the “Cautionary Statements” section for additional

information regarding drill results.

“Exploration at Silvertip in 2023 achieved a key priority of

expanding the resource base immediately adjacent to the main

Silvertip deposit and existing underground infrastructure,” said

Mitchell J. Krebs, President and Chief Executive Officer. “Recent

results continue to reinforce the high-grade nature, overall size,

and prospectivity of this exploration project. This success

continues to support the growing potential of Silvertip as an

emerging tier one asset and future cornerstone for the Company,

containing some of the highest grades of silver, zinc and lead of

any global carbonate replacement deposit in addition to a

potentially meaningful complement of critical minerals.”

Resource expansion activities and step-out drilling commenced in

July 2023 with the goals of expanding the Southern Silver Zone (the

largest chimney structure identified on the property so far) and

infill drilling at Saddle Zone to incorporate it into year-end

resource calculations. During the year, approximately 90,000 feet

(28,000 meters) of drilling were completed over 92 holes. Drilling

into the Saddle Zone produced consistent, massive sulphide manto

intercepts demonstrating the continuity of this new mineralized

horizon. (Figures 2 and 3). Assays are still pending from the

Saddle Zone.

Geological interpretation from both drilling and underground

mine development has led to a new understanding of the geometries

of manto and chimney mineralization and is forming the basis for a

new Silvertip geological model expected to be completed in early

2024.

Between 2018 and 2023, the Company has invested roughly $60

million in exploration at the high-grade Silvertip deposit, leading

to a near tripling of the total resource as of year-end 2022. A

resource update based on 2023 drilling is expected to be included

in Coeur’s year-end 2023 mineral resource and reserve update and

will include a maiden estimate for the Saddle Zone.

“Exploration continues to uncover grades and geological features

that indicate Silvertip is on the periphery of a much larger

mineralizing system,” said Aoife McGrath, Senior Vice President of

Exploration. “The resource has nearly tripled in just six years and

we firmly believe that we have merely scratched the surface. The

significant resource growth so far validates the immense potential,

but we believe that the most potent and lucrative part of the

deposit is yet to be uncovered, promising an exciting phase of

exploration and development that has the potential to elevate

Silvertip into a world-class carbonate replacement mineralizing

system.”

2024 Exploration Programs

Exploration plans for 2024 are expected to include up to 115,000

feet (35,000 meters) of drilling along with extensive mapping and

sampling during the summer field season. The year has been kicked

off with a technical review session, attended by consultant Dr.

Peter Megaw who is helping guide exploration at Silvertip. Dr.

Megaw is recognized as one of the world’s foremost experts on

carbonate replacement deposits.

Silvertip core samples will be on display at the AME Roundup in

Vancouver, British Columbia on January 24-25. Silvertip core will

also be on display at other industry conferences in the first

quarter of 2024, including the PDAC 2024 Convention in Toronto on

March 3-6.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, the Company wholly-owns the

Silvertip silver-zinc-lead exploration project in British

Columbia.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding exploration efforts and plans,

resource growth potential, expectations regarding the nature and

size of mineralized structures and the range of minerals they may

host, expected grades, timing of future geological modeling, 2024

drilling plans and expected resource delineation, expansion,

upgrade or conversion. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause Coeur’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others, the risk that

potential resource growth may not be achieved, mineralized

structures may not be as large or have the characteristics

anticipated, future drill results may not be as successful,

anticipated additions or upgrades to resources are not attained,

the risk that planned drilling programs may be curtailed or

canceled due to budget constraints or other reasons, the risks and

hazards inherent in the mining business (including risks inherent

in developing large-scale mining projects, environmental hazards,

industrial accidents, weather or geologically related conditions),

changes in the market prices of gold, silver, zinc and lead and a

sustained lower price environment, the uncertainties inherent in

Coeur’s production, exploratory and developmental activities,

including risks relating to permitting and regulatory delays

(including the impact of government shutdowns), ground conditions,

grade and recovery variability, any future labor disputes or work

stoppages, the uncertainties inherent in the estimation of mineral

reserves and resources, the potential effects of the COVID-19

pandemic, including impacts to the availability of our workforce,

continued access to financing sources, government orders that may

require temporary suspension of operations at one or more of our

sites and effects on our suppliers or the refiners and smelters to

whom the Company markets its production, changes that could result

from Coeur’s future acquisition of new mining properties or

businesses, the loss of any third-party smelter to which Coeur

markets its production, the effects of environmental and other

governmental regulations, the risks inherent in the ownership or

operation of or investment in mining properties or businesses in

foreign countries, Coeur’s ability to raise additional financing

necessary to conduct its business, make payments or refinance its

debt, as well as other uncertainties and risk factors set out in

filings made from time to time with the United States Securities

and Exchange Commission, and the Canadian securities regulators,

including, without limitation, Coeur’s most recent reports on Form

10-K and Form 10-Q. Actual results, developments and timetables

could vary significantly from the estimates presented. Readers are

cautioned not to put undue reliance on forward-looking statements.

Coeur disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information,

future events or otherwise. Additionally, Coeur undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of Coeur, its financial or operating

results or its securities.

The scientific and technical information concerning the

Silvertip mine referenced in this news release have been reviewed

and approved by a “qualified person” under S-K 1300, namely our

Senior Director, Technical Services, Christopher Pascoe.

Notes

The ranges of potential tonnage and grade (or quality) of the

exploration results described in this news release are conceptual

in nature. There has been insufficient exploration work to estimate

a mineral resource. It is uncertain if further exploration will

result in the estimation of a mineral resource. The exploration

results described in this news release therefore does not

represent, and should not be construed to be, an estimate of a

mineral resource or mineral reserve.

For additional information regarding 2022 mineral reserves and

mineral resources, see

https://www.coeur.com/operations/operations/reserves-resources/.

- For a complete table of all drill results included in this

release, please refer to the following link:

https://www.coeur.com/news/news-details/2024/Silvertip-Exploration-Drilling-Update.

- Rounding of grades, to significant figures, may result in

apparent differences.

- Silver equivalence assumes silver-to-lead, -zinc ratios of

1:19.05 and 1:15.38, respectively.

Conversion Table

1 short ton

=

0.907185 metric tons

1 troy ounce

=

31.10348 grams

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240122895073/en/

Coeur Mining, Inc. Attention: Jeff Wilhoit, Director, Investor

Relations Phone: (312) 489-5800 www.coeur.com

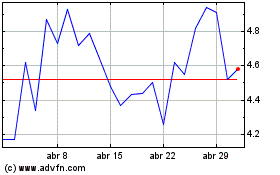

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024