Compañía de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 4Q23 results for production and volume sold.

Production per Metal

Three Months Ended December

31, 2023

Year Ended December 31,

2023

Year Ended December 31, 2024

Guidance (1)

Gold ounces produced

El Brocal

6,472

21,103

17.0k - 20.0k

Orcopampa

22,692

83,239

70.0k - 75.0k

Tambomayo

12,052

41,675

28.0k - 32.0k

Julcani

237

237

2.8k - 3.2k

La Zanja

2,308

9,080

5.0k - 7.0k

Total Direct Operations (2)

43,761

155,334

122.8k - 137.2k

Coimolache

27,351

67,140

38.0k - 43.0k

Total incl. Associated (3)

52,231

174,114

131.5k - 146.7k

Silver ounces produced

El Brocal (4)

1,009,294

3,264,859

1.4M - 1.7M

Uchucchacua

278,538

278,538

2.2M - 2.5M

Yumpag (5)

2,316,499

2,316,499

6.5M - 7.2M

Orcopampa

8,136

30,164

-

Tambomayo

353,783

1,590,784

1.7M - 1.9M

Julcani

352,784

1,670,679

1.7M - 1.9M

La Zanja

4,956

20,589

-

Total Direct Operations (2)

4,323,991

9,172,113

13.5M - 15.2M

Coimolache

88,080

264,835

0.1M - 0.2M

Total incl. Associated (3)

3,970,021

8,019,040

13.0M - 14.6M

Lead metric tons produced

El Brocal

2,866

5,026

-

Uchucchacua

1,962

1,962

13.0k - 15.0k

Tambomayo

1,026

3,877

2.4k - 2.7k

Julcani

147

545

0.9k - 1.0k

Total Direct Operations (2)

6,002

11,410

16.3k - 18.7k

Zinc metric tons produced

El Brocal

10,492

17,153

3.1k - 3.5k

Uchucchacua

2,763

2,763

17.0k - 19.0k

Tambomayo

1,478

5,092

4.0k - 4.4k

Total Direct Operations (2)

14,732

25,008

24.1k - 26.9k

Copper metric tons produced

El Brocal (4)

13,581

57,707

55.0k - 60.0k

Julcani

14

14

-

Total Direct Operations (2)

13,595

57,721

55.0k - 60.0k

- 2024 projections are considered to be forward-looking

statements and represent management’s good faith estimates or

expectations of future production results as of February 2024.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja and 100% of El Brocal.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja, 61.43% of El Brocal and 40.094% of Coimolache.

- 3Q23 silver and copper production for El Brocal has been

updated. The updated figure is 1,183,357 Oz Ag and 18,674 tons

Cu.

- Considers ore from the pilot stope approved within Yumpag

EIA-sd

Volume Sold per Metal

Three Months Ended December

31, 2023

Year Ended December 31,

2023

Gold ounces sold

El Brocal

4,411

12,985

Orcopampa

22,807

83,311

Tambomayo

10,806

37,456

Julcani

241

330

La Zanja

2,220

9,102

Total Direct Operations (1)

40,484

143,185

Coimolache

30,756

67,016

Total incl. Associated (2)

51,114

165,046

Silver ounces sold

El Brocal

816,847

2,690,844

Uchucchacua

228,125

594,903

Yumpag (3)

1,836,387

1,836,387

Orcopampa

7,236

26,668

Tambomayo

307,614

1,433,048

Julcani

319,975

1,571,560

La Zanja

6,027

35,000

Total Direct Operations (1)

3,522,212

8,188,411

Coimolache

98,834

263,729

Total incl. Associated (2)

3,246,780

7,256,292

Lead metric tons sold

El Brocal

2,712

4,651

Uchucchacua

1,721

1,721

Tambomayo

873

3,394

Julcani

122

461

Total Direct Operations (1)

5,428

10,227

Zinc metric tons sold

El Brocal

8,532

14,010

Uchucchacua

2,129

2,129

Tambomayo

1,153

3,998

Total Direct Operations (1)

11,813

20,137

Copper metric tons sold

El Brocal

13,476

55,366

Julcani

11

61

Total Direct Operations (1)

13,487

55,427

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja and 100% of El Brocal.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja, 61.43% of El Brocal and 40.094% of Coimolache.

- Considers ore from the pilot stope approved within the Yumpag

EIA-sd

Average realized prices(1)(2)

Three Months Ended December

31, 2023

Year Ended December 31,

2023

Gold (US$/Oz)

2,022

1,954

Silver (US$/Oz)

23.55

23.98

Lead (US$/MT)

2,148

2,093

Zinc (US$/MT)

2,430

2,315

Copper (US$/MT)

7,574

8,418

- Considers Buenaventura consolidated figures.

- Realized prices include both provisional sales and final

adjustments for price changes.

Commentary on Operations

Tambomayo: 2023 gold and lead production exceeded revised

guidance, as grades within areas mined during 4Q23 were 40% higher

than previously estimated. 2023 silver and zinc production were in

line with revised guidance.

2024 Guidance: Buenaventura expects gold, lead, and zinc

production at its Tambomayo operations to decrease year on year,

with an expected ~10% decrease in annual throughput and lower gold,

lead and zinc grades as the mining sequence migrates into lower

grade areas. Increased silver grades within scheduled 2024 mining

areas will partially offset the expected processing volume

decrease, with an increased silver production relative to 2023.

Orcopampa: 2023 gold production slightly exceeded

guidance, as ore extracted during the 4Q23 had higher than

anticipated gold grades.

2024 Guidance: guidance reflects a year-on-year decrease in gold

production with lower gold grades expected to be mined during 2024,

as an increased percentage of ore will be mined from lower-grade

secondary stopes near the previously mined adjacent primary

stopes.

Coimolache: 2023 gold production exceeded guidance, as

optimized leach pad space enabled higher-than-planned volumes of

ore treated during 4Q23. This was partially offset by lower grade

and longer percolation rates during 4Q23. However, it’s important

to note that 65% of full year 2023 production came from the

Tantahuatay NW-Ext pit which successfully achieved target

production within its first year of operation.

2024 Guidance: Buenaventura expects a year-on-year decline in

gold due to limited leach pad capacity, as environmental permits

required for leach pad expansion remain pending with continued

delays from the Peruvian environmental authority (SENACE).

Buenaventura expects to receive relevant permits in the 1H24,

enabling construction of the necessary components during 2H24. The

Coimolache production plan combines fresh ore with re-leaching at

the Tantahuatay main pad to offset this production gap.

Julcani: 2023 silver production underperformed slightly

relative to adjusted guidance, primarily due to a negative geology

reconciliation and a year-on-year decrease in treated ore. However,

it’s important to note that gold and copper production from the

Rosario sector began in December 2024.

2024 Guidance: the Company expects a year-on-year increase in

silver production due to a ~10% increase in annual throughput with

benefit of full ramp up relative to the same period in 2023 and

noting a 10-day suspension of operations in February 2023.

Exploration at Julcani will also continue during 2024, with

exploration, mine development and batch processing campaigns within

the Rosario sector resulting in 3k Oz gold and 250k Oz silver in

expected production, in addition to production from the Achilla

sector.

Uchucchacua: Buenaventura re-initiated Uchucchacua and

Yumpag ore processing in the 4Q23 after the Uchucchacua processing

plant had been placed under Care and Maintenance (C&M) since

3Q21. 2023 lead and zinc production surpassed guidance while silver

production underperformed guidance due to a short-term planning

adjustment and to prioritize processing higher value ore production

at Yumpag.

2024 Guidance: Buenaventura expects a year-on-year increase in

silver, lead and zinc production due to Uchucchacua's sustained

operation throughout full year 2024. Moving forward Uchucchacua

will also primarily treat polymetallic ore, with ore value balanced

between silver, lead and zinc- as opposed to exclusively silver ore

which was produced previously. Additionally, Buenaventura has

optimized Uchucchacua’s operations, which is now operating at

approximately ~800 tpd and the plan is to ramp-up to ~1,500 tpd by

4Q24.

Yumpag: Yumpag ore processing from the pilot stope began

simultaneously with that of Uchucchacua in 4Q23. Yumpag 2023 silver

production exceeded guidance, offsetting lower production at

Uchucchacua. The increased silver production is due to the

prioritization of high-grade ore at Yumpag’s pilot stope.

2024 Guidance: Buenaventura expects a year-over-year increase in

silver production, primarily due to a higher volume of ore treated.

Yumpag continued processing pilot stope ore through January 2024,

after which mineral processing has been suspended until definitive

operating permits are obtained, expected by the end of 1Q24. Yumpag

is therefore expected to initiate mineral processing in 2Q24 to

achieve the estimated guidance.

El Brocal: 2023 silver production exceeded guidance due

to higher-than-expected silver grades at the El Brocal underground

mine. Copper, gold, lead and zinc production were in line with

revised 2023 guidance. Record 2023 copper production resulted from

successful massive underground method migration completion,

enabling El Brocal to ultimately achieve an average of 10.8 ktpd

during the 4Q23, surpassing its targeted 10,000 tpd underground

mine exploitation rate, also with benefit of the successful

implementation of Buenaventura’s plan to increase production at its

Marcapunta underground mine to offset the temporary suspension of

mining activities at Colquijirca’s Tajo Norte Mine as was announced

on October 3, 2023.

2024 Guidance: Buenaventura expects copper production to remain

in line with 2023 as underground mine production ramp-up continues,

partially offset by lower copper grades. The targeted 2024

underground mine exploitation rate for El Brocal will increase to

11,000 tpd from 10,000 tpd in 4Q23. 2024 gold production is

expected to decrease slightly year-over-year due to lower grades,

partially offset by increased volume of treated ore. A significant

year-on-year decline in El Brocal silver and zinc production is

expected in 2024 due to the temporary suspension of mining

activities at Colquijirca’s Tajo Norte Mine. No lead production has

been planned for the full year 2024.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

(*) Operations wholly owned by Buenaventura.

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214288084/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer +51 1 419 2540 Gabriel Salas, Head of Investor

Relations +51 1 419 2591 gabriel.salas@buenaventura.pe

Contact in New York: Barbara Cano, InspIR Group +1 646

452 2334 barbara@inspirgroup.com Website:

www.buenaventura.com

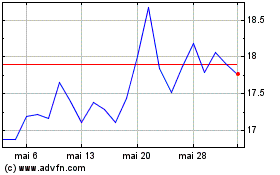

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024