Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

16 Julho 2024 - 6:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2024

Commission File Number: 001-14370

COMPANIA DE MINAS BUENAVENTURA S.A.A.

(Exact name of registrant as specified in its charter)

BUENAVENTURA MINING COMPANY INC.

(Translation of registrant’s name into English)

CARLOS VILLARAN 790

SANTA

CATALINA, LIMA 13, PERU

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Buenaventura Announces Second

Quarter 2024 Results for Production and Volume Sold per Metal

Lima, Peru, July 16, 2024 –

Compañía de Minas Buenaventura S.A.A. (“Buenaventura” or “the Company”) (NYSE: BVN; Lima

Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious metals mining company, today announced 2Q24 results for production

and volume sold.

Production per Metal

| |

|

Three Months Ended

June 30, 2024 |

|

Six Months Ended

June 30, 2024 |

|

2024 Updated

Guidance (1) |

| |

|

|

|

|

|

|

| Gold ounces produced |

|

|

|

|

|

|

| El Brocal |

|

3,981 |

|

10,656 |

|

17.0k - 20.0k |

| Orcopampa |

|

17,569 |

|

36,595 |

|

70.0k - 75.0k |

| Tambomayo |

|

8,934 |

|

18,058 |

|

28.0k - 32.0k |

| Julcani |

|

1,033 |

|

1,412 |

|

2.8k - 3.2k |

| La Zanja |

|

2,303 |

|

3,692 |

|

5.0k - 7.0k |

| Total Direct Operations (2) |

|

33,819 |

|

70,412 |

|

122.8k - 137.2k |

| Coimolache |

|

7,390 |

|

30,186 |

|

38.0k - 43.0k |

| Total incl. Associated (3) |

|

35,247 |

|

78,405 |

|

131.5k - 146.7k |

| |

|

|

|

|

|

|

| Silver ounces produced |

|

|

|

|

|

|

| El Brocal |

|

312,440 |

|

1,185,460 |

|

1.4M - 1.7M |

| Uchucchacua |

|

409,481 |

|

916,532 |

|

2.2M - 2.5M |

| Yumpag (4) |

|

2,461,616 |

|

3,426,612 |

|

7.5M - 8.0M |

| Orcopampa |

|

7,979 |

|

15,966 |

|

- |

| Tambomayo |

|

380,370 |

|

709,437 |

|

1.7M - 1.9M |

| Julcani |

|

442,400 |

|

828,741 |

|

1.7M - 1.9M |

| La Zanja |

|

3,692 |

|

6,003 |

|

- |

| Total Direct Operations (2) |

|

4,017,977 |

|

7,088,751 |

|

14.5M - 16.0M |

| Coimolache |

|

35,678 |

|

139,635 |

|

0.1M - 0.2M |

| Total incl. Associated (3) |

|

3,911,774 |

|

6,687,504 |

|

14.0M - 15.4M |

| |

|

|

|

|

|

|

| Lead metric tons produced |

|

|

|

|

|

|

| Uchucchacua |

|

3,037 |

|

6,947 |

|

13.0k - 15.0k |

| Tambomayo |

|

1,085 |

|

2,113 |

|

3.5k - 4.0k |

| Julcani |

|

261 |

|

510 |

|

0.9k - 1.0k |

| Total Direct Operations (2) |

|

4,383 |

|

9,570 |

|

17.4k - 20.0k |

| |

|

|

|

|

|

|

| Zinc metric tons produced |

|

|

|

|

|

|

| El Brocal |

|

0 |

|

1,985 |

|

1.9k - 2.0k |

| Uchucchacua |

|

4,874 |

|

10,368 |

|

17.0k - 19.0k |

| Tambomayo |

|

1,477 |

|

2,812 |

|

5.4k - 5.8k |

| Total Direct Operations (2) |

|

6,352 |

|

15,165 |

|

24.3k - 26.8k |

| |

|

|

|

|

|

|

| Copper metric tons produced |

|

|

|

|

|

|

| El Brocal |

|

10,123 |

|

25,565 |

|

55.0k - 60.0k |

| Total Direct Operations (2) |

|

10,123 |

|

25,565 |

|

55.0k - 60.0k |

| 1. | 2024 projections are considered to be forward-looking statements

and represent management’s good faith estimates or expectations of future production results as of July 2024. |

| 2. | Considers 100% of Buenaventura’s operating units, 100%

of La Zanja and 100% of El Brocal. |

| 3. | Considers 100% of Buenaventura’s operating units, 100%

of La Zanja, 61.43% of El Brocal and 40.094% of Coimolache. |

| 4. | Considers ore from the pilot stope approved within Yumpag EIA-sd.

|

Volume Sold per Metal

| |

|

Three Months Ended

June 30, 2024 |

|

Six Months Ended

June 30, 2024 |

| |

|

|

|

|

| Gold ounces sold |

|

|

|

|

| El Brocal |

|

2,192 |

|

6,765 |

| Orcopampa |

|

17,365 |

|

36,196 |

| Tambomayo |

|

8,317 |

|

16,761 |

| Julcani |

|

909 |

|

1,234 |

| La Zanja |

|

2,437 |

|

3,850 |

| Total Direct Operations (1) |

|

31,220 |

|

64,806 |

| Coimolache |

|

8,375 |

|

30,076 |

| Total incl. Associated (2) |

|

33,732 |

|

74,255 |

| |

|

|

|

|

| Silver ounces sold |

|

|

|

|

| El Brocal |

|

249,032 |

|

989,899 |

| Uchucchacua |

|

354,404 |

|

790,717 |

| Yumpag (3) |

|

2,452,482 |

|

3,556,610 |

| Orcopampa |

|

4,231 |

|

12,143 |

| Tambomayo |

|

343,677 |

|

633,058 |

| Julcani |

|

420,236 |

|

803,609 |

| La Zanja |

|

9,638 |

|

15,690 |

| Total Direct Operations (1) |

|

3,833,701 |

|

6,801,726 |

| Coimolache |

|

40,753 |

|

138,645 |

| Total incl. Associated (2) |

|

3,753,989 |

|

6,475,510 |

| |

|

|

|

|

| Lead metric tons sold |

|

|

|

|

| El Brocal |

|

0 |

|

72 |

| Uchucchacua |

|

2,774 |

|

6,263 |

| Yumpag (3) |

|

34 |

|

34 |

| Tambomayo |

|

928 |

|

1,843 |

| Julcani |

|

232 |

|

461 |

| Total Direct Operations (1) |

|

3,967 |

|

8,674 |

| |

|

|

|

|

| Zinc metric tons sold |

|

|

|

|

| El Brocal |

|

0 |

|

1,592 |

| Uchucchacua |

|

4,033 |

|

8,568 |

| Tambomayo |

|

1,195 |

|

2,262 |

| Total Direct Operations (1) |

|

5,228 |

|

12,422 |

| |

|

|

|

|

| Copper metric tons sold |

|

|

|

|

| El Brocal |

|

9,571 |

|

24,138 |

| Tambomayo |

|

63 |

|

63 |

| Julcani |

|

38 |

|

60 |

| Total Direct Operations (1) |

|

9,673 |

|

24,261 |

| 1. | Considers 100% of Buenaventura’s operating units, 100%

of La Zanja and 100% of El Brocal. |

| 2. | Considers 100% of Buenaventura’s operating units, 100%

of La Zanja, 61.43% of El Brocal and 40.094% of Coimolache. |

| 3. | Considers ore from the pilot stope approved within Yumpag EIA-sd. |

Average realized prices(1)(2)

| |

|

Three Months Ended

June 30, 2024 |

|

Six Months Ended

June 30, 2024 |

| |

|

|

|

|

| Gold (US$/Oz) |

|

2,336 |

|

2,219 |

| Silver (US$/Oz) |

|

29.98 |

|

27.13 |

| Lead (US$/MT) |

|

2,153 |

|

2,077 |

| Zinc (US$/MT) |

|

2,703 |

|

2,490 |

| Copper (US$/MT) |

|

9,998 |

|

8,952 |

| 1. | Considers Buenaventura consolidated figures. |

| 2. | Realized prices include both provisional sales and final adjustments

for price changes. |

Commentary on Operations

Tambomayo:

| · | Gold, lead and zinc production

exceeded 2Q24 projections due to a positive reconciliation of gold, lead and zinc grades relative to the mid-term production program,

partially offset by decreased silver production. Full year 2024 lead and zinc guidance has therefore been updated. 2024 gold guidance

remains unchanged. |

Orcopampa:

| · | 2Q24 gold production was

in line with expectations. 2024 guidance remains unchanged. |

Coimolache:

| · | 2Q24 gold production was

in line with expectations. 2024 guidance remains unchanged. |

| · | Coimolache’s third

Environmental Impact Assessment was approved by Peru’s National Service of Environmental Certification for Sustainable Investments

(SENACE) on May 31, 2024. This permit enables Buenaventura to file for the relevant construction permit to increase leach pad capacity

at Coimolache. |

Julcani:

| · | Silver and lead production

was in line with expectations for 2Q24. 2024 guidance remains unchanged. |

Uchucchacua:

| · | Silver production was

in line with expectations for 2Q24. |

| · | Lead and zinc production

exceeded 2Q24 projections due to a positive ore grade reconciliation. 2024 guidance remains unchanged. |

| · | Uchucchacua daily throughput

increased to an average 1,200 TPD during the 6M24, aligned with the Company’s targeted 1,500 TPD by year end 2024. |

Yumpag:

| · | Silver production exceeded

2Q24 projections as ore processing was initiated earlier than expected, in March 2024, due to operating permit approval which was initially

expected in May 2024. 2024 guidance has therefore been updated. |

El Brocal:

| · | Copper and silver production

was below expectations for 2Q24 due to a decrease in volume processed during the quarter resulting from a 16 day voluntary temporary suspension

of El Brocal’s processing plant facilities, as was announced by the Company on May 22, 2024. |

| · | Buenaventura announced

that ore treatment operations at its El Brocal processing plant resumed operations at midnight on June 7, 2024. El Brocal had accumulated

approximately 220,000 tonnes of copper ore upon the plant’s reinitiation. The processing of said stockpiled inventories, combined

with production from the mine, will gradually ramp to a processing rate of 15,000 tons per day, leveraging the two plants’ previously

idle capacity. El Brocal is expected to achieve its nine month 2024 copper production target by September 2024. Full year 2024 copper

guidance therefore remains unchanged. |

| · | The Company’s target

to achieve a 11,000 TPD underground mining rate by year end 2024 remains unchanged. |

| · | Open pit ore inventories

were fully processed by the end of 1Q24. Lead and zinc production is not expected until the open pit resumes operation. The Company temporarily

suspended mining activities at the open pit mine for up to three years, as was previously announced on October 3, 2023. 2024 zinc guidance

has therefore been updated. |

Company Description

Compañía

de Minas Buenaventura S.A.A. is Peru’s largest, publicly traded precious and base metals Company and a major holder of mining rights

in Peru. The Company is engaged in the exploration, mining development, processing and trade of gold, silver and other base metals via

wholly-owned mines and through its participation in joint venture projects. Buenaventura currently operates several mines in Peru (Orcopampa*,

Uchucchacua*, Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The

Company owns 19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper producer (a partnership with Freeport-McMorRan Inc.

and Sumitomo Corporation).

(*)

Operations wholly owned by Buenaventura.

Note

on Forward-Looking Statements

This

press release may contain forward-looking information (as defined in the U.S. Private Securities Litigation Reform Act of 1995) that

involve risks and uncertainties, including those concerning Cerro Verde’s costs and expenses, results of exploration, the continued

improving efficiency of operations, prevailing market prices of gold, silver, copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production, subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments. These forward-looking statements reflect the Company’s view with

respect to Cerro Verde’s future financial performance. Actual results could differ materially from those projected in the forward-looking

statements as a result of a variety of factors discussed elsewhere in this Press Release.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A. |

| |

|

|

| Date: July 16, 2024 |

By: |

/s/ DANIEL DOMÍNGUEZ VERA |

| |

Name: |

Daniel Domínguez Vera |

| |

Title: |

Market Relations Officer |

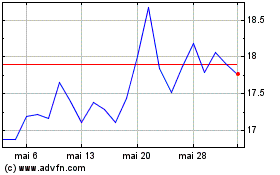

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024