Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

11 Dezembro 2024 - 7:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December, 2024

Commission File Number: 001-14370

COMPANIA DE MINAS BUENAVENTURA S.A.A.

(Exact name of registrant as specified in its charter)

BUENAVENTURA

MINING COMPANY INC.

(Translation of registrant’s name into English)

AV. BEGONIAS

NO. 415, 19TH FLOOR,

SAN ISIDRO, LIMA, PERU

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Free translation into English

December 10, 2024

Messrs.

Superintendencia del Mercado de Valores

Ref.: Notice of Material Information

Dear Sirs:

Through

this notice and in accordance with Article 16.1 of the Regulation on Material and Reserved Information,

SMV Resolution No. 005-2014-SMV-01 (hereinafter, the “Regulation”), we inform you that:

Compañía de

Minas Buenaventura S.A.A. (“Buenaventura”) is pleased to announce that Fitch Ratings (“Fitch”) has upgraded the

company’s long-term issuer ratings in both local and foreign currency, as well as the ratings of the $550 million senior unsecured

bonds maturing in 2026, from BB- to BB, with a stable outlook. This upgrade reflects Fitch’s expectations of an increase in production,

greater operational diversification, and a low level of leverage.

Fitch also highlights the

expected growth in Buenaventura’s production, driven by the restart of Uchucchacua and the commissioning of San Gabriel in the second

half of 2025. Furthermore, it points out the progress in cost reduction, the extension of the life of key mines, and the reduced dependence

on dividends from Cerro Verde as key factors contributing to the rating upgrade.

This improvement in the credit

rating reaffirms Buenaventura’s commitment to generating greater value for its shareholders. Our efforts are focused on mitigating

the risks associated with the construction of San Gabriel, adhering to the established timelines and CAPEX, while continuing to optimize

cost reductions in our operations to increase profitability and maintain a strong financial position.

Sincerely,

DANIEL DOMINGUEZ VERA

MARKET RELATIONS OFFICER

COMPAÑIA DE MINAS BUENAVENTURA S.A.A.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

| |

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A. |

| |

|

|

| Date: December 11, 2024 |

By: |

/s/ DANIEL DOMÍNGUEZ VERA |

| |

Name: |

Daniel Domínguez Vera |

| |

Title: |

Market Relations Officer |

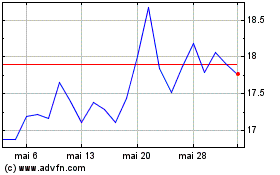

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Compania De Minas Buenav... (NYSE:BVN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024