Comparable Sales Declined 4.8%

GAAP Diluted EPS of $2.12

Non-GAAP Diluted EPS of $2.72

Increasing Quarterly Dividend 2% to $0.94

per Share

Expects FY25 Non-GAAP Diluted EPS of $5.75

to $6.20

Best Buy Co., Inc. (NYSE: BBY) today announced results for the

14-week fourth quarter ended February 3, 2024 (“Q4 FY24”), as

compared to the 13-week fourth quarter ended January 28, 2023 (“Q4

FY23”).

Q4 FY24

Q4 FY23

FY24

FY23

(14 weeks)

(13 weeks)

(53 weeks)

(52 weeks)

Revenue ($ in millions)

Enterprise

$

14,646

$

14,735

$

43,452

$

46,298

Domestic segment

$

13,410

$

13,531

$

40,097

$

42,794

International segment

$

1,236

$

1,204

$

3,355

$

3,504

Enterprise comparable sales % change1

(4.8)

%

(9.3)

%

(6.8)

%

(9.9)

%

Domestic comparable sales % change1

(5.1)

%

(9.6)

%

(7.1)

%

(10.3)

%

Domestic comparable online sales %

change1

(4.8)

%

(13.0)

%

(7.8)

%

(13.5)

%

International comparable sales %

change1

(1.4)

%

(5.7)

%

(3.2)

%

(5.4)

%

Operating Income

GAAP operating income as a % of

revenue

3.8

%

4.1

%

3.6

%

3.9

%

Non-GAAP operating income as a % of

revenue

5.0

%

4.8

%

4.1

%

4.4

%

Diluted Earnings per Share

("EPS")

GAAP diluted EPS

$

2.12

$

2.23

$

5.68

$

6.29

Non-GAAP diluted EPS

$

2.72

$

2.61

$

6.37

$

7.08

For GAAP to non-GAAP reconciliations of the measures referred to

in the above table, please refer to the attached supporting

schedule.

“I’m proud of the performance of our teams across the company as

they showed resourcefulness, passion, and an unwavering focus on

our customers this past year,” said Corie Barry, Best Buy CEO. “In

the fourth quarter and throughout FY24, we demonstrated strong

operational execution as we navigated a pressured consumer

electronics sales environment. This allowed us to deliver annual

profitability at the high end of our original guidance range even

though sales came in below our original guidance range.

Importantly, we grew our paid membership base and drove customer

experience improvements in many areas of our business, particularly

in services and delivery.”

“As we enter FY25, we are energized about delivering on our

purpose to Enrich Lives through Technology in our vibrant, always

changing industry,” continued Barry. “In what we expect to be a

year of increasing industry sales stabilization, we are focused on

sharpening our customer experiences and industry positioning while

maintaining, if not expanding, our operating income rate on a

52-week basis.”

FY25 Financial Guidance

Note: FY25 has 52 weeks compared to 53 weeks in FY24. The

company estimates the impact of the extra week in FY24 added

approximately $735 million in revenue, approximately 15 basis

points of non-GAAP operating income rate, and approximately $0.30

of non-GAAP diluted EPS to the full year results.

Best Buy’s guidance for FY25 is the following:

- Revenue of $41.3 billion to $42.6 billion

- Comparable sales of (3.0%) to 0.0%

- Enterprise non-GAAP operating income rate2 of 3.9% to 4.1%

- Non-GAAP effective income tax rate2 of approximately 25.0%

- Non-GAAP diluted EPS2 of $5.75 to $6.20

- Capital expenditures of $750 to $800 million

“For FY25, we expect to expand our gross profit rate

approximately 20 to 30 basis points versus FY24 as we continue to

annualize the benefits of prior changes to our membership program,

partially offset by expected pressure coming from the profit share

on our credit card arrangement,” said Matt Bilunas, Best Buy CFO.

“At the high-end of our non-GAAP EPS guide, non-GAAP SG&A

expense2 is expected be similar to FY24.”

Bilunas continued, “For Q1 FY25, we expect comparable sales to

decline by approximately 5% and our non-GAAP operating income rate

to be approximately 3.4%, which is flat to Q1 FY24.”

Domestic Segment Q4 FY24

Results

Domestic Revenue

Domestic revenue of $13.41 billion decreased 0.9% versus last

year driven by a comparable sales decline of 5.1%, which was

partially offset by approximately $675 million of revenue from the

extra week.

From a merchandising perspective, the largest drivers of the

comparable sales decline on a weighted basis were home theater,

appliances, mobile phones and tablets. These drivers were partially

offset by growth in gaming.

Domestic online revenue of $5.10 billion decreased 4.8% on a

comparable basis, and as a percentage of total Domestic revenue,

online revenue was flat to last year at 38.0%.

Domestic Gross Profit Rate

Domestic gross profit rate was 20.4% versus 19.8% last year. The

higher gross profit rate was primarily due to improved financial

performance from the company’s membership offerings, which included

higher services margin rates, and an improved gross profit rate

from the company’s Health initiatives. These items were partially

offset by unfavorable product margin rates.

Domestic Selling, General and Administrative Expenses

(“SG&A”)

Domestic GAAP SG&A expenses were $2.07 billion, or 15.4% of

revenue, versus $2.07 billion, or 15.3% of revenue, last year. On a

non-GAAP basis, SG&A expenses were $2.06 billion, or 15.4% of

revenue, versus $2.05 billion, or 15.1% of revenue, last year. Both

GAAP and non-GAAP SG&A increased primarily due to the impact of

the extra week and higher incentive compensation. These increases

were partially offset by reduced store payroll and advertising

expense.

International Segment Q4 FY24

Results

International Revenue

International revenue of $1.24 billion increased 2.7% versus

last year. This increase was primarily driven by approximately $60

million of revenue from the extra week, which was partially offset

by a comparable sales decline of 1.4% and the negative impact from

foreign currency exchange rates.

International Gross Profit Rate

International gross profit rate was 21.0% versus 21.7% last

year. The lower gross profit rate was primarily due to unfavorable

product margin rates.

International SG&A

International SG&A expenses were $202 million, or 16.3% of

revenue, versus $189 million, or 15.7% of revenue, last year.

SG&A increased primarily due to higher incentive compensation

and the impact of the extra week.

Restructuring Charges

The company incurred $169 million of restructuring charges in Q4

FY24, primarily related to employee termination benefits associated

with an enterprise-wide restructuring initiative that commenced in

Q4 FY24. The restructuring initiative is intended to help the

company to: (1) align field labor resources with where customers

want to shop to optimize the customer experience; (2) redirect

corporate resources for better alignment with the company’s

strategy; and (3) right-size resources to better align with the

company’s revenue outlook for FY25.

The company expects approximately $10 million to $30 million of

additional charges in FY25 for this initiative and to pay up to

$135 million of the employee termination benefits during FY25, with

the remainder being paid in FY26. Consistent with prior practice,

restructuring charges are excluded from the company’s non-GAAP

results.

Share Repurchases and

Dividends

In Q4 FY24, the company returned a total of $268 million to

shareholders through dividends of $198 million and share

repurchases of $70 million. For the full year, the company returned

a total of $1.1 billion to shareholders through dividends of $801

million and share repurchases of $340 million.

Today, the company announced its board of directors approved a

2% increase in the regular quarterly dividend to $0.94 per share.

The regular quarterly dividend will be payable on April 11, 2024,

to shareholders of record as of the close of business on March 21,

2024.

Conference Call

Best Buy is scheduled to conduct an earnings conference call at

8:00 a.m. Eastern Time (7:00 a.m. Central Time) on February 29,

2024. A webcast of the call is expected to be available at

www.investors.bestbuy.com, both live and after the call.

Notes:

(1) The method of calculating comparable sales varies across the

retail industry. As a result, our method of calculating comparable

sales may not be the same as other retailers’ methods. For

additional information on comparable sales, please see our most

recent Annual Report on Form 10-K, and our subsequent Quarterly

Reports on Form 10-Q, filed with the Securities and Exchange

Commission (“SEC”), and available at www.investors.bestbuy.com.

Revenue for the 14-week Q4 FY24 and 53-week FY24 includes

approximately $675 million and $60 million related to our Domestic

and International segments, respectively, as a result of the extra

week in Q4 FY24. Comparable sales for the 14-week Q4 FY24 and

53-week FY24 exclude the impact of the extra week.

(2) A reconciliation of the projected non-GAAP operating income

rate, non-GAAP effective income tax rate, non-GAAP SG&A expense

and non-GAAP diluted EPS, which are forward-looking non-GAAP

financial measures, to the most directly comparable GAAP financial

measures, is not provided because the company is unable to provide

such reconciliation without unreasonable effort. The inability to

provide a reconciliation is due to the uncertainty and inherent

difficulty predicting the occurrence, the financial impact and the

periods in which the non-GAAP adjustments may be recognized. These

GAAP measures may include the impact of such items as restructuring

charges; price-fixing settlements; goodwill and intangible asset

impairments; gains and losses on sales of subsidiaries and certain

investments; intangible asset amortization; certain

acquisition-related costs; and the tax effect of all such items.

Historically, the company has excluded these items from non-GAAP

financial measures. The company currently expects to continue to

exclude these items in future disclosures of non-GAAP financial

measures and may also exclude other items that may arise

(collectively, “non-GAAP adjustments”). The decisions and events

that typically lead to the recognition of non-GAAP adjustments,

such as a decision to exit part of the business or reaching

settlement of a legal dispute, are inherently unpredictable as to

if or when they may occur. For the same reasons, the company is

unable to address the probable significance of the unavailable

information, which could be material to future results.

Forward-Looking and Cautionary Statements:

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 as

contained in Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. You can identify these

statements by the fact that they use words such as "anticipate,"

“appear,” “approximate,” "assume," "believe," “continue,” “could,”

"estimate," "expect," “foresee,” "guidance," "intend," “may,”

“might,” "outlook," "plan," “possible,” "project" “seek,” “should,”

“would,” and other words and terms of similar meaning or the

negatives thereof. Such statements reflect our current views and

estimates with respect to future market conditions, company

performance and financial results, operational investments,

business prospects, our operating model, new strategies and growth

initiatives, the competitive environment, consumer behavior and

other events. These statements involve a number of judgments and

are subject to certain risks and uncertainties, many of which are

outside the control of the Company, that could cause actual results

to differ materially from the potential results discussed in such

forward-looking statements. Readers should review Item 1A, Risk

Factors, of our most recent Annual Report on Form 10-K, and any

updated information in subsequent Quarterly Reports on Form 10-Q,

for a description of important factors that could cause our actual

results to differ materially from those contemplated by the

forward-looking statements made in this release. Among the factors

that could cause actual results and outcomes to differ materially

from those contained in such forward-looking statements are the

following: macroeconomic pressures in the markets in which we

operate (including but not limited to inflation rates, fluctuations

in foreign currency exchange rates, limitations on a government’s

ability to borrow and/or spend capital, fluctuations in housing

prices, energy markets, and jobless rates and effects related to

the conflicts in Eastern Europe and the Middle East or other

geopolitical events); catastrophic events, health crises and

pandemics; susceptibility of the products we sell to technological

advancements, product life cycle fluctuations and changes in

consumer preferences; competition (including from multi-channel

retailers, e-commerce business, technology service providers,

traditional store-based retailers, vendors and mobile network

carriers and in the provision of delivery speed and options); our

ability to attract and retain qualified employees; changes in

market compensation rates; our expansion into health and new

products, services and technologies; our focus on services as a

strategic priority; our reliance on key vendors and mobile network

carriers (including product availability); our ability to maintain

positive brand perception and recognition; our ability to

effectively manage strategic ventures, alliances or acquisitions;

our ability to effectively manage our real estate portfolio;

inability of vendors or service providers to perform components our

supply chain (impacting our stores or other aspects of our

operations) and other various functions of our business; risks

arising from and potentially unique to our exclusive brands

products; our reliance on our information technology systems,

internet and telecommunications access and capabilities; our

ability to prevent or effectively respond to a cyber-attack,

privacy or security breach; product safety and quality concerns;

changes to labor or employment laws or regulations; risks arising

from statutory, regulatory and legal developments (including

statutes and/or regulations related to tax or privacy); evolving

corporate governance and public disclosure regulations and

expectations (including, but not limited to, cybersecurity and

environmental, social and governance matters); risks arising from

our international activities (including those related to the

conflicts in Eastern Europe and the Middle East or fluctuations in

foreign currency exchange rates) and those of our vendors; failure

to effectively manage our costs; our dependence on cash flows and

net earnings generated during the fourth fiscal quarter; pricing

investments and promotional activity; economic or regulatory

developments that might affect our ability to provide attractive

promotional financing; constraints in the capital markets; changes

to our vendor credit terms; changes in our credit ratings; failure

to meet financial-performance guidance or other forward-looking

statements; and general economic uncertainty in key global markets

and worsening of global economic conditions or low levels of

economic growth. We caution that the foregoing list of important

factors is not complete. Any forward-looking statements speak only

as of the date they are made and we assume no obligation to update

any forward-looking statement that we may make.

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

($ and shares in millions, except

per share amounts)

(Unaudited and subject to

reclassification)

Three Months Ended

Twelve Months Ended

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Revenue

$

14,646

$

14,735

$

43,452

$

46,298

Cost of sales

11,645

11,795

33,849

36,386

Gross profit

3,001

2,940

9,603

9,912

Gross profit %

20.5

%

20.0

%

22.1

%

21.4

%

Selling, general and administrative

expenses

2,271

2,257

7,876

7,970

SG&A %

15.5

%

15.3

%

18.1

%

17.2

%

Restructuring charges

169

86

153

147

Operating income

561

597

1,574

1,795

Operating income %

3.8

%

4.1

%

3.6

%

3.9

%

Other income (expense):

Gain on sale of subsidiary, net

-

-

21

-

Investment income and other

37

26

78

28

Interest expense

(14)

(12)

(52)

(35)

Earnings before income tax expense and

equity in income of affiliates

584

611

1,621

1,788

Income tax expense

124

118

381

370

Effective tax rate

21.2

%

19.3

%

23.5

%

20.7

%

Equity in income of affiliates

-

2

1

1

Net earnings

$

460

$

495

$

1,241

$

1,419

Basic earnings per share

$

2.13

$

2.24

$

5.70

$

6.31

Diluted earnings per share

$

2.12

$

2.23

$

5.68

$

6.29

Weighted-average common shares

outstanding:

Basic

215.9

220.9

217.7

224.8

Diluted

216.8

221.8

218.5

225.7

BEST BUY CO., INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

($ in millions)

(Unaudited and subject to

reclassification)

February 3, 2024

January 28, 2023

Assets

Current assets:

Cash and cash equivalents

$

1,447

$

1,874

Receivables, net

939

1,141

Merchandise inventories

4,958

5,140

Other current assets

553

647

Total current assets

7,897

8,802

Property and equipment, net

2,260

2,352

Operating lease assets

2,758

2,746

Goodwill

1,383

1,383

Other assets

669

520

Total assets

$

14,967

$

15,803

Liabilities and equity

Current liabilities:

Accounts payable

$

4,637

$

5,687

Unredeemed gift card liabilities

253

274

Deferred revenue

1,000

1,116

Accrued compensation and related

expenses

486

405

Accrued liabilities

902

843

Current portion of operating lease

liabilities

618

638

Current portion of long-term debt

13

16

Total current liabilities

7,909

8,979

Long-term operating lease liabilities

2,199

2,164

Long-term debt

1,152

1,160

Long-term liabilities

654

705

Equity

3,053

2,795

Total liabilities and equity

$

14,967

$

15,803

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited and subject to

reclassification)

Twelve Months Ended

February 3, 2024

January 28, 2023

Operating activities

Net earnings

$

1,241

$

1,419

Adjustments to reconcile net earnings to

total cash provided by operating activities:

Depreciation and amortization

923

918

Restructuring charges

153

147

Stock-based compensation

145

138

Deferred income taxes

(214)

51

Gain on sale of subsidiary, net

(21)

-

Other, net

26

12

Changes in operating assets and

liabilities:

Receivables

204

(103)

Merchandise inventories

178

809

Other assets

(18)

(21)

Accounts payable

(1,025)

(1,099)

Income taxes

52

36

Other liabilities

(174)

(483)

Total cash provided by operating

activities

1,470

1,824

Investing activities

Additions to property and equipment

(795)

(930)

Purchases of investments

(9)

(46)

Net proceeds from sale of subsidiary

14

-

Sales of investments

7

7

Other, net

2

7

Total cash used in investing

activities

(781)

(962)

Financing activities

Repurchase of common stock

(340)

(1,014)

Issuance of common stock

19

16

Dividends paid

(801)

(789)

Repayments of debt

(19)

(19)

Other, net

(3)

-

Total cash used in financing

activities

(1,144)

(1,806)

Effect of exchange rate changes on cash

and cash equivalents

(5)

(8)

Decrease in cash, cash equivalents and

restricted cash

(460)

(952)

Cash, cash equivalents and restricted

cash at beginning of period

2,253

3,205

Cash, cash equivalents and restricted

cash at end of period

$

1,793

$

2,253

BEST BUY CO., INC.

SEGMENT INFORMATION

($ in millions)

(Unaudited and subject to

reclassification)

Three Months Ended

Twelve Months Ended

Domestic Segment Results

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Revenue

$

13,410

$

13,531

$

40,097

$

42,794

Comparable sales % change

(5.1)

%

(9.6)

%

(7.1)

%

(10.3)

%

Comparable online sales % change

(4.8)

%

(13.0)

%

(7.8)

%

(13.5)

%

Gross profit

$

2,742

$

2,679

$

8,850

$

9,106

Gross profit as a % of revenue

20.4

%

19.8

%

22.1

%

21.3

%

SG&A

$

2,069

$

2,068

$

7,236

$

7,332

SG&A as a % of revenue

15.4

%

15.3

%

18.0

%

17.1

%

Operating income

$

512

$

530

$

1,467

$

1,634

Operating income as a % of revenue

3.8

%

3.9

%

3.7

%

3.8

%

Domestic Segment Non-GAAP

Results1

Gross profit

$

2,742

$

2,679

$

8,850

$

9,106

Gross profit as a % of revenue

20.4

%

19.8

%

22.1

%

21.3

%

SG&A

$

2,064

$

2,047

$

7,175

$

7,246

SG&A as a % of revenue

15.4

%

15.1

%

17.9

%

16.9

%

Operating income

$

678

$

632

$

1,675

$

1,860

Operating income as a % of revenue

5.1

%

4.7

%

4.2

%

4.3

%

Three Months Ended

Twelve Months Ended

International Segment Results

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Revenue

$

1,236

$

1,204

$

3,355

$

3,504

Comparable sales % change

(1.4)

%

(5.7)

%

(3.2)

%

(5.4)

%

Gross profit

$

259

$

261

$

753

$

806

Gross profit as a % of revenue

21.0

%

21.7

%

22.4

%

23.0

%

SG&A

$

202

$

189

$

640

$

638

SG&A as a % of revenue

16.3

%

15.7

%

19.1

%

18.2

%

Operating income

$

49

$

67

$

107

$

161

Operating income as a % of revenue

4.0

%

5.6

%

3.2

%

4.6

%

International Segment Non-GAAP

Results1

Gross profit

$

259

$

261

$

753

$

806

Gross profit as a % of revenue

21.0

%

21.7

%

22.4

%

23.0

%

SG&A

$

202

$

189

$

640

$

638

SG&A as a % of revenue

16.3

%

15.7

%

19.1

%

18.2

%

Operating income

$

57

$

72

$

113

$

168

Operating income as a % of revenue

4.6

%

6.0

%

3.4

%

4.8

%

(1)

For GAAP to non-GAAP reconciliations,

please refer to the attached supporting schedule titled

Reconciliation of Non-GAAP Financial Measures.

BEST BUY CO., INC.

REVENUE CATEGORY

SUMMARY

(Unaudited and subject to

reclassification)

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

Domestic Segment

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Computing and Mobile Phones

42

%

41

%

(4.2)

%

(10.0)

%

Consumer Electronics

31

%

33

%

(9.0)

%

(11.8)

%

Appliances

11

%

12

%

(13.7)

%

(13.2)

%

Entertainment

10

%

9

%

8.4

%

0.2

%

Services

5

%

5

%

6.3

%

12.4

%

Other

1

%

-

%

90.8

%

N/A

Total

100

%

100

%

(5.1)

%

(9.6)

%

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

International Segment

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Computing and Mobile Phones

44

%

43

%

1.8

%

(0.5)

%

Consumer Electronics

31

%

33

%

(9.2)

%

(10.1)

%

Appliances

9

%

9

%

(4.1)

%

(2.5)

%

Entertainment

11

%

9

%

16.1

%

(10.5)

%

Services

4

%

4

%

7.7

%

(15.1)

%

Other

1

%

2

%

(38.8)

%

(6.2)

%

Total

100

%

100

%

(1.4)

%

(5.7)

%

BEST BUY CO., INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

($ in millions, except per share

amounts)

(Unaudited and subject to

reclassification)

The following information provides

reconciliations of the most comparable financial measures presented

in accordance with accounting principles generally accepted in the

U.S. (GAAP financial measures) to presented non-GAAP financial

measures. The company believes that non-GAAP financial measures,

when reviewed in conjunction with GAAP financial measures, can

provide more information to assist investors in evaluating current

period performance and in assessing future performance. For these

reasons, internal management reporting also includes non-GAAP

financial measures. Generally, presented non-GAAP financial

measures include adjustments for items such as restructuring

charges, goodwill and intangible asset impairments, price-fixing

settlements, gains and losses on sales of subsidiaries and certain

investments, intangible asset amortization, certain

acquisition-related costs and the tax effect of all such items. In

addition, certain other items may be excluded from non-GAAP

financial measures when the company believes this provides greater

clarity to management and investors. These non-GAAP financial

measures should be considered in addition to, and not superior to

or as a substitute for, the GAAP financial measures presented in

this earnings release and the company’s financial statements and

other publicly filed reports. Non-GAAP financial measures as

presented herein may not be comparable to similarly titled measures

used by other companies.

Three Months Ended

Three Months Ended

February 3, 2024

January 28, 2023

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

2,069

$

202

$

2,271

$

2,068

$

189

$

2,257

% of revenue

15.4

%

16.3

%

15.5

%

15.3

%

15.7

%

15.3

%

Intangible asset amortization1

(5)

-

(5)

(21)

-

(21)

Non-GAAP SG&A

$

2,064

$

202

$

2,266

$

2,047

$

189

$

2,236

% of revenue

15.4

%

16.3

%

15.5

%

15.1

%

15.7

%

15.2

%

Operating income

$

512

$

49

$

561

$

530

$

67

$

597

% of revenue

3.8

%

4.0

%

3.8

%

3.9

%

5.6

%

4.1

%

Intangible asset amortization1

5

-

5

21

-

21

Restructuring charges2

161

8

169

81

5

86

Non-GAAP operating income

$

678

$

57

$

735

$

632

$

72

$

704

% of revenue

5.1

%

4.6

%

5.0

%

4.7

%

6.0

%

4.8

%

Effective tax rate

21.2

%

19.3

%

Intangible asset amortization1

-

%

0.1

%

Restructuring charges2

0.9

%

0.4

%

Non-GAAP effective tax rate

22.1

%

19.8

%

Three Months Ended

Three Months Ended

February 3, 2024

January 28, 2023

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

2.12

$

2.23

Intangible asset amortization1

$

5

$

3

0.02

$

21

$

16

0.08

Restructuring charges2

169

127

0.58

86

67

0.30

Non-GAAP diluted EPS

$

2.72

$

2.61

Twelve Months Ended

Twelve Months Ended

February 3, 2024

January 28, 2023

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

7,236

$

640

$

7,876

$

7,332

$

638

$

7,970

% of revenue

18.0

%

19.1

%

18.1

%

17.1

%

18.2

%

17.2

%

Intangible asset amortization1

(61)

-

(61)

(86)

-

(86)

Non-GAAP SG&A

$

7,175

$

640

$

7,815

$

7,246

$

638

$

7,884

% of revenue

17.9

%

19.1

%

18.0

%

16.9

%

18.2

%

17.0

%

Operating income

$

1,467

$

107

$

1,574

$

1,634

$

161

$

1,795

% of revenue

3.7

%

3.2

%

3.6

%

3.8

%

4.6

%

3.9

%

Intangible asset amortization1

61

-

61

86

-

86

Restructuring charges2

147

6

153

140

7

147

Non-GAAP operating income

$

1,675

$

113

$

1,788

$

1,860

$

168

$

2,028

% of revenue

4.2

%

3.4

%

4.1

%

4.3

%

4.8

%

4.4

%

Effective tax rate

23.5

%

20.7

%

Intangible asset amortization1

0.1

%

0.1

%

Restructuring charges2

0.2

%

0.2

%

Non-GAAP effective tax rate

23.8

%

21.0

%

Twelve Months Ended

Twelve Months Ended

February 3, 2024

January 28, 2023

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

5.68

$

6.29

Intangible asset amortization1

$

61

$

46

0.21

$

86

$

65

0.29

Restructuring charges2

153

115

0.53

147

113

0.50

Loss on investments

11

11

0.05

-

-

-

Gain on sale of subsidiary, net3

(21)

(21)

(0.10)

-

-

-

Non-GAAP diluted EPS

$

6.37

$

7.08

(1)

Represents the non-cash amortization of

definite-lived intangible assets associated with acquisitions,

including customer relationships, tradenames and developed

technology assets.

(2)

Represents charges primarily related to

employee termination benefits associated with enterprise-wide

restructuring initiatives.

(3)

Represents the gain on sale of a Mexico

subsidiary subsequent to our exit from operations in Mexico.

(4)

The non-GAAP adjustments primarily relate

to the U.S. As such, the income tax charge on the U.S. non-GAAP

adjustments is calculated using the statutory tax rate of

24.5%.

Return

on Assets and Non-GAAP Return on Investment

The tables below provide calculations of

return on assets ("ROA") (GAAP financial measure) and non-GAAP

return on investment (“ROI”) (non-GAAP financial measure) for the

periods presented. The company believes ROA is the most directly

comparable financial measure to ROI. Non-GAAP ROI is defined as

non-GAAP adjusted operating income after tax divided by average

invested operating assets. All periods presented below apply this

methodology consistently. The company believes non-GAAP ROI is a

meaningful metric for investors to evaluate capital efficiency

because it measures how key assets are deployed by adjusting

operating income and total assets for the items noted below. This

method of determining non-GAAP ROI may differ from other companies'

methods and therefore may not be comparable to those used by other

companies

Return on Assets ("ROA")

February 3, 20241

January 28, 20231

Net earnings

$

1,241

$

1,419

Total assets

15,888

16,490

ROA

7.8

%

8.6

%

Non-GAAP Return on Investment

("ROI")

February 3, 20241

January 28, 20231

Numerator

Operating income

$

1,574

$

1,795

Add: Non-GAAP operating income

adjustments2

214

233

Add: Operating lease interest3

113

113

Less: Income taxes4

(466)

(525)

Add: Depreciation

862

832

Add: Operating lease amortization5

661

661

Adjusted operating income after

tax

$

2,958

$

3,109

Denominator

Total assets

$

15,888

$

16,490

Less: Excess cash6

(258)

(270)

Add: Accumulated depreciation and

amortization7

5,122

5,375

Less: Adjusted current liabilities8

(8,389)

(9,143)

Average invested operating

assets

$

12,363

$

12,452

Non-GAAP ROI

23.9

%

25.0

%

(1)

Income statement accounts

represent the activity for the trailing 12 months ended as of each

of the balance sheet dates. Balance sheet accounts represent the

average account balances for the trailing 12 months ended as of

each of the balance sheet dates.

(2)

Non-GAAP operating income

adjustments include continuing operations adjustments for

intangible asset amortization and restructuring charges. Additional

details regarding these adjustments are included in the

Reconciliation of Non-GAAP Financial Measures schedule within the

company’s earnings releases.

(3)

Operating lease interest

represents the add-back to operating income to approximate the

total interest expense that the company would incur if its

operating leases were owned and financed by debt. The add-back is

approximated by multiplying average operating lease assets by 4%,

which approximates the interest rate on the company’s operating

lease liabilities.

(4)

Income taxes are approximated by

using a blended statutory rate at the Enterprise level based on

statutory rates from the countries in which the company does

business, which primarily consists of the U.S. with a statutory

rate of 24.5% for the periods presented.

(5)

Operating lease amortization

represents operating lease cost less operating lease interest.

Operating lease cost includes short-term leases, which are

immaterial, and excludes variable lease costs as these costs are

not included in the operating lease asset balance.

(6)

Excess cash represents the amount

of cash, cash equivalents and short-term investments greater than

$1 billion, which approximates the amount of cash the company

believes is necessary to run the business and may fluctuate over

time.

(7)

Accumulated depreciation and

amortization represents accumulated depreciation related to

property and equipment and accumulated amortization related to

definite-lived intangible assets.

(8)

Adjusted current liabilities

represent total current liabilities less short-term debt and the

current portions of operating lease liabilities and long-term

debt.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228409182/en/

Investor Contact: Mollie O'Brien

mollie.obrien@bestbuy.com

Media Contact: Carly Charlson

carly.charlson@bestbuy.com

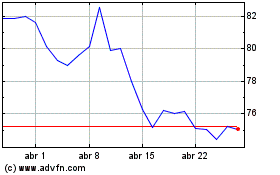

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025