Riot Platforms, Inc. (“Riot”) issues this press release

pursuant to Part 3 of Canadian National Instrument 62-103 – The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues and Part 5 of Canadian National Instrument 62-104

– Take-Over Bids and Issuer Bids in respect of Bitfarms Ltd. (the

“Company”).

Riot announces that on June 5, 2024 it acquired ownership of

1,460,278 common shares (the “Purchased Shares”) of the

Company representing approximately 0.37% of the issued and

outstanding Common Shares (the “Common Shares”) of the

Company.

The Purchased Shares were acquired through normal course

purchases on the Nasdaq Stock Market and other open market trades

for a weighted average price of approximately US$2.45 per Purchased

Share (equivalent to approximately C$3.36 per Purchased Share based

on the daily exchange rate posted by the Bank of Canada on June 5,

2024 (the “Exchange Rate”)) at a price range per Purchased

Share of approximately US$2.39 to US$2.52 (equivalent to

approximately C$3.27 to C$3.44 based on the Exchange Rate) for an

aggregate amount equal to US$3,580,455.63 (equivalent to

approximately C$4,903,792.03 based on the Exchange Rate).

Immediately prior to the acquisition of Common Shares giving

rise to the issuance of this press release, Riot beneficially owned

46,370,162 Common Shares, representing approximately 11.63% of the

issued and outstanding Common Shares. Following completion of the

aforementioned acquisition, Riot beneficially owned 47,830,440

Common Shares, representing approximately 12.00% of the issued and

outstanding Common Shares as at the date hereof.

Riot currently intends to requisition a special meeting of the

Company’s shareholders, at which Riot intends to nominate several

well-qualified and independent directors to join the Company’s

board of directors (the “Board”), which follows from Riot’s

serious concerns regarding the Board’s track record of poor

corporate governance.

Riot intends to review its investment in the Company on a

continuing basis and depending upon various factors, including

without limitation, any discussion between Riot, the Company and/or

the Board and its advisors regarding Riot’s previously submitted

non-binding proposal (the “Proposal”), the proposed

requisition and/or the composition of the Board, the Company’s

financial position and strategic direction, overall market

conditions, other investment opportunities available to Riot, and

the availability of securities of the Company at prices that would

make the purchase or sale of such securities desirable, Riot may

(i) increase or decrease its position in the Company through, among

other things, the purchase or sale of securities of the Company,

including through transactions involving the Common Shares and/or

other equity, debt, notes, other securities, or derivative or other

instruments that are based upon or relate to the value of

securities of the Company in the open market or otherwise, (ii)

enter into transactions that increase or hedge its economic

exposure to the Common Shares without affecting its beneficial

ownership of the Common Shares or (iii) consider or propose one or

more of the actions described in subparagraphs (a) - (k) of Item 5

of Riot’s early warning report filed in accordance with applicable

Canadian securities laws.

This press release is not meant to be, nor should it be

construed as, an offer (or an intention to make an offer) to buy or

the solicitation of an offer to sell any of the Company’s

securities.

Riot will file the Early Warning Report in accordance with

applicable securities laws, which will be available under the

Company’s profile at www.sedarplus.ca. The head office of the

Company is 110 Yonge Street, Suite 1601 Toronto, Ontario M5C 1T4.

The address of Riot is 3855 Ambrosia Street, Suite 301, Castle

Rock, CO 80109.

FOR MORE INFORMATION

For further information and to obtain a copy of the Early

Warning Report, please see the Company’s profile on the SEDAR+

website (www.sedarplus.ca) or contact Phil McPherson, Vice

President, Capital Markets & Investor Relations, at (303)

794-2000 ext. 110.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading

Bitcoin-driven infrastructure platform. Our mission is to

positively impact the sectors, networks, and communities that we

touch. We believe that the combination of an innovative spirit and

strong community partnership allows the Company to achieve

best-in-class execution and create successful outcomes.

Riot, a Nevada corporation, is a Bitcoin mining and digital

infrastructure company focused on a vertically integrated strategy.

Riot has Bitcoin mining operations in central Texas and electrical

switchgear engineering and fabrication operations in Denver,

Colorado.

For more information, visit www.riotplatforms.com.

Non-Binding Proposal

Riot cautions Riot shareholders, Company shareholders and others

considering trading in Riot securities or Company securities that

the Proposal referred to in this press release is non-binding, does

not constitute and should not be construed as an offer or intention

to make an offer directly to Company shareholders, and there can be

no assurance that any definitive offer will be made by Riot, that

the Company will accept any offer made by Riot, that any agreement

will be entered into by Riot and the Company or that the Proposal

or any other transaction will be approved or consummated. Riot does

not undertake any obligation to provide any updates with respect to

the proposed transaction, except as required by applicable law.

Cautionary Note Regarding Forward Looking Statements

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable U.S. and Canadian securities laws that

reflect management’s current expectations, assumptions, and

estimates of future events, performance and economic conditions.

Such forward-looking statements rely on the safe harbor provisions

of Section 27A of the U.S. Securities Act of 1933 and Section 21E

of the U.S. Securities Exchange Act of 1934 and the safe harbor

provisions of applicable Canadian securities laws. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Words and phrases such as “anticipate,”

“believe,” “combined company,” “create,” “drive,” “expect,”

“forecast,” “future,” “growth,” “intend,” “hope,” “opportunity,”

“plan,” “potential,” “proposal,” “synergies,” “unlock,” “upside,”

“will,” “would,” and similar words and phrases are intended to

identify forward-looking statements. These forward-looking

statements may include, but are not limited to, statements

concerning: uncertainties as to whether any definitive offer will

be made by Riot or the Company will accept any offer made by Riot;

whether the Company will enter into discussions with Riot regarding

the proposed combination of Riot and the Company; the outcome of

any such discussions, including the possibility that the terms of

any such combination will be materially different from those

described herein; the conditions to the completion of any

combination, including the receipt of Company shareholder approval

and the receipt of all required regulatory approvals; the future

performance, results of operations, liquidity and financial

position of each of Riot, the Company and the company resulting

from the combination of Riot and the Company; the possibility that

the combined company may be unable to achieve expected synergies

and operating efficiencies within the expected timeframes or at

all; the integration of the Company’s operations with those of Riot

and the possibility that such integration may be more difficult,

time-consuming and costly than expected or that operating costs and

business disruption may be greater than expected in connection with

the proposed transaction. Such forward-looking statements are not

guarantees of future performance or actual results, and readers

should not place undue reliance on any forward-looking statement as

actual results may differ materially and adversely from

forward-looking statements. Detailed information regarding the

factors identified by the management of Riot, which they believe

may cause actual results to differ materially from those expressed

or implied by such forward-looking statements in this press

release, may be found in Riot’s filings with the U.S. Securities

and Exchange Commission (the “SEC”), including the risks,

uncertainties and other factors discussed under the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” of Riot’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, filed with the SEC on

February 23, 2024, and the other filings Riot has made or will make

with the SEC after such date, copies of which may be obtained from

the SEC’s website at www.sec.gov. All forward-looking statements

contained herein are made only as of the date hereof, and Riot

disclaims any intention or obligation to update or revise any such

forward-looking statements to reflect events or circumstances that

subsequently occur, or of which Riot hereafter becomes aware,

except as required by applicable law.

No Offer or Solicitation

This press release is for informational purposes only and is not

intended to and does not constitute an offer to sell or the

solicitation of an offer, or an intention to offer, to subscribe

for or buy or an invitation to purchase or subscribe for any

securities, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

Such an offer to purchase securities would only be made pursuant to

a registration statement, prospectus, tender offer, takeover bid

circular, management information circular or other regulatory

filing filed by Riot with the SEC and available at www.sec.gov or

filed with applicable Canadian securities regulatory authorities on

SEDAR+ and available at www.sedarplus.ca. This press release is not

intended to, and does not, solicit a proxy from any shareholder of

the Company. Such a solicitation of proxies would only be made

pursuant to a proxy circular filed with applicable Canadian

securities regulatory authorities on SEDAR+ and available at

www.sedarplus.ca or pursuant to an exemption from the proxy

solicitation rules under applicable Canadian securities law.

Important Information for Investors

This press release relates to, among other things, a proposal

that Riot has made for a business combination transaction with the

Company. In furtherance of this proposal and subject to future

developments, Riot (and, if applicable, the Company) may file one

or more registration statements, prospectuses, management

information circulars, proxy statements, proxy circulars, tender

offers, takeover bid circulars or other documents with the SEC and

applicable Canadian securities regulatory authorities. This press

release is not a substitute for any registration statement,

prospectus, management information circular, proxy statement, proxy

circular, tender offer, takeover bid circular or other document

(collectively, “Regulatory Filings”) Riot and/or the Company

may file with the SEC and/or applicable Canadian securities

regulatory authorities in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF RIOT AND THE COMPANY ARE URGED TO

READ EACH REGULATORY FILING WHEN AND IF FILED BY RIOT AND/OR THE

COMPANY WITH THE SEC AND/OR APPLICABLE CANADIAN SECURITIES

REGULATORY AUTHORITIES CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

RIOT, THE COMPANY, THE PROPOSED TRANSACTION AND RELATED MATTERS.

Any proxy circular, takeover bid circular, management information

circular, prospectus or other applicable Regulatory Filing (if and

when filed) will be mailed to shareholders of the Company (if and

when required to be mailed by applicable law). Investors and

security holders will be able to obtain free copies of Regulatory

Filings (if and when available) and other documents filed by Riot

with the SEC and available at www.sec.gov, and on the “Investor

Relations” page of Riot’s corporate website, www.Riotplatforms.com.

Investors and security holders will be able to obtain free copies

of any documents filed with applicable Canadian securities

regulatory authorities by Riot on SEDAR+ at www.sedarplus.ca, and

on the “Investor Relations” page of Riot’s corporate website,

www.Riotplatforms.com.

This press release is neither a solicitation of a proxy nor a

substitute for any proxy statement or other filings that may be

made with the SEC or Canadian securities regulatory authorities.

Nonetheless, Riot and its directors and executive officers and

other members of management and employees may be deemed to be

participants in the solicitation of proxies in respect of the

proposed transaction. You can find information about Riot’s

executive officers and directors in Riot’s Annual Report on Form

10-K for the year ended December 31, 2023. Additional information

regarding the interests of such potential participants will be

included in one or more Regulatory Filings filed with the SEC and

Canadian securities regulatory authorities if and when they become

available. These documents (if and when available) may be obtained

free of charge from the SEC’s website at www.sec.gov, on SEDAR+ at

www.sedarplus.ca and by visiting the “Investor Relations” page of

Riot’s corporate website, www.Riotplatforms.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240605673049/en/

Investor Contacts: Phil McPherson 303-794-2000 ext. 110

IR@Riot.Inc Okapi Partners Bruce Goldfarb / Chuck Garske, (877)

285-5990 info@okapipartners.com Media Contact: Longacre

Square Partners Joe Germani / Dan Zacchei

jgermani@longacresquare.com / dzacchei@longacresquare.com

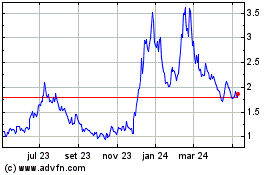

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

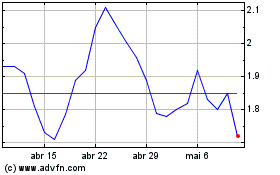

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024