Bitcoin reaches $72,992 peak before US elections

Bitcoin (COIN:BTCUSD) rose 4% in the last 24 hours, currently at

$72,720, after hitting an intraday high of $72,992, its highest

level since Q2 2024. This increase was driven by factors like the

US presidential election and support from candidates like Trump,

who advocates for a strategic Bitcoin reserve.

Cryptocurrency-related companies rose on Tuesday, with

MicroStrategy (NASDAQ:MSTR) up 3.0%, Coinbase (NASDAQ:COIN) 3.2%,

and Bitfarms (NASDAQ:BITF) leading at 8.9% following Andrew Chang’s

board appointment amid a potential hostile takeover by Riot

Platforms (NASDAQ:RIOT). Bitcoin has gained 14.8% in October,

surpassing the S&P 500. Ethereum (COIN:ETHUSD) and Solana

(COIN:SOLUSD) recorded monthly gains of 2.5% and 19.4%,

respectively.

Bitcoin hits record ETF inflows; Ether slows withdrawals

On October 28, US spot Bitcoin ETFs saw total inflows of $479.35

million, marking the fourth consecutive day of positive net

inflows. BlackRock’s ETF (NASDAQ:IBIT) led with $315.2 million,

followed by ARK (AMEX:ARKB), Fidelity (AMEX:FBTC), Biwise

(AMEX:BITB), and Grayscale Bitcoin Mini Trust (AMEX:BTC). The total

Bitcoins held by US ETFs rose to 976,893 BTC, nearly 5% of the

market, targeting 1 million BTC by week’s end. In contrast, Ether

ETFs slowed their withdrawals, totaling only $1.14 million in

redemptions.

ARK Invest sells Block shares, ups Bitcoin ETF exposure

ARK Invest sold 418,556 Block shares (NYSE:SQ), generating $31

million as shares rose to $74.50. This sale coincided with a nearly

13% October gain in Block, driven by crypto market optimism.

Concurrently, ARK increased its stake in the ARK 21Shares Bitcoin

ETF (AMEX:ARKB), purchasing 6,698 shares for $466,000, signaling

confidence in the crypto sector as Bitcoin surpassed $71,000.

Consensys cuts 20% and accuses SEC of overreach

Consensys, a backer of Ethereum and creator of MetaMask,

announced a 20% workforce reduction, citing global economic

conditions and US regulatory pressure, particularly the SEC’s

“overreach.” CEO Joe Lubin criticized the agency for disrupting

business and financial stability. In response, Consensys filed a

lawsuit against the SEC, joining other crypto firms like Coinbase

and Grayscale challenging regulatory action on the sector.

Bhutan moves Bitcoin amid price surge, hints at sale

The Bhutanese government transferred around $66 million in

Bitcoin to Binance after prices topped $70,000, indicating a

possible sale. This move, executed in two transactions on October

29, was tracked by Arkham Intelligence. The government wallet,

having accumulated Bitcoin through mining over five years, still

holds about $886 million. Profit-taking by major holders may lead

to volatility and affect the cryptocurrency’s price.

HIVE Digital plans to double hash rate, bets on AI

HIVE Digital (NASDAQ:HIVE) plans to more than double its hash

rate from 5.5 EH/s to 13 EH/s over the next 12 months, according to

a Cantor brokerage report initiating coverage with a $9 price

target. Cantor believes the market undervalues HIVE’s projected

growth and its initiatives in high-performance computing and

artificial intelligence, with expected $100 million in annual

recurring revenue by the end of 2025.

Fairshake backs pro-crypto Republican candidate in Wisconsin

The crypto-funded Fairshake committee allocated over $760,000 to

support the re-election of Wisconsin Republican Representative

Bryan Steil. Fairshake’s media buy for Steil, a pro-crypto

legislation advocate, is among its last moves before the elections.

Steil is running against Democrat Peter Barca in a close race in

Wisconsin’s 1st district, as all House seats are up for grabs this

election cycle.

Crypto.com leads North American trading volume

Crypto.com’s spot trading volume surged to $134 billion in

September, surpassing Coinbase’s $46 billion. The exchange has led

the North American market since July, reaching $112 billion in

October, while Kraken handled less than $10 billion. The exchange’s

popularity stems from its wide range of tokens, including BTC, ETH,

and memecoins, comprising over 85% of trades in stablecoin pairs.

The company faces a legal challenge from the SEC to protect its

business model.

Alameda Research sues KuCoin over $50M in frozen assets

Alameda Research, linked to bankrupt FTX, sued KuCoin to recover

over $50 million in frozen assets since FTX’s 2022 collapse. The

case, filed in the Delaware Bankruptcy Court, claims KuCoin

unjustly withheld the funds, now valued at $50 million due to

appreciation. Alameda seeks asset return and loss compensation to

protect FTX creditors’ interests.

Kraken launches Layer 2 with 25M OP token incentives

Exchange Kraken introduced its new Layer 2, named Ink, built

with Optimism’s OP Stack, joining the Superchain alongside Coinbase

and Uniswap. As part of the agreement, the Optimism Foundation

granted Kraken 25 million Optimism tokens (COIN:OPUSD), initially

valued at $100 million, now estimated at $42.5 million, with

gradual release. Kraken’s commitment includes transaction goals to

enhance the blockchain development ecosystem.

Min Lin appointed Chief Business Officer of Bitget, boosting global

expansion

Bitget announced the appointment of Min Lin as Chief Business

Officer (CBO), strengthening its commitment to global expansion and

innovation in the crypto sector. Lin, previously holding leadership

roles at Binance, was instrumental in developing regulatory

partnerships and expansion in Latin America. His compliance and

regulatory expertise is seen as a strategic asset to solidify

Bitget’s presence in emerging markets, especially Latin America,

where the platform has grown 98% in active users this year.

Binance launches service for high-net-worth clients

Binance launched Binance Wealth, an exclusive service allowing

wealth managers to onboard high-net-worth clients, offering them

access to a range of crypto assets. These managers create

individual subaccounts with KYC documentation, enabling clients to

operate within a structure akin to traditional wealth management.

Initially focused on Asia and Latin America, the service is

unavailable in the US. Binance emphasizes that, while providing

tech support, it is not a financial advisory service.

Gemini advances in Singapore with preliminary license approval

Crypto exchange Gemini received preliminary approval from the

Monetary Authority of Singapore (MAS) for a Major Payment

Institution license, allowing it to offer digital token services

and international transfers. Upon final approval, Gemini can exceed

local payment volume limits. Other US firms, like Coinbase and

Ripple, have recently secured full MPI licenses in the country.

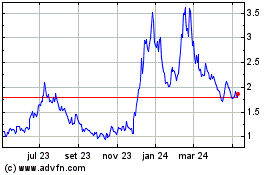

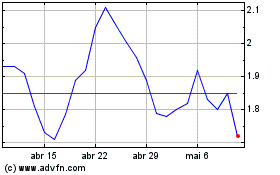

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024